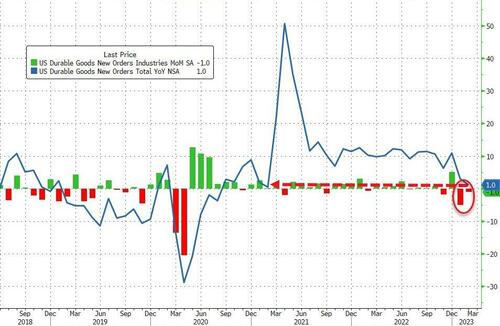

After tumbling in January (thanks to no big Boeing plan order that juiced December's data), analysts expected a modest rebound (+0.2% MoM) in preliminary February data. However, they were wrong as durable goods orders dropped 1.0% MoM. And it's worse because this happened even after January's 4.5% drop was revised even lower to -5.0% MoM.

That is the weakest YoY rise in Durable Goods Orders since Feb 2021...

Source: Bloomberg

Core orders (ex transports) also disappointed - printing unchanged (below the +0.2% MoM exp), with the prior month's 0.8% MoM cut in half to +0.4% MoM downward revision.

On the positive side, the value of core capital goods orders, a proxy for investment in equipment that excludes aircraft and military hardware, rose 0.2% last month after a 0.3% advance in January.

However, this is all lagged and preliminary data for February (an eon ago relative to the current crisis levels).

After tumbling in January (thanks to no big Boeing plan order that juiced December’s data), analysts expected a modest rebound (+0.2% MoM) in preliminary February data. However, they were wrong as durable goods orders dropped 1.0% MoM. And it’s worse because this happened even after January’s 4.5% drop was revised even lower to -5.0% MoM.

That is the weakest YoY rise in Durable Goods Orders since Feb 2021…

Source: Bloomberg

Core orders (ex transports) also disappointed – printing unchanged (below the +0.2% MoM exp), with the prior month’s 0.8% MoM cut in half to +0.4% MoM downward revision.

On the positive side, the value of core capital goods orders, a proxy for investment in equipment that excludes aircraft and military hardware, rose 0.2% last month after a 0.3% advance in January.

However, this is all lagged and preliminary data for February (an eon ago relative to the current crisis levels).

Loading…