Authored by Simon White, Bloomberg macro strategist,

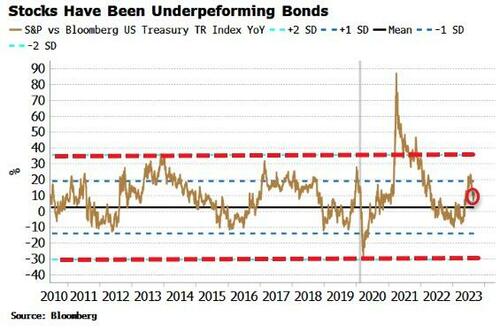

The growth in the US stock-bond ratio is poised to keep falling, but yields on nominal and inflation bonds both bouncing from very oversold levels are likely to be choppy.

It’s generally a frustrating time after big moves as markets take time to settle down, and a new clear, tradeable trend becomes apparent. We are in one of those periods now, but yields should have an overall downwards bias, enough to keep pressure on the stock-bond ratio.

I highlighted a couple of weeks ago that stocks were on the overbought side versus bonds, and we may see a reversal. Since then the annual change of the stock-bond ratio has fallen from its one standard-deviation level.

Equities have run into some resistance around the 4500 level on the S&P. Countervailing forces from rising recession risks and a Fed still drumming the “higher for longer” mantra will conspire to keep equities in a range until the logjam is broken.

Bonds, though, may have a slight edge as they bounce from very oversold levels.

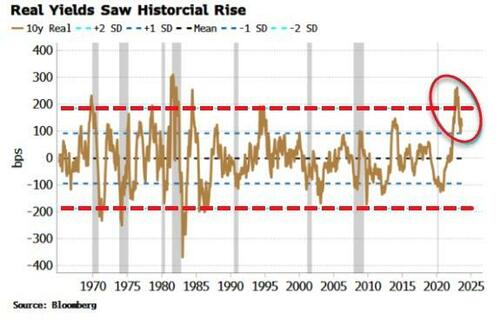

Real yields’ rise at the beginning of 2023 was close to the sharpest they had experienced in over 50 years. Their annual rate of change subsequently fell, but then has bounced again over the last few weeks.

Historically when moves have been very extreme it can lead to periods of choppiness in the breaks of the overall normalization trend. And even though real yields are less overbought, they are still stretched to the upside, meaning in the medium term they should have a downwards bias.

It’s similar for nominal yields. They are less overbought than they were, and face choppiness, but they should have an overall downwards bias in the longer term.

Moreover, as volatility settles down, +4% yields will look increasingly attractive to many buyers – leveraged and unleveraged – especially if recession risks are perceived to be rising (even though investors should not assume the usual investment rules apply in inflationary recessions).

Authored by Simon White, Bloomberg macro strategist,

The growth in the US stock-bond ratio is poised to keep falling, but yields on nominal and inflation bonds both bouncing from very oversold levels are likely to be choppy.

It’s generally a frustrating time after big moves as markets take time to settle down, and a new clear, tradeable trend becomes apparent. We are in one of those periods now, but yields should have an overall downwards bias, enough to keep pressure on the stock-bond ratio.

I highlighted a couple of weeks ago that stocks were on the overbought side versus bonds, and we may see a reversal. Since then the annual change of the stock-bond ratio has fallen from its one standard-deviation level.

Equities have run into some resistance around the 4500 level on the S&P. Countervailing forces from rising recession risks and a Fed still drumming the “higher for longer” mantra will conspire to keep equities in a range until the logjam is broken.

Bonds, though, may have a slight edge as they bounce from very oversold levels.

Real yields’ rise at the beginning of 2023 was close to the sharpest they had experienced in over 50 years. Their annual rate of change subsequently fell, but then has bounced again over the last few weeks.

Historically when moves have been very extreme it can lead to periods of choppiness in the breaks of the overall normalization trend. And even though real yields are less overbought, they are still stretched to the upside, meaning in the medium term they should have a downwards bias.

It’s similar for nominal yields. They are less overbought than they were, and face choppiness, but they should have an overall downwards bias in the longer term.

Moreover, as volatility settles down, +4% yields will look increasingly attractive to many buyers – leveraged and unleveraged – especially if recession risks are perceived to be rising (even though investors should not assume the usual investment rules apply in inflationary recessions).

Loading…