After the mixed message from Manufacturing surveys (PMI highest since Sept 2021, ISM weakest since Sept 2020) analysts expected the opposite mixed message for the Services surveys (PMI down, ISM up) in April.

-

April US Services PMI final print was 55.6, down from 58.0 in March but higher than the preliminary print of 54.7 for April

-

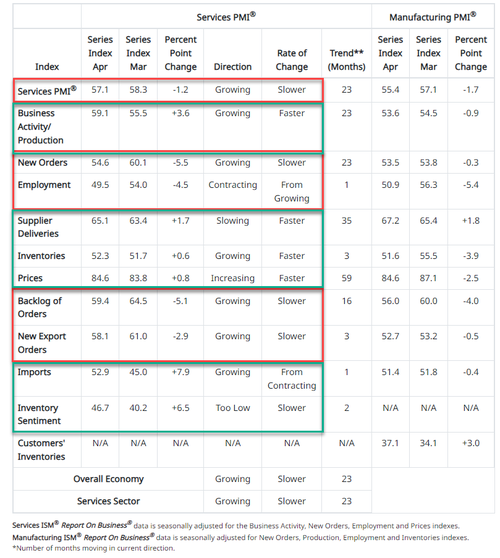

April ISM Services fell to 57.1 from 58.3 in March (compared to 58.5 expected).

Source: Bloomberg

So - to summarize - ISM sees Manufacturing weaker in April and Services weaker too, while Markit (S&P Global) sees Manufacturing surging in April but Services weaker... and prices are soaring!

One word: Stagflation!

Source: Bloomberg

And employment in the services sector is now contracting (below 50), which means that together with the negative GDP prints, the Fed's tightening cycle will be very short lived...

The respondents confirm that what comes next is very ugly:

- housing nuked: “Mortgage rates have skyrocketed. While relatively low from a historical perspective, the new rates — combined with historically high home prices — will temper new home demand at some point over the next 12 months.”

- labor still nuked: “Talent shortages continue to make it difficult to get work done at companies across many industry sectors. Light industrial labor is in high demand, but supply gaps still exist. Wages continue to rise in nearly all labor categories, contributing to the rise in prices of goods and services.”

- Economy slumping: “Overall business has softened.”

- Inflation still rising: “Continued delays due to supply chain logistics issues; increased pricing across the board.”

- And most importantly, demand destruction: “Cost pressures beginning to slow demand.”

Elsewhere, The S&P Global US Composite PMI Output Index posted 56.0 in April, down from 57.7 in March.

Although slightly slower than the upturn at the end of the first quarter, the rise in overall output was sharp overall. A faster expansion in manufacturing production was offset by softer service growth.

Chris Williamson, Chief Business Economist at S&P Global, said:

“Alongside the acceleration in manufacturing growth recorded by the S&P Global PMI in April, the sustained solid performance of the service sector points to GDP growth returning in the second quarter.

"Although the service sector lost some momentum in April, this merely reflects pay-back from the surge in spending seen at the end of the first quarter, when Omicron-related virus containment measures were eased.

"It’s clear that growth could be even stronger if activity was not still be constrained by supply chain bottlenecks and labor availability issues. Domestic demand remains buoyant among both households and businesses in spite of current inflationary pressures, and exports are being boosted by pent-up pandemic demand as global travel restrictions are eased. Exports of services grew in April at the fastest rate since data were first collected in 2014.

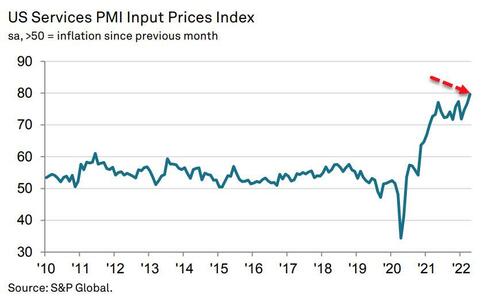

"The consequence of demand running ahead of supply is higher prices, with average charges levied for services rising at a sharply increased and unprecedented rate in April following a record increase in firms’ costs. Enjoying strong demand, firms were increasingly able to pass on higher energy, materials and staff costs to customers, indicating an economy that continues to run hot."

Meanwhile, inflationary pressures intensified further in April. Input prices and output charges increased at the sharpest rates on record.

Material and labor shortages, alongside greater transportation costs drove the rise in prices.

ISM Manufacturing employment stagnant (50), ISM Services employment contracting (<50), ADP employment gains a disaster and GDP negative in Q1... Get back to work Mr.Powell.

After the mixed message from Manufacturing surveys (PMI highest since Sept 2021, ISM weakest since Sept 2020) analysts expected the opposite mixed message for the Services surveys (PMI down, ISM up) in April.

-

April US Services PMI final print was 55.6, down from 58.0 in March but higher than the preliminary print of 54.7 for April

-

April ISM Services fell to 57.1 from 58.3 in March (compared to 58.5 expected).

Source: Bloomberg

So – to summarize – ISM sees Manufacturing weaker in April and Services weaker too, while Markit (S&P Global) sees Manufacturing surging in April but Services weaker… and prices are soaring!

One word: Stagflation!

Source: Bloomberg

And employment in the services sector is now contracting (below 50), which means that together with the negative GDP prints, the Fed’s tightening cycle will be very short lived…

The respondents confirm that what comes next is very ugly:

- housing nuked: “Mortgage rates have skyrocketed. While relatively low from a historical perspective, the new rates — combined with historically high home prices — will temper new home demand at some point over the next 12 months.”

- labor still nuked: “Talent shortages continue to make it difficult to get work done at companies across many industry sectors. Light industrial labor is in high demand, but supply gaps still exist. Wages continue to rise in nearly all labor categories, contributing to the rise in prices of goods and services.”

- Economy slumping: “Overall business has softened.”

- Inflation still rising: “Continued delays due to supply chain logistics issues; increased pricing across the board.”

- And most importantly, demand destruction: “Cost pressures beginning to slow demand.”

Elsewhere, The S&P Global US Composite PMI Output Index posted 56.0 in April, down from 57.7 in March.

Although slightly slower than the upturn at the end of the first quarter, the rise in overall output was sharp overall. A faster expansion in manufacturing production was offset by softer service growth.

Chris Williamson, Chief Business Economist at S&P Global, said:

“Alongside the acceleration in manufacturing growth recorded by the S&P Global PMI in April, the sustained solid performance of the service sector points to GDP growth returning in the second quarter.

“Although the service sector lost some momentum in April, this merely reflects pay-back from the surge in spending seen at the end of the first quarter, when Omicron-related virus containment measures were eased.

“It’s clear that growth could be even stronger if activity was not still be constrained by supply chain bottlenecks and labor availability issues. Domestic demand remains buoyant among both households and businesses in spite of current inflationary pressures, and exports are being boosted by pent-up pandemic demand as global travel restrictions are eased. Exports of services grew in April at the fastest rate since data were first collected in 2014.

“The consequence of demand running ahead of supply is higher prices, with average charges levied for services rising at a sharply increased and unprecedented rate in April following a record increase in firms’ costs. Enjoying strong demand, firms were increasingly able to pass on higher energy, materials and staff costs to customers, indicating an economy that continues to run hot.”

Meanwhile, inflationary pressures intensified further in April. Input prices and output charges increased at the sharpest rates on record.

Material and labor shortages, alongside greater transportation costs drove the rise in prices.

ISM Manufacturing employment stagnant (50), ISM Services employment contracting (<50), ADP employment gains a disaster and GDP negative in Q1… Get back to work Mr.Powell.