The housing bull market has peaked for now. Recent home price declines are leading to decreased tappable equity for homeowners.

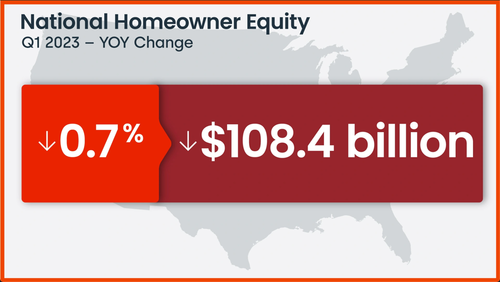

A new CoreLogic Homeowner Equity Insights report shows homeowners with mortgages (roughly 63% of all properties) saw their equity decrease by a total of $108.4 billion in the first quarter of 2023 versus the same period last year, a loss of 0.7% year-over-year (or about $5,400 per borrower). Even though it was a small loss of equity, it was the first loss since 2012.

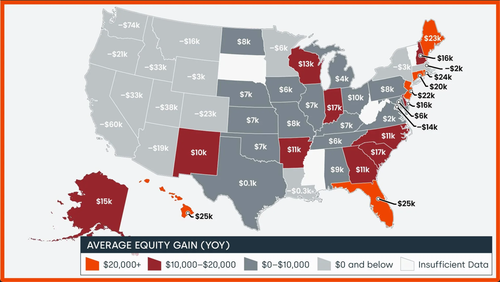

Home equity trends for the quarter show Hawaii, Florida, and Rhode Island had the most significant gains of $24,900, $24,500, and $23,700, respectively. Meanwhile, thirteen states and one district recorded annual equity losses: Arizona, California, Colorado, Idaho, Louisiana, Massachusetts, Minnesota, Montana, Nevada, New York, Oregon, Utah, Washington, and Washington, DC.

Despite the declines, the average US homeowner now has more than $274,000 in equity — up significantly from $182,000 before the pandemic. However, the trend is reversing.

In recent months, we've noted "US Home Price Growth Slowest In A Decade, San Francisco Crashes" and "US Home Prices Show Annual Decline For First Time Since 2012." The Federal Reserve has put a chill in the housing market with the most aggressive rate hikes in a generation to combat decades-high inflation.

Still, home prices have yet to crash, and that's a function of tight supply. Those chasing the real estate market during the Covid boom in the western half of the US are experiencing the worst declines in equity and home prices.

The housing bull market has peaked for now. Recent home price declines are leading to decreased tappable equity for homeowners.

A new CoreLogic Homeowner Equity Insights report shows homeowners with mortgages (roughly 63% of all properties) saw their equity decrease by a total of $108.4 billion in the first quarter of 2023 versus the same period last year, a loss of 0.7% year-over-year (or about $5,400 per borrower). Even though it was a small loss of equity, it was the first loss since 2012.

Home equity trends for the quarter show Hawaii, Florida, and Rhode Island had the most significant gains of $24,900, $24,500, and $23,700, respectively. Meanwhile, thirteen states and one district recorded annual equity losses: Arizona, California, Colorado, Idaho, Louisiana, Massachusetts, Minnesota, Montana, Nevada, New York, Oregon, Utah, Washington, and Washington, DC.

Despite the declines, the average US homeowner now has more than $274,000 in equity — up significantly from $182,000 before the pandemic. However, the trend is reversing.

In recent months, we’ve noted “US Home Price Growth Slowest In A Decade, San Francisco Crashes” and “US Home Prices Show Annual Decline For First Time Since 2012.” The Federal Reserve has put a chill in the housing market with the most aggressive rate hikes in a generation to combat decades-high inflation.

Still, home prices have yet to crash, and that’s a function of tight supply. Those chasing the real estate market during the Covid boom in the western half of the US are experiencing the worst declines in equity and home prices.

Loading…