In April, one of America’s largest office owners, Brookfield, defaulted on a $161 million loan.

The loan, covering 12 office buildings, was mainly concentrated in the Washington, D.C. market. Faced with low occupancy rates, it joined other office giants Blackstone and WeWork defaulting on office debt this year.

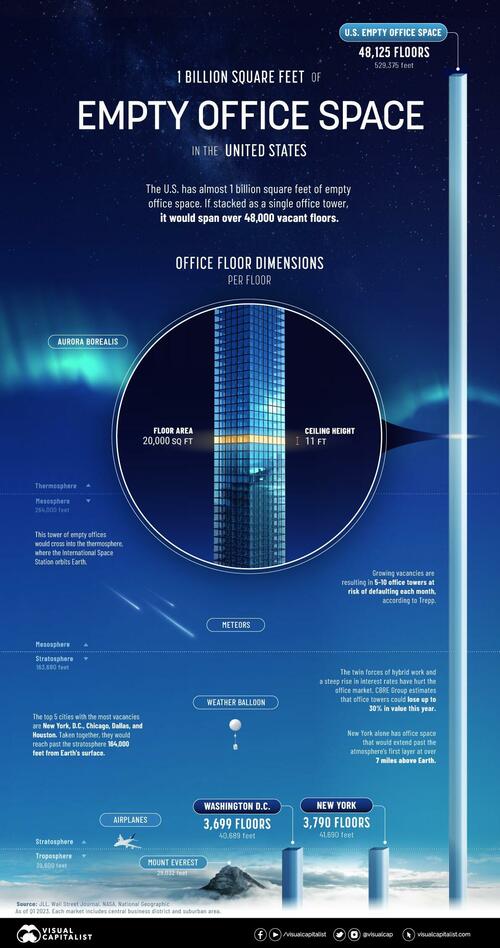

As Visual Capitalist's Dorothy Neufeld shows in the graphic below, nearly 1 billion square feet of empty office space in the U.S. based on data from JLL - and the wider implications of office towers standing empty.

Ranking U.S. Cities by Empty Office Space

At the end of the first quarter of 2023, a record 963 million square feet of office space was unoccupied in America. An estimated five to 10 office towers are at risk of defaulting each month according to Manus Clancy, senior managing director at Trepp.

Here are cities ranked by their total square feet of office vacancy as of Q1 2023. Figures include central business districts and suburban areas.

| Ranking | Market | Total Vacancy (SF) | Total Vacancy (%) |

|---|---|---|---|

| 1 | New York | 75.8M | 16.1% |

| 2 | Washington, D.C. | 74.0M | 20.8% |

| 3 | Chicago | 63.2M | 23.5% |

| 4 | Dallas | 53.5M | 25.0% |

| 5 | Houston | 49.3M | 25.6% |

| 6 | Los Angeles | 47.1M | 24.1% |

| 7 | New Jersey | 43.3M | 25.8% |

| 8 | Atlanta | 38.1M | 21.6% |

| 9 | Boston | 31.8M | 19.1% |

| 10 | Philadelphia | 27.8M | 18.8% |

| 11 | Denver | 27.3M | 21.6% |

| 12 | Phoenix | 25.2M | 23.9% |

| 13 | San Francisco | 22.8M | 26.4% |

| 14 | Seattle | 21.4M | 17.7% |

| 15 | Minneapolis | 19.9M | 19.7% |

| 16 | Detroit | 18.0M | 19.3% |

| 17 | Orange County | 17.7M | 17.6% |

| 18 | Salt Lake City | 13.9M | 18.5% |

| 19 | Kansas City | 13.8M | 20.8% |

| 20 | Pittsburgh | 13.8M | 21.8% |

| 21 | Charlotte | 13.7M | 20.6% |

| 22 | Austin | 13.6M | 18.9% |

| 23 | Baltimore | 13.1M | 18.2% |

| 24 | Portland | 12.8M | 17.5% |

| 25 | Silicon Valley | 12.1M | 17.3% |

| 26 | Oakland–East Bay | 11.7M | 22.0% |

| 27 | San Diego | 10.7M | 12.3% |

| 28 | St. Louis | 10.5M | 21.9% |

| 29 | Cincinnati | 10.1M | 21.4% |

| 30 | Sacramento | 9.9M | 19.6% |

| 31 | Fairfield County | 9.7M | 25.4% |

| 32 | Columbus | 9.7M | 21.7% |

| 33 | Milwaukee | 9.2M | 24.0% |

| 34 | Nashville | 9.0M | 18.9% |

| 35 | Raleigh-Durham | 8.9M | 15.2% |

| 36 | Indianapolis | 8.6M | 22.4% |

| 37 | Tampa | 8.2M | 17.2% |

| 38 | Fort Worth | 7.6M | 16.7% |

| 39 | Miami | 7.6M | 16.2% |

| 40 | Cleveland | 7.3M | 18.3% |

| 41 | San Antonio | 7.2M | 17.8% |

| 42 | Long Island | 6.3M | 15.2% |

| 43 | Westchester County | 5.8M | 22.1% |

| 44 | Jacksonville | 5.4M | 18.6% |

| 45 | Orlando | 5.0M | 13.3% |

| 46 | San Francisco Peninsula | 4.4M | 13.3% |

| 47 | Richmond | 4.3M | 13.3% |

| 48 | Fort Lauderdale | 4.3M | 16.1% |

| 49 | North San Francisco Bay | 4.0M | 18.3% |

| 50 | Louisville | 3.6M | 16.8% |

| 51 | Des Moines | 3.2M | 12.0% |

| 52 | Hampton Roads | 3.1M | 14.7% |

| 53 | West Palm Beach | 2.4M | 10.3% |

| 54 | Grand Rapids | 1.8M | 13.2% |

| United States | 962.5M | 20.2% |

Numbers may not total 100 due to rounding.

New York has roughly 76 million square feet of empty office space. If this were stacked as a single office building, it would stretch 7 miles into the atmosphere. In 2019, the office sector accounted for about a third of all jobs in the city.

Falling closely behind is Washington, D.C. with a 21% vacancy rate—8% higher than what is typically considered healthy. Occupiers are downsizing given remote work trends, yet some office buildings are being converted to residential properties, curtailing vacancy rates.

Across 54 markets in the dataset, San Francisco has the highest vacancy rate at over 26%. Prior to the pandemic, vacancy rates were about 4%. This year, Salesforce walked away from a 30-story tower in downtown San Francisco spanning 104,000 square feet in an effort to cut costs.

Overall, rising interest rates and higher vacancies have hurt U.S. office markets, with many cities potentially seeing an uptick in vacancies going forward.

Empty Office Space: Impact on Banks

Office building valuations are projected to fall 30% in 2023 according to Richard Barkham, global chief economist at CBRE Group.

A sharp decline in property values could potentially result in steep losses for banks. This is especially true for small and regional banks that make up the majority of U.S. office loans. Big banks cover roughly 20% of office and downtown retail totals.

Consider how commercial real estate exposure breaks down by different types of banks:

| Bank Assets | Commercial Real Estate Loans % of Total Assets | Share of Industry Assets |

|---|---|---|

| <$100M | 11.3% | 0.2% |

| $100M-$1B | 26.9% | 4.7% |

| $1B-$10B | 32.5% | 9.7% |

| $10B-$250B | 18.1% | 30.1% |

| >$250B | 5.6% | 55.5% |

Source: FitchRatings

For big banks, a recent stress test by the Federal Reserve shows that a 40% decline in commercial property values could result in a $65 billion loss on their commercial loan portfolios. The good news is that many big banks are sitting on healthy capital reserves based on requirements set in place after the global financial crisis.

Smaller banks are a different story. Many have higher loan concentrations and less oversight on reserve requirements. If these loan portfolios deteriorate, banks may face a downgrade in ratings and higher credit losses.

Additionally, banks with loans in markets with high vacancy rates like San Francisco, Houston, and Washington, D.C. could see more elevated risk.

How High Rates Could Escalate Losses

Adding further strain are the ramifications of higher interest rates.

Higher rates have negatively impacted smaller banks’ balance sheets—meaning they are less likely to issue new loans. This is projected to cause commercial real estate transaction volume to decline 27% in 2023, contributing to lower prices. Banks have already slowed lending for commercial real estate in 2023 due to credit quality concerns.

The good news is that some banks are extending existing loan terms or restructuring debt. In this way, banks are willing to negotiate new loan agreements to prevent widespread foreclosures from hurting their commercial loan portfolios. Short-term extensions on existing loans were often seen during the global financial crisis.

Still, foreclosures could take place if restructuring the loan doesn’t make financial sense.

Overall, only so many banks may be willing to wait out the uncertainty with loan extensions if fundamentals continue to worsen. Offices that are positioned to weather declines will likely have better quality, location, roster of tenants, and financing structures.

In April, one of America’s largest office owners, Brookfield, defaulted on a $161 million loan.

The loan, covering 12 office buildings, was mainly concentrated in the Washington, D.C. market. Faced with low occupancy rates, it joined other office giants Blackstone and WeWork defaulting on office debt this year.

As Visual Capitalist’s Dorothy Neufeld shows in the graphic below, nearly 1 billion square feet of empty office space in the U.S. based on data from JLL – and the wider implications of office towers standing empty.

Ranking U.S. Cities by Empty Office Space

At the end of the first quarter of 2023, a record 963 million square feet of office space was unoccupied in America. An estimated five to 10 office towers are at risk of defaulting each month according to Manus Clancy, senior managing director at Trepp.

Here are cities ranked by their total square feet of office vacancy as of Q1 2023. Figures include central business districts and suburban areas.

| Ranking | Market | Total Vacancy (SF) | Total Vacancy (%) |

|---|---|---|---|

| 1 | New York | 75.8M | 16.1% |

| 2 | Washington, D.C. | 74.0M | 20.8% |

| 3 | Chicago | 63.2M | 23.5% |

| 4 | Dallas | 53.5M | 25.0% |

| 5 | Houston | 49.3M | 25.6% |

| 6 | Los Angeles | 47.1M | 24.1% |

| 7 | New Jersey | 43.3M | 25.8% |

| 8 | Atlanta | 38.1M | 21.6% |

| 9 | Boston | 31.8M | 19.1% |

| 10 | Philadelphia | 27.8M | 18.8% |

| 11 | Denver | 27.3M | 21.6% |

| 12 | Phoenix | 25.2M | 23.9% |

| 13 | San Francisco | 22.8M | 26.4% |

| 14 | Seattle | 21.4M | 17.7% |

| 15 | Minneapolis | 19.9M | 19.7% |

| 16 | Detroit | 18.0M | 19.3% |

| 17 | Orange County | 17.7M | 17.6% |

| 18 | Salt Lake City | 13.9M | 18.5% |

| 19 | Kansas City | 13.8M | 20.8% |

| 20 | Pittsburgh | 13.8M | 21.8% |

| 21 | Charlotte | 13.7M | 20.6% |

| 22 | Austin | 13.6M | 18.9% |

| 23 | Baltimore | 13.1M | 18.2% |

| 24 | Portland | 12.8M | 17.5% |

| 25 | Silicon Valley | 12.1M | 17.3% |

| 26 | Oakland–East Bay | 11.7M | 22.0% |

| 27 | San Diego | 10.7M | 12.3% |

| 28 | St. Louis | 10.5M | 21.9% |

| 29 | Cincinnati | 10.1M | 21.4% |

| 30 | Sacramento | 9.9M | 19.6% |

| 31 | Fairfield County | 9.7M | 25.4% |

| 32 | Columbus | 9.7M | 21.7% |

| 33 | Milwaukee | 9.2M | 24.0% |

| 34 | Nashville | 9.0M | 18.9% |

| 35 | Raleigh-Durham | 8.9M | 15.2% |

| 36 | Indianapolis | 8.6M | 22.4% |

| 37 | Tampa | 8.2M | 17.2% |

| 38 | Fort Worth | 7.6M | 16.7% |

| 39 | Miami | 7.6M | 16.2% |

| 40 | Cleveland | 7.3M | 18.3% |

| 41 | San Antonio | 7.2M | 17.8% |

| 42 | Long Island | 6.3M | 15.2% |

| 43 | Westchester County | 5.8M | 22.1% |

| 44 | Jacksonville | 5.4M | 18.6% |

| 45 | Orlando | 5.0M | 13.3% |

| 46 | San Francisco Peninsula | 4.4M | 13.3% |

| 47 | Richmond | 4.3M | 13.3% |

| 48 | Fort Lauderdale | 4.3M | 16.1% |

| 49 | North San Francisco Bay | 4.0M | 18.3% |

| 50 | Louisville | 3.6M | 16.8% |

| 51 | Des Moines | 3.2M | 12.0% |

| 52 | Hampton Roads | 3.1M | 14.7% |

| 53 | West Palm Beach | 2.4M | 10.3% |

| 54 | Grand Rapids | 1.8M | 13.2% |

| United States | 962.5M | 20.2% |

Numbers may not total 100 due to rounding.

New York has roughly 76 million square feet of empty office space. If this were stacked as a single office building, it would stretch 7 miles into the atmosphere. In 2019, the office sector accounted for about a third of all jobs in the city.

Falling closely behind is Washington, D.C. with a 21% vacancy rate—8% higher than what is typically considered healthy. Occupiers are downsizing given remote work trends, yet some office buildings are being converted to residential properties, curtailing vacancy rates.

Across 54 markets in the dataset, San Francisco has the highest vacancy rate at over 26%. Prior to the pandemic, vacancy rates were about 4%. This year, Salesforce walked away from a 30-story tower in downtown San Francisco spanning 104,000 square feet in an effort to cut costs.

Overall, rising interest rates and higher vacancies have hurt U.S. office markets, with many cities potentially seeing an uptick in vacancies going forward.

Empty Office Space: Impact on Banks

Office building valuations are projected to fall 30% in 2023 according to Richard Barkham, global chief economist at CBRE Group.

A sharp decline in property values could potentially result in steep losses for banks. This is especially true for small and regional banks that make up the majority of U.S. office loans. Big banks cover roughly 20% of office and downtown retail totals.

Consider how commercial real estate exposure breaks down by different types of banks:

| Bank Assets | Commercial Real Estate Loans % of Total Assets |

Share of Industry Assets |

|---|---|---|

| <$100M | 11.3% | 0.2% |

| $100M-$1B | 26.9% | 4.7% |

| $1B-$10B | 32.5% | 9.7% |

| $10B-$250B | 18.1% | 30.1% |

| >$250B | 5.6% | 55.5% |

Source: FitchRatings

For big banks, a recent stress test by the Federal Reserve shows that a 40% decline in commercial property values could result in a $65 billion loss on their commercial loan portfolios. The good news is that many big banks are sitting on healthy capital reserves based on requirements set in place after the global financial crisis.

Smaller banks are a different story. Many have higher loan concentrations and less oversight on reserve requirements. If these loan portfolios deteriorate, banks may face a downgrade in ratings and higher credit losses.

Additionally, banks with loans in markets with high vacancy rates like San Francisco, Houston, and Washington, D.C. could see more elevated risk.

How High Rates Could Escalate Losses

Adding further strain are the ramifications of higher interest rates.

Higher rates have negatively impacted smaller banks’ balance sheets—meaning they are less likely to issue new loans. This is projected to cause commercial real estate transaction volume to decline 27% in 2023, contributing to lower prices. Banks have already slowed lending for commercial real estate in 2023 due to credit quality concerns.

The good news is that some banks are extending existing loan terms or restructuring debt. In this way, banks are willing to negotiate new loan agreements to prevent widespread foreclosures from hurting their commercial loan portfolios. Short-term extensions on existing loans were often seen during the global financial crisis.

Still, foreclosures could take place if restructuring the loan doesn’t make financial sense.

Overall, only so many banks may be willing to wait out the uncertainty with loan extensions if fundamentals continue to worsen. Offices that are positioned to weather declines will likely have better quality, location, roster of tenants, and financing structures.

Loading…