Yesterday's stellar 3Y auction was followed by a very ugly sale of 10Y notes which priced moments ago at the highest yield since Nov 2018 and tailed the When Issued by 1.4bps.

Today's sale of $36 billion in 10Y paper priced at 2.943%, well above last month's 2.72% and the highest since 3.209% in November 2018. Curiously, while the 10Y was trading at 3.2% just two days ago, which would have ensured the first 3% coupon on the 10Y since 2018, the recent drop in yields was sufficient to avoid this outcome and the interest rate on today's note was 2.875%, just one tick shy of 3.00%.

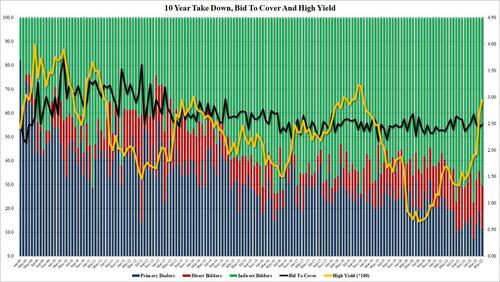

The Bid to Cover of 2.49 was above last month's 2.43 and was right on top of the six-auction average of 2.48.

The internals were solid as well, with foreign buyers, or Indirects, awarded 70.3%, the most since February and just above the 69.25% recent average. And with Directs taking a solid 18.2%, also higher than the 16.6% recent average, Dealers were left with a near record low 11.5%, sharply below last month's 18.7%. One can be certain that the end of QE has a factor in this.

Yesterday’s stellar 3Y auction was followed by a very ugly sale of 10Y notes which priced moments ago at the highest yield since Nov 2018 and tailed the When Issued by 1.4bps.

Today’s sale of $36 billion in 10Y paper priced at 2.943%, well above last month’s 2.72% and the highest since 3.209% in November 2018. Curiously, while the 10Y was trading at 3.2% just two days ago, which would have ensured the first 3% coupon on the 10Y since 2018, the recent drop in yields was sufficient to avoid this outcome and the interest rate on today’s note was 2.875%, just one tick shy of 3.00%.

The Bid to Cover of 2.49 was above last month’s 2.43 and was right on top of the six-auction average of 2.48.

The internals were solid as well, with foreign buyers, or Indirects, awarded 70.3%, the most since February and just above the 69.25% recent average. And with Directs taking a solid 18.2%, also higher than the 16.6% recent average, Dealers were left with a near record low 11.5%, sharply below last month’s 18.7%. One can be certain that the end of QE has a factor in this.