New home sales rose in January, but less than expected.

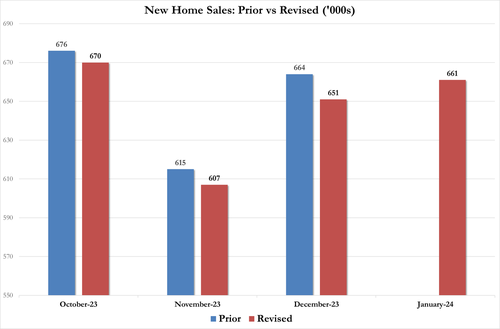

After December's 8.0% surprise jump was revised down to +7.2% MoM, January sales rose just 1.5% MoM (half the 3.0% expected). In fact all three of the last months' data was revised lower...

The downward revision and disappointment reduced the YoY sales growth to just 1.8%...

Source: Bloomberg

The total new home sales SAAR rose from a downwardly revised 651k to 661k in January (well below the 684k expected)...

Source: Bloomberg

Interestingly, the median new home price dropped to $413,000 - the lowest since Dec 2021.

Source: Bloomberg

Mortgage rates are back on the rise, not exactly a good sign for new home sales as homebuilders margins collapse...

Source: Bloomberg

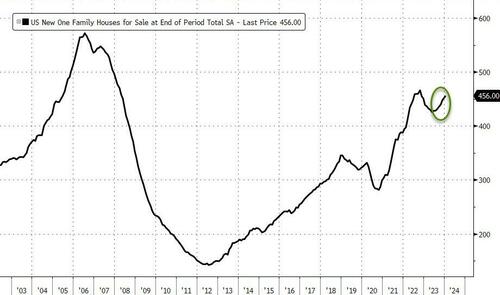

Finally, new-home supply increased to 456,000 from the prior month, the most in over a year.

Source: Bloomberg

Is reality about to set in for the US housing market? Or will Powell step in (with a banking crisis excuse) to save all that 'wealth'?

New home sales rose in January, but less than expected.

After December’s 8.0% surprise jump was revised down to +7.2% MoM, January sales rose just 1.5% MoM (half the 3.0% expected). In fact all three of the last months’ data was revised lower…

The downward revision and disappointment reduced the YoY sales growth to just 1.8%…

Source: Bloomberg

The total new home sales SAAR rose from a downwardly revised 651k to 661k in January (well below the 684k expected)…

Source: Bloomberg

The median sales price of a home decreased to $420,700 in January from a year ago, marking the fifth-straight decline (up marginally from the $413,000 in December which was two year low).

Interestingly, the average price (NSA) soared from $493.4k to $534.3k)… which signals more higher-priced homes selling…

Source: Bloomberg

Mortgage rates are back on the rise, not exactly a good sign for new home sales as homebuilders margins collapse…

Source: Bloomberg

Finally, new-home supply increased to 456,000 from the prior month, the most in over a year.

Source: Bloomberg

Is reality about to set in for the US housing market? Or will Powell step in (with a banking crisis excuse) to save all that ‘wealth’?

Loading…