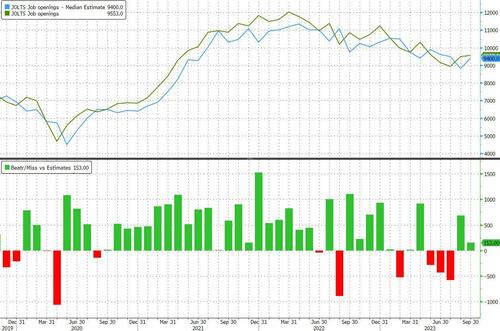

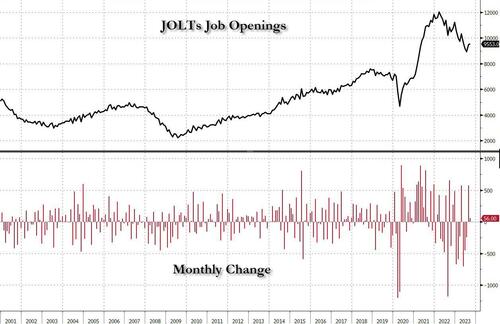

After today's below-estimate ADP report, and the disappointing Manufacturing ISM index where the employment number tumbled into contraction from 51.2 to 46.8 - the second lowest since the covid crash - all eyes were on the September JOLTS report for additional insight into Friday's jobs report. However, those expecting a big outlier print were to be disappointed after the BLS reported that in September, the number of job openings rose modestly by 56K, from a 9.497MM August print (which of course was revised lower from the original 9.610MM number, which as a reminder was driven by a staggering - and goalseeked0 - 35% increase in professional and business services job openings) to 9.553MM...

... above consensus estimates of a 9.4MM print.

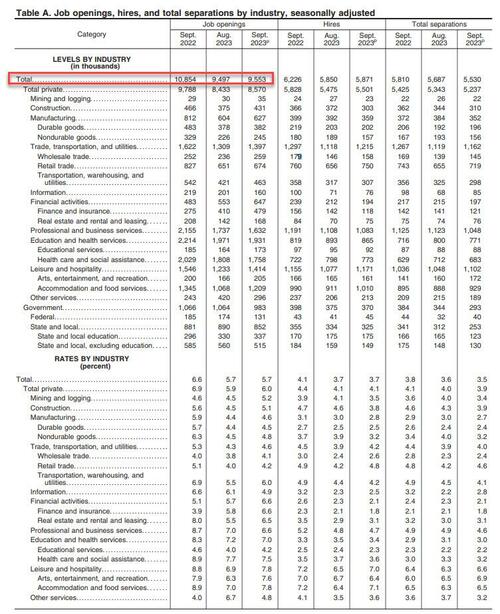

According to the BLS, job openings increased in accommodation and food services (+141,000) and in arts, entertainment, and recreation (+39,000); job openings decreased in other services (-124,000), federal government (-43,000), and information (-41,000).

As for last month's "surge" in professional services job openings, it looks like we are back to reality.

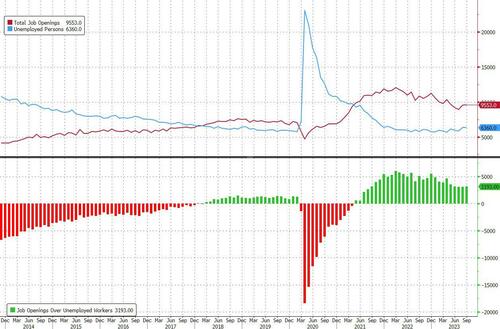

The 2nd consecutive increase in the number of job openings meant that in September the number of job openings was 3.193 million more than the number of unemployed workers, the highest since June and reversing the last three months of normalization in the labor market.

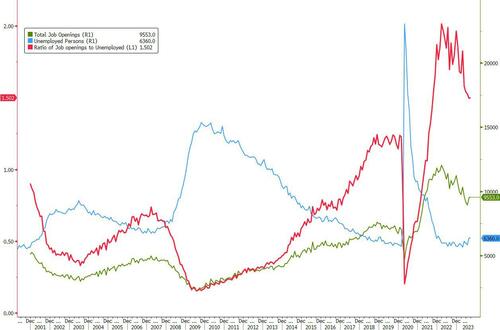

Curiously, despite the recent surge in job openings, the concurrent increase in unemployed workers (which in September rose to 6.36 million), meant that the number of job openings for every unemployed worker was virtually unchanged for the 3rd month at 1.50.

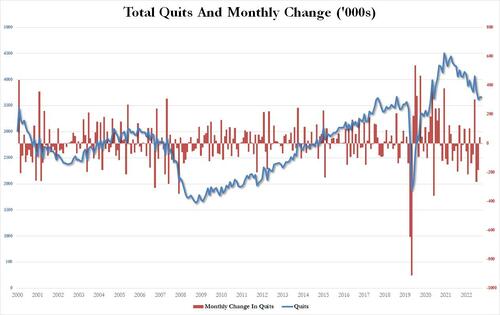

And while the paradoxical continued increase in job openings at a time when even the ISM institute is saying that the latest Manufacturing print implied a -0.7% Q4 GDP, remained a head-scratcher one certainly could not see a similar euphoria in the other data points tracked by the JOLTS reported, starting with the number of quits, which dropped in September to 3.661 million, down from 3.663 million, and far below the quitting frenzy observed in late 2021/early 2022 when 4.5 million workers quit their jobs every month.

Furthermore, while the DOL goalseeked job openings higher, it forgot to do the same to not only quits but also hires; in fact, hires rose a tiny 21K to 5.5871 million, also just barely above the lowest level since March 2021.

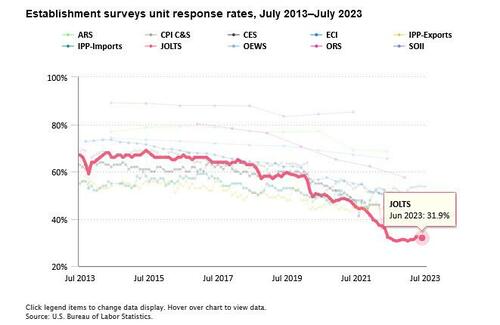

And while we have previously discussed the chronic fabrication of job openings data by the BLS, which goes against all private surveys, we are confident that when the Biden admin finally falls and some enterprising forensic accountant digs to find out just where all these bullshit numbers came from, what they will find is some political hack at the BLS/DOL claiming that it's not their fault, but rather that it's the response rate. And indeed, as the BLS itself indicates, the response rate to most of its various labor (and other) surveys has collapsed in recent years, nothing is as bad as the JOLTS report where the actual response rate has tumbled to a record low 31%

In other words, more than two thirds, or 70% of the final number of job openings, is estimated!

And at a time when it is critical for Biden to still maintain the illusion that at least the labor market remains strong when everything else in Biden's economy is crashing and burning (or soaring as is the case of inflation) we'll let readers decide if the admin's Labor Department is plugging the estimate gap with numbers that are stronger or weaker.

As for the market, it appears to also have given up on any signaling information from JOLTS because unlike last month when yields spiked on the JOLTS report, today's increase in job openings had exactly zero impact on rates, which dropped to session lows, focusing far more on the ugly ISM employment number and the ADP miss, while completely ignoring the JOLTS data.

After today’s below-estimate ADP report, and the disappointing Manufacturing ISM index where the employment number tumbled into contraction from 51.2 to 46.8 – the second lowest since the covid crash – all eyes were on the September JOLTS report for additional insight into Friday’s jobs report. However, those expecting a big outlier print were to be disappointed after the BLS reported that in September, the number of job openings rose modestly by 56K, from a 9.497MM August print (which of course was revised lower from the original 9.610MM number, which as a reminder was driven by a staggering – and goalseeked0 – 35% increase in professional and business services job openings) to 9.553MM…

… above consensus estimates of a 9.4MM print.

According to the BLS, job openings increased in accommodation and food services (+141,000) and in arts, entertainment, and recreation (+39,000); job openings decreased in other services (-124,000), federal government (-43,000), and information (-41,000).

As for last month’s “surge” in professional services job openings, it looks like we are back to reality.

The 2nd consecutive increase in the number of job openings meant that in September the number of job openings was 3.193 million more than the number of unemployed workers, the highest since June and reversing the last three months of normalization in the labor market.

Curiously, despite the recent surge in job openings, the concurrent increase in unemployed workers (which in September rose to 6.36 million), meant that the number of job openings for every unemployed worker was virtually unchanged for the 3rd month at 1.50.

And while the paradoxical continued increase in job openings at a time when even the ISM institute is saying that the latest Manufacturing print implied a -0.7% Q4 GDP, remained a head-scratcher one certainly could not see a similar euphoria in the other data points tracked by the JOLTS reported, starting with the number of quits, which dropped in September to 3.661 million, down from 3.663 million, and far below the quitting frenzy observed in late 2021/early 2022 when 4.5 million workers quit their jobs every month.

Furthermore, while the DOL goalseeked job openings higher, it forgot to do the same to not only quits but also hires; in fact, hires rose a tiny 21K to 5.5871 million, also just barely above the lowest level since March 2021.

And while we have previously discussed the chronic fabrication of job openings data by the BLS, which goes against all private surveys, we are confident that when the Biden admin finally falls and some enterprising forensic accountant digs to find out just where all these bullshit numbers came from, what they will find is some political hack at the BLS/DOL claiming that it’s not their fault, but rather that it’s the response rate. And indeed, as the BLS itself indicates, the response rate to most of its various labor (and other) surveys has collapsed in recent years, nothing is as bad as the JOLTS report where the actual response rate has tumbled to a record low 31%

In other words, more than two thirds, or 70% of the final number of job openings, is estimated!

And at a time when it is critical for Biden to still maintain the illusion that at least the labor market remains strong when everything else in Biden’s economy is crashing and burning (or soaring as is the case of inflation) we’ll let readers decide if the admin’s Labor Department is plugging the estimate gap with numbers that are stronger or weaker.

As for the market, it appears to also have given up on any signaling information from JOLTS because unlike last month when yields spiked on the JOLTS report, today’s increase in job openings had exactly zero impact on rates, which dropped to session lows, focusing far more on the ugly ISM employment number and the ADP miss, while completely ignoring the JOLTS data.

Loading…