A cashless society is one in which financial transactions are conducted primarily through digital means rather than physical cash, relying on technologies like credit cards and mobile payments.

While no country today has fully reached this concept, there are some (like China and South Korea) that have seen widespread adoption of mobile payment platforms and digital wallets.

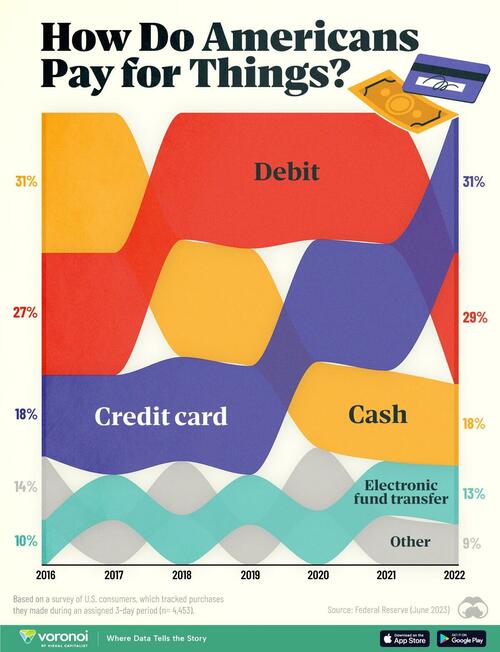

To see whether the U.S. is also moving in this direction, Visual Capitalist's Marcus Lu visualized data from the Federal Reserve’s latest Diary of Consumer Payment Choice.

Data and Methodology

This graphic shows the share of each payment method’s use for all purchases in the country.

These figures are based on the results of a nationally representative survey of U.S. consumers, which tracked purchases they made during an assigned three-day period (n= 4,453). The following table lists the data we used.

The key takeaway here is that the use of cash has fallen from 31% in 2016, to just 18% in 2022.

Cash Use Fell During COVID-19 Pandemic

Cash usage in the U.S. fell during the COVID-19 pandemic due to several reasons:

-

Hygiene Concerns: Fear of virus transmission through physical cash led consumers and businesses to prefer contactless payment methods.

-

Social Distancing: The shift towards online shopping and delivery services, which require digital payments, increased during lockdowns and social distancing measures.

-

Banking Adjustments: Reduced access to ATMs and banking services during lockdowns made obtaining and using cash less convenient.

It’s interesting to note that based on the Federal Reserve’s data, cash usage was already trending downwards before the pandemic, suggesting that the pandemic merely accelerated a trend that was already happening.

A cashless society is one in which financial transactions are conducted primarily through digital means rather than physical cash, relying on technologies like credit cards and mobile payments.

While no country today has fully reached this concept, there are some (like China and South Korea) that have seen widespread adoption of mobile payment platforms and digital wallets.

To see whether the U.S. is also moving in this direction, Visual Capitalist’s Marcus Lu visualized data from the Federal Reserve’s latest Diary of Consumer Payment Choice.

Data and Methodology

This graphic shows the share of each payment method’s use for all purchases in the country.

These figures are based on the results of a nationally representative survey of U.S. consumers, which tracked purchases they made during an assigned three-day period (n= 4,453). The following table lists the data we used.

The key takeaway here is that the use of cash has fallen from 31% in 2016, to just 18% in 2022.

Cash Use Fell During COVID-19 Pandemic

Cash usage in the U.S. fell during the COVID-19 pandemic due to several reasons:

-

Hygiene Concerns: Fear of virus transmission through physical cash led consumers and businesses to prefer contactless payment methods.

-

Social Distancing: The shift towards online shopping and delivery services, which require digital payments, increased during lockdowns and social distancing measures.

-

Banking Adjustments: Reduced access to ATMs and banking services during lockdowns made obtaining and using cash less convenient.

It’s interesting to note that based on the Federal Reserve’s data, cash usage was already trending downwards before the pandemic, suggesting that the pandemic merely accelerated a trend that was already happening.

Loading…