Update (1433ET):

Shares of US Steel in New York crashed around 1343 ET after a Washington Post report, citing three people familiar with the matter, revealed that President Biden intends to formally block Nippon Steel's proposed $14.9 billion deal with the Pittsburgh-based steelmaker.

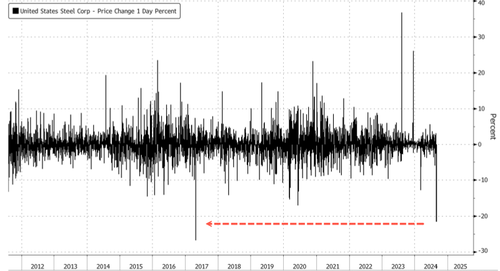

Shares crashed 21% to the $27 handle, erasing all gains made in late 2023 after Japan's largest steelmaker said it would buy US Steel for $55 per share in an all-cash transaction.

If losses hold through the end of the cash session, this would be the largest daily loss since -26.8% on April 26, 2017.

Financial Times said Biden's formal decision could come in just a few days. Democratic presidential nominee Kamala Harris revealed on Monday that she opposed the deal, and President Trump has also vowed to block it.

Earlier, WSJ cited US Steel CEO David Burritt as warning that a blocked deal with Japan's Nippon would result in plant closures.

* * *

Just days after Democratic presidential nominee Kamala Harris publicly opposed Nippon Steel's $14.9 billion bid for US Steel, the CEO of the Pittsburgh-based steel giant told the Wall Street Journal that the company would be forced to relocate its headquarters and shut down steel mills if the deal falls through.

CEO David Burritt told WSJ that Japan's Nippon plans to invest $3 billion in the company's older mills, ensuring the plants remain competitive in domestic and global markets. The investment will also secure the jobs of thousands of steelworkers.

"We wouldn't do that [upgrade plants] if the deal falls through," Burritt said in an interview, adding that US Steel doesn't have the money to afford upgrades.

The timing of Burritt's comments comes days after VP Harris said in a speech on Monday that she opposes Nippon's deal to purchase US steel, arguing that the Pittsburgh steelmaker "should remain American-owned and American-operated."

Since the deal was first announced in December following a multi-month bidding process, CEO Burritt has mostly refrained from making public statements. In the interview, he said Nippon would bring much-needed investment and the latest steelmaking technology to older mills in Gary, Ind., and its Mon Valley Works near Pittsburgh. He called the mounting opposition to the deal highly "puzzling and confusing."

Spending on mill maintenance and equipment upgrades was deferred over the last decade because US Steel was losing money as it struggled with elevated costs and low steel prices. Higher steel prices in recent years have helped restore profits despite some Wall Street analysts forecasting dismal demand in the quarters ahead amid recession threats.

US Steel owns two modern steel mills in Arkansas near Osceola in Mississippi County. Without investment from Nippon, the company could shutter Mon Valley, the company's last steelmaking operation in Pittsburgh.

"If that mill won't make it to the next decade, why would we stay there?" Burritt said, adding more of its steelmaking capacity is shifting to the southern part of the US, and with that, so could the headquarters.

Besides VP Harris and President Biden, former President Trump has also vowed to block the deal if re-elected. Both candidates are fighting for the votes of Pennsylvania steelworkers and blue-collar folks in this crucial battleground state.

Update (1433ET):

Shares of US Steel in New York crashed around 1343 ET after a Washington Post report, citing three people familiar with the matter, revealed that President Biden intends to formally block Nippon Steel’s proposed $14.9 billion deal with the Pittsburgh-based steelmaker.

Shares crashed 21% to the $27 handle, erasing all gains made in late 2023 after Japan’s largest steelmaker said it would buy US Steel for $55 per share in an all-cash transaction.

If losses hold through the end of the cash session, this would be the largest daily loss since -26.8% on April 26, 2017.

Financial Times said Biden’s formal decision could come in just a few days. Democratic presidential nominee Kamala Harris revealed on Monday that she opposed the deal, and President Trump has also vowed to block it.

Earlier, WSJ cited US Steel CEO David Burritt as warning that a blocked deal with Japan’s Nippon would result in plant closures.

* * *

Just days after Democratic presidential nominee Kamala Harris publicly opposed Nippon Steel’s $14.9 billion bid for US Steel, the CEO of the Pittsburgh-based steel giant told the Wall Street Journal that the company would be forced to relocate its headquarters and shut down steel mills if the deal falls through.

CEO David Burritt told WSJ that Japan’s Nippon plans to invest $3 billion in the company’s older mills, ensuring the plants remain competitive in domestic and global markets. The investment will also secure the jobs of thousands of steelworkers.

“We wouldn’t do that [upgrade plants] if the deal falls through,” Burritt said in an interview, adding that US Steel doesn’t have the money to afford upgrades.

The timing of Burritt’s comments comes days after VP Harris said in a speech on Monday that she opposes Nippon’s deal to purchase US steel, arguing that the Pittsburgh steelmaker “should remain American-owned and American-operated.”

Since the deal was first announced in December following a multi-month bidding process, CEO Burritt has mostly refrained from making public statements. In the interview, he said Nippon would bring much-needed investment and the latest steelmaking technology to older mills in Gary, Ind., and its Mon Valley Works near Pittsburgh. He called the mounting opposition to the deal highly “puzzling and confusing.”

Spending on mill maintenance and equipment upgrades was deferred over the last decade because US Steel was losing money as it struggled with elevated costs and low steel prices. Higher steel prices in recent years have helped restore profits despite some Wall Street analysts forecasting dismal demand in the quarters ahead amid recession threats.

US Steel owns two modern steel mills in Arkansas near Osceola in Mississippi County. Without investment from Nippon, the company could shutter Mon Valley, the company’s last steelmaking operation in Pittsburgh.

“If that mill won’t make it to the next decade, why would we stay there?” Burritt said, adding more of its steelmaking capacity is shifting to the southern part of the US, and with that, so could the headquarters.

Besides VP Harris and President Biden, former President Trump has also vowed to block the deal if re-elected. Both candidates are fighting for the votes of Pennsylvania steelworkers and blue-collar folks in this crucial battleground state.

Loading…