It's been a challenging year for consumers. And with the highest inflation in four decades, some are paring back spending on big-ticket items, such as used automobiles. After jumping 90%, since the start of the virus pandemic, used car prices are cooling as buyers balk due to affordability issues stemming from soaring interest rates.

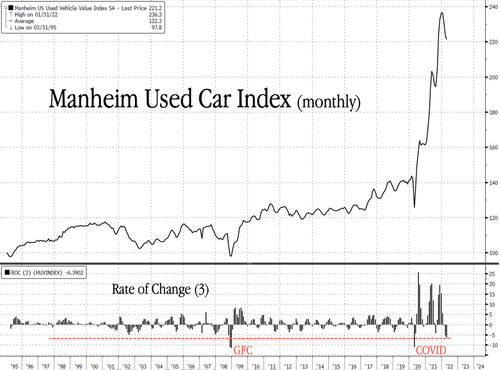

Outside of the COVID shock and Great Financial Crisis of 2008/09, the Manheim Used Vehicle Value Index, a wholesale tracker of used car prices, printed the most significant monthly decline in terms of rate of change averaged out over three months in April at 6.4%. It didn't beat the April 2020 print of -11.2% nor December 2008 of -11.5%, but those two periods were in full-blown financial crises.

Currently, the Federal Reserve and the Biden administration reassure everyone the economy is strong, and there's nothing to worry about. The Fed routinely says monetary tightening will create a soft-landing, similar to the mid-90s. However, tightening financial conditions could only spark trouble for an economy based 70% on consumption and driven by access to cheap credit.

The cooling in the used car market could suggest a broader economic slowdown is ahead.

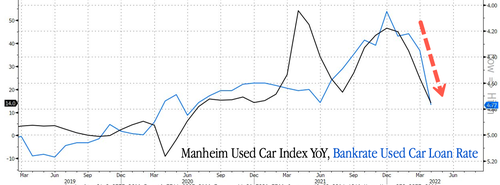

Take a look at the used car market year-over-year growth rates versus used car auto loan rates. A jump in rates has dampened upward price pressure as fewer buyers can afford cars.

The rate surge was evident in April as used car sales slowed down precipitously, down 13% compared with March.

Though the Used Car Index tracks *wholesale pricing*

— CarDealershipGuy (@GuyDealership) May 6, 2022

Manheim estimates that *retail used car sales* declined 13% MoM in April.

Time will tell how this will unfold

but I will be sure to keep you posted on what I'm seeing on the ground floor.

Readers may recall the first used car price stall warning printed in early February. In a piece titled "Used Car Prices Arrive At Yet Another Major Inflection Point," it was evident that the loss in momentum in used car prices was a grave concern. By mid-March, used car prices slid some more as supply chain congestion peaked and was believed to soon increase the supply of new cars. Then by early April, used car prices continued to slump as we asked the question: "Are Used Car Prices About To Peak For Real This Time?"

Some have pointed out that used car prices via the CarGurus index have already rebounded and suggest Manheim could be a laggard indicator.

CarGurus index shows dip and recovery, what does that mean compared to auction prices? Is Manheim lagging? pic.twitter.com/V3qWFE4mp6

— sixdee9er (@sixD9er) May 6, 2022

However, those in the industry have more confidence in Manheim than CarGurus.

I don't trust this index.

— CarDealershipGuy (@GuyDealership) May 6, 2022

Manheim has *actual* sales data.

Cargurus only tracks listing prices (which we all know are not accurate)

Consumers have likely tightened their belts in early May. This comes as the Fed is cooling off hot inflation. New and used vehicles account for 9.2% of consumer prices. And if the Fed wants to find the neutral rate by the midterms, interest rates will go higher and inflict more downward pressure on used car prices, thus helping to extinguish the inflation fire it sparked two years ago by printing trillions of dollars.

It’s been a challenging year for consumers. And with the highest inflation in four decades, some are paring back spending on big-ticket items, such as used automobiles. After jumping 90%, since the start of the virus pandemic, used car prices are cooling as buyers balk due to affordability issues stemming from soaring interest rates.

Outside of the COVID shock and Great Financial Crisis of 2008/09, the Manheim Used Vehicle Value Index, a wholesale tracker of used car prices, printed the most significant monthly decline in terms of rate of change averaged out over three months in April at 6.4%. It didn’t beat the April 2020 print of -11.2% nor December 2008 of -11.5%, but those two periods were in full-blown financial crises.

Currently, the Federal Reserve and the Biden administration reassure everyone the economy is strong, and there’s nothing to worry about. The Fed routinely says monetary tightening will create a soft-landing, similar to the mid-90s. However, tightening financial conditions could only spark trouble for an economy based 70% on consumption and driven by access to cheap credit.

The cooling in the used car market could suggest a broader economic slowdown is ahead.

Take a look at the used car market year-over-year growth rates versus used car auto loan rates. A jump in rates has dampened upward price pressure as fewer buyers can afford cars.

The rate surge was evident in April as used car sales slowed down precipitously, down 13% compared with March.

Though the Used Car Index tracks *wholesale pricing*

Manheim estimates that *retail used car sales* declined 13% MoM in April.

Time will tell how this will unfold

but I will be sure to keep you posted on what I’m seeing on the ground floor.

— CarDealershipGuy (@GuyDealership) May 6, 2022

Readers may recall the first used car price stall warning printed in early February. In a piece titled “Used Car Prices Arrive At Yet Another Major Inflection Point,” it was evident that the loss in momentum in used car prices was a grave concern. By mid-March, used car prices slid some more as supply chain congestion peaked and was believed to soon increase the supply of new cars. Then by early April, used car prices continued to slump as we asked the question: “Are Used Car Prices About To Peak For Real This Time?”

Some have pointed out that used car prices via the CarGurus index have already rebounded and suggest Manheim could be a laggard indicator.

CarGurus index shows dip and recovery, what does that mean compared to auction prices? Is Manheim lagging? pic.twitter.com/V3qWFE4mp6

— sixdee9er (@sixD9er) May 6, 2022

However, those in the industry have more confidence in Manheim than CarGurus.

I don’t trust this index.

Manheim has *actual* sales data.

Cargurus only tracks listing prices (which we all know are not accurate)

— CarDealershipGuy (@GuyDealership) May 6, 2022

Consumers have likely tightened their belts in early May. This comes as the Fed is cooling off hot inflation. New and used vehicles account for 9.2% of consumer prices. And if the Fed wants to find the neutral rate by the midterms, interest rates will go higher and inflict more downward pressure on used car prices, thus helping to extinguish the inflation fire it sparked two years ago by printing trillions of dollars.