President Trump's tariffs are reshaping non- "America First" trade policies and agreements, causing concern among Goldman analysts. They recently downgraded the US GDP growth forecast to 1.7% from 2.4%, marking their first below-consensus call in 2.5 years.

In the latest Top of Mind macro research note titled "All About Fading U.S. Exceptionalism," analysts Jenny Grimberg, Allison Nathan, and Ashley Rhodes provided clients with a brief note about the declining US outlook and the rise of the rest of the world amid expectations that the average US tariff rate will increase by 10 percentage points this year—a generational high.

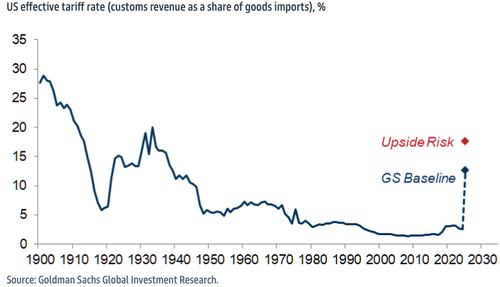

Chart of the Day: The US effective tariff rate is likely to rise by 10pp this year, roughly 5x the increase during the first Trump Administration.

Here's the summary:

Our expectation that the average US tariff rate will rise by 10pp this year has left our 2025 US GDP growth forecast at 1.7%, down from 2.4% (both on a Q4/Q4 basis) at the start of the year and our first below-consensus call in 2.5 years. Markets have also downgraded their US growth views—and sharply so, on our estimates—as evidenced by the S&P 500 entering correction territory this week. While we continue to expect US equities to move higher ahead, we recently lowered our YE25 S&P 500 index target from 6500 to 6200 and trimmed our 2025 EPS growth forecast from 9% to 7% on the back of our US growth downgrade, and modestly reduced our valuation expectations given the significant uncertainty around US policy.

In stark contrast, markets have significantly upgraded their European growth views, fueling strong outperformance of European assets that we think has further to run. Specifically, we believe European equities can continue to outperform given the still-large valuation gap between US and European equities and recently raised our 2025/2026/2027 SXXP EPS growth forecasts to 4%/6%/6% (from 3%/4%/4%), partly on the back of the growth boost from higher European defense spending that we expect. We believe Europe has made a promising start on the road to this higher spending amid positive signals from the EU Council and Germany, where preliminary coalition negotiations have resulted in an agreement on the recently-announced substantial fiscal package. We also expect EUR credit to continue outperforming USD credit ahead, as implied by our recently-revised spread forecasts. But we think the risks are more two-sided for Bunds and the Euro even as we recently raised our YE25 10y Bund yield forecast to 3.00% (from 2.25%). Beyond Europe, China and broader EM equities have also performed relatively well this year, and we see further room to run here as well.

We believe this fading of US exceptionalism further underscores the case for regional diversification, and continue to like Defense, Technology, and Healthcare stocks in Europe, both China A and H shares, and pockets of EM equities. That said, we believe the diversification theme could run into challenges if the current US equity market correction extends further, as we find that regional correlations tend to be higher during larger US corrections and regional equities have rarely delivered positive returns in such periods.

Trump's tariff saber-rattling has been seen as a critical tool to unleash America First and globalism last. Ridding the system of toxic policies will likely result in a detox period for the economy. At the same time, hemispheric defense comes next.

President Trump’s tariffs are reshaping non- “America First” trade policies and agreements, causing concern among Goldman analysts. They recently downgraded the US GDP growth forecast to 1.7% from 2.4%, marking their first below-consensus call in 2.5 years.

In the latest Top of Mind macro research note titled “All About Fading U.S. Exceptionalism,” analysts Jenny Grimberg, Allison Nathan, and Ashley Rhodes provided clients with a brief note about the declining US outlook and the rise of the rest of the world amid expectations that the average US tariff rate will increase by 10 percentage points this year—a generational high.

Chart of the Day: The US effective tariff rate is likely to rise by 10pp this year, roughly 5x the increase during the first Trump Administration.

Here’s the summary:

Our expectation that the average US tariff rate will rise by 10pp this year has left our 2025 US GDP growth forecast at 1.7%, down from 2.4% (both on a Q4/Q4 basis) at the start of the year and our first below-consensus call in 2.5 years. Markets have also downgraded their US growth views—and sharply so, on our estimates—as evidenced by the S&P 500 entering correction territory this week. While we continue to expect US equities to move higher ahead, we recently lowered our YE25 S&P 500 index target from 6500 to 6200 and trimmed our 2025 EPS growth forecast from 9% to 7% on the back of our US growth downgrade, and modestly reduced our valuation expectations given the significant uncertainty around US policy.

In stark contrast, markets have significantly upgraded their European growth views, fueling strong outperformance of European assets that we think has further to run. Specifically, we believe European equities can continue to outperform given the still-large valuation gap between US and European equities and recently raised our 2025/2026/2027 SXXP EPS growth forecasts to 4%/6%/6% (from 3%/4%/4%), partly on the back of the growth boost from higher European defense spending that we expect. We believe Europe has made a promising start on the road to this higher spending amid positive signals from the EU Council and Germany, where preliminary coalition negotiations have resulted in an agreement on the recently-announced substantial fiscal package. We also expect EUR credit to continue outperforming USD credit ahead, as implied by our recently-revised spread forecasts. But we think the risks are more two-sided for Bunds and the Euro even as we recently raised our YE25 10y Bund yield forecast to 3.00% (from 2.25%). Beyond Europe, China and broader EM equities have also performed relatively well this year, and we see further room to run here as well.

We believe this fading of US exceptionalism further underscores the case for regional diversification, and continue to like Defense, Technology, and Healthcare stocks in Europe, both China A and H shares, and pockets of EM equities. That said, we believe the diversification theme could run into challenges if the current US equity market correction extends further, as we find that regional correlations tend to be higher during larger US corrections and regional equities have rarely delivered positive returns in such periods.

Trump’s tariff saber-rattling has been seen as a critical tool to unleash America First and globalism last. Ridding the system of toxic policies will likely result in a detox period for the economy. At the same time, hemispheric defense comes next.

Loading…