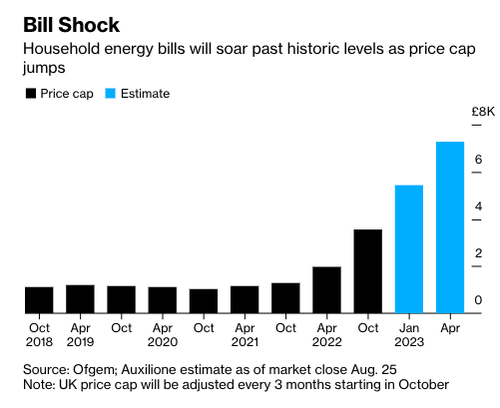

The 80% rise in the U.K.'s cap for consumer electricity and natural gas bills this fall will drive millions of households into energy poverty this winter as the worsening cost-of-living crisis stokes fears of recession.

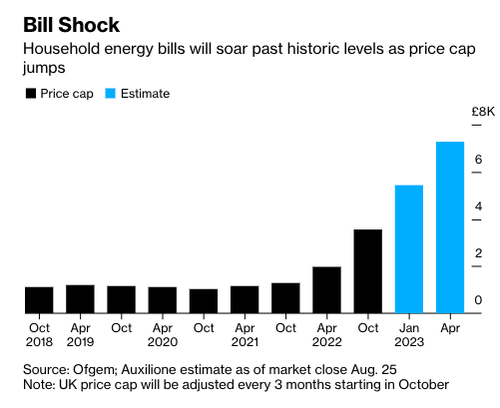

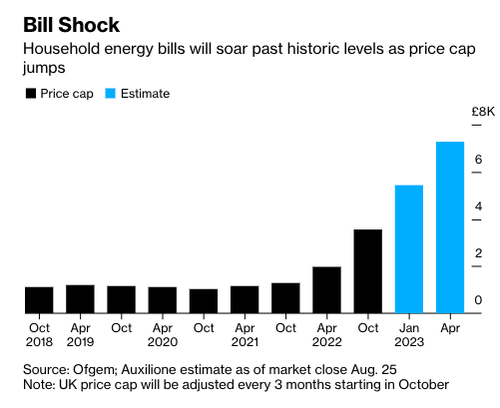

All the chatter today among British people is energy regulator Ofgem's rise in the cap on power bills to a record £3,549 ($4,189) beginning Oct. 1 from £1,971 ($2,330) at present. That cap is expected to rise to £5,439 ($6,427) by January and £7,272 ($8,594) by spring -- all due to skyrocketing wholesale NatGas and electricity prices caused by declining Russian energy supplies to Europe, made worse by Western sanctions that have backfired.

"An increase of this much cannot be budgeted for by households with no wiggle room," said Peter Smith, director of policy and advocacy for the National Energy Action charity. "Come October, low-income households will simply not turn on their heating."

Reuters spoke to one Brit, Philip Keetley, who said:

"The cost of living has increased and yet you're still expected to live on the money provided for when there wasn't a crisis ... I either can have my heating on or eat."

Another Brit, Dawn White, who has kidney failure, fears the cost of soaring energy costs means she won't be able to afford life-saving medical treatment:

"Without my (dialysis) machine five times a week, 20 hours, I will die," the 59-year-old woman said.

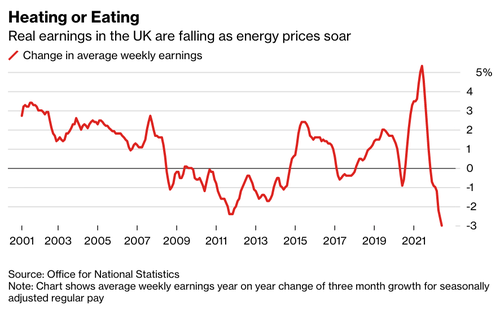

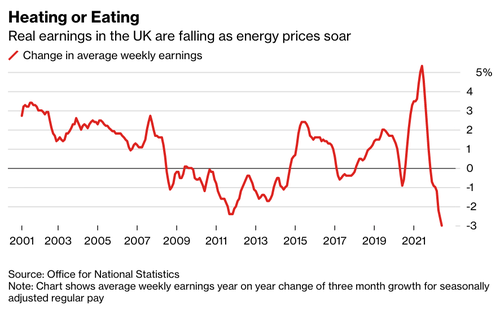

Soaring energy inflation has crushed real earnings for Brits, forcing many to pull back on spending.

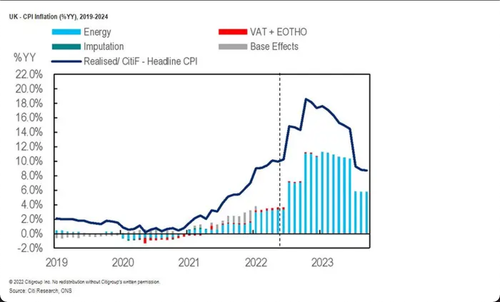

The higher cap rate could push inflation to even more elevated levels as U.K. economists at Citi warned CPI inflation could reach a mindboggling 18.6% print in January due to soaring energy prices.

The last time CPI printed above 18% was during the stagflationary years of the mid-1970s (more precisely, 1976) after an oil supply shock led to soaring energy prices worldwide.

Currently, the CPI stands at 10.1% in July for the first time in four decades, primarily driven by skyrocketing food and fuel prices as households crumble under the weight of the cost of living crisis.

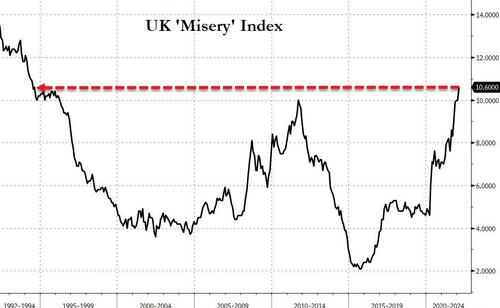

Inflation at decades highs has pushed U.K. Misery Index, an economic indicator to gauge how the average person is doing, to three-decade highs, a sign discontent is emerging.

"It's going to be horrendous," said Bill Bullen, chief executive officer of Utilita Energy Ltd., which supplies 810,000 homes in the U.K. "We are going to see a big increase in people struggling to pay for their energy bills."

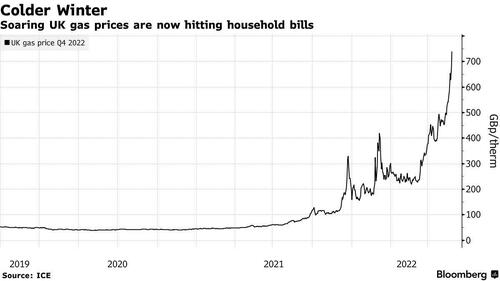

Last winter's cap was £1,277, but that was before European leaders sanctioned the hell out of Moscow for the invasion of Ukraine. With the cold season just a few short months away, power prices are already at record highs as Russia's Nord Stream 1 NatGas pipeline to the bloc experiences supply disruptions.

UK NatGas prices are also hyperinflating.

This winter could be one of the darkest in decades for U.K. households. The government has provided billions of pounds to support families, but that may not reduce the growing discontent.

The resistance is growing as more than 116,000 irritated people have pledged not to pay their electricity bill this fall when the new price cap begins, in a movement called "Don't Pay U.K."

"Ofgem just passed a debt and death sentence on millions - we've been left with no options but to refuse to pay," the anonymous group spearheading the effort to have more than one million Brits boycott paying their power bill by Oct. 1.

🚨 Our call to the country: No one cold or hungry this winter!

— Don't Pay. (@dontpayuk) August 26, 2022

🔥 Ofgem just passed a debt and death sentence on millions - we've been left with no options but to refuse to pay.

We can't pay, we won't pay! Strike! https://t.co/RYOlAVpjfL#DontPayUK #CostOfGreedCrisis pic.twitter.com/h8VhsmIOpo

Soaring power bills will have a devastating impact on society, far greater than the GFC over a decade ago, warned James Cooper, a partner at Baringa. He warned:

"We're now moving into territory where a majority of households are placed into debt or a very fragile financial position."

A financial implosion of the households will spur discontent in what could be winter from hell across the U.K.

The 80% rise in the U.K.’s cap for consumer electricity and natural gas bills this fall will drive millions of households into energy poverty this winter as the worsening cost-of-living crisis stokes fears of recession.

All the chatter today among British people is energy regulator Ofgem’s rise in the cap on power bills to a record £3,549 ($4,189) beginning Oct. 1 from £1,971 ($2,330) at present. That cap is expected to rise to £5,439 ($6,427) by January and £7,272 ($8,594) by spring — all due to skyrocketing wholesale NatGas and electricity prices caused by declining Russian energy supplies to Europe, made worse by Western sanctions that have backfired.

“An increase of this much cannot be budgeted for by households with no wiggle room,” said Peter Smith, director of policy and advocacy for the National Energy Action charity. “Come October, low-income households will simply not turn on their heating.”

Reuters spoke to one Brit, Philip Keetley, who said:

“The cost of living has increased and yet you’re still expected to live on the money provided for when there wasn’t a crisis … I either can have my heating on or eat.”

Another Brit, Dawn White, who has kidney failure, fears the cost of soaring energy costs means she won’t be able to afford life-saving medical treatment:

“Without my (dialysis) machine five times a week, 20 hours, I will die,” the 59-year-old woman said.

Soaring energy inflation has crushed real earnings for Brits, forcing many to pull back on spending.

The higher cap rate could push inflation to even more elevated levels as U.K. economists at Citi warned CPI inflation could reach a mindboggling 18.6% print in January due to soaring energy prices.

The last time CPI printed above 18% was during the stagflationary years of the mid-1970s (more precisely, 1976) after an oil supply shock led to soaring energy prices worldwide.

Currently, the CPI stands at 10.1% in July for the first time in four decades, primarily driven by skyrocketing food and fuel prices as households crumble under the weight of the cost of living crisis.

Inflation at decades highs has pushed U.K. Misery Index, an economic indicator to gauge how the average person is doing, to three-decade highs, a sign discontent is emerging.

“It’s going to be horrendous,” said Bill Bullen, chief executive officer of Utilita Energy Ltd., which supplies 810,000 homes in the U.K. “We are going to see a big increase in people struggling to pay for their energy bills.”

Last winter’s cap was £1,277, but that was before European leaders sanctioned the hell out of Moscow for the invasion of Ukraine. With the cold season just a few short months away, power prices are already at record highs as Russia’s Nord Stream 1 NatGas pipeline to the bloc experiences supply disruptions.

UK NatGas prices are also hyperinflating.

This winter could be one of the darkest in decades for U.K. households. The government has provided billions of pounds to support families, but that may not reduce the growing discontent.

The resistance is growing as more than 116,000 irritated people have pledged not to pay their electricity bill this fall when the new price cap begins, in a movement called “Don’t Pay U.K.”

“Ofgem just passed a debt and death sentence on millions – we’ve been left with no options but to refuse to pay,” the anonymous group spearheading the effort to have more than one million Brits boycott paying their power bill by Oct. 1.

🚨 Our call to the country: No one cold or hungry this winter!

🔥 Ofgem just passed a debt and death sentence on millions – we’ve been left with no options but to refuse to pay.

We can’t pay, we won’t pay! Strike! https://t.co/RYOlAVpjfL#DontPayUK #CostOfGreedCrisis pic.twitter.com/h8VhsmIOpo

— Don’t Pay. (@dontpayuk) August 26, 2022

Soaring power bills will have a devastating impact on society, far greater than the GFC over a decade ago, warned James Cooper, a partner at Baringa. He warned:

“We’re now moving into territory where a majority of households are placed into debt or a very fragile financial position.”

A financial implosion of the households will spur discontent in what could be winter from hell across the U.K.