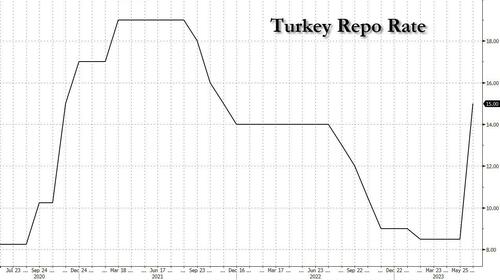

Ahead of today's Turkish central bank rate hike - the direct result of Erdogan replacing his entire economic team with a new generation of "traditionalists" including hiring the former co-CEO of First Republic to run his central bank (“I didn’t know her. We thought we should have a female chief at the central bank and took this step."), confusion reigned with FX strategists as clueless on what to expect from the CBRT as Adam Jonas is on Tesla, with estimates ranging from Goldman’s call for a hike to 40%, to Standard Chartered’s 14%. In the end, the central. bank's first move in ended up being weaker than pretty much anyone expected, with the new (female) head of the Turkish central bank delivering a significantly smaller interest-rate increase than anticipated, as the effectively insolvent country - with negative central bank net reserves...

Game Over For Turkey As Net Reserves Turn Negative, Morgan Stanley Sees Lira Collapsing https://t.co/H9fbUXr8H4

— zerohedge (@zerohedge) May 30, 2023

... embarks on what it said would be a gradual transition from an era of ultra-cheap money. In kneejerk reaction, the lira dropped to a new record low, crashing as much a 3% to a new all time low, as the USDJPY hit a record high of 24.6224...

... well on its way to our forecast for a 30 print in the near future.

Turkish Lira craters 3% to fresh Record Low; now below 22.

— zerohedge (@zerohedge) June 7, 2023

30 within weeks. Then it goes full Bolivar

In the first rate-setting meeting after Governor Hafize Gaye Erkan took over this month, the Monetary Policy Committee increased its benchmark to 15% from 8.5%, the first rate hike in more than two years... and very possibly the last one.

The Turkish lira reversed small kneejerk gains and slumped as much as 3% to a record low after the decision. It was trading at 24.35 per dollar at last check. Turkey’s dollar bonds erased gains to trade lower on the day, and the cost to insure Turkish debt against default using credit-default swaps jumped 20 basis points to 513.

The hike “sets the stage for a gradualist approach and policy mix that will be a learning process between markets and policymakers in the coming months,” said Simon Quijano-Evans, chief economist at Gemcorp Capital Management in London.

And while the central bank pledged some further tightening, saying that "monetary tightening will be further strengthened as much as needed in a timely and gradual manner until a significant improvement in the inflation outlook is achieved,” adding that “the Committee will simplify and improve the existing micro and macroprudential framework,” it cautioned that future steps would be gradual, in line with guidance from Treasury and Finance Minister Mehmet Simsek.

In fact, reading between the lines, it appears that even the new/former finance minister agrees with Erdogan that a weaker lira is a policy goal: in a twitter post, he said that “oolicy framework based on the principles of market economy, free foreign exchange regime and open economy will ensure significant capital inflow to Turkey,” adding that the central bank rates decision should be viewed in this context. “Stability and security of our currency is the most effective solution to get rid of dollarization problem.”

- Fiyat istikrarına odaklanan ve finansal istikrarı gözeten kurala dayalı para politikası,

— Mehmet Simsek (@memetsimsek) June 22, 2023

- Kamu kesimi mali dengesinde istikrarlı bir yapıyı ve sürdürülebilir bütçe finansmanını hedefleyen kurala dayalı öngörülebilir maliye politikası,

- Piyasa ekonomisi, serbest kambiyo…

In any case, the first rate hike in over two years is a turning point in Turkey’s departure from unconventional policies that are blamed for causing foreign investors to flee and prices to spiral out of control. At the same time, Bloomberg notes that it also vindicates those who questioned if President Recep Tayyip Erdogan — a self-described “enemy” of high interest rates who’s espoused the benefit of loose monetary policy for years — would give Erkan free rein. Indeed he has, if only for now... and in a few months when the Turkish reserve picture implodes even more, Erdogan will blame the new woman head of the central bank and revert back to conventional erdoganomics.

Erdogan set the gears in motion toward a policy reset soon after emerging victorious from presidential elections last month. In overhauling his economic team, Erdogan brought back ex-Merrill Lynch strategist Simsek as finance minister and installed Erkan at the helm of the central bank. Turkey’s first female central bank governor worked for nearly a decade at Goldman Sachs before spending almost eight years at failed US regional lender First Republic Bank.

Though the latest move was a surprise to much of the market, authorities tried to manage expectations ahead of the meeting. A senior Turkish economic official, who asked not to be named because of the sensitivity of the issue, cautioned that the jumbo rate hikes that were being priced in by the market may not materialize on Thursday. Simsek also told the nation’s top business and banking executives last week that he wanted to tread carefully to avoid unwanted side-effects, suggesting he’s wary of raising the cost of money too sharply.

Erdogan, who’s on his fifth central bank governor in four years, has maintained that lowering the cost of money will eventually result in slower and more stable inflation, a belief that goes against the core premise of economics and conventional monetary policy.

Earlier this month, the president appeared to give his new economy team the flexibility to act, saying he had “accepted” the measures they would take. In 2020, he allowed a brief return to conventional monetary policies, but ended up sacking then-Governor Naci Agbal for increasing rates too aggressively.

Looking ahead markets expect the central bank to deliver much more tightening - if at a very gradual pace - with the swaps market now expects the policy rate to climb to above 25% at the June meeting and to about 34% by the end of the year. Further disappointment if the central bank fails to achieve those levels would only hurt the economic team’s ability to restore what little is left of foreign investors’ confidence in Turkey.

Ahead of today’s Turkish central bank rate hike – the direct result of Erdogan replacing his entire economic team with a new generation of “traditionalists” including hiring the former co-CEO of First Republic to run his central bank (“I didn’t know her. We thought we should have a female chief at the central bank and took this step.“), confusion reigned with FX strategists as clueless on what to expect from the CBRT as Adam Jonas is on Tesla, with estimates ranging from Goldman’s call for a hike to 40%, to Standard Chartered’s 14%. In the end, the central. bank’s first move in ended up being weaker than pretty much anyone expected, with the new (female) head of the Turkish central bank delivering a significantly smaller interest-rate increase than anticipated, as the effectively insolvent country – with negative central bank net reserves…

Game Over For Turkey As Net Reserves Turn Negative, Morgan Stanley Sees Lira Collapsing https://t.co/H9fbUXr8H4

— zerohedge (@zerohedge) May 30, 2023

… embarks on what it said would be a gradual transition from an era of ultra-cheap money. In kneejerk reaction, the lira dropped to a new record low, crashing as much a 3% to a new all time low, as the USDJPY hit a record high of 24.6224…

… well on its way to our forecast for a 30 print in the near future.

Turkish Lira craters 3% to fresh Record Low; now below 22.

30 within weeks. Then it goes full Bolivar

— zerohedge (@zerohedge) June 7, 2023

In the first rate-setting meeting after Governor Hafize Gaye Erkan took over this month, the Monetary Policy Committee increased its benchmark to 15% from 8.5%, the first rate hike in more than two years… and very possibly the last one.

The Turkish lira reversed small kneejerk gains and slumped as much as 3% to a record low after the decision. It was trading at 24.35 per dollar at last check. Turkey’s dollar bonds erased gains to trade lower on the day, and the cost to insure Turkish debt against default using credit-default swaps jumped 20 basis points to 513.

The hike “sets the stage for a gradualist approach and policy mix that will be a learning process between markets and policymakers in the coming months,” said Simon Quijano-Evans, chief economist at Gemcorp Capital Management in London.

And while the central bank pledged some further tightening, saying that “monetary tightening will be further strengthened as much as needed in a timely and gradual manner until a significant improvement in the inflation outlook is achieved,” adding that “the Committee will simplify and improve the existing micro and macroprudential framework,” it cautioned that future steps would be gradual, in line with guidance from Treasury and Finance Minister Mehmet Simsek.

In fact, reading between the lines, it appears that even the new/former finance minister agrees with Erdogan that a weaker lira is a policy goal: in a twitter post, he said that “oolicy framework based on the principles of market economy, free foreign exchange regime and open economy will ensure significant capital inflow to Turkey,” adding that the central bank rates decision should be viewed in this context. “Stability and security of our currency is the most effective solution to get rid of dollarization problem.”

– Fiyat istikrarına odaklanan ve finansal istikrarı gözeten kurala dayalı para politikası,

– Kamu kesimi mali dengesinde istikrarlı bir yapıyı ve sürdürülebilir bütçe finansmanını hedefleyen kurala dayalı öngörülebilir maliye politikası,

– Piyasa ekonomisi, serbest kambiyo…

— Mehmet Simsek (@memetsimsek) June 22, 2023

In any case, the first rate hike in over two years is a turning point in Turkey’s departure from unconventional policies that are blamed for causing foreign investors to flee and prices to spiral out of control. At the same time, Bloomberg notes that it also vindicates those who questioned if President Recep Tayyip Erdogan — a self-described “enemy” of high interest rates who’s espoused the benefit of loose monetary policy for years — would give Erkan free rein. Indeed he has, if only for now… and in a few months when the Turkish reserve picture implodes even more, Erdogan will blame the new woman head of the central bank and revert back to conventional erdoganomics.

Erdogan set the gears in motion toward a policy reset soon after emerging victorious from presidential elections last month. In overhauling his economic team, Erdogan brought back ex-Merrill Lynch strategist Simsek as finance minister and installed Erkan at the helm of the central bank. Turkey’s first female central bank governor worked for nearly a decade at Goldman Sachs before spending almost eight years at failed US regional lender First Republic Bank.

Though the latest move was a surprise to much of the market, authorities tried to manage expectations ahead of the meeting. A senior Turkish economic official, who asked not to be named because of the sensitivity of the issue, cautioned that the jumbo rate hikes that were being priced in by the market may not materialize on Thursday. Simsek also told the nation’s top business and banking executives last week that he wanted to tread carefully to avoid unwanted side-effects, suggesting he’s wary of raising the cost of money too sharply.

Erdogan, who’s on his fifth central bank governor in four years, has maintained that lowering the cost of money will eventually result in slower and more stable inflation, a belief that goes against the core premise of economics and conventional monetary policy.

Earlier this month, the president appeared to give his new economy team the flexibility to act, saying he had “accepted” the measures they would take. In 2020, he allowed a brief return to conventional monetary policies, but ended up sacking then-Governor Naci Agbal for increasing rates too aggressively.

Looking ahead markets expect the central bank to deliver much more tightening – if at a very gradual pace – with the swaps market now expects the policy rate to climb to above 25% at the June meeting and to about 34% by the end of the year. Further disappointment if the central bank fails to achieve those levels would only hurt the economic team’s ability to restore what little is left of foreign investors’ confidence in Turkey.

Loading…