According to a recent report from Goldman Sachs, the balance of global economic power is projected to shift dramatically in the coming decades.

More specifically, analysts believe that Asia could soon become the largest regional contributor to world GDP, surpassing the traditional economic powerhouses grouped together in the Developed Markets (DM) category.

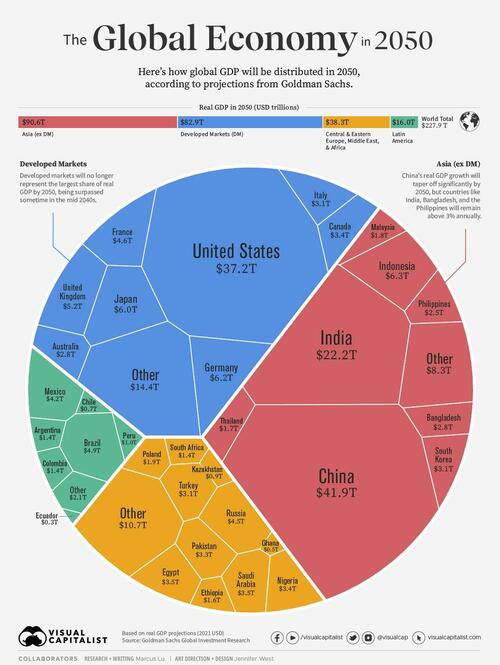

In the graphic below, Visual Capitalist's Marcus Lu visualizes Goldman Sachs’ real GDP forecasts for the year 2050 using a voronoi diagram.

Data and Highlights

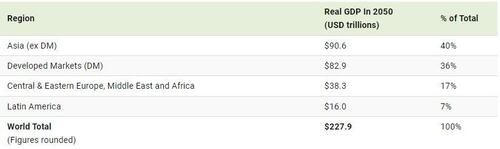

The following table includes a regional breakdown of expected real GDP in 2050. All figures are based on 2021 USD.

Based on these projections, Asia (ex DM) will represent 40% of global GDP, slightly ahead of Developed Markets’ expected share of 36%. This would mark a massive shift from 50 years ago (2000), when DMs represented over 77% of global GDP.

Asia

Focusing on Asia, China and India will account for the majority of the region’s expected GDP in 2050, though growth in China will have tapered off significantly. In fact, Goldman Sachs expects annual real GDP growth in the country to average 1.1% through the 2050s. This is surprisingly slower than America’s expected 1.4% annual growth during the same decade.

The fastest growing economies in Asia during the 2050s will be India (3.1% annually), Bangladesh (3.0% annually), and the Philippines (3.5% annually). These countries are expected to thrive thanks to their high population growth rates and relatively low median age, which translates into a larger work force.

Latin America

Turning our attention to Latin America, we can see that the region will account for a relatively small 7% of global GDP in 2050. According to Goldman Sachs’ previous projections from 2011, many Latin American countries have underperformed over the past decade. For example, Brazil’s real GDP shrank from $2.7 trillion in 2010, to $1.5 trillion in 2020.

Because of these setbacks, Goldman Sachs believes Indonesia will be able to overtake Brazil as the world’s largest emerging market before 2050.

That said, Brazil’s economic ranking is still expected to climb above France and Canada by then, if these projections prove to be accurate.

According to a recent report from Goldman Sachs, the balance of global economic power is projected to shift dramatically in the coming decades.

More specifically, analysts believe that Asia could soon become the largest regional contributor to world GDP, surpassing the traditional economic powerhouses grouped together in the Developed Markets (DM) category.

In the graphic below, Visual Capitalist’s Marcus Lu visualizes Goldman Sachs’ real GDP forecasts for the year 2050 using a voronoi diagram.

Data and Highlights

The following table includes a regional breakdown of expected real GDP in 2050. All figures are based on 2021 USD.

Based on these projections, Asia (ex DM) will represent 40% of global GDP, slightly ahead of Developed Markets’ expected share of 36%. This would mark a massive shift from 50 years ago (2000), when DMs represented over 77% of global GDP.

Asia

Focusing on Asia, China and India will account for the majority of the region’s expected GDP in 2050, though growth in China will have tapered off significantly. In fact, Goldman Sachs expects annual real GDP growth in the country to average 1.1% through the 2050s. This is surprisingly slower than America’s expected 1.4% annual growth during the same decade.

The fastest growing economies in Asia during the 2050s will be India (3.1% annually), Bangladesh (3.0% annually), and the Philippines (3.5% annually). These countries are expected to thrive thanks to their high population growth rates and relatively low median age, which translates into a larger work force.

Latin America

Turning our attention to Latin America, we can see that the region will account for a relatively small 7% of global GDP in 2050. According to Goldman Sachs’ previous projections from 2011, many Latin American countries have underperformed over the past decade. For example, Brazil’s real GDP shrank from $2.7 trillion in 2010, to $1.5 trillion in 2020.

Because of these setbacks, Goldman Sachs believes Indonesia will be able to overtake Brazil as the world’s largest emerging market before 2050.

That said, Brazil’s economic ranking is still expected to climb above France and Canada by then, if these projections prove to be accurate.

Loading…