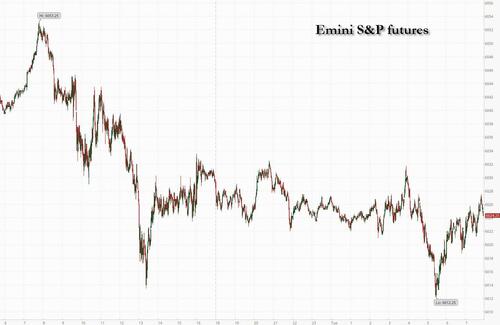

The torrid five-day rally that pushed the S&P 500 to its 51st record close above 6,000 on Monday has finally reversed amid unease over nosebleed equity valuations and the composition of Trump’s incoming cabinet. As of 8:00am, contracts on the S&P 500 and Nasdaq 100 indexes slipped about 0.2% with Mag7 and semiconductors under pressure, while Tesla also dropped in after a post-election surge that lifted its valuation past $1 trillion; healthcare names among the notable gainers. Europe’s Stoxx 600 gauge lost 1% as the rout in Asia continued and the MSCI Asia Pacific Index dropped as much as 1.3%, with chipmakers TSMC and Samsung among the biggest drags. Bond yields are 3-6bps higher as the curve twists flatter; yields are pulling the dollar higher. Commodities are weaker with Energy outperforming. Other Trump trades remained in play, however, with Treasuries falling, the dollar hitting a one-year high and Bitcoin hovering just below $90,000. Today’s macro data focus is on SLOOS, 1-year inflation expectations, and Small Business Optimism, as well as five Fed speakers.

In premarket trading, cryptocurrency-exposed stocks erase earlier premarket gains as Bitcoin retreated after its record-breaking rally took the digital asset beyond $89,000. The digital currency has rallied as traders bet on a crypto boom under Trump. Here are some other notable premarket movers:

- Grab Holdings (GRAB) jumps 8% after the ride-hailing and delivery company boosted its earnings and revenue forecasts for the year.

- Live Nation (LYV) climbs 5% after the entertainment posted 3Q profit that impressed.

- Luminar (LAZR) gains 2% after the auto technology company entered pacts with Volvo and a Japanes automaker.

- Neurogene (NGNE) sinks 33% after the drug developer said it became aware of an emerging serious side effect related to its experimental treatment for Rett syndrome. Rival Taysha Gene Therapies rose 19% as analysts say issues at Neurogene could level the playing field.

- On Holding (ONON) rises 1% after the sportswear company reported third-quarter net sales ahead of consensus estimates.

- Sea (SE) rises 8% after the e-commerce company reported 3Q revenue that came ahead of estimates.

- Shopify (SHOP) soars 13% after reporting 3Q sales that beat analysts’ estimates, a sign that the Canadian e-commerce company is gaining momentum as spending continues to shift from stores to websites.

According to Citi, the election outcome has taken investors’ US equity exposure to the highest in three years, suggesting the rally could run out of steam. Traders are also pondering the potential for Trump’s economic policies, including trade tariffs and immigration crackdowns, to spur inflation and affect the path for Federal Reserve monetary policy.

“If we have those tariffs kicking in, if we have those so-called deportations, those would have an outright inflationary impact, and so would result in higher bond yields,” said Kevin Thozet, a member of the investment committee at Carmignac. “Higher bond yields across the curve may start to bite at some point,” especially at a time of lofty stock-market valuations, he said. Ten-year Treasury yields rose as much as six basis points as the market reopened after Monday’s holiday.

Traders are now focusing on the make-up of the incoming Trump adminstration. Fears for the future of China’s relationship with the US played out in Hong Kong’s Hang Seng Index, which shed more than 3%. US-listed Chinese stocks, such as Alibaba Group Holding Ltd. and PDD Holdings Inc. also fell.

Overnight, we got reports that Senator Marco Rubio — known for his aggressive stance on China — is expected to be named secretary of state. Representative Mike Waltz, who views China as a “greater threat” to the US than any other nation, is in line to be national security advisor. Tom Homan, named as “border czar,” was criticized for harsh immigration policies implemented during Trump’s first term.

“Up until Trump’s inauguration in January, we will be in a period where there will be some form of uncertainty regarding the implementation of his policy measures,” Thozet said. Meanwhile, US inflation data due Wednesday, could determine whether the Fed cuts interest rates again next month. The core consumer price index, which excludes food and energy, is expected to have risen at the same pace on both a monthly and annual basis compared with September’s readings.

European stocks dropped in early trading in the wake of similar declines in Asia as worries over the policies of US President-elect Donald Trump may fuel inflation. The Stoxx 600 fell 1.1% to 506.61 with basic resources, chemicals and consumer products leading declines. German chemical giant Bayer shares plunged as much as 14% to the lowest level in 20 years after the German company reported weaker-than-expected results for the third quarter and cut its guidance for the year. Here are the biggest movers Tuesday:

- ConvaTec rises as much as 22%, the most since March 2020, after the maker of medical and surgical equipment lifted its FY24 guidance. Analysts note that organic growth was stronger than expected

- DCC shares rise as much as 18%, the most since May 1994, after the sales and support services group announced a new strategy plan that analysts said will help unlock value

- Infineon rises 6.4% as the chipmaker guided for a modest rebound starting from 2Q fiscal 2025, following a steep sales drop in the current quarter as an inventory correction drags on

- FLSmidth rises as much as 7.2%, the most since February, after the Danish industrial machinery company revealed a strong third-quarter Ebita beat. It also upped its margin guidance

- OCI shares rise as much as 6.6% after the Dutch agricultural chemicals firm released a trading update and said it expects to make another extraordinary distribution of ~$1 billion

- Drax shares gain as much as 7.6%, the most since July, after the renewable energy company reported a trading update, saying it sees FY24 Ebitda guidance toward the top end of range

- Temenos gains as much as 4.8%, the most in over a month as analysts saw the Swiss banking software firm’s delayed mid-term targets as a more realistic strategy

- Bayer shares plunge as much as 14% to the lowest level in 20 years after the German company reported weaker-than-expected results for the third quarter and cut its guidance for the year

- Brenntag falls as much as 10% to their lowest intraday value since 2022 after the German chemicals firm reported operating Ebita for the third quarter that missed the average estimate

- Vodafone shares fall as much as 5.5% after the telecom operator reported a bigger-than-expected drop in service revenue in its core market of Germany, hit by a regulatory changes

- Direct Line drops as much as 8.2% to the lowest since 2023 after Jefferies downgrades to hold from buy, saying in a note the insurer’s valuation is “uncompelling” and upside risks are muted

- Fresnillo shares drop as much as 7.4% after the gold and silver miner warned the Sabinas mine is experiencing “operational difficulties” that are affecting production

- Verbio falls as much as 14% to their lowest intraday value in over four years. Jefferies says the German biofuel firm’s results missed expectations due to biodiesel and bioethanol pricing

Earlier, Asian equities fell, weighed by declines in China and major technology companies amid rising geopolitical uncertainties. The MSCI Asia Pacific Index dropped as much as 1.3%, with chipmakers TSMC and Samsung among the biggest drags. Chinese internet firms Tencent and Alibaba also slumped ahead of their earnings reports later this week.

Chinese stocks fell as fears of worsening Sino-US ties further undermined investor confidence after underwhelming fiscal stimulus and weak economic data affected sentiment. Reports that President-elect Donald Trump is poised to pick two men with track records of harshly criticizing China for key positions in his new administration added to investor worries.

In FX, the dollar added to its post-election gain, with the Bloomberg Dollar Spot Index advancing 0.4% to the highest since Nov. 1, 2023. Investor expectations for Trump’s policy agenda have lifted the greenback in recent sessions. “The fundamental dollar uptrend remains intact,” Win Thin, global head of markets strategy at Brown Brothers Harriman & Co., wrote in a note. “The Fed made it clear it is in no hurry to cut rates, growth remains solid in Q4”

In rates, treasuries slumped as the incoming Trump administration has investors fretting over the prospect of a resurgence in inflation. US 10-year yields climb 5 bps to 4.36% while the yield on the two-year Treasury rose as much as 8 basis points to 4.33%, its highest since July 31. Bunds rose to session highs after German ZEW data fell short of estimates. German lawmakers have also agreed to hold an early election in February, according to government officials familiar with the talks. Gilts underperform their German peers after mixed UK jobs data. Oil prices advance, with WTI rising 0.8% to $68.60 a barrel. Spot gold falls $26 to $2,592/oz.

Bitcoin is lower having flirted with the $90,000 level earlier on.

The US economic data calendar includes October New York Fed 1-year inflation expectations at 11am and the Senior Loan Officers Survey at 2pm; the Fed speaker slate includes Waller (10am), Barkin (10:15am, 5:30pm), Kashkari (2pm) and Harker (5pm). Senior Loan Officer opinion survey is released at 2pm.

Market Snapshot

S&P 500 futures little changed at 6,026.75

Brent Futures up 0.5% to $72.17/bbl

Gold spot down 1.0% to $2,593.31

US Dollar Index up 0.28% to 105.84

Top Overnight News

- China may embrace greater stimulus, manufacturing support and a weaker yuan to counter the negative effects of a second Trump presidency, according to surveyed economists. BBG

- China plans to cut taxes for home purchases as the government continues to take steps aimed at bolstering the economy. Regulators are working on a proposal that would allow mega cities including Shanghai and Beijing to cut the deed tax for buyers to as low as 1% from a current level of as much as 3%. BBG

- A Chinese court will hear a lawsuit filed by a local developer against Apple over its App Store practices — a decision may spur greater scrutiny of the company’s role in the mobile ecosystem. BBG

- Japan’s government said it would provide at least ~$65B in support for the semiconductor and AI industries through 2030. Nikkei

- UK wage growth cools modestly in Sept while hiring stalls, leaving the door open to further BOE easing. WSJ

- Trump’s initial immigration staffing selections point to a very hawkish approach to this issue when the new administration takes power in January. Politico

- Marco Rubio is expected to be named secretary of state, a person familiar said, as Trump turns to allies and China skeptics to fill his cabinet. Mike Waltz was said to be selected as national security advisor and CNN reported that Kristi Noem will head homeland security. BBG

- Trump is preparing to hire a slew of crypto-friendly officials as he staffs up his new government. Washington Post

- American LNG may prove a crucial bargaining chip in a potential US-EU trade deal, the FT reported. Higher shipments to Europe could be exchanged for dissuading Trump from levying hefty import tariffs. BBG

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were ultimately mixed and failed to sustain the momentum from Wall St where the major indices climbed to fresh record highs in a continuation of the Trump Trade and in quiet conditions due to Veterans Day. ASX 200 was restrained by weakness in mining and resources after underlying commodity prices were hit by dollar strength. Nikkei 225 gave up its early gains and more despite initial tailwinds from JPY weakness and chip-related support. Hang Seng and Shanghai Comp weakened with notable underperformance in the Hong Kong benchmark amid weakness in tech and auto names owing to the current tariff-related concerns, while the mainland was also pressured after recent new loans and financing data underwhelmed but with the downside cushioned after the PBoC recently pledged measures and with China reportedly planning to cut homebuying taxes to boost the property sector. Softbank Group (9984 JT) 6-month (JPY): Revenue 3.47tln (exp. 3.42tln). Net +1.01tln (prev. -1.41tln). Co. reaffirms guidance.

Top Asian News

- Fitch says China's new fiscal proposals are unlikely to immediately bolster growth

- China plans to cut homebuying taxes to boost the property sector in which the home purchase deed tax could be reduced to 1% from 3%, according to Bloomberg.

- China is to strengthen monetary support for the economy and PBoC should provide liquidity through a RRR cut, while the PBoC should inject long-term liquidity in Q4 to offset a rise in government bond issuance, according to an article by PBoC-backed Financial News citing analysts.

Top European News

- BoE's Pill says still some work to be done on underlying domestic inflation pressure in the UK. Policy has anchored expectations close to target. It was not obvious two years ago that CPI would now be at target. Today's labour data shows that pay growth it still at high levels. Additional rate cuts are to be a gradual process. Shocks the the global economy could know the UK off its lower inflation path. Underlying Q/Q UK economic growth of 0.3% is not far off the trend growth rate. Overall picture on fiscal policy is one of consolidation despite the short-term boost from the budget. UK is perhaps further along with its adjustment process towards neutral rates. Higher neutral rate in the UK is not a base case but is something the MPC must consider. Not surprising that markets are considering possibility of a higher neutral rate.

- ECB's Rehn says the ECB is data dependent, not data point dependent; the direction of the ECB is clear, the speed depends on data; will could be leaving restrictive territory in Spring 2025. Disinflation is well on track in EZ. Says the speed of rate cuts will depend on the assessment at each meeting. sees downside risks to growth; waiting for December macro projection for a better view, most of the data is quite weak, particularly in manufacturing.

- ECB's Holzman says Trump's tariffs will put pressure on EZ inflation; will mean higher US rates with an affect on FX

- Brussels is to free up billions of euros for defence from the EU budget and policy shift will allow the bloc’s capitals to redirect ‘cohesion funds’ amid the Ukraine conflict and Trump victory, according to FT.

- German union and employers' association says an agreement was reached in wage talks for metal and electrical engineering industries

- German lawmakers reportedly near deal for early election in February, according to Bloomberg. Chancellor will first submit to a confidence vote in the lower house of parliament to trigger national ballot, likely H1 of December.

- Germany's political parties propose Feb 23rd as the date for the new election, according to Rheinische post. According to the report, there is also talk that the Chancellor could ask for a vote of confidence on December 18. However, this is still open because time could then be running out to pass laws, according to party circles. German Parliment to hold a confidence vote on Dec 16th, according to Reuters sources. mixed reporting

- UK reportedly nearing a free-trade agreement with oil-rich Gulf nations including Saudi Arabia, according to Bloomberg sources

FX

- DXY is firmer vs. all peers as the post-election rally continues and focuses markets on the prospect of looser fiscal policy vs. a subsequently potentially tighter approach from the Fed. DXY has been as high as 105.87 with all eyes on a test of the 106 mark.

- EUR is softer vs. the broadly stronger USD with the pair's bruising post-election sell-off continuing to pick-up pace. From a macro perspective in the Eurozone, today has seen commentary from ECB's Rehn and Holzmann with the former flagging downside risks to growth and the latter cautioning over the impact of Trump tariffs on inflation. German ZEW fell short of expectations. EUR/USD has delved as low as 1.0618.

- USD/JPY has made its way onto a 154 handle, topping out at 154.16 vs. yesterday's opening levels of 152.61. Fresh macro drivers for Japan have been on the quiet side today.

- GBP is near the foot of the leaderboard in the wake of UK jobs metrics. The usual data quality caveats apply, however, the main takeaway was a larger-than-expected jump in the unemployment rate to 4.3% from 4.0% and a slowdown in the rate of employment. Comments from BoE's Pill this morning adopted a cautious stance towards further policy loosening.

- Antipodeans are both softer vs. the USD with risk sentiment in Europe very much on the backfoot and a poor showing for China overnight.

- PBoC set USD/CNY mid-point at 7.1927 vs exp. 7.1944 (prev. 7.1786).

Fixed Income

- USTs are softer but only modestly so, with US-specific newsflow somewhat light as we count down to a handful of Fed speakers today before CPI and Powell later in the week. Currently, at the mid-point of a 109-24+ to 110-04 bound, yields firmer across the curve which is a touch flatter as it stands.

- Bunds were under modest pressure, but lifted incrementally from a 132.24 base, amid geopolitical reports, which suggested that Israel is planning an imminent ground operation in Lebanon, reported via Sky News Arabia (since deleted). Thereafter, soft ZEW metrics helped lift Bunds futher to a 132.62 peak.

- Gilts underperform vs peers after today's mixed jobs report, where the unemployment rate lifting markedly, whilst the wages metrics remained sticky. Gilts lifted off lows in tandem with the bid in Bunds, and were largelly unreactive to its own robust auction.

- Netherlands sells EUR 2.105bln vs exp. EUR 2.0-2.5bln 0.25% 2029 DSL Auction: average yield +2.295% (prev. -0.427%).

- UK sells GBP 2.25bln 4.75% 2043 Gilt Auction: b/c 3.28x (prev. 3.27x), average yield 4.4836% (prev. 4.421%) & tail 0.1bps (prev. 0.1bps)

- Germany sells EUR 4.019bln vs exp. EUR 5bln 2.0% 2026 Schatz Auction; b/c 2.20x (prev. 2.61x), average yield 2.11% (prev. 2.16%) & retention 19.62% (prev. 16.76%)

Commodities

- Crude holds a mild upward bias after Israel's Defence Minister Katz poured cold water on hopes of a Hezbollah-Israel ceasefire, suggesting there will be no ceasefire and Israel will continue to hit Hezbollah with full force. Brent towards the top of a USD 71.55-72.36/bbl parameter.

- Precious metals are softer across the board amid the continued gains in the USD on the back of the ongoing Trump trade. Spot gold fell under USD 2,600/oz resides towards the bottom of a USD 2,590.89-2,627.23/oz parameter.

- Base metals are lower across the board amid the firmer Dollar and a continuation of the disappointment from the NPC Standing Committee meeting last week. 3M LME copper fell to levels under USD 9,200/t.

- OPEC Monthly Oil Market Report due to be released at 11:40GMT/06:40EST.

- Biden’s administration is setting out plans for the US to triple nuclear power capacity by 2050, according to Bloomberg.

Geopolitics: Middle East

- Washington Post quoting US official: Israel tells Washington that it is planning an imminent ground operation in Lebanon", via Sky News Arabia - NOTE: Sky News Arabia has since deleted this tweet

- Israel's Defence Minister Katz says in Lebanon there will be no ceasefire, and will continue to hit Hezbollah with full force.

- "Palestinian source to Sky News Arabia: No agreement between Fatah and Hamas and the gaps between the two sides are still wide", according to Sky News Arabia.

- "Israeli PM Netanyahu in conversations in recent days: When Trump goes back to the White House - we should put the annexation issue back on the table", according to sources via Kann news.

- Walla cited US officials stating Israeli PM Netanyahu made it clear to the Biden administration that he wants to end the war in Lebanon within weeks, according to Sky News Arabia. Axios also cited US and Israeli officials stating that the Israeli Minister of Strategic Affairs briefed US President-elect Trump on plans for Gaza and Lebanon over the next two months. It was also reported that Israeli PM Netanyahu's close aide Dermer met with US President-elect Trump on Sunday.

- Times of Israel reported that two officials in the previous Trump administration warned Israelis against assuming Trump would support Israel's annexation of the West Bank in his second term, according to Sky News Arabia.

- Israeli occupation forces raided the cities of Bethlehem and Hebron in the southern West Bank, according to Al Jazeera.

- Iraqi armed factions attacked a "military target" in southern Israel with drones, according to Sky News. Arabia.

- Central Command of the US Army announced that it attacked nine targets in two locations linked to pro-Iranian militias in Syria as a response to the militias' activity against US forces in the past 24 hours, according to Kann News.

- Ansar Allah media outlets reported US-British raids on the Hodeidah governorate in Yemen, according to Al Jazeera.

Geopolitics: Other

- Russian state agencies reported that a Russian navy carrier of hypersonic missiles conducted drills while passing through the English Channel, while RIA reported that the Russian ship capable of carrying hypersonic missiles carried out missions in the Atlantic after passing through the English Channel.

US Event Calendar

- 06:00: Oct. SMALL BUSINESS OPTIMISM 93.7, est. 92.0, prior 91.5

- 11:00: Oct. NY Fed 1-Yr Inflation Expectat, est. 2.97%, prior 3.00%

- 14:00: Senior Loan Officer Opinion Survey on Bank Lending Practices

Central Bank Speakers

- 10:00: Fed’s Waller Speaks at Banking Conference

- 10:15: Fed’s Barkin Speaks in Baltimore

- 14:00: Senior Loan Officer Opinion Survey on Bank Lending Practices

- 14:00: Fed’s Kashkari Participates in Moderated Conversation

- 17:00: Fed’s Harker Speaks on Fintech, AI

- 17:30: Fed’s Barkin Repeats Speech, followed with Q&A

DB's Jim Reid concludes the overnight wrap

The post-election rally edged higher yesterday, as the S&P 500 (+0.10%) closed above the 6,000 mark for the first time, posting a fourth consecutive record high following the election and its 51st of 2024 so far. In fact, the index is currently experiencing its strongest YTD performance since 1995, having risen by +25.82% since the start of the year, and it’s the first time since 1997-98 that it’s on course to post back-to-back annual gains above +20% and only the third time in 100 years. So it was another strong performance, with the Dow Jones (+0.69%) closing above 44,000 for the first time as well, just as the small-cap Russell 2000 (+1.47%) closed just 0.3% from its all-time high back in November 2021.

This rally has led to a significant easing of financial conditions, but yesterday also saw investors dial back their expectations for rate cuts yet again. For instance, the rate priced in by the December 2025 meeting was up to 3.82% yesterday, meaning that investors are only pricing in three more 25bp rate cuts by the end of 2025. Bear in mind that’s risen by almost 100bps in just over six weeks, thanks to positive US data and the election result. So this is a significant reassessment of the Fed’s outlook, and with investors pricing in fewer rate cuts, the dollar index strengthened another +0.52%, reaching its highest level since early July.

Given the Veterans Day holiday, cash trading in US Treasuries was closed yesterday. But futures markets showed them losing ground across the curve, with 2yr, 5yr and 10yr futures all pointing towards higher yields. This morning in Asia they've crystallised this with 2 and 10yr yields up +3.8bps and +2.1bps, respectively. That also comes ahead of the CPI release tomorrow, where there’s been some concern about another robust print, particularly after monthly core CPI was at a 6-month high in September. We’ll have to see what that brings, but inflation expectations have risen quite a bit over the last couple of months, with the 2yr inflation swap up from just 1.99% on September 10 to 2.62% yesterday, so another upside surprise would only accelerate that trend. That said, our US economists expect core CPI to tick down in October to +0.26%.

In the meantime, there was a lot of focus on several “Trump trades”, which continued to outperform yesterday. Bitcoin was one of the most notable, rising by more than 10% yesterday and up another +0.96% this morning to trade above $88,000. Its YTD gain now stands above 100%. It’s been supported by the fact that Trump and the new Congress appear more friendly to crypto, and Marion Laboure on my team has just released a note looking at the immediate impact of the election on crypto along with the outlook ahead.

Among equities themselves, the Trump trade was also clear, and Tesla (+8.96%) advanced for a 5th consecutive session, bringing its gains over the last week to +44.1%. That single-handedly dragged the Magnificent 7 group to a +1.02% gain and another record high, even as five of them actually lost ground on the day. Nvidia (-1.61%) was the weakest of the Mag-7, echoing a -2.54% decline for the Philadelphia Semiconductor index after Reuters reported over the weekend that the US had told TSMC to stop shipping its advance AI chips to China. Meanwhile, banks continued to post strong gains, with the KBW Bank index rising +2.35%.

In terms of US politics, we got a few more reports on potential appointees to the new Trump administration yesterday. That included a report from Bloomberg, which said Trump would narrow the shortlist for Treasury Secretary this week. It also said he was leaning towards someone with Wall Street experience to the job. Otherwise, CNN reported that Trump would name Stephen Miller, his immigration adviser, as Deputy Chief of Staff for Policy. Overnight the FT and others suggest he will appoint Mike Waltz as national security advisor and Marco Rubio as Secretary of State. They are China hawks.

Lastly, we still don’t officially know who’s going to end up in control of the House of Representatives, but the current AP tally now stands at 214-205 to the Republicans, with 218 required for a majority. Polymarket is now putting the likelihood of a Republican sweep at 99%, and as it stands, the Republicans are currently ahead in more-than-enough districts to put them over the 218 majority line.

Over in Europe, risk assets followed a broadly similar pattern, and the STOXX 600 (+1.13%) posted its strongest performance in six weeks. But for sovereign bonds, there was a clear rally across the continent as investors priced in a growing likelihood of ECB rate cuts over the months ahead. In fact, yields on 10yr bunds (-4.0bps), OATs (-4.1bps) and BTPs (-6.3bps) all moved lower, which was in contrast to the way that US Treasury futures were pointing.

When it comes to German politics, there was still no clarity on when an election might take place, but there’s been plenty of pressure to bring forward the timetable of a confidence motion before the new year. AFP reported yesterday that German President Frank-Walter Steinmeier was moderating discussions between the parties, and Chancellor Scholz said on Sunday that an earlier vote could happen this year “if all sides agree”. Nevertheless, Scholz’s spokesman said yesterday that a vote of confidence wouldn’t happen this Wednesday, and Vice Chancellor Habeck of the Greens said yesterday that the decision was down to Scholz.

Asian equity markets are mostly lower this morning with non-US risk still struggling to weigh up all the post-election implications. Leading the losses is the Hang Seng (-2.73%), followed by the KOSPI (-1.73%), the Nikkei (-0.97%), and the Shanghai Composite (-0.85%). S&P 500 (-0.11%) and Nasdaq (-0.08%) futures are slightly lower.

A Bloomberg report overnight indicates that China is planning to cut taxes on home purchases. The proposal would allow major cities to reduce the deed tax for buyers to as low as 1%, down from the current rate of up to 3% in an effort to revive the struggling housing market.

To the day ahead now, and one of the main highlights will be the Fed’s Senior Loan Officer Opinion Survey on Bank Lending Practices. Otherwise, central bank speakers include the Fed’s Waller, Barkin, Kashkari and Harker, the ECB’s Rehn, Holzmann, Centeno and Cipollone, and the BoE’s Pill. Data releases include the UK unemployment rate for September, the German ZEW survey for November, and in the US there’s the NFIB’s small business optimism index for October.

The torrid five-day rally that pushed the S&P 500 to its 51st record close above 6,000 on Monday has finally reversed amid unease over nosebleed equity valuations and the composition of Trump’s incoming cabinet. As of 8:00am, contracts on the S&P 500 and Nasdaq 100 indexes slipped about 0.2% with Mag7 and semiconductors under pressure, while Tesla also dropped in after a post-election surge that lifted its valuation past $1 trillion; healthcare names among the notable gainers. Europe’s Stoxx 600 gauge lost 1% as the rout in Asia continued and the MSCI Asia Pacific Index dropped as much as 1.3%, with chipmakers TSMC and Samsung among the biggest drags. Bond yields are 3-6bps higher as the curve twists flatter; yields are pulling the dollar higher. Commodities are weaker with Energy outperforming. Other Trump trades remained in play, however, with Treasuries falling, the dollar hitting a one-year high and Bitcoin hovering just below $90,000. Today’s macro data focus is on SLOOS, 1-year inflation expectations, and Small Business Optimism, as well as five Fed speakers.

In premarket trading, cryptocurrency-exposed stocks erase earlier premarket gains as Bitcoin retreated after its record-breaking rally took the digital asset beyond $89,000. The digital currency has rallied as traders bet on a crypto boom under Trump. Here are some other notable premarket movers:

- Grab Holdings (GRAB) jumps 8% after the ride-hailing and delivery company boosted its earnings and revenue forecasts for the year.

- Live Nation (LYV) climbs 5% after the entertainment posted 3Q profit that impressed.

- Luminar (LAZR) gains 2% after the auto technology company entered pacts with Volvo and a Japanes automaker.

- Neurogene (NGNE) sinks 33% after the drug developer said it became aware of an emerging serious side effect related to its experimental treatment for Rett syndrome. Rival Taysha Gene Therapies rose 19% as analysts say issues at Neurogene could level the playing field.

- On Holding (ONON) rises 1% after the sportswear company reported third-quarter net sales ahead of consensus estimates.

- Sea (SE) rises 8% after the e-commerce company reported 3Q revenue that came ahead of estimates.

- Shopify (SHOP) soars 13% after reporting 3Q sales that beat analysts’ estimates, a sign that the Canadian e-commerce company is gaining momentum as spending continues to shift from stores to websites.

According to Citi, the election outcome has taken investors’ US equity exposure to the highest in three years, suggesting the rally could run out of steam. Traders are also pondering the potential for Trump’s economic policies, including trade tariffs and immigration crackdowns, to spur inflation and affect the path for Federal Reserve monetary policy.

“If we have those tariffs kicking in, if we have those so-called deportations, those would have an outright inflationary impact, and so would result in higher bond yields,” said Kevin Thozet, a member of the investment committee at Carmignac. “Higher bond yields across the curve may start to bite at some point,” especially at a time of lofty stock-market valuations, he said. Ten-year Treasury yields rose as much as six basis points as the market reopened after Monday’s holiday.

Traders are now focusing on the make-up of the incoming Trump adminstration. Fears for the future of China’s relationship with the US played out in Hong Kong’s Hang Seng Index, which shed more than 3%. US-listed Chinese stocks, such as Alibaba Group Holding Ltd. and PDD Holdings Inc. also fell.

Overnight, we got reports that Senator Marco Rubio — known for his aggressive stance on China — is expected to be named secretary of state. Representative Mike Waltz, who views China as a “greater threat” to the US than any other nation, is in line to be national security advisor. Tom Homan, named as “border czar,” was criticized for harsh immigration policies implemented during Trump’s first term.

“Up until Trump’s inauguration in January, we will be in a period where there will be some form of uncertainty regarding the implementation of his policy measures,” Thozet said. Meanwhile, US inflation data due Wednesday, could determine whether the Fed cuts interest rates again next month. The core consumer price index, which excludes food and energy, is expected to have risen at the same pace on both a monthly and annual basis compared with September’s readings.

European stocks dropped in early trading in the wake of similar declines in Asia as worries over the policies of US President-elect Donald Trump may fuel inflation. The Stoxx 600 fell 1.1% to 506.61 with basic resources, chemicals and consumer products leading declines. German chemical giant Bayer shares plunged as much as 14% to the lowest level in 20 years after the German company reported weaker-than-expected results for the third quarter and cut its guidance for the year. Here are the biggest movers Tuesday:

- ConvaTec rises as much as 22%, the most since March 2020, after the maker of medical and surgical equipment lifted its FY24 guidance. Analysts note that organic growth was stronger than expected

- DCC shares rise as much as 18%, the most since May 1994, after the sales and support services group announced a new strategy plan that analysts said will help unlock value

- Infineon rises 6.4% as the chipmaker guided for a modest rebound starting from 2Q fiscal 2025, following a steep sales drop in the current quarter as an inventory correction drags on

- FLSmidth rises as much as 7.2%, the most since February, after the Danish industrial machinery company revealed a strong third-quarter Ebita beat. It also upped its margin guidance

- OCI shares rise as much as 6.6% after the Dutch agricultural chemicals firm released a trading update and said it expects to make another extraordinary distribution of ~$1 billion

- Drax shares gain as much as 7.6%, the most since July, after the renewable energy company reported a trading update, saying it sees FY24 Ebitda guidance toward the top end of range

- Temenos gains as much as 4.8%, the most in over a month as analysts saw the Swiss banking software firm’s delayed mid-term targets as a more realistic strategy

- Bayer shares plunge as much as 14% to the lowest level in 20 years after the German company reported weaker-than-expected results for the third quarter and cut its guidance for the year

- Brenntag falls as much as 10% to their lowest intraday value since 2022 after the German chemicals firm reported operating Ebita for the third quarter that missed the average estimate

- Vodafone shares fall as much as 5.5% after the telecom operator reported a bigger-than-expected drop in service revenue in its core market of Germany, hit by a regulatory changes

- Direct Line drops as much as 8.2% to the lowest since 2023 after Jefferies downgrades to hold from buy, saying in a note the insurer’s valuation is “uncompelling” and upside risks are muted

- Fresnillo shares drop as much as 7.4% after the gold and silver miner warned the Sabinas mine is experiencing “operational difficulties” that are affecting production

- Verbio falls as much as 14% to their lowest intraday value in over four years. Jefferies says the German biofuel firm’s results missed expectations due to biodiesel and bioethanol pricing

Earlier, Asian equities fell, weighed by declines in China and major technology companies amid rising geopolitical uncertainties. The MSCI Asia Pacific Index dropped as much as 1.3%, with chipmakers TSMC and Samsung among the biggest drags. Chinese internet firms Tencent and Alibaba also slumped ahead of their earnings reports later this week.

Chinese stocks fell as fears of worsening Sino-US ties further undermined investor confidence after underwhelming fiscal stimulus and weak economic data affected sentiment. Reports that President-elect Donald Trump is poised to pick two men with track records of harshly criticizing China for key positions in his new administration added to investor worries.

In FX, the dollar added to its post-election gain, with the Bloomberg Dollar Spot Index advancing 0.4% to the highest since Nov. 1, 2023. Investor expectations for Trump’s policy agenda have lifted the greenback in recent sessions. “The fundamental dollar uptrend remains intact,” Win Thin, global head of markets strategy at Brown Brothers Harriman & Co., wrote in a note. “The Fed made it clear it is in no hurry to cut rates, growth remains solid in Q4”

In rates, treasuries slumped as the incoming Trump administration has investors fretting over the prospect of a resurgence in inflation. US 10-year yields climb 5 bps to 4.36% while the yield on the two-year Treasury rose as much as 8 basis points to 4.33%, its highest since July 31. Bunds rose to session highs after German ZEW data fell short of estimates. German lawmakers have also agreed to hold an early election in February, according to government officials familiar with the talks. Gilts underperform their German peers after mixed UK jobs data. Oil prices advance, with WTI rising 0.8% to $68.60 a barrel. Spot gold falls $26 to $2,592/oz.

Bitcoin is lower having flirted with the $90,000 level earlier on.

The US economic data calendar includes October New York Fed 1-year inflation expectations at 11am and the Senior Loan Officers Survey at 2pm; the Fed speaker slate includes Waller (10am), Barkin (10:15am, 5:30pm), Kashkari (2pm) and Harker (5pm). Senior Loan Officer opinion survey is released at 2pm.

Market Snapshot

S&P 500 futures little changed at 6,026.75

Brent Futures up 0.5% to $72.17/bbl

Gold spot down 1.0% to $2,593.31

US Dollar Index up 0.28% to 105.84

Top Overnight News

- China may embrace greater stimulus, manufacturing support and a weaker yuan to counter the negative effects of a second Trump presidency, according to surveyed economists. BBG

- China plans to cut taxes for home purchases as the government continues to take steps aimed at bolstering the economy. Regulators are working on a proposal that would allow mega cities including Shanghai and Beijing to cut the deed tax for buyers to as low as 1% from a current level of as much as 3%. BBG

- A Chinese court will hear a lawsuit filed by a local developer against Apple over its App Store practices — a decision may spur greater scrutiny of the company’s role in the mobile ecosystem. BBG

- Japan’s government said it would provide at least ~$65B in support for the semiconductor and AI industries through 2030. Nikkei

- UK wage growth cools modestly in Sept while hiring stalls, leaving the door open to further BOE easing. WSJ

- Trump’s initial immigration staffing selections point to a very hawkish approach to this issue when the new administration takes power in January. Politico

- Marco Rubio is expected to be named secretary of state, a person familiar said, as Trump turns to allies and China skeptics to fill his cabinet. Mike Waltz was said to be selected as national security advisor and CNN reported that Kristi Noem will head homeland security. BBG

- Trump is preparing to hire a slew of crypto-friendly officials as he staffs up his new government. Washington Post

- American LNG may prove a crucial bargaining chip in a potential US-EU trade deal, the FT reported. Higher shipments to Europe could be exchanged for dissuading Trump from levying hefty import tariffs. BBG

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were ultimately mixed and failed to sustain the momentum from Wall St where the major indices climbed to fresh record highs in a continuation of the Trump Trade and in quiet conditions due to Veterans Day. ASX 200 was restrained by weakness in mining and resources after underlying commodity prices were hit by dollar strength. Nikkei 225 gave up its early gains and more despite initial tailwinds from JPY weakness and chip-related support. Hang Seng and Shanghai Comp weakened with notable underperformance in the Hong Kong benchmark amid weakness in tech and auto names owing to the current tariff-related concerns, while the mainland was also pressured after recent new loans and financing data underwhelmed but with the downside cushioned after the PBoC recently pledged measures and with China reportedly planning to cut homebuying taxes to boost the property sector. Softbank Group (9984 JT) 6-month (JPY): Revenue 3.47tln (exp. 3.42tln). Net +1.01tln (prev. -1.41tln). Co. reaffirms guidance.

Top Asian News

- Fitch says China’s new fiscal proposals are unlikely to immediately bolster growth

- China plans to cut homebuying taxes to boost the property sector in which the home purchase deed tax could be reduced to 1% from 3%, according to Bloomberg.

- China is to strengthen monetary support for the economy and PBoC should provide liquidity through a RRR cut, while the PBoC should inject long-term liquidity in Q4 to offset a rise in government bond issuance, according to an article by PBoC-backed Financial News citing analysts.

Top European News

- BoE’s Pill says still some work to be done on underlying domestic inflation pressure in the UK. Policy has anchored expectations close to target. It was not obvious two years ago that CPI would now be at target. Today’s labour data shows that pay growth it still at high levels. Additional rate cuts are to be a gradual process. Shocks the the global economy could know the UK off its lower inflation path. Underlying Q/Q UK economic growth of 0.3% is not far off the trend growth rate. Overall picture on fiscal policy is one of consolidation despite the short-term boost from the budget. UK is perhaps further along with its adjustment process towards neutral rates. Higher neutral rate in the UK is not a base case but is something the MPC must consider. Not surprising that markets are considering possibility of a higher neutral rate.

- ECB’s Rehn says the ECB is data dependent, not data point dependent; the direction of the ECB is clear, the speed depends on data; will could be leaving restrictive territory in Spring 2025. Disinflation is well on track in EZ. Says the speed of rate cuts will depend on the assessment at each meeting. sees downside risks to growth; waiting for December macro projection for a better view, most of the data is quite weak, particularly in manufacturing.

- ECB’s Holzman says Trump’s tariffs will put pressure on EZ inflation; will mean higher US rates with an affect on FX

- Brussels is to free up billions of euros for defence from the EU budget and policy shift will allow the bloc’s capitals to redirect ‘cohesion funds’ amid the Ukraine conflict and Trump victory, according to FT.

- German union and employers’ association says an agreement was reached in wage talks for metal and electrical engineering industries

- German lawmakers reportedly near deal for early election in February, according to Bloomberg. Chancellor will first submit to a confidence vote in the lower house of parliament to trigger national ballot, likely H1 of December.

- Germany’s political parties propose Feb 23rd as the date for the new election, according to Rheinische post. According to the report, there is also talk that the Chancellor could ask for a vote of confidence on December 18. However, this is still open because time could then be running out to pass laws, according to party circles. German Parliment to hold a confidence vote on Dec 16th, according to Reuters sources. mixed reporting

- UK reportedly nearing a free-trade agreement with oil-rich Gulf nations including Saudi Arabia, according to Bloomberg sources

FX

- DXY is firmer vs. all peers as the post-election rally continues and focuses markets on the prospect of looser fiscal policy vs. a subsequently potentially tighter approach from the Fed. DXY has been as high as 105.87 with all eyes on a test of the 106 mark.

- EUR is softer vs. the broadly stronger USD with the pair’s bruising post-election sell-off continuing to pick-up pace. From a macro perspective in the Eurozone, today has seen commentary from ECB’s Rehn and Holzmann with the former flagging downside risks to growth and the latter cautioning over the impact of Trump tariffs on inflation. German ZEW fell short of expectations. EUR/USD has delved as low as 1.0618.

- USD/JPY has made its way onto a 154 handle, topping out at 154.16 vs. yesterday’s opening levels of 152.61. Fresh macro drivers for Japan have been on the quiet side today.

- GBP is near the foot of the leaderboard in the wake of UK jobs metrics. The usual data quality caveats apply, however, the main takeaway was a larger-than-expected jump in the unemployment rate to 4.3% from 4.0% and a slowdown in the rate of employment. Comments from BoE’s Pill this morning adopted a cautious stance towards further policy loosening.

- Antipodeans are both softer vs. the USD with risk sentiment in Europe very much on the backfoot and a poor showing for China overnight.

- PBoC set USD/CNY mid-point at 7.1927 vs exp. 7.1944 (prev. 7.1786).

Fixed Income

- USTs are softer but only modestly so, with US-specific newsflow somewhat light as we count down to a handful of Fed speakers today before CPI and Powell later in the week. Currently, at the mid-point of a 109-24+ to 110-04 bound, yields firmer across the curve which is a touch flatter as it stands.

- Bunds were under modest pressure, but lifted incrementally from a 132.24 base, amid geopolitical reports, which suggested that Israel is planning an imminent ground operation in Lebanon, reported via Sky News Arabia (since deleted). Thereafter, soft ZEW metrics helped lift Bunds futher to a 132.62 peak.

- Gilts underperform vs peers after today’s mixed jobs report, where the unemployment rate lifting markedly, whilst the wages metrics remained sticky. Gilts lifted off lows in tandem with the bid in Bunds, and were largelly unreactive to its own robust auction.

- Netherlands sells EUR 2.105bln vs exp. EUR 2.0-2.5bln 0.25% 2029 DSL Auction: average yield +2.295% (prev. -0.427%).

- UK sells GBP 2.25bln 4.75% 2043 Gilt Auction: b/c 3.28x (prev. 3.27x), average yield 4.4836% (prev. 4.421%) & tail 0.1bps (prev. 0.1bps)

- Germany sells EUR 4.019bln vs exp. EUR 5bln 2.0% 2026 Schatz Auction; b/c 2.20x (prev. 2.61x), average yield 2.11% (prev. 2.16%) & retention 19.62% (prev. 16.76%)

Commodities

- Crude holds a mild upward bias after Israel’s Defence Minister Katz poured cold water on hopes of a Hezbollah-Israel ceasefire, suggesting there will be no ceasefire and Israel will continue to hit Hezbollah with full force. Brent towards the top of a USD 71.55-72.36/bbl parameter.

- Precious metals are softer across the board amid the continued gains in the USD on the back of the ongoing Trump trade. Spot gold fell under USD 2,600/oz resides towards the bottom of a USD 2,590.89-2,627.23/oz parameter.

- Base metals are lower across the board amid the firmer Dollar and a continuation of the disappointment from the NPC Standing Committee meeting last week. 3M LME copper fell to levels under USD 9,200/t.

- OPEC Monthly Oil Market Report due to be released at 11:40GMT/06:40EST.

- Biden’s administration is setting out plans for the US to triple nuclear power capacity by 2050, according to Bloomberg.

Geopolitics: Middle East

- Washington Post quoting US official: Israel tells Washington that it is planning an imminent ground operation in Lebanon”, via Sky News Arabia – NOTE: Sky News Arabia has since deleted this tweet

- Israel’s Defence Minister Katz says in Lebanon there will be no ceasefire, and will continue to hit Hezbollah with full force.

- “Palestinian source to Sky News Arabia: No agreement between Fatah and Hamas and the gaps between the two sides are still wide”, according to Sky News Arabia.

- “Israeli PM Netanyahu in conversations in recent days: When Trump goes back to the White House – we should put the annexation issue back on the table”, according to sources via Kann news.

- Walla cited US officials stating Israeli PM Netanyahu made it clear to the Biden administration that he wants to end the war in Lebanon within weeks, according to Sky News Arabia. Axios also cited US and Israeli officials stating that the Israeli Minister of Strategic Affairs briefed US President-elect Trump on plans for Gaza and Lebanon over the next two months. It was also reported that Israeli PM Netanyahu’s close aide Dermer met with US President-elect Trump on Sunday.

- Times of Israel reported that two officials in the previous Trump administration warned Israelis against assuming Trump would support Israel’s annexation of the West Bank in his second term, according to Sky News Arabia.

- Israeli occupation forces raided the cities of Bethlehem and Hebron in the southern West Bank, according to Al Jazeera.

- Iraqi armed factions attacked a “military target” in southern Israel with drones, according to Sky News. Arabia.

- Central Command of the US Army announced that it attacked nine targets in two locations linked to pro-Iranian militias in Syria as a response to the militias’ activity against US forces in the past 24 hours, according to Kann News.

- Ansar Allah media outlets reported US-British raids on the Hodeidah governorate in Yemen, according to Al Jazeera.

Geopolitics: Other

- Russian state agencies reported that a Russian navy carrier of hypersonic missiles conducted drills while passing through the English Channel, while RIA reported that the Russian ship capable of carrying hypersonic missiles carried out missions in the Atlantic after passing through the English Channel.

US Event Calendar

- 06:00: Oct. SMALL BUSINESS OPTIMISM 93.7, est. 92.0, prior 91.5

- 11:00: Oct. NY Fed 1-Yr Inflation Expectat, est. 2.97%, prior 3.00%

- 14:00: Senior Loan Officer Opinion Survey on Bank Lending Practices

Central Bank Speakers

- 10:00: Fed’s Waller Speaks at Banking Conference

- 10:15: Fed’s Barkin Speaks in Baltimore

- 14:00: Senior Loan Officer Opinion Survey on Bank Lending Practices

- 14:00: Fed’s Kashkari Participates in Moderated Conversation

- 17:00: Fed’s Harker Speaks on Fintech, AI

- 17:30: Fed’s Barkin Repeats Speech, followed with Q&A

DB’s Jim Reid concludes the overnight wrap

The post-election rally edged higher yesterday, as the S&P 500 (+0.10%) closed above the 6,000 mark for the first time, posting a fourth consecutive record high following the election and its 51st of 2024 so far. In fact, the index is currently experiencing its strongest YTD performance since 1995, having risen by +25.82% since the start of the year, and it’s the first time since 1997-98 that it’s on course to post back-to-back annual gains above +20% and only the third time in 100 years. So it was another strong performance, with the Dow Jones (+0.69%) closing above 44,000 for the first time as well, just as the small-cap Russell 2000 (+1.47%) closed just 0.3% from its all-time high back in November 2021.

This rally has led to a significant easing of financial conditions, but yesterday also saw investors dial back their expectations for rate cuts yet again. For instance, the rate priced in by the December 2025 meeting was up to 3.82% yesterday, meaning that investors are only pricing in three more 25bp rate cuts by the end of 2025. Bear in mind that’s risen by almost 100bps in just over six weeks, thanks to positive US data and the election result. So this is a significant reassessment of the Fed’s outlook, and with investors pricing in fewer rate cuts, the dollar index strengthened another +0.52%, reaching its highest level since early July.

Given the Veterans Day holiday, cash trading in US Treasuries was closed yesterday. But futures markets showed them losing ground across the curve, with 2yr, 5yr and 10yr futures all pointing towards higher yields. This morning in Asia they’ve crystallised this with 2 and 10yr yields up +3.8bps and +2.1bps, respectively. That also comes ahead of the CPI release tomorrow, where there’s been some concern about another robust print, particularly after monthly core CPI was at a 6-month high in September. We’ll have to see what that brings, but inflation expectations have risen quite a bit over the last couple of months, with the 2yr inflation swap up from just 1.99% on September 10 to 2.62% yesterday, so another upside surprise would only accelerate that trend. That said, our US economists expect core CPI to tick down in October to +0.26%.

In the meantime, there was a lot of focus on several “Trump trades”, which continued to outperform yesterday. Bitcoin was one of the most notable, rising by more than 10% yesterday and up another +0.96% this morning to trade above $88,000. Its YTD gain now stands above 100%. It’s been supported by the fact that Trump and the new Congress appear more friendly to crypto, and Marion Laboure on my team has just released a note looking at the immediate impact of the election on crypto along with the outlook ahead.

Among equities themselves, the Trump trade was also clear, and Tesla (+8.96%) advanced for a 5th consecutive session, bringing its gains over the last week to +44.1%. That single-handedly dragged the Magnificent 7 group to a +1.02% gain and another record high, even as five of them actually lost ground on the day. Nvidia (-1.61%) was the weakest of the Mag-7, echoing a -2.54% decline for the Philadelphia Semiconductor index after Reuters reported over the weekend that the US had told TSMC to stop shipping its advance AI chips to China. Meanwhile, banks continued to post strong gains, with the KBW Bank index rising +2.35%.

In terms of US politics, we got a few more reports on potential appointees to the new Trump administration yesterday. That included a report from Bloomberg, which said Trump would narrow the shortlist for Treasury Secretary this week. It also said he was leaning towards someone with Wall Street experience to the job. Otherwise, CNN reported that Trump would name Stephen Miller, his immigration adviser, as Deputy Chief of Staff for Policy. Overnight the FT and others suggest he will appoint Mike Waltz as national security advisor and Marco Rubio as Secretary of State. They are China hawks.

Lastly, we still don’t officially know who’s going to end up in control of the House of Representatives, but the current AP tally now stands at 214-205 to the Republicans, with 218 required for a majority. Polymarket is now putting the likelihood of a Republican sweep at 99%, and as it stands, the Republicans are currently ahead in more-than-enough districts to put them over the 218 majority line.

Over in Europe, risk assets followed a broadly similar pattern, and the STOXX 600 (+1.13%) posted its strongest performance in six weeks. But for sovereign bonds, there was a clear rally across the continent as investors priced in a growing likelihood of ECB rate cuts over the months ahead. In fact, yields on 10yr bunds (-4.0bps), OATs (-4.1bps) and BTPs (-6.3bps) all moved lower, which was in contrast to the way that US Treasury futures were pointing.

When it comes to German politics, there was still no clarity on when an election might take place, but there’s been plenty of pressure to bring forward the timetable of a confidence motion before the new year. AFP reported yesterday that German President Frank-Walter Steinmeier was moderating discussions between the parties, and Chancellor Scholz said on Sunday that an earlier vote could happen this year “if all sides agree”. Nevertheless, Scholz’s spokesman said yesterday that a vote of confidence wouldn’t happen this Wednesday, and Vice Chancellor Habeck of the Greens said yesterday that the decision was down to Scholz.

Asian equity markets are mostly lower this morning with non-US risk still struggling to weigh up all the post-election implications. Leading the losses is the Hang Seng (-2.73%), followed by the KOSPI (-1.73%), the Nikkei (-0.97%), and the Shanghai Composite (-0.85%). S&P 500 (-0.11%) and Nasdaq (-0.08%) futures are slightly lower.

A Bloomberg report overnight indicates that China is planning to cut taxes on home purchases. The proposal would allow major cities to reduce the deed tax for buyers to as low as 1%, down from the current rate of up to 3% in an effort to revive the struggling housing market.

To the day ahead now, and one of the main highlights will be the Fed’s Senior Loan Officer Opinion Survey on Bank Lending Practices. Otherwise, central bank speakers include the Fed’s Waller, Barkin, Kashkari and Harker, the ECB’s Rehn, Holzmann, Centeno and Cipollone, and the BoE’s Pill. Data releases include the UK unemployment rate for September, the German ZEW survey for November, and in the US there’s the NFIB’s small business optimism index for October.

Loading…