Authored by Charles Kennedy via OilPrice.com,

The benchmark U.S. natural gas prices slumped by more than 10% early on Monday amid high inventories and forecasts of warmer-than-usual weather suggesting very light demand for space heating.

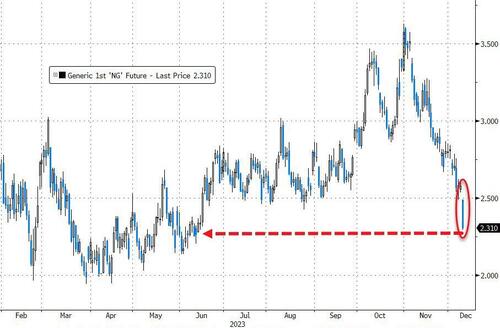

As of 9:24 a.m. ET on Monday, the front-month futures at the Henry Hub, the American benchmark, were trading down by 10.50% at $2.305 per million British thermal units (MMBtu). Prices are now at their lowest level since the start of the summer.

“The weekend data failed to trend any colder with the setup through Dec. 26 suggesting warmer than normal temperatures and lighter than normal demand will continue through the end of the month,” according to a report by NatGasWeather.com cited by The Wall Street Journal.

NatGasWeather.com expects “light to very light national demand the next 7 days,” it said on Monday.

Adding to the bearish factors are the higher-than-average inventories at the start of the winter heating season.

The United States is entering the heating season with the highest natural gas in storage since 2020, the U.S. Energy Information Administration (EIA) said last week.

Moreover, the U.S. now has 5% more natural gas in inventories entering the winter heating season than the previous five-year average, and 7% more than last October 31.

The high natural gas inventories are partially the result of a milder 2022-2023 winter and weaker heating demand, which allowed working natural gas inventories to total 1,823 Bcf on April 1, 2023 - the end of the previous heating season. This was 19% higher than the average U.S. April 1 total for the previous five years.

High storage levels, rising natural gas production, and a milder start to this year’s heating season are putting downward pressure on U.S. benchmark natural gas prices at Henry Hub. Prices have fallen from a high of $3.40 per million British thermal units (MMBtu) on November 13, to $2.21 per MMBtu on December 11.

Authored by Charles Kennedy via OilPrice.com,

The benchmark U.S. natural gas prices slumped by more than 10% early on Monday amid high inventories and forecasts of warmer-than-usual weather suggesting very light demand for space heating.

As of 9:24 a.m. ET on Monday, the front-month futures at the Henry Hub, the American benchmark, were trading down by 10.50% at $2.305 per million British thermal units (MMBtu). Prices are now at their lowest level since the start of the summer.

“The weekend data failed to trend any colder with the setup through Dec. 26 suggesting warmer than normal temperatures and lighter than normal demand will continue through the end of the month,” according to a report by NatGasWeather.com cited by The Wall Street Journal.

NatGasWeather.com expects “light to very light national demand the next 7 days,” it said on Monday.

Adding to the bearish factors are the higher-than-average inventories at the start of the winter heating season.

The United States is entering the heating season with the highest natural gas in storage since 2020, the U.S. Energy Information Administration (EIA) said last week.

Moreover, the U.S. now has 5% more natural gas in inventories entering the winter heating season than the previous five-year average, and 7% more than last October 31.

The high natural gas inventories are partially the result of a milder 2022-2023 winter and weaker heating demand, which allowed working natural gas inventories to total 1,823 Bcf on April 1, 2023 – the end of the previous heating season. This was 19% higher than the average U.S. April 1 total for the previous five years.

High storage levels, rising natural gas production, and a milder start to this year’s heating season are putting downward pressure on U.S. benchmark natural gas prices at Henry Hub. Prices have fallen from a high of $3.40 per million British thermal units (MMBtu) on November 13, to $2.21 per MMBtu on December 11.

Loading…