Today's market moves were very much specific as geopolitical and macro-economic chaos reigned...

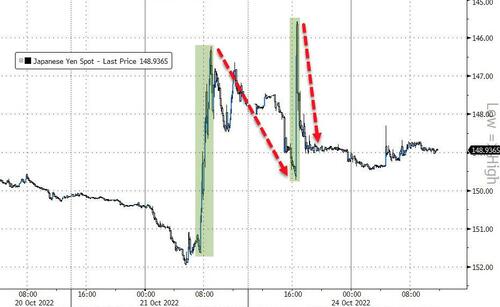

It appeared like BoJ stepped in rather inelegantly last night as the Asian FX markets started trading (in an attempt to use the thin markets to extend Friday's intervention liftathon). It worked for around 15 minutes... and then yen started to fall and by the end of the US session had erased all of that yen-tervention and erased half of Friday's gains...

Source: Bloomberg

Chinese markets shit the bed, technically speaking, overnight as Xi's new era appears anything but more open.

Chinese tech stocks were a total bloodbath today with Nasdaq's Golden Dragon index down a stunning 16% (biggest daily drop ever) to its lowest since Dec 2012...

Source: Bloomberg

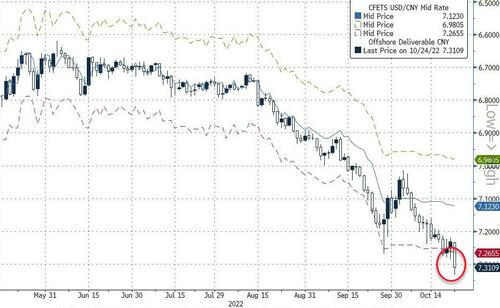

The offshore yuan plunged to new record lows (breaking down below the RMB Fix lower bound)...

Source: Bloomberg

And all that after they announced better than expected GDP growth and Industrial production.

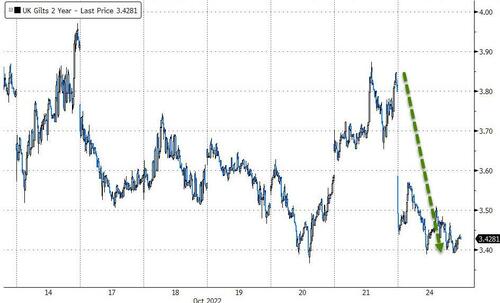

Next up was the UK as Rishi Sunak became the new UK PM (by default), which appeared to reassure British capital markets as bond yields tumbled (2Y gilt yields plunged 37bps - the biggest daily drop since 1992!), but we do note that Cable was modestly lower today...

Source: Bloomberg

And then came the US... where PMIs plunged into contraction and Janet Yellen told MSNBC she "can't rule out the risk" of a recession (is she a biologist?)... which of course is great news for stocks.

Small Caps underperformed, but the rest of the majors accelerated higher on the day with The Dow leading. We did see 'Dump Capital' appear around 1530ET though, which wiped some lipstick off this pig. Nasdaq had ytet another day of being down 1% and then being up 1%...

Today's melt-up should not have been a surprise to readers since Goldman warned "the pain trade is to the upside"...

ICYMI: "The Pain Trade Is To The Upside": 10 Reasons From Goldman's Trading Desk For A November Meltuphttps://t.co/DSSrkjUB3A

— zerohedge (@zerohedge) October 24, 2022

TSLA bucked the trend of the day (tumbling in the pre and early market, down to its lowest level since mid-2021, below $200 briefly), but was bid all afternoon and ended just over 1% lower...

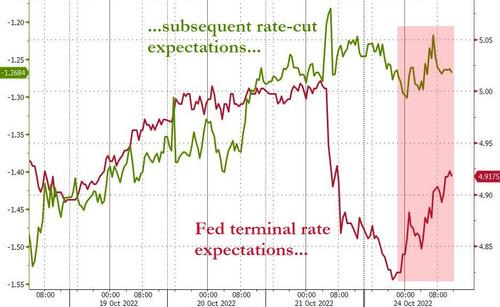

But, we note that the market's expectations for Fed rates shifted notably hawkishly, erasing some of Friday's dovish dive (odds for a 75bps hike in Dec rose to 40% from 30%)...

Source: Bloomberg

Treasury yields were volatile intraday but ended higher with the long-end underperforming...

Source: Bloomberg

Most notably, long-term inflation breakevens (market expectations) soared in the last week...

Source: Bloomberg

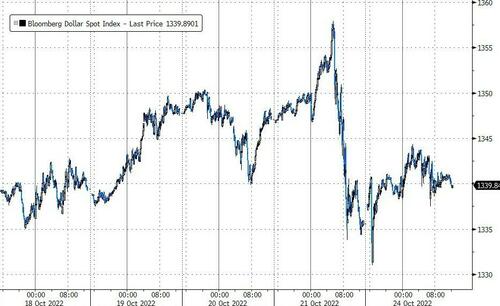

The Dollar managed modest gains on the day, but remains well down from Friday's pre-yentervention puke...

Source: Bloomberg

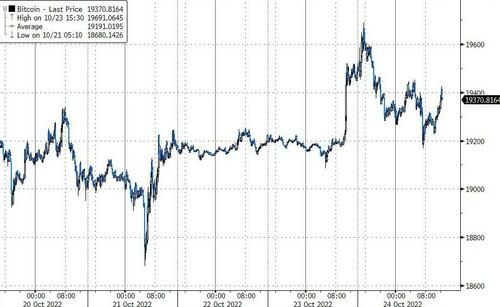

Bitcoin is higher from Friday's close after a surge in buying yesterday early afternoon (which was sold into)...

Source: Bloomberg

Oil prices tumbled overnight (perhaps on the back of Xi's 'crowning' signaling the likelihood of ZeroCOVID policies continuing) then rallied back to a modest loss with WTI just below $85...

Gold was very modestly lower on the day with futures hovering around $1655, holding most of Friday's gains...

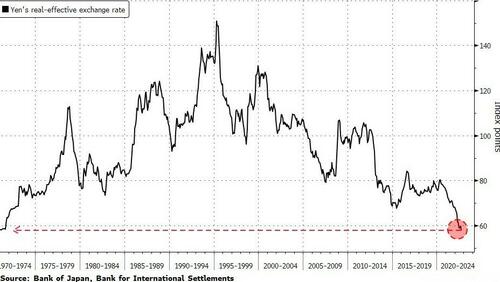

Finally, as Bloomberg details, the value of the yen against its peers - adjusted for inflation - has slumped to a 52-year low, as widening interest-rate differentials between Japan and other major economies continued to pile pressure on the currency.

A gauge of the real effective exchange rate slumped 3% in September, based on the most recent data from the Bank of Japan and Bank for International Settlements.

The decline has been driven in part by outflows from Japan owing to the lack of attractive investment opportunities locally, according to Takuya Kanda, general manager at Gaitame.com Research Institute in Tokyo.

Today’s market moves were very much specific as geopolitical and macro-economic chaos reigned…

[embedded content]

It appeared like BoJ stepped in rather inelegantly last night as the Asian FX markets started trading (in an attempt to use the thin markets to extend Friday’s intervention liftathon). It worked for around 15 minutes… and then yen started to fall and by the end of the US session had erased all of that yen-tervention and erased half of Friday’s gains…

Source: Bloomberg

Chinese markets shit the bed, technically speaking, overnight as Xi’s new era appears anything but more open.

Chinese tech stocks were a total bloodbath today with Nasdaq’s Golden Dragon index down a stunning 16% (biggest daily drop ever) to its lowest since Dec 2012…

Source: Bloomberg

The offshore yuan plunged to new record lows (breaking down below the RMB Fix lower bound)…

Source: Bloomberg

And all that after they announced better than expected GDP growth and Industrial production.

Next up was the UK as Rishi Sunak became the new UK PM (by default), which appeared to reassure British capital markets as bond yields tumbled (2Y gilt yields plunged 37bps – the biggest daily drop since 1992!), but we do note that Cable was modestly lower today…

Source: Bloomberg

And then came the US… where PMIs plunged into contraction and Janet Yellen told MSNBC she “can’t rule out the risk” of a recession (is she a biologist?)… which of course is great news for stocks.

Small Caps underperformed, but the rest of the majors accelerated higher on the day with The Dow leading. We did see ‘Dump Capital’ appear around 1530ET though, which wiped some lipstick off this pig. Nasdaq had ytet another day of being down 1% and then being up 1%…

Today’s melt-up should not have been a surprise to readers since Goldman warned “the pain trade is to the upside”…

ICYMI: “The Pain Trade Is To The Upside”: 10 Reasons From Goldman’s Trading Desk For A November Meltuphttps://t.co/DSSrkjUB3A

— zerohedge (@zerohedge) October 24, 2022

TSLA bucked the trend of the day (tumbling in the pre and early market, down to its lowest level since mid-2021, below $200 briefly), but was bid all afternoon and ended just over 1% lower…

But, we note that the market’s expectations for Fed rates shifted notably hawkishly, erasing some of Friday’s dovish dive (odds for a 75bps hike in Dec rose to 40% from 30%)…

Source: Bloomberg

Treasury yields were volatile intraday but ended higher with the long-end underperforming…

Source: Bloomberg

Most notably, long-term inflation breakevens (market expectations) soared in the last week…

Source: Bloomberg

The Dollar managed modest gains on the day, but remains well down from Friday’s pre-yentervention puke…

Source: Bloomberg

Bitcoin is higher from Friday’s close after a surge in buying yesterday early afternoon (which was sold into)…

Source: Bloomberg

Oil prices tumbled overnight (perhaps on the back of Xi’s ‘crowning’ signaling the likelihood of ZeroCOVID policies continuing) then rallied back to a modest loss with WTI just below $85…

Gold was very modestly lower on the day with futures hovering around $1655, holding most of Friday’s gains…

Finally, as Bloomberg details, the value of the yen against its peers – adjusted for inflation – has slumped to a 52-year low, as widening interest-rate differentials between Japan and other major economies continued to pile pressure on the currency.

A gauge of the real effective exchange rate slumped 3% in September, based on the most recent data from the Bank of Japan and Bank for International Settlements.

The decline has been driven in part by outflows from Japan owing to the lack of attractive investment opportunities locally, according to Takuya Kanda, general manager at Gaitame.com Research Institute in Tokyo.