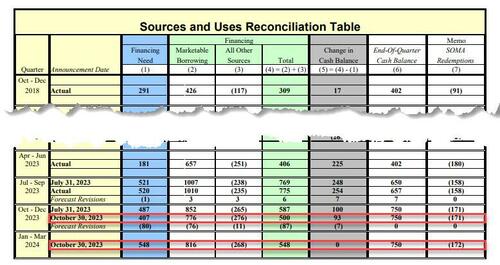

We already knew - after its publication on Monday - that in the current quarter, the Treasury expected to issue $776BN in debt in the current quarter, or some $76BN below the previous forecast published last quarter, a welcome slowdown in debt issuance as a result of slightly higher than expected tax receipts in October.

Today's Treasury Refunding Announcement gave the details of what the composition of this issuance would be, with a focus on Coupon vs Bill sales.

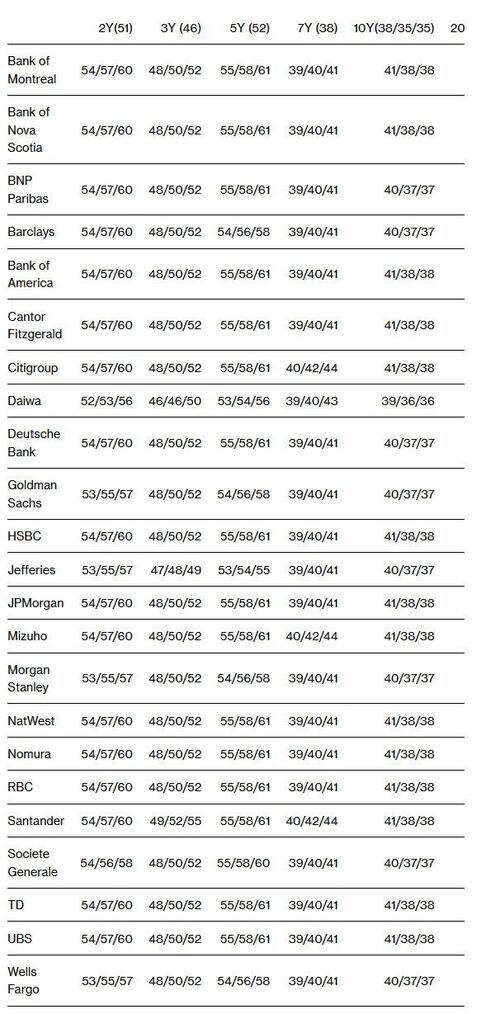

Here is what we learned: next week, the US Treasury's debt sales will total $112BN, which while an increase from the $103BN unveiled in August, was less than the $114BN anticipated by Wall Street bond dealers. It was the second straight boost to the so-called quarterly refunding, if slightly less than expected.

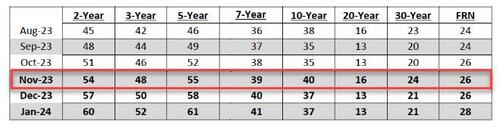

The offering of $112 billion in coupons will refund approximately $102.2 billion of privately-held Treasury notes maturing on November 15, 2023. This issuance will raise new cash from private investors of approximately $9.8 billion. The securities are:

- A 3-year note in the amount of $48 billion on Nov 7, up $2BN from $46BN in October

- A 10-year note in the amount of $40 billion on Nov 8, up $5BN from $35BN in October

- A 30-year bond in the amount of $24 billion on Nov 9, up $3BN from $20BN in October

Treasury plans to increase both the new issue and reopening auction size of the 10-year note by $2bn and the 30-year bond by $1bn; Treasury will maintain the 20-year bond new issue and reopening auction size, noting that "treasury issuance plans will continue to depend on a variety of factors, including the evolution of the fiscal outlook and the pace and duration of future SOMA redemptions”

Compared with the August refunding, the key difference this time was a slower pace of increases in sales of 10-year and 30-year securities, with 20-year bonds kept unchanged.

Some more details:

- The Treasury also plans to increase the Nov. and Dec. reopening auction size of the 2-year FRN by $2b and the January new issue auction size by $2b;

- Treasury plans to maintain Nov. 10-year TIPS reopening auction size at $15b and increase Dec. 5-year TIPS reopening auction size by $1b to $20b; Jan. 10-year TIPS new issue auction size to be increased by $1b to $18b.

- Additionally, two- and five-year auction sizes are set to increase by $3BN per month; three-year by $2BN per month; and seven-year by $1BN per month.

The table below summarizes all of the above:

This is what most rates traders on Wall Street had expected from the Treasury today.

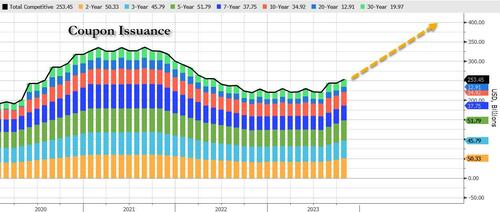

The total of $112 billion compares a peak of $126BN first reached in February 2021; auction sizes across the curve began rising in 2018 to finance tax cuts and surged in 2020 to finance federal pandemic response. Then after dipping modestly in 2022, coupon issuance is once again rising and will continue to do so pretty much indefinitely unless the government learns to live within its means, which of course will never happen.

The Treasury also specified that it now expects a single additional step up in quarterly issuance of longer-term debt. “As these changes will make substantial progress towards aligning auction sizes with projected borrowing needs, Treasury anticipates that one additional quarter of increases to coupon auction sizes will likely be needed beyond the increases announced today,” the Treasury said in its release Wednesday.

As usual, the Treasury said it plans to address any seasonal or unexpected variations in borrowing needs over the next quarter through changes in regular bill auction sizes and/or CMBs.

The department said its plans “will continue to depend on a variety of factors, including the evolution of the fiscal outlook” and the pace and duration of the Federal Reserve’s shrinking of its portfolio of Treasuries. The Fed is letting up to $60 billion a month of its holdings mature without replacement, forcing the government to issue more to the public.

And since there was a modest miss in coupon issuance, the offset naturally had to come at the expense of bills; this is what the Treasury said regarding the coming bill issuance: "Given current fiscal forecasts, treasury expects to maintain bill auction sizes at current levels into late-November – this will help to ensure sufficient liquidity to meet our elevated one-week cash needs around the end of this month. By early-December, Treasury anticipates implementing modest reductions to short-dated bill auction sizes that will likely then be maintained through mid- to late-January."

Readers will recall that the August refunding announcement - which spooked bond markets with the surge in new issuance - came as a bit of a shock, sending yields surging with 10-year rates up more than 75 basis points since then.

While Treasury Secretary Janet Yellen has rejected the idea that increased government borrowing caused the move, market participants highlight increasing concern about the widening US fiscal deficit.

In its guidance to officials, the Treasury Borrowing Advisory Committee — a panel of bond-market participants — noted that there’s more liquidity and demand for securities maturing sooner than 10 years.

With regard to bills, which mature in one year or less, the Treasury said it “expects to maintain bill auction sizes at current levels into late-November.”

By early next month, “Treasury anticipates implementing modest reductions to short-dated bill auction sizes that will likely then be maintained through mid- to late-January.” That plan comes after the department said Monday that it expects more revenue this quarter than previously expected, thanks in part to an influx of deferred taxes from much of California and other states.

The share of bills in total government debt pile current is currently more than 20%, the cap that TBAC has long advised as most ideal. However, in August, TBAC indicated that exceeding the peak for a time before returning to the recommended range wouldn’t pose an issue.

Turning to the topic of buybacks, which some have called QE in sheep's clothing, the Treasury said that it "intends to provide an update on the timing for implementing the regular buyback program in the next quarterly refunding announcement.”

For its Issuance plans for Treasury Inflation-Protected Securities, or TIPS, the department said it will maintain the November 10-year maturity reopening at $15 billion and increase its new issue sale in January by $1 billion. It also said it will lift its December reopening 5-year maturity by $1 billion.

As for floating-rate notes, the Treasury plans to increase the November and December reopening auction size of the 2-year FRN by $2 billion and the January new issue auction size by $2 billion.

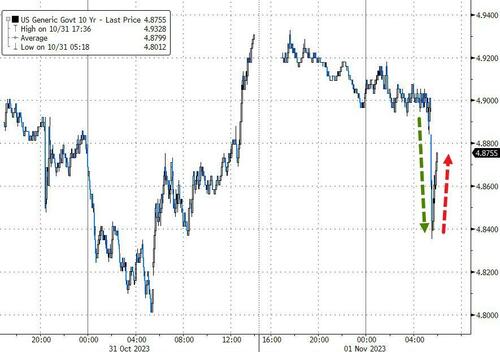

In kneejerk response, 10Y yields dropped to session lows if rising modestly since after today's refunding was slightly lower than most had expected.

We already knew – after its publication on Monday – that in the current quarter, the Treasury expected to issue $776BN in debt in the current quarter, or some $76BN below the previous forecast published last quarter, a welcome slowdown in debt issuance as a result of slightly higher than expected tax receipts in October.

Today’s Treasury Refunding Announcement gave the details of what the composition of this issuance would be, with a focus on Coupon vs Bill sales.

Here is what we learned: next week, the US Treasury’s debt sales will total $112BN, which while an increase from the $103BN unveiled in August, was less than the $114BN anticipated by Wall Street bond dealers. It was the second straight boost to the so-called quarterly refunding, if slightly less than expected.

The offering of $112 billion in coupons will refund approximately $102.2 billion of privately-held Treasury notes maturing on November 15, 2023. This issuance will raise new cash from private investors of approximately $9.8 billion. The securities are:

- A 3-year note in the amount of $48 billion on Nov 7, up $2BN from $46BN in October

- A 10-year note in the amount of $40 billion on Nov 8, up $5BN from $35BN in October

- A 30-year bond in the amount of $24 billion on Nov 9, up $3BN from $20BN in October

Treasury plans to increase both the new issue and reopening auction size of the 10-year note by $2bn and the 30-year bond by $1bn; Treasury will maintain the 20-year bond new issue and reopening auction size, noting that “treasury issuance plans will continue to depend on a variety of factors, including the evolution of the fiscal outlook and the pace and duration of future SOMA redemptions”

Compared with the August refunding, the key difference this time was a slower pace of increases in sales of 10-year and 30-year securities, with 20-year bonds kept unchanged.

Some more details:

- The Treasury also plans to increase the Nov. and Dec. reopening auction size of the 2-year FRN by $2b and the January new issue auction size by $2b;

- Treasury plans to maintain Nov. 10-year TIPS reopening auction size at $15b and increase Dec. 5-year TIPS reopening auction size by $1b to $20b; Jan. 10-year TIPS new issue auction size to be increased by $1b to $18b.

- Additionally, two- and five-year auction sizes are set to increase by $3BN per month; three-year by $2BN per month; and seven-year by $1BN per month.

The table below summarizes all of the above:

This is what most rates traders on Wall Street had expected from the Treasury today.

The total of $112 billion compares a peak of $126BN first reached in February 2021; auction sizes across the curve began rising in 2018 to finance tax cuts and surged in 2020 to finance federal pandemic response. Then after dipping modestly in 2022, coupon issuance is once again rising and will continue to do so pretty much indefinitely unless the government learns to live within its means, which of course will never happen.

The Treasury also specified that it now expects a single additional step up in quarterly issuance of longer-term debt. “As these changes will make substantial progress towards aligning auction sizes with projected borrowing needs, Treasury anticipates that one additional quarter of increases to coupon auction sizes will likely be needed beyond the increases announced today,” the Treasury said in its release Wednesday.

As usual, the Treasury said it plans to address any seasonal or unexpected variations in borrowing needs over the next quarter through changes in regular bill auction sizes and/or CMBs.

The department said its plans “will continue to depend on a variety of factors, including the evolution of the fiscal outlook” and the pace and duration of the Federal Reserve’s shrinking of its portfolio of Treasuries. The Fed is letting up to $60 billion a month of its holdings mature without replacement, forcing the government to issue more to the public.

And since there was a modest miss in coupon issuance, the offset naturally had to come at the expense of bills; this is what the Treasury said regarding the coming bill issuance: “Given current fiscal forecasts, treasury expects to maintain bill auction sizes at current levels into late-November – this will help to ensure sufficient liquidity to meet our elevated one-week cash needs around the end of this month. By early-December, Treasury anticipates implementing modest reductions to short-dated bill auction sizes that will likely then be maintained through mid- to late-January.”

Readers will recall that the August refunding announcement – which spooked bond markets with the surge in new issuance – came as a bit of a shock, sending yields surging with 10-year rates up more than 75 basis points since then.

While Treasury Secretary Janet Yellen has rejected the idea that increased government borrowing caused the move, market participants highlight increasing concern about the widening US fiscal deficit.

In its guidance to officials, the Treasury Borrowing Advisory Committee — a panel of bond-market participants — noted that there’s more liquidity and demand for securities maturing sooner than 10 years.

With regard to bills, which mature in one year or less, the Treasury said it “expects to maintain bill auction sizes at current levels into late-November.”

By early next month, “Treasury anticipates implementing modest reductions to short-dated bill auction sizes that will likely then be maintained through mid- to late-January.” That plan comes after the department said Monday that it expects more revenue this quarter than previously expected, thanks in part to an influx of deferred taxes from much of California and other states.

The share of bills in total government debt pile current is currently more than 20%, the cap that TBAC has long advised as most ideal. However, in August, TBAC indicated that exceeding the peak for a time before returning to the recommended range wouldn’t pose an issue.

Turning to the topic of buybacks, which some have called QE in sheep’s clothing, the Treasury said that it “intends to provide an update on the timing for implementing the regular buyback program in the next quarterly refunding announcement.”

For its Issuance plans for Treasury Inflation-Protected Securities, or TIPS, the department said it will maintain the November 10-year maturity reopening at $15 billion and increase its new issue sale in January by $1 billion. It also said it will lift its December reopening 5-year maturity by $1 billion.

As for floating-rate notes, the Treasury plans to increase the November and December reopening auction size of the 2-year FRN by $2 billion and the January new issue auction size by $2 billion.

In kneejerk response, 10Y yields dropped to session lows if rising modestly since after today’s refunding was slightly lower than most had expected.

Loading…