Nomura's Charlie McElligott began his must-read note overnight by warning "go home options, u r drunk!"

And 'drunk' they are, as the cross-asset strategist details below a few market-structure / behavioral dynamics contributing to the outrageous intraday volatility of the past week+ period in US Equities, alongside a few stunning charts / metrics...

WHY THIS WEEK HAS BEEN SUCH A HOT-MESS OF SWINGS, FUELED BY AN UNUSUALLY PROFILIC AMOUNT OF $DELTA TO TRADE INTO OP-EX:

So we went over all the key “Vol Themes” in yesterday’s note, where I spoke to contributing factors behind a very “mechanically-driven” market flow of late (and 2nd order knock-on into Systematic strategy flows thereafter)…and I’d recommend a re-read of those themes, bc they speak to a vol-regime that remains incredibly abnormal vs historical precedent

But I really gotta stress two dynamics here which have been evolving / accelerating in recent months, as it relates to the insanity that has been the open-to-close trading in US Equities so acutely over this past week period:

1) the explosion (and institutionalizion) of trading in hyper-convex 0-1DT options which has escalated in recent days / weeks, and

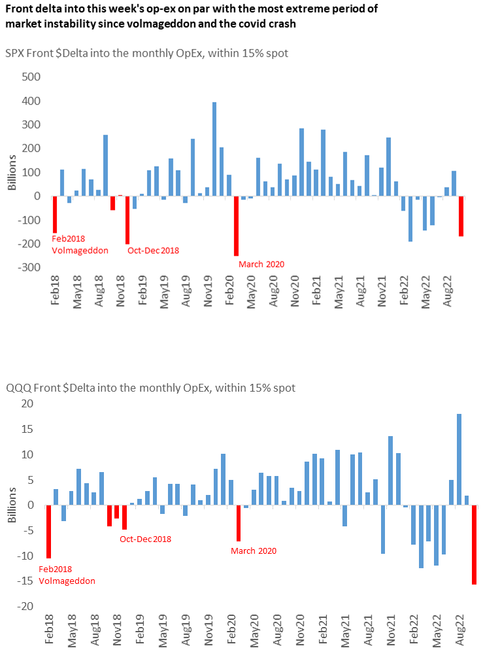

2) the sheer scale of the Front-Delta needing to be traded into this week’s Op-Ex, which for SPX is on par with Volmageddon Feb ‘18, the J Powell “Autopilot / Long-way from Neutral” Debacle in Dec ‘18 and the COVID panic of Mar ’20…while the front-Delta to be traded into this week’s QQQ (Nasdaq) expiration actually exceeded each of those prior “Vol Shocks”!

1. YOLO’ing into 0 and 1 Days-Til-Expiration (DTE) Options

This has now been “institutionalized” by Vol traders at many of the largest funds on the Street….i.e. it’s not about Retail-alone playing this game anymore

INSTITUTIONAL entities are now the most prominent users creating all this extreme daily market convexity with their usage of ultra-short dated options—because now, we see the “big boys” having surpassed the prior Retail YOLO set (which had been the largest users of the of the 0-1DTE stuff), and have become full-tilt DAY TRADERS, using the certainty of Dealer hedging flows that their orders create to then amplify and “juice” the intended directional market move... before closing-out positions mere hours later by EOD

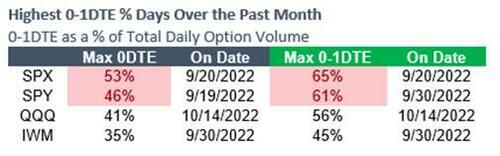

The proof is in the pudding - over the past 1m period alone, we have seen witnessed some absolutely biblical usage of 0DTE and 1DTE options, and it’s acting like jet fuel being dumped on the already out of control “macro” fire occurring into persistent “Negative Gamma” momentum overshoot flows…looking at this snippet of the “max” usage days as % of overall volumes in the underlying product over the past month:

-

On 9/20/22, 53% of total SPX options volume was from 0 days-til-expiration options—and 65% of the overall was from 0-1DTE options combined

-

46% of SPY options volume was from 0DTE’s alone on 9/19/22—while on 9/30/22, 61% of total SPY options volume that day was from 0-1DTE’s

-

For QQQ, we saw 0DTE’s make a high print of 41% of overall options volume on 10/14/22—with 56% of the overall QQQ options volumes that same day coming from 0-1DTE’s alone

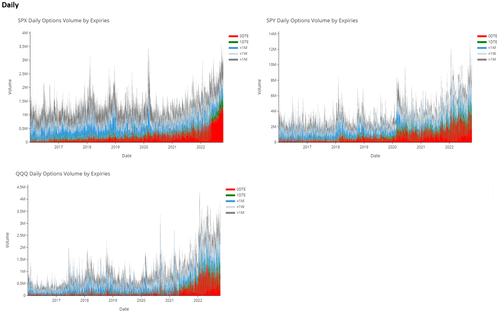

And the bigger picture, look at the trend trajectory in the % of the overall daily options volume with 0-1DTE options are now making-up, EXPLODING vertically in usage in recent years and even more exponentially in recent months /weeks /days, corresponding with now-daily Options Expirations which have made “Weaponized Gamma” the only game in town:

Source: Nomura

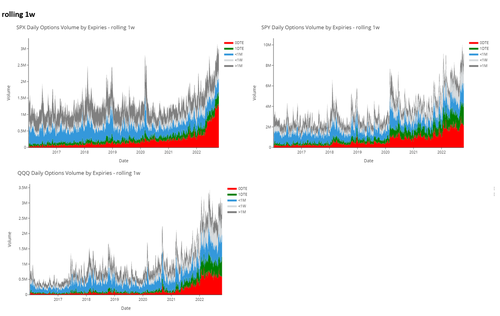

“Smoothing” the noisy dailies, this shot of the rolling 1w trajectory is even cleaner in showing how the “institutional” engagement in these options is behind “exponential”-like growth in their volumes...

Source: Nomura

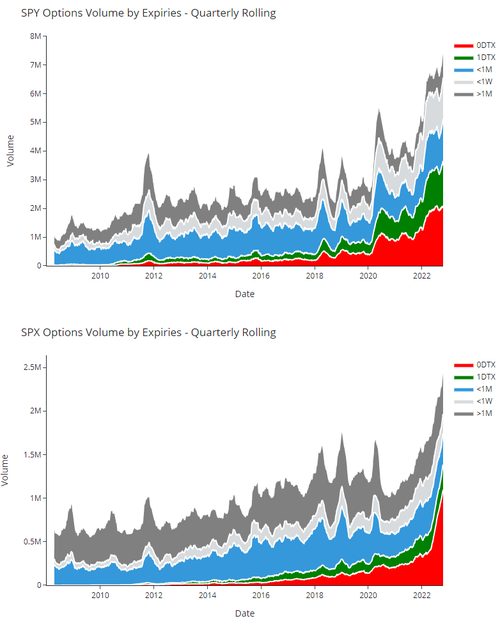

And these zoomed-in view of 0 and 1 DTE options in SPY and SPX through a quarterly rolling lens is even more compelling:

Source: Nomura

2. Separately, this past week + period into Friday’s monthly Op-Ex has been an absolute outlier on par with some of the “most stressed” periods of market instability seen in recent history, as it relates to the sheer scale of the Front-Delta into this week’s Op-Ex

Yes, This Friday’s Op-Ex has a substantial amount of exposure rolling-off: 29% of SPX/SPY $Gamma is set to drop, 42% of QQQ $Gamma and 49% of IWM $Gamma…all of which then frees us up for movement thereafter, as those hedging barriers are then reduced…

But most critically as it relates to the outrageous ranges & swings this past week in US Equities and into the upcoming expiration, it is the staggering amount of (negative) front-Delta into Friday’s Op-Ex that has then needed to be traded on the approach, which is then acting as further shadow-convexity in the market (and then commingling as part of the feedback loop of flows from the aforementioned “same day” Options flows discussed earlier)

Source: Nomura

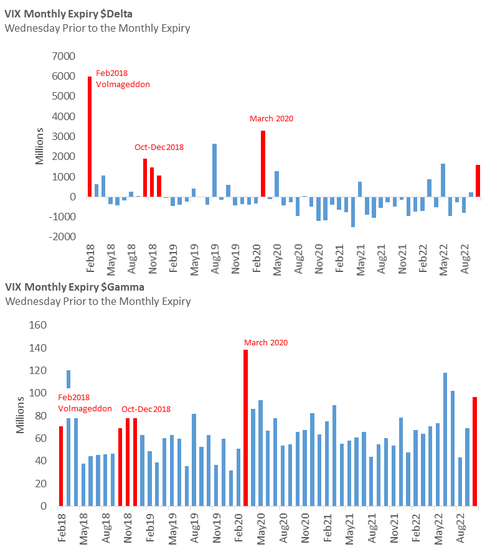

And there is definitely some interplay here with a similar dynamic being seen in recently very active VIX options, where the past week period into today’s VIXpiration had some of the largest $Delta and $Gamma to trade / move over the past four years, and again in-line with recent “Vol Shock” periods:

Source: Nomura

So putting it all together:

-

Unprecedented “Weaponized Gamma” from the “institutionalization” of 0-1DTE Index / ETF options trading causing “intraday chase” flows we’ve never seen the likes of previously;

-

US Equities options front-Delta to trade into Op-Ex at levels only seen during prior Vol Shock / “crash” periods;

-

$Yen coming unglued with intervention likely to necessitate reserves funded by selling UST front-end;

-

and all as financial conditions further “impulse tighten,” with the US Dollar and Real Yields re-emboldened higher to rest of world’s detriment,

-

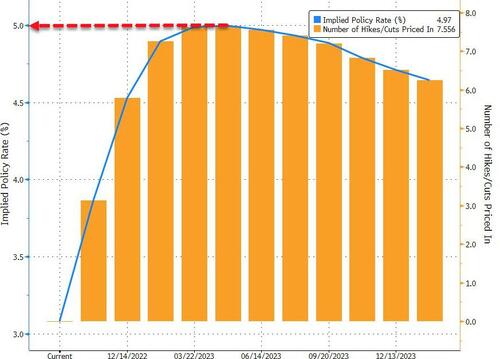

and all as Fed “Terminal Rate” projections are about to make fresh highs at 5.00%...

ARE YOU NOT ENTERTAINED?

Nomura’s Charlie McElligott began his must-read note overnight by warning “go home options, u r drunk!”

And ‘drunk’ they are, as the cross-asset strategist details below a few market-structure / behavioral dynamics contributing to the outrageous intraday volatility of the past week+ period in US Equities, alongside a few stunning charts / metrics…

WHY THIS WEEK HAS BEEN SUCH A HOT-MESS OF SWINGS, FUELED BY AN UNUSUALLY PROFILIC AMOUNT OF $DELTA TO TRADE INTO OP-EX:

So we went over all the key “Vol Themes” in yesterday’s note, where I spoke to contributing factors behind a very “mechanically-driven” market flow of late (and 2nd order knock-on into Systematic strategy flows thereafter)…and I’d recommend a re-read of those themes, bc they speak to a vol-regime that remains incredibly abnormal vs historical precedent

But I really gotta stress two dynamics here which have been evolving / accelerating in recent months, as it relates to the insanity that has been the open-to-close trading in US Equities so acutely over this past week period:

1) the explosion (and institutionalizion) of trading in hyper-convex 0-1DT options which has escalated in recent days / weeks, and

2) the sheer scale of the Front-Delta needing to be traded into this week’s Op-Ex, which for SPX is on par with Volmageddon Feb ‘18, the J Powell “Autopilot / Long-way from Neutral” Debacle in Dec ‘18 and the COVID panic of Mar ’20…while the front-Delta to be traded into this week’s QQQ (Nasdaq) expiration actually exceeded each of those prior “Vol Shocks”!

1. YOLO’ing into 0 and 1 Days-Til-Expiration (DTE) Options

This has now been “institutionalized” by Vol traders at many of the largest funds on the Street….i.e. it’s not about Retail-alone playing this game anymore

INSTITUTIONAL entities are now the most prominent users creating all this extreme daily market convexity with their usage of ultra-short dated options—because now, we see the “big boys” having surpassed the prior Retail YOLO set (which had been the largest users of the of the 0-1DTE stuff), and have become full-tilt DAY TRADERS, using the certainty of Dealer hedging flows that their orders create to then amplify and “juice” the intended directional market move… before closing-out positions mere hours later by EOD

The proof is in the pudding – over the past 1m period alone, we have seen witnessed some absolutely biblical usage of 0DTE and 1DTE options, and it’s acting like jet fuel being dumped on the already out of control “macro” fire occurring into persistent “Negative Gamma” momentum overshoot flows…looking at this snippet of the “max” usage days as % of overall volumes in the underlying product over the past month:

-

On 9/20/22, 53% of total SPX options volume was from 0 days-til-expiration options—and 65% of the overall was from 0-1DTE options combined

-

46% of SPY options volume was from 0DTE’s alone on 9/19/22—while on 9/30/22, 61% of total SPY options volume that day was from 0-1DTE’s

-

For QQQ, we saw 0DTE’s make a high print of 41% of overall options volume on 10/14/22—with 56% of the overall QQQ options volumes that same day coming from 0-1DTE’s alone

And the bigger picture, look at the trend trajectory in the % of the overall daily options volume with 0-1DTE options are now making-up, EXPLODING vertically in usage in recent years and even more exponentially in recent months /weeks /days, corresponding with now-daily Options Expirations which have made “Weaponized Gamma” the only game in town:

Source: Nomura

“Smoothing” the noisy dailies, this shot of the rolling 1w trajectory is even cleaner in showing how the “institutional” engagement in these options is behind “exponential”-like growth in their volumes…

Source: Nomura

And these zoomed-in view of 0 and 1 DTE options in SPY and SPX through a quarterly rolling lens is even more compelling:

Source: Nomura

2. Separately, this past week + period into Friday’s monthly Op-Ex has been an absolute outlier on par with some of the “most stressed” periods of market instability seen in recent history, as it relates to the sheer scale of the Front-Delta into this week’s Op-Ex

Yes, This Friday’s Op-Ex has a substantial amount of exposure rolling-off: 29% of SPX/SPY $Gamma is set to drop, 42% of QQQ $Gamma and 49% of IWM $Gamma…all of which then frees us up for movement thereafter, as those hedging barriers are then reduced…

But most critically as it relates to the outrageous ranges & swings this past week in US Equities and into the upcoming expiration, it is the staggering amount of (negative) front-Delta into Friday’s Op-Ex that has then needed to be traded on the approach, which is then acting as further shadow-convexity in the market (and then commingling as part of the feedback loop of flows from the aforementioned “same day” Options flows discussed earlier)

Source: Nomura

And there is definitely some interplay here with a similar dynamic being seen in recently very active VIX options, where the past week period into today’s VIXpiration had some of the largest $Delta and $Gamma to trade / move over the past four years, and again in-line with recent “Vol Shock” periods:

Source: Nomura

So putting it all together:

-

Unprecedented “Weaponized Gamma” from the “institutionalization” of 0-1DTE Index / ETF options trading causing “intraday chase” flows we’ve never seen the likes of previously;

-

US Equities options front-Delta to trade into Op-Ex at levels only seen during prior Vol Shock / “crash” periods;

-

$Yen coming unglued with intervention likely to necessitate reserves funded by selling UST front-end;

-

and all as financial conditions further “impulse tighten,” with the US Dollar and Real Yields re-emboldened higher to rest of world’s detriment,

-

and all as Fed “Terminal Rate” projections are about to make fresh highs at 5.00%…

ARE YOU NOT ENTERTAINED?