Update (1021ET):

United Auto Workers boss Shawn Fain said, "Today at noon Eastern time, all of the parts distribution facilities of GM and Stellantis are being called to stand up and strike." He said there will be strikes at 38 locations across 20 states.

* * *

Update (1018ET):

United Auto Workers boss Shawn Fain said, "Ford is serious about reaching a deal," but "It's a different story at GM and Stellantis."

* * *

Update (1004ET):

United Auto Workers boss Shawn Fain is set to speak with union members momentarily.

Fain is expected to "announce progress at the bargaining table with Ford Motor Co., an indication the union may not expand its strike targeting the automaker," according to Bloomberg, citing sources.

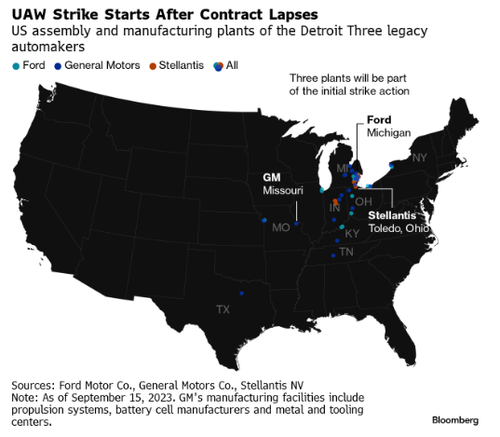

As for the other automakers, Fain is expected to target six more General Motors and Stellantis plants (in Michigan).

* * *

The head of United Auto Workers, Shawn Fain, warned General Motors Co., Ford Motor Co., and Stellantis NV earlier this week that strikes would expand on Friday - if offers for a new four-year labor contract were not increased to 'satisfying levels.'

Fast forward to Friday morning, UAW boss Fain is expected to address all 146,000 members via Facebook Live event around 1000 ET. He is expected to reveal the union's next steps in broadening strikes at automakers' manufacturing plants.

"Either the Big Three get down to business and work with us to make progress in negotiations, or more locals will be called on to stand up and go out on strike," Fain said on Monday.

A Deutsche Bank note shows the automakers have offered around 20% pay hike increase over a new four-year labor contract. There have been no new offers by automakers this week. UAW pay hike demands are still around 36%, indicating a very large gap in talks.

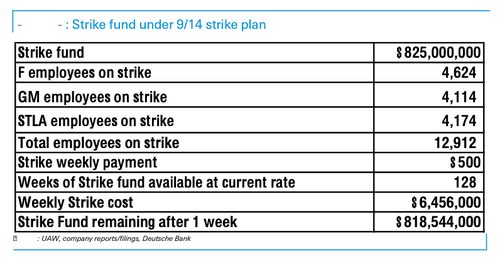

Bloomberg noted, "An expanded strike could ratchet up pressure on the carmakers to reach a deal. Fain's strategy has been to keep the companies guessing about his next move. But more members walking on also poses a risk to the union in the form of a diminished strike fund."

Deutsche Bank shows the union's strike fund had $825 million at the start of the strike one week ago.

The pressure is on for automakers and the union to find common ground at the bargaining table. Morgan Stanley's auto strategist, Adam Jonas, revealed in a note to clients this week, "The value of N. American light production of the D3 (F, GM, STLA collectively) is approximately $750mm per day (approx. 15k units per day). Applying slightly more than a 30% decremental (yes, mix is that high) implies around $250mm of lost profit per day (assuming 100% of production impacted)."

We've pointed out that automakers have already responded with layoffs of non-striking workers (see here & here).

The ball is in Fain's court today.

Update (1021ET):

United Auto Workers boss Shawn Fain said, “Today at noon Eastern time, all of the parts distribution facilities of GM and Stellantis are being called to stand up and strike.” He said there will be strikes at 38 locations across 20 states.

* * *

Update (1018ET):

United Auto Workers boss Shawn Fain said, “Ford is serious about reaching a deal,” but “It’s a different story at GM and Stellantis.”

* * *

Update (1004ET):

United Auto Workers boss Shawn Fain is set to speak with union members momentarily.

Fain is expected to “announce progress at the bargaining table with Ford Motor Co., an indication the union may not expand its strike targeting the automaker,” according to Bloomberg, citing sources.

[embedded content]

As for the other automakers, Fain is expected to target six more General Motors and Stellantis plants (in Michigan).

* * *

The head of United Auto Workers, Shawn Fain, warned General Motors Co., Ford Motor Co., and Stellantis NV earlier this week that strikes would expand on Friday – if offers for a new four-year labor contract were not increased to ‘satisfying levels.’

Fast forward to Friday morning, UAW boss Fain is expected to address all 146,000 members via Facebook Live event around 1000 ET. He is expected to reveal the union’s next steps in broadening strikes at automakers’ manufacturing plants.

“Either the Big Three get down to business and work with us to make progress in negotiations, or more locals will be called on to stand up and go out on strike,” Fain said on Monday.

A Deutsche Bank note shows the automakers have offered around 20% pay hike increase over a new four-year labor contract. There have been no new offers by automakers this week. UAW pay hike demands are still around 36%, indicating a very large gap in talks.

Bloomberg noted, “An expanded strike could ratchet up pressure on the carmakers to reach a deal. Fain’s strategy has been to keep the companies guessing about his next move. But more members walking on also poses a risk to the union in the form of a diminished strike fund.”

Deutsche Bank shows the union’s strike fund had $825 million at the start of the strike one week ago.

The pressure is on for automakers and the union to find common ground at the bargaining table. Morgan Stanley’s auto strategist, Adam Jonas, revealed in a note to clients this week, “The value of N. American light production of the D3 (F, GM, STLA collectively) is approximately $750mm per day (approx. 15k units per day). Applying slightly more than a 30% decremental (yes, mix is that high) implies around $250mm of lost profit per day (assuming 100% of production impacted).”

We’ve pointed out that automakers have already responded with layoffs of non-striking workers (see here & here).

The ball is in Fain’s court today.

Loading…