Uranium stocks moved higher late in the US cash session after a report from Bloomberg, citing "people familiar with the matter," revealed that the Biden administration is considering an executive order to ban Russian imports of enriched uranium after congressional efforts stall.

Officials from the White House National Security Council, the Department of Energy, and other top-level officials have discussed reducing reliance on Russian uranium imports. The people said the potential ban could include waivers similar to legislation that quickly passed the House last year.

"Because of procedural rules, the next best potential legislative vehicle to attach the uranium ban in the Senate to is must-pass legislation needed to reauthorize the Federal Aviation Administration, which is slated for the Senate floor this week," Bloomberg said.

Certainly, final decisions have yet to be reached on the matter. According to sources, the administration and the nuclear industry favor Congress enacting the ban. However, if push come to shove, executive authority could be used, they said.

After Russia invaded Ukraine, Washington imposed sanctions on Russian-produced oil and gas—yet Russian-enriched uranium is still being imported.

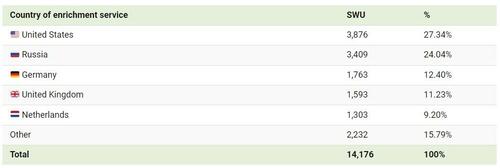

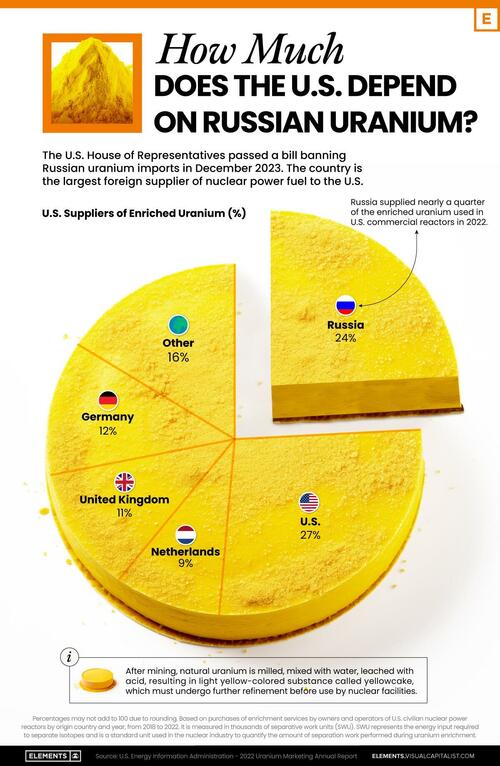

In this graphic, Visual Capitalist's Bruno Venditti shows how much America's nuclear power plants rely on Russian uranium.

According to the Energy Information Administration, Russia supplied about a quarter of all enriched uranium used in more than 90 commercial reactors.

Bloomberg estimated that America's power plants spend at least $1 billion a year on Russian-enriched uranium. The White House has warned that dependence on Russian sources of uranium "creates risk to the US economy."

"At the same time, replacing that supply could be a challenge and is poised to raise the costs of enriched uranium by as much as 20%," the media pointed out.

In markets, the world's largest publicly traded uranium company, Cameco Corporation, caught a slight bid after the Bloomberg story was released. Miner Uranium Energy Corp and Sprott Uranium Miners ETF (URNM) also rose.

The nonpartisan Congressional Budget Office has estimated that a ban on Russian uranium imports could raise nuclear fuel costs by at least 13%, if not more.

Late last month, Jonathan Hinze, president of UxC, a nuclear industry research firm, told Bloomberg that uranium prices have likely "reached a bottom."

Uranium stocks moved higher late in the US cash session after a report from Bloomberg, citing “people familiar with the matter,” revealed that the Biden administration is considering an executive order to ban Russian imports of enriched uranium after congressional efforts stall.

Officials from the White House National Security Council, the Department of Energy, and other top-level officials have discussed reducing reliance on Russian uranium imports. The people said the potential ban could include waivers similar to legislation that quickly passed the House last year.

“Because of procedural rules, the next best potential legislative vehicle to attach the uranium ban in the Senate to is must-pass legislation needed to reauthorize the Federal Aviation Administration, which is slated for the Senate floor this week,” Bloomberg said.

Certainly, final decisions have yet to be reached on the matter. According to sources, the administration and the nuclear industry favor Congress enacting the ban. However, if push come to shove, executive authority could be used, they said.

After Russia invaded Ukraine, Washington imposed sanctions on Russian-produced oil and gas—yet Russian-enriched uranium is still being imported.

In this graphic, Visual Capitalist’s Bruno Venditti shows how much America’s nuclear power plants rely on Russian uranium.

According to the Energy Information Administration, Russia supplied about a quarter of all enriched uranium used in more than 90 commercial reactors.

Bloomberg estimated that America’s power plants spend at least $1 billion a year on Russian-enriched uranium. The White House has warned that dependence on Russian sources of uranium “creates risk to the US economy.”

“At the same time, replacing that supply could be a challenge and is poised to raise the costs of enriched uranium by as much as 20%,” the media pointed out.

In markets, the world’s largest publicly traded uranium company, Cameco Corporation, caught a slight bid after the Bloomberg story was released. Miner Uranium Energy Corp and Sprott Uranium Miners ETF (URNM) also rose.

The nonpartisan Congressional Budget Office has estimated that a ban on Russian uranium imports could raise nuclear fuel costs by at least 13%, if not more.

Late last month, Jonathan Hinze, president of UxC, a nuclear industry research firm, told Bloomberg that uranium prices have likely “reached a bottom.”

Loading…