So much can change in just 48 hours.

Late on Thursday, just hours after the SNB had launched the first (of many) bailout attempts of Swiss banking giant Credit Suisse, Bloomberg blasted the following headline:

- *UBS, CREDIT SUISSE SAID TO OPPOSE IDEA OF A FORCED COMBINATION

This lack of enthusiasm by UBS to acquire its struggling rival of course forced the Swiss National Bank to front CS a CHF50 billion credit line to hold it over for the next four days amid a furious bank run, one which we said would be woefully insufficient to restore confidence in the collapsing lender, and which we probably used up in just a few hours.

Then, late on Friday, both banks "unexpectedly" changed their minds and we got the following 180 degree U-Turn report from the FT:

- *UBS IN TALKS TO ACQUIRE ALL OR PART OF CREDIT SUISSE: FT

So a deal is inevitable after all... but as always, there is a footnote one which we predicted yesterday when we said that a deal would only happen if the acquiring bank - in this case UBS - got a full central bank backstop.

bank megamerger weekend, with lots of central bank backstops https://t.co/pobOLTtFJM

— zerohedge (@zerohedge) March 17, 2023

That now appears to be the case with Bloomberg, Reuters and the WSJ all reporting that UBS is asking the Swiss government for a backstop to cover future risks if it were to buy Credit Suisse Group AG, after the Swiss National Bank and regulator Finma have told international counterparts that they regard a deal with UBS as the only option to arrest a collapse in confidence in Credit Suisse. The FT reported that deposit outflows from the bank topped CHF10bn ($10.8bn) a day late last week as fears for its health mounted.

According to the reports, UBS is discussing scenarios in which the government would take on certain legal costs and potential losses in any deal. Credit Suisse set aside SFr1.2bn in legal provisions in 2022 and warned that as yet unresolved lawsuits and regulatory probes could add another SFr1.2bn.

UBS also wants to be allowed to phase in any demands it would face under global rules on capital for the world’s biggest banks.

The backroom negotiations are taking place as the largest Swiss bank is exploring an urgent acquisition of all or parts of its smaller rival at the urging of regulators to halt a crisis of confidence, one which local authorities hope will be concluded on Saturday

Under one likely scenario, the deal would involve UBS acquiring Credit Suisse to obtain its wealth and asset management units, while possibly divesting the investment banking division, which has become the laughing stock on Wall Street after being one of the most iconic groups less than two decades ago. Talks are also still ongoing on the fate of Credit Suisse’s profitable Swiss universal bank.

According to the FT, the boards of the two banks are meeting this weekend as Credit Suisse’s regulators in the US, the UK and Switzerland are considering the legal structure of a deal and several concessions that UBS has sought.

UBS wants to be allowed to phase in any demands it would face under global rules on capital for the world’s biggest banks. Additionally, UBS has requested some form of indemnity or government agreement to cover future legal costs, one of the people said.

* * *

The time scale for agreement is fluid, according to Bloomberg which notes that the goal is for an announcement of a deal between the two banks by Sunday evening at the latest, while the Financial Times reported that a deal could emerge as soon as Saturday evening.

UBS executives had been opposed to an arranged combination with its rival because they wanted to focus on their own wealth management-centric strategy and were reluctant to take on risks related to Credit Suisse, Bloomberg reported earlier this week. Credit Suisse had 1.2 billion Swiss francs ($1.3 billion) in legal provisions at the end of 2022 and disclosed that it saw reasonably possible losses adding another 1.2 billion francs to that total, with several lawsuits and regulatory probes outstanding, according to Bloomberg Intelligence.

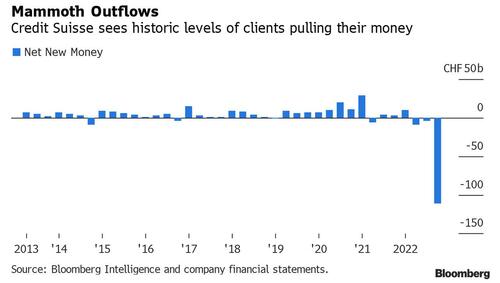

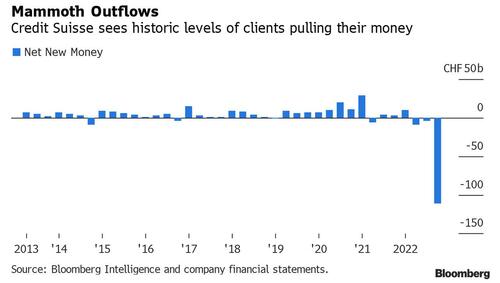

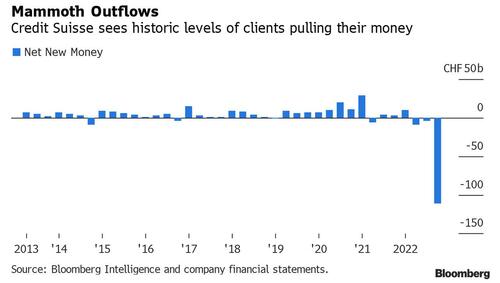

Credit Suisse has been unprofitable over the course of the last decade and has racked up billions in legal losses, while also suffering a historic bank run.

As we reported yesterday, the bank run spike late last week, and FT sources said deposit outflows from the bank topped Sfr10bn ($10.8bn) a day late last week as fears for its health mounted.

A government-brokered deal would address a rout in Credit Suisse that sent shock waves across the global financial system this week when panicked investors dumped its shares and bonds following the collapse of several smaller US lenders. A liquidity backstop by the Swiss central bank this week briefly arrested the declines, but the market drama carries the risk that clients or counterparties would continue fleeing, with potential ramifications for the broader industry.

The prospective takeover reflects the sharp divergence in the two banks’ fortunes. Over the past three years, UBS shares have gained about 120% while those of its smaller rival have plunged roughly 70%.

The former has a market capitalisation of $56.6bn, while Credit Suisse closed trading on Friday with a value of $8bn. In 2022, UBS generated $7.6bn of profit, whereas Credit Suisse made a $7.9bn loss, effectively wiping out the entire previous decade’s earnings.

* * *

Swiss regulators told their US and UK counterparts on Friday evening that merging the two banks was “plan A” to arrest a collapse in investor confidence in Credit Suisse, one of the people said. There is no guarantee a deal, which would need to be approved by UBS shareholders, will be reached the FT warned.

Negotiators have given Credit Suisse the code name Cedar and UBS is referred to as Ulmus, according to people briefed on the matter.

The fact that the SNB and Finma favour a Swiss solution has deterred other potential bidders. Earlier today the FT reported that BlackRock had drawn up a rival approach, evaluated a number of options and talked to other potential investors, but in the end withdrew from the process.

A full merger between UBS and Credit Suisse - whose headquarters face each other across Zurich’s central Paradeplatz square, would be an historic event for the nation and global finance and would create one of the biggest global systemically important financial institutions in Europe. UBS has $1.1tn total assets on its balance sheet and Credit Suisse has $575bn. However, such a large deal may prove too unwieldy to execute.

The Financial Times has previously reported that other options under consideration include breaking up Credit Suisse and raising funds via a public offering of its ringfenced Swiss division, with the wealth and asset management units being sold to UBS or other bidders.

UBS has been on high alert for an emergency rescue call from the Swiss government after investors grew wary of Credit Suisse’s most recent restructuring. Last year, chief executive Ulrich Körner announced a plan to cut 9,000 jobs and spin off much of its investment bank into a new entity called First Boston, run by former board member Michael Klein.

So much can change in just 48 hours.

Late on Thursday, just hours after the SNB had launched the first (of many) bailout attempts of Swiss banking giant Credit Suisse, Bloomberg blasted the following headline:

- *UBS, CREDIT SUISSE SAID TO OPPOSE IDEA OF A FORCED COMBINATION

This lack of enthusiasm by UBS to acquire its struggling rival of course forced the Swiss National Bank to front CS a CHF50 billion credit line to hold it over for the next four days amid a furious bank run, one which we said would be woefully insufficient to restore confidence in the collapsing lender, and which we probably used up in just a few hours.

Then, late on Friday, both banks “unexpectedly” changed their minds and we got the following 180 degree U-Turn report from the FT:

- *UBS IN TALKS TO ACQUIRE ALL OR PART OF CREDIT SUISSE: FT

So a deal is inevitable after all… but as always, there is a footnote one which we predicted yesterday when we said that a deal would only happen if the acquiring bank – in this case UBS – got a full central bank backstop.

bank megamerger weekend, with lots of central bank backstops https://t.co/pobOLTtFJM

— zerohedge (@zerohedge) March 17, 2023

That now appears to be the case with Bloomberg, Reuters and the WSJ all reporting that UBS is asking the Swiss government for a backstop to cover future risks if it were to buy Credit Suisse Group AG, after the Swiss National Bank and regulator Finma have told international counterparts that they regard a deal with UBS as the only option to arrest a collapse in confidence in Credit Suisse. The FT reported that deposit outflows from the bank topped CHF10bn ($10.8bn) a day late last week as fears for its health mounted.

According to the reports, UBS is discussing scenarios in which the government would take on certain legal costs and potential losses in any deal. Credit Suisse set aside SFr1.2bn in legal provisions in 2022 and warned that as yet unresolved lawsuits and regulatory probes could add another SFr1.2bn.

UBS also wants to be allowed to phase in any demands it would face under global rules on capital for the world’s biggest banks.

The backroom negotiations are taking place as the largest Swiss bank is exploring an urgent acquisition of all or parts of its smaller rival at the urging of regulators to halt a crisis of confidence, one which local authorities hope will be concluded on Saturday

Under one likely scenario, the deal would involve UBS acquiring Credit Suisse to obtain its wealth and asset management units, while possibly divesting the investment banking division, which has become the laughing stock on Wall Street after being one of the most iconic groups less than two decades ago. Talks are also still ongoing on the fate of Credit Suisse’s profitable Swiss universal bank.

According to the FT, the boards of the two banks are meeting this weekend as Credit Suisse’s regulators in the US, the UK and Switzerland are considering the legal structure of a deal and several concessions that UBS has sought.

UBS wants to be allowed to phase in any demands it would face under global rules on capital for the world’s biggest banks. Additionally, UBS has requested some form of indemnity or government agreement to cover future legal costs, one of the people said.

* * *

The time scale for agreement is fluid, according to Bloomberg which notes that the goal is for an announcement of a deal between the two banks by Sunday evening at the latest, while the Financial Times reported that a deal could emerge as soon as Saturday evening.

UBS executives had been opposed to an arranged combination with its rival because they wanted to focus on their own wealth management-centric strategy and were reluctant to take on risks related to Credit Suisse, Bloomberg reported earlier this week. Credit Suisse had 1.2 billion Swiss francs ($1.3 billion) in legal provisions at the end of 2022 and disclosed that it saw reasonably possible losses adding another 1.2 billion francs to that total, with several lawsuits and regulatory probes outstanding, according to Bloomberg Intelligence.

Credit Suisse has been unprofitable over the course of the last decade and has racked up billions in legal losses, while also suffering a historic bank run.

As we reported yesterday, the bank run spike late last week, and FT sources said deposit outflows from the bank topped Sfr10bn ($10.8bn) a day late last week as fears for its health mounted.

A government-brokered deal would address a rout in Credit Suisse that sent shock waves across the global financial system this week when panicked investors dumped its shares and bonds following the collapse of several smaller US lenders. A liquidity backstop by the Swiss central bank this week briefly arrested the declines, but the market drama carries the risk that clients or counterparties would continue fleeing, with potential ramifications for the broader industry.

The prospective takeover reflects the sharp divergence in the two banks’ fortunes. Over the past three years, UBS shares have gained about 120% while those of its smaller rival have plunged roughly 70%.

The former has a market capitalisation of $56.6bn, while Credit Suisse closed trading on Friday with a value of $8bn. In 2022, UBS generated $7.6bn of profit, whereas Credit Suisse made a $7.9bn loss, effectively wiping out the entire previous decade’s earnings.

* * *

Swiss regulators told their US and UK counterparts on Friday evening that merging the two banks was “plan A” to arrest a collapse in investor confidence in Credit Suisse, one of the people said. There is no guarantee a deal, which would need to be approved by UBS shareholders, will be reached the FT warned.

Negotiators have given Credit Suisse the code name Cedar and UBS is referred to as Ulmus, according to people briefed on the matter.

The fact that the SNB and Finma favour a Swiss solution has deterred other potential bidders. Earlier today the FT reported that BlackRock had drawn up a rival approach, evaluated a number of options and talked to other potential investors, but in the end withdrew from the process.

A full merger between UBS and Credit Suisse – whose headquarters face each other across Zurich’s central Paradeplatz square, would be an historic event for the nation and global finance and would create one of the biggest global systemically important financial institutions in Europe. UBS has $1.1tn total assets on its balance sheet and Credit Suisse has $575bn. However, such a large deal may prove too unwieldy to execute.

The Financial Times has previously reported that other options under consideration include breaking up Credit Suisse and raising funds via a public offering of its ringfenced Swiss division, with the wealth and asset management units being sold to UBS or other bidders.

UBS has been on high alert for an emergency rescue call from the Swiss government after investors grew wary of Credit Suisse’s most recent restructuring. Last year, chief executive Ulrich Körner announced a plan to cut 9,000 jobs and spin off much of its investment bank into a new entity called First Boston, run by former board member Michael Klein.

Loading…