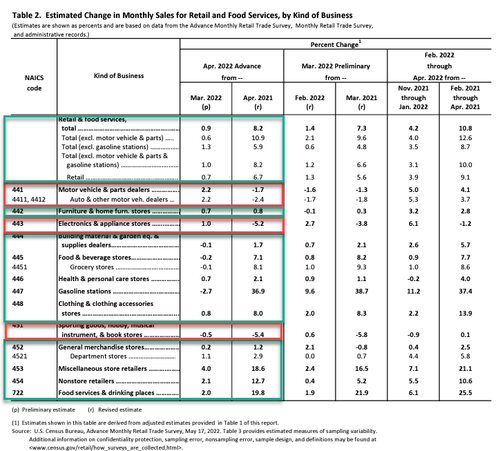

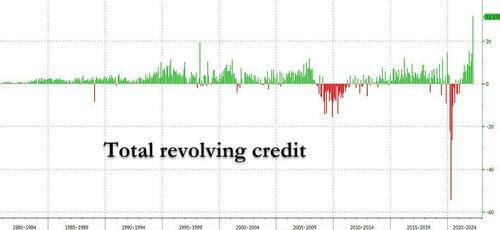

Amid a record surge in revolving consumer credit (i.e. credit card spending), and soaring inflation, analysts expected another monthly rise in retail sales (which is reported in nominal dollars) and they were right but the headline print modestly disappointed (+0.9% MoM vs +1.0% MoM exp) but that was offset by a huge upward revision in March data from +0.5% MoM to +1.4% MoM....

Source: Bloomberg

Ex-Autos, retail sales bounced more than expected MoM (with a huge upward revision for March from +1.1% to +2.1% MoM), reaccelerating the YoY gains...

MoM gains were led by motor vehicles...

The Control Group - which is used to filter into the GDP calculation rose 1.0% MoM in April (better than the +0.7% MoM expected) and March was revised dramatically higher from a drop of 0.1% MoM to a 1.1% MoM rise.

How long can Americans maintain this level of living beyond their means?

Those credit card bills are gonna hit soon and the interest rates on those balances are anything but low.

Amid a record surge in revolving consumer credit (i.e. credit card spending), and soaring inflation, analysts expected another monthly rise in retail sales (which is reported in nominal dollars) and they were right but the headline print modestly disappointed (+0.9% MoM vs +1.0% MoM exp) but that was offset by a huge upward revision in March data from +0.5% MoM to +1.4% MoM….

Source: Bloomberg

Ex-Autos, retail sales bounced more than expected MoM (with a huge upward revision for March from +1.1% to +2.1% MoM), reaccelerating the YoY gains…

MoM gains were led by motor vehicles…

The Control Group – which is used to filter into the GDP calculation rose 1.0% MoM in April (better than the +0.7% MoM expected) and March was revised dramatically higher from a drop of 0.1% MoM to a 1.1% MoM rise.

How long can Americans maintain this level of living beyond their means?

Those credit card bills are gonna hit soon and the interest rates on those balances are anything but low.