A key question mark for the U.S. and global economy is around when the Federal Reserve will cut interest rates in 2024 and by how much.

After a rapid set of rate hikes throughout 2022, the U.S. Federal Reserve now faces the challenge of timing its easing of monetary policy to ensure a soft landing for the economy.

Visual Capitalist's Niccolo Conte created this visualization (from their 2024 Global Forecast Series) using data from the Federal Reserve to chart past interest rate cut cycles and visualizes forecasts by top banks and institutions on when they expect the first rate cut of 2024 and the number of cuts they expect by end of year.

Looking Back at Past Interest Rate Cuts Cycles

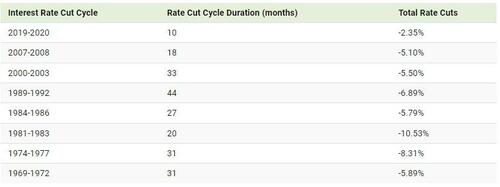

While interest rate cycles are an economic balancing act which must be carefully managed, rate hikes and cuts of the past have typically been steep and swift.

Looking back at past interest rate cuts for historical context, we can see how quickly these easing cycles played out, especially those in the 1970s and 1980s.

Rate cuts typically begin once the Federal Reserve has confirmation that the economy has slowed down and inflationary pressures have subsided. Nearly every interest rate cutting cycle has seen the economy enter a recession right before or after rate cuts have started.

“There is always a delay between when central banks raise interest rates and when the economy feels the effects.”

– Simon Rabinovitch, The Economist

While the recessions occur around the time rates are cut, they’re usually a delayed effect from the tighter financial conditions caused by rate hikes, with cuts bringing looser and more accommodative financial conditions for the economy down the line.

Institutional Forecasts for Interest Rate Cuts in 2024

After some of the most rapid rate hikes in history kicked off this latest interest rate cycle in 2022, market participants and banks are leaning towards similarly rapid set of rate cuts in 2024.

Most institutions, including J.P. Morgan, Deutsche Bank, and Morgan Stanley, are expecting the Fed’s first rate cut to occur at the mid-point of the year in June. There is a group of outliers which includes UBS, Bank of America, and Goldman Sachs, that are expecting the first rate cut as early as March.

When it comes to the total amount of interest rate cuts we’ll see in 2024, the majority of institutions are forecasting around 100 to 125 basis points (bps) in rate cuts, which would bring the Federal Funds Rate to around 4-4.25%.

Rate Cuts or Not, is a Recession Inevitable?

While nearly every interest rate cycle of the past has experienced a recession around the time of rate cuts, Federal Reserve Chair Jerome Powell is optimistic that this time may be different.

“I have always felt, since the beginning, that there was a possibility, because of the unusual situation, that the economy could cool off in a way that enabled inflation to come down without the kind of large job losses that have often been associated with high inflation and tightening cycles.

So far, that’s what we’re seeing.”

With FOMC members themselves projecting more conservative rate cuts in 2024 with a forecasted median year-end rate of 4.6%, time will tell whether more conservative or agressive rate cuts this year will manage to keep the economy out of a recession.

* * *

This visual is from Visual Capitalist's 2024 Global Forecast Series Report:

Get full access to the series, which compiles insights from 700+ expert predictions for what will happen in 2024, by becoming a VC+ member today.

A key question mark for the U.S. and global economy is around when the Federal Reserve will cut interest rates in 2024 and by how much.

After a rapid set of rate hikes throughout 2022, the U.S. Federal Reserve now faces the challenge of timing its easing of monetary policy to ensure a soft landing for the economy.

Visual Capitalist’s Niccolo Conte created this visualization (from their 2024 Global Forecast Series) using data from the Federal Reserve to chart past interest rate cut cycles and visualizes forecasts by top banks and institutions on when they expect the first rate cut of 2024 and the number of cuts they expect by end of year.

Looking Back at Past Interest Rate Cuts Cycles

While interest rate cycles are an economic balancing act which must be carefully managed, rate hikes and cuts of the past have typically been steep and swift.

Looking back at past interest rate cuts for historical context, we can see how quickly these easing cycles played out, especially those in the 1970s and 1980s.

Rate cuts typically begin once the Federal Reserve has confirmation that the economy has slowed down and inflationary pressures have subsided. Nearly every interest rate cutting cycle has seen the economy enter a recession right before or after rate cuts have started.

“There is always a delay between when central banks raise interest rates and when the economy feels the effects.”

– Simon Rabinovitch, The Economist

While the recessions occur around the time rates are cut, they’re usually a delayed effect from the tighter financial conditions caused by rate hikes, with cuts bringing looser and more accommodative financial conditions for the economy down the line.

Institutional Forecasts for Interest Rate Cuts in 2024

After some of the most rapid rate hikes in history kicked off this latest interest rate cycle in 2022, market participants and banks are leaning towards similarly rapid set of rate cuts in 2024.

Most institutions, including J.P. Morgan, Deutsche Bank, and Morgan Stanley, are expecting the Fed’s first rate cut to occur at the mid-point of the year in June. There is a group of outliers which includes UBS, Bank of America, and Goldman Sachs, that are expecting the first rate cut as early as March.

When it comes to the total amount of interest rate cuts we’ll see in 2024, the majority of institutions are forecasting around 100 to 125 basis points (bps) in rate cuts, which would bring the Federal Funds Rate to around 4-4.25%.

Rate Cuts or Not, is a Recession Inevitable?

While nearly every interest rate cycle of the past has experienced a recession around the time of rate cuts, Federal Reserve Chair Jerome Powell is optimistic that this time may be different.

“I have always felt, since the beginning, that there was a possibility, because of the unusual situation, that the economy could cool off in a way that enabled inflation to come down without the kind of large job losses that have often been associated with high inflation and tightening cycles.

So far, that’s what we’re seeing.”

With FOMC members themselves projecting more conservative rate cuts in 2024 with a forecasted median year-end rate of 4.6%, time will tell whether more conservative or agressive rate cuts this year will manage to keep the economy out of a recession.

* * *

This visual is from Visual Capitalist’s 2024 Global Forecast Series Report:

Get full access to the series, which compiles insights from 700+ expert predictions for what will happen in 2024, by becoming a VC+ member today.

Loading…