While there was much more talk about the soaring US budget deficit earlier this year, when debt seemed to rise by $1 trillion every other month, lately it appears that the topic has become almost taboo perhaps because neither presidential candidate has any plan or clue how to normalize the trend which assures fiscal collapse for the US and the loss of dollar reserve status.

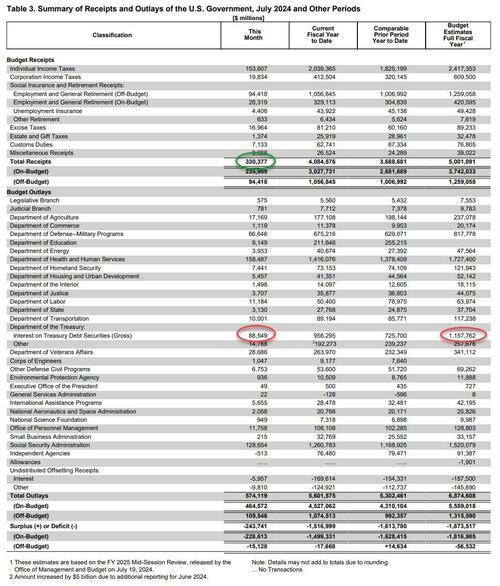

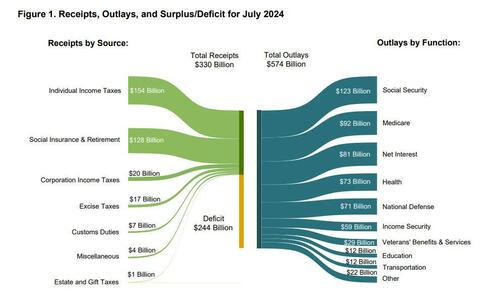

But while others may have conflicts of interest in reporting on this most important topic, we don't, and we are sad to inform our readers that July was another catastrophic month for US fiscal viability: that's because US tax revenue of $330.4BN (down sharply from the $466.3BN in June, if higher than the $276.2BN a year ago), was far below the $573.1BN in government outlays (which was materially above the $537.2BN in June and also the $496.9BN last July)...

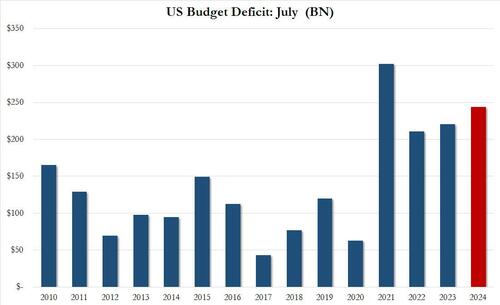

.... resulting in a monthly deficit of $243.7BN, the second largest July budget deficit on record, surpassed only by the record post-covid print in July 2021.

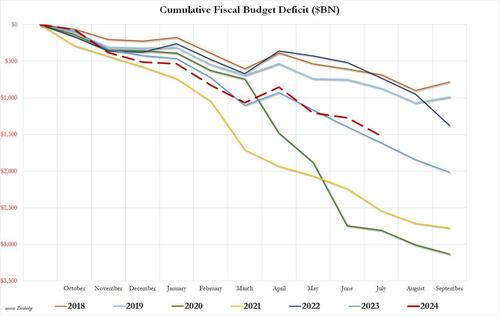

With two months left in the fiscal year, the US budget deficit for fiscal 2024 has hite $1.517 trillion, tracking last year's blowout expansion almost dollar for dollar (one year ago the cumulative deficit was $1.613 trillion), and the 4th highest on record despite there being no raging emergency and no war demanding such a massive deficit spend.

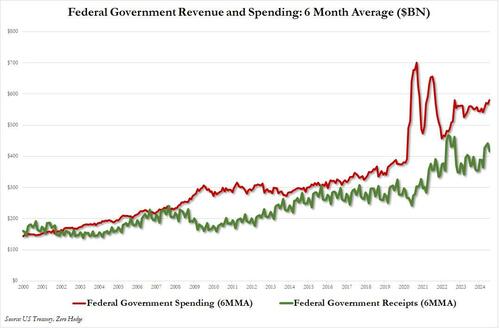

Unfortunately, that's as good as it gets, because when one takes a step back and ignores the monthly calendar effects, the picture remains the same: the US is spending far more than it is generating in tax revenues.

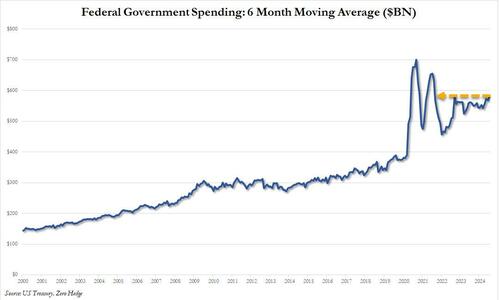

In fact, at $581BN, the 6-month moving average (to smooth out month-to-month changes) in US government spending has risen to the highest level since August 2021, when the US was still reeling from the covid shock.

So how is this possible? How can the US, which is now $35 trillion in the hole justify this kind of irresponsible, profligate spending? The only possible answer for why this level of explosive deficit (and debt) growth continues, is the admin's ongoing attempts to buy as many votes as possible, as well as the relentless increase in interest on the US debt.

And it only goes downhill from there, because as we have noted previously, the biggest risk factor is not so much spending on such discretionary items as social security, health and national defense ("how dare you say these are discretionary! these are mandatory, untouchable outlays" some will scream, but if and when the taxes dry up and the dollar loses its reserve status you will see just how discretionary they are), but on interest, and here recall what we said back in April: "interest on US debt - currently the second biggest government outlay at $1.2 trillion - will surpass social security and become the single biggest US expense before the end of 2024 at $1.6 trillion."...

Now that rate cuts are off the table, interest on US debt - currently the second biggest government outlay at $1.1 trillion - will surpass social security and become the single biggest US expense before the end of 2024 at $1.6 trillion. pic.twitter.com/OQYjHhOks9

— zerohedge (@zerohedge) April 11, 2024

... and hit $1.7 trillion by April 2025, at which point it will be by far the single biggest outlay of the US government.

$1.7 trillion in interest spending next April.

— zerohedge (@zerohedge) April 26, 2024

This is the Minsky Moment pic.twitter.com/S3ChHjFbyg

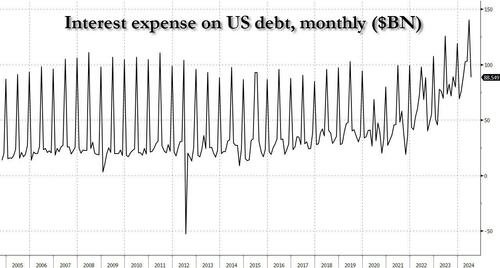

So where are we now? Well, according to the latest Treasury Monthly Statement, in July the US spent a gross $88.6 billion on debt interest, bringing the YTD total to $956 billion and is on pace to hit $1.157 trillion for the full year.

And putting it in context, the $87 billion in gross interest spending (which follows June's record $140 billion) was 25% of all US receipts (mostly taxes) in June...

... a staggering number fast approaching the threshold where everyone will be forced to admit the US has crossed into a Minsky moment.

While there was much more talk about the soaring US budget deficit earlier this year, when debt seemed to rise by $1 trillion every other month, lately it appears that the topic has become almost taboo perhaps because neither presidential candidate has any plan or clue how to normalize the trend which assures fiscal collapse for the US and the loss of dollar reserve status.

But while others may have conflicts of interest in reporting on this most important topic, we don’t, and we are sad to inform our readers that July was another catastrophic month for US fiscal viability: that’s because US tax revenue of $330.4BN (down sharply from the $466.3BN in June, if higher than the $276.2BN a year ago), was far below the $573.1BN in government outlays (which was materially above the $537.2BN in June and also the $496.9BN last July)…

…. resulting in a monthly deficit of $243.7BN, the second largest July budget deficit on record, surpassed only by the record post-covid print in July 2021.

With two months left in the fiscal year, the US budget deficit for fiscal 2024 has hite $1.517 trillion, tracking last year’s blowout expansion almost dollar for dollar (one year ago the cumulative deficit was $1.613 trillion), and the 4th highest on record despite there being no raging emergency and no war demanding such a massive deficit spend.

Unfortunately, that’s as good as it gets, because when one takes a step back and ignores the monthly calendar effects, the picture remains the same: the US is spending far more than it is generating in tax revenues.

In fact, at $581BN, the 6-month moving average (to smooth out month-to-month changes) in US government spending has risen to the highest level since August 2021, when the US was still reeling from the covid shock.

So how is this possible? How can the US, which is now $35 trillion in the hole justify this kind of irresponsible, profligate spending? The only possible answer for why this level of explosive deficit (and debt) growth continues, is the admin’s ongoing attempts to buy as many votes as possible, as well as the relentless increase in interest on the US debt.

And it only goes downhill from there, because as we have noted previously, the biggest risk factor is not so much spending on such discretionary items as social security, health and national defense (“how dare you say these are discretionary! these are mandatory, untouchable outlays” some will scream, but if and when the taxes dry up and the dollar loses its reserve status you will see just how discretionary they are), but on interest, and here recall what we said back in April: “interest on US debt – currently the second biggest government outlay at $1.2 trillion – will surpass social security and become the single biggest US expense before the end of 2024 at $1.6 trillion.”…

Now that rate cuts are off the table, interest on US debt – currently the second biggest government outlay at $1.1 trillion – will surpass social security and become the single biggest US expense before the end of 2024 at $1.6 trillion. pic.twitter.com/OQYjHhOks9

— zerohedge (@zerohedge) April 11, 2024

… and hit $1.7 trillion by April 2025, at which point it will be by far the single biggest outlay of the US government.

$1.7 trillion in interest spending next April.

This is the Minsky Moment pic.twitter.com/S3ChHjFbyg

— zerohedge (@zerohedge) April 26, 2024

So where are we now? Well, according to the latest Treasury Monthly Statement, in July the US spent a gross $88.6 billion on debt interest, bringing the YTD total to $956 billion and is on pace to hit $1.157 trillion for the full year.

And putting it in context, the $87 billion in gross interest spending (which follows June’s record $140 billion) was 25% of all US receipts (mostly taxes) in June…

… a staggering number fast approaching the threshold where everyone will be forced to admit the US has crossed into a Minsky moment.

Loading…