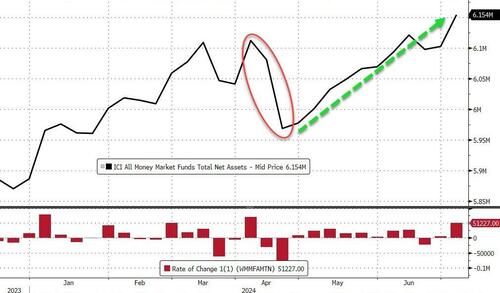

For the 10th week in the last 12 (basically since taxes), money-market funds saw inflows and last week was bigly with $51BN added pushing the total AUM to a new record high $6.15TN...

Source: Bloomberg

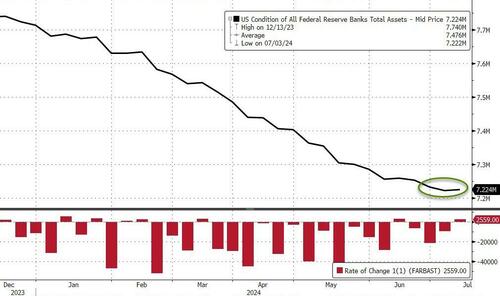

The Fed balance sheet rose by $2.5BN last week...

Source: Bloomberg

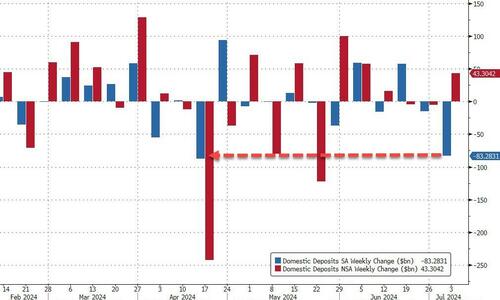

But as The Fed balance sheet rise, banks saw large deposit outflows last week, -$67BN on an SA basis...

Source: Bloomberg

BUT on an NSA basis, deposits rose by $42BN....?

Source: Bloomberg

Excluding foreign deposits, domestic banks saw $83BN in deposit outflows on a seasonally-adjusted basis - the biggest since April's Tax Day decline. The drop was dominated by large banks losing $72BN (small banks saw an $11BN decline). On an NSA basis, domestic banks saw $43BN inflows (large banks +$30BN, small banks +13BN)...

Source: Bloomberg

Did the genii at The Fed just make the 'adjustment' clean up?

Source: Bloomberg

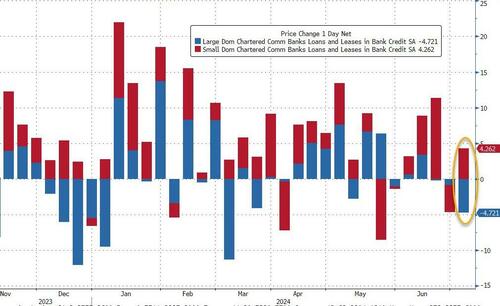

On the other side of the ledger, there was an overall shrinkage in loan volumes with large banks seeing volumes drop $4.7BN while small bank loans rose $4.3BN...

Source: Bloomberg

Bank reserves at The Fed rose last week but the chasm between US equity market cap and those reserves remains near record highs...

Source: Bloomberg

And that liquidity gap is evident on a global scale...

Source: Bloomberg

Are stocks pricing in a massive central bank balance sheet expansion?

For the 10th week in the last 12 (basically since taxes), money-market funds saw inflows and last week was bigly with $51BN added pushing the total AUM to a new record high $6.15TN…

Source: Bloomberg

The Fed balance sheet rose by $2.5BN last week…

Source: Bloomberg

But as The Fed balance sheet rise, banks saw large deposit outflows last week, -$67BN on an SA basis…

Source: Bloomberg

BUT on an NSA basis, deposits rose by $42BN….?

Source: Bloomberg

Excluding foreign deposits, domestic banks saw $83BN in deposit outflows on a seasonally-adjusted basis – the biggest since April’s Tax Day decline. The drop was dominated by large banks losing $72BN (small banks saw an $11BN decline). On an NSA basis, domestic banks saw $43BN inflows (large banks +$30BN, small banks +13BN)…

Source: Bloomberg

Did the genii at The Fed just make the ‘adjustment’ clean up?

Source: Bloomberg

On the other side of the ledger, there was an overall shrinkage in loan volumes with large banks seeing volumes drop $4.7BN while small bank loans rose $4.3BN…

Source: Bloomberg

Bank reserves at The Fed rose last week but the chasm between US equity market cap and those reserves remains near record highs…

Source: Bloomberg

And that liquidity gap is evident on a global scale…

Source: Bloomberg

Are stocks pricing in a massive central bank balance sheet expansion?

Loading…