Remember when freight, trucking and logistics data provider Freightwaves warned at the last day of April that a freight recession was imminent and was set to cripple the trucking sector and broader economy (prompted Jim Cramer to declare that "Mr Freightwaves" knows nothing). Well, as always, Cramer was wrong and Freightwaves was right, and today we are seeing nothing short of bloodbath in the trucking and logistics space, where stocks have plunged the most in over six weeks amid weak outlook from several retailers, including Target, which just like Walmart plunged the most since 1987 as inflation crippled its profit margins, and as it warned that fuel and freight costs soared in the first quarter.

How bad is it looking? On the Target earnings call, the COO said the company is now expecting $1 billion in incremental freight costs this year.

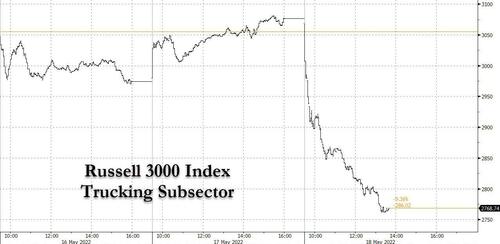

The Russell 3000 Index Trucking Subsector (RGUSPTK) dropped over 10% versus a 3.3% drop in the S&P 500 Index, although both are still sliding.

Big decliners on the trucking index include Saia, JB Hunt, ArcBest, Knight-Swift, Werner, Schneider and Old Dominion

The bottom line is that, just as Freightwaves warned two months ago, prices are now so high that demand destruction is crushing margins, with a recession now just a matter of months.

Remember when freight, trucking and logistics data provider Freightwaves warned at the last day of April that a freight recession was imminent and was set to cripple the trucking sector and broader economy (prompted Jim Cramer to declare that “Mr Freightwaves” knows nothing). Well, as always, Cramer was wrong and Freightwaves was right, and today we are seeing nothing short of bloodbath in the trucking and logistics space, where stocks have plunged the most in over six weeks amid weak outlook from several retailers, including Target, which just like Walmart plunged the most since 1987 as inflation crippled its profit margins, and as it warned that fuel and freight costs soared in the first quarter.

How bad is it looking? On the Target earnings call, the COO said the company is now expecting $1 billion in incremental freight costs this year.

The Russell 3000 Index Trucking Subsector (RGUSPTK) dropped over 10% versus a 3.3% drop in the S&P 500 Index, although both are still sliding.

Big decliners on the trucking index include Saia, JB Hunt, ArcBest, Knight-Swift, Werner, Schneider and Old Dominion

The bottom line is that, just as Freightwaves warned two months ago, prices are now so high that demand destruction is crushing margins, with a recession now just a matter of months.