The computing power used to mine bitcoin is at all-time highs, rising by more than sixfold since November 2019.

Today, 94% of bitcoin’s supply has been mined out of the total cap of 21 million. To mine bitcoin, powerful computers solve complex math problems that validate and secure the network. The total computing power, or bitcoin hashrate, measures how many guesses per second are made to solve these calculations.

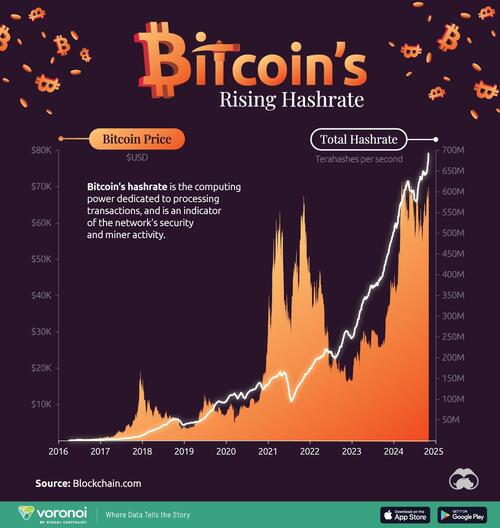

This graphic, via Visual Capitalist's Dorothy Neufeld, shows bitcoin’s hashrate since 2016, based on data from Blockchain.com.

Bitcoin Hashrate Hits Record Highs

Below, we show how the total bitcoin hashrate hit a 693.1 million terahashes per second in late October, rising significantly over the past month:

| Date | Bitcoin Price (USD) | Total Hashrate (Terahashes per second) |

|---|---|---|

| Oct 30 2024 | $70,287 | 693.1M |

| Oct 2024 | $62,051 | 641.4M |

| Sep 2024 | $56,157 | 637.6M |

| Aug 2024 | $60,675 | 615.9M |

| Jul 2024 | $57,042 | 580.4M |

| Jun 2024 | $70,542 | 599.4M |

| May 2024 | $64,023 | 624.0M |

| Apr 2024 | $67,857 | 604.8M |

| Mar 2024 | $63,154 | 574.9M |

| Feb 2024 | $42,658 | 524.7M |

| Jan 2024 | $42,862 | 506.4M |

| Dec 2023 | $44,084 | 476.6M |

| Nov 2023 | $35,035 | 446.6M |

| Oct 2023 | $27,429 | 407.4M |

| Sep 2023 | $25,970 | 387.1M |

| Aug 2023 | $29,076 | 380.4M |

| Jul 2023 | $30,499 | 370.0M |

| Jun 2023 | $25,742 | 358.1M |

| May 2023 | $29,039 | 346.4M |

| Apr 2023 | $27,812 | 331.0M |

| Mar 2023 | $22,351 | 293.6M |

| Feb 2023 | $22,936 | 273.5M |

| Jan 2023 | $16,669 | 250.1M |

| Dec 2022 | $16,966 | 256.0M |

| Nov 2022 | $21,300 | 261.8M |

| Oct 2022 | $19,633 | 232.6M |

| Sep 2022 | $19,835 | 211.4M |

| Aug 2022 | $22,624 | 200.0M |

| Jul 2022 | $20,154 | 214.5M |

| Jun 2022 | $29,902 | 216.5M |

| May 2022 | $37,720 | 209.1M |

| Apr 2022 | $46,422 | 199.9M |

| Mar 2022 | $39,167 | 198.4M |

| Feb 2022 | $41,405 | 187.3M |

| Jan 2022 | $46,460 | 173.9M |

| Dec 2021 | $49,484 | 161.2M |

| Nov 2021 | $61,006 | 149.1M |

| Oct 2021 | $48,234 | 136.6M |

| Sep 2021 | $50,025 | 121.9M |

| Aug 2021 | $39,722 | 101.3M |

| Jul 2021 | $33,698 | 120.1M |

| Jun 2021 | $35,539 | 159.7M |

| May 2021 | $57,213 | 157.3M |

| Apr 2021 | $57,094 | 160.6M |

| Mar 2021 | $48,369 | 154.6M |

| Feb 2021 | $38,311 | 149.4M |

| Jan 2021 | $33,081 | 136.7M |

| Dec 2020 | $18,658 | 129.0M |

| Nov 2020 | $14,161 | 130.5M |

| Oct 2020 | $10,795 | 135.2M |

| Sep 2020 | $10,168 | 123.9M |

| Aug 2020 | $11,233 | 121.3M |

| Jul 2020 | $9,139 | 112.5M |

| Jun 2020 | $9,788 | 103.1M |

| May 2020 | $9,029 | 112.0M |

| Apr 2020 | $6,778 | 105.9M |

| Mar 2020 | $8,758 | 111.5M |

| Feb 2020 | $9,614 | 109.1M |

| Jan 2020 | $7,334 | 96.3M |

| Dec 2019 | $7,394 | 91.7M |

| Nov 2019 | $9,322 | 95.1M |

| Oct 2019 | $8,240 | 89.5M |

| Sep 2019 | $10,628 | 74.8M |

| Aug 2019 | $10,978 | 67.0M |

| Jul 2019 | $11,005 | 57.4M |

| Jun 2019 | $7,789 | 50.4M |

| May 2019 | $5,657 | 45.8M |

| Apr 2019 | $4,976 | 45.0M |

| Mar 2019 | $3,701 | 44.0M |

| Feb 2019 | $3,428 | 41.9M |

| Jan 2019 | $3,788 | 38.3M |

| Dec 2018 | $3,694 | 42.9M |

| Nov 2018 | $6,404 | 51.3M |

| Oct 2018 | $6,466 | 51.3M |

| Sep 2018 | $7,257 | 49.0M |

| Aug 2018 | $7,005 | 40.0M |

| Jul 2018 | $6,533 | 37.4M |

| Jun 2018 | $7,613 | 31.7M |

| May 2018 | $9,726 | 28.5M |

| Apr 2018 | $7,425 | 25.2M |

| Mar 2018 | $11,470 | 22.3M |

| Feb 2018 | $6,905 | 18.2M |

| Jan 2018 | $15,098 | 13.6M |

| Dec 2017 | $11,718 | 9.9M |

| Nov 2017 | $7,392 | 9.4M |

| Oct 2017 | $4,308 | 7.9M |

| Sep 2017 | $4,626 | 6.4M |

| Aug 2017 | $2,857 | 6.1M |

| Jul 2017 | $2,617 | 5.1M |

| Jun 2017 | $2,698 | 4.5M |

| May 2017 | $1,533 | 3.8M |

| Apr 2017 | $1,152 | 3.5M |

| Mar 2017 | $1,274 | 3.2M |

| Feb 2017 | $1,016 | 2.8M |

| Jan 2017 | $1,021 | 2.3M |

| Dec 2016 | $768 | 2.0M |

| Nov 2016 | $706 | 1.8M |

| Oct 2016 | $613 | 1.7M |

| Sep 2016 | $606 | 1.6M |

| Aug 2016 | $573 | 1.5M |

| Jul 2016 | $682 | 1.5M |

| Jun 2016 | $576 | 1.4M |

| May 2016 | $450 | 1.3M |

| Apr 2016 | $422 | 1.2M |

Since bitcoin’s fourth halving in April 2024, the hashrate has hit all-time highs, while bitcoin’s price has increased by roughly 4% as of November 4, 2024.

During each halving event, which occurs every four years, the reward for mining bitcoin is cut in half. In April, it dropped from 6.25 to 3.125 bitcoins, making it harder for miners to turn a profit with unchanged operating costs.

Despite this, rising hashrates indicate a rising number of active miners, signaling a bullish outlook. As bitcoin’s price rises, it incentivizes miners to join the network since it becomes more profitable, pushing up the hashrate.

Today, notable miners include publicly traded companies like Core Scientific, Riot Platforms, and Marathon Digital, which operate machines capable of trillions of hashes per second using specialized hardware. For instance, Core Scientific runs 169,000 miners, while Riot Platforms aims to fully deploy at least 100,000 miners by 2025.

Still, performance varies across major bitcoin mining companies this year. While Core Scientific stands as one of the top-performing miners year-to-date, with 267% returns as of November 4, both Riot Platforms and Marathon Digital have declined over 20%. By comparison, bitcoin has risen 53%, approaching record highs seen in March.

To learn more about this topic from a crypto ownership perspective, check out this graphic on the largest corporate holders of bitcoin.

The computing power used to mine bitcoin is at all-time highs, rising by more than sixfold since November 2019.

Today, 94% of bitcoin’s supply has been mined out of the total cap of 21 million. To mine bitcoin, powerful computers solve complex math problems that validate and secure the network. The total computing power, or bitcoin hashrate, measures how many guesses per second are made to solve these calculations.

This graphic, via Visual Capitalist’s Dorothy Neufeld, shows bitcoin’s hashrate since 2016, based on data from Blockchain.com.

Bitcoin Hashrate Hits Record Highs

Below, we show how the total bitcoin hashrate hit a 693.1 million terahashes per second in late October, rising significantly over the past month:

| Date | Bitcoin Price (USD) | Total Hashrate (Terahashes per second) |

|---|---|---|

| Oct 30 2024 | $70,287 | 693.1M |

| Oct 2024 | $62,051 | 641.4M |

| Sep 2024 | $56,157 | 637.6M |

| Aug 2024 | $60,675 | 615.9M |

| Jul 2024 | $57,042 | 580.4M |

| Jun 2024 | $70,542 | 599.4M |

| May 2024 | $64,023 | 624.0M |

| Apr 2024 | $67,857 | 604.8M |

| Mar 2024 | $63,154 | 574.9M |

| Feb 2024 | $42,658 | 524.7M |

| Jan 2024 | $42,862 | 506.4M |

| Dec 2023 | $44,084 | 476.6M |

| Nov 2023 | $35,035 | 446.6M |

| Oct 2023 | $27,429 | 407.4M |

| Sep 2023 | $25,970 | 387.1M |

| Aug 2023 | $29,076 | 380.4M |

| Jul 2023 | $30,499 | 370.0M |

| Jun 2023 | $25,742 | 358.1M |

| May 2023 | $29,039 | 346.4M |

| Apr 2023 | $27,812 | 331.0M |

| Mar 2023 | $22,351 | 293.6M |

| Feb 2023 | $22,936 | 273.5M |

| Jan 2023 | $16,669 | 250.1M |

| Dec 2022 | $16,966 | 256.0M |

| Nov 2022 | $21,300 | 261.8M |

| Oct 2022 | $19,633 | 232.6M |

| Sep 2022 | $19,835 | 211.4M |

| Aug 2022 | $22,624 | 200.0M |

| Jul 2022 | $20,154 | 214.5M |

| Jun 2022 | $29,902 | 216.5M |

| May 2022 | $37,720 | 209.1M |

| Apr 2022 | $46,422 | 199.9M |

| Mar 2022 | $39,167 | 198.4M |

| Feb 2022 | $41,405 | 187.3M |

| Jan 2022 | $46,460 | 173.9M |

| Dec 2021 | $49,484 | 161.2M |

| Nov 2021 | $61,006 | 149.1M |

| Oct 2021 | $48,234 | 136.6M |

| Sep 2021 | $50,025 | 121.9M |

| Aug 2021 | $39,722 | 101.3M |

| Jul 2021 | $33,698 | 120.1M |

| Jun 2021 | $35,539 | 159.7M |

| May 2021 | $57,213 | 157.3M |

| Apr 2021 | $57,094 | 160.6M |

| Mar 2021 | $48,369 | 154.6M |

| Feb 2021 | $38,311 | 149.4M |

| Jan 2021 | $33,081 | 136.7M |

| Dec 2020 | $18,658 | 129.0M |

| Nov 2020 | $14,161 | 130.5M |

| Oct 2020 | $10,795 | 135.2M |

| Sep 2020 | $10,168 | 123.9M |

| Aug 2020 | $11,233 | 121.3M |

| Jul 2020 | $9,139 | 112.5M |

| Jun 2020 | $9,788 | 103.1M |

| May 2020 | $9,029 | 112.0M |

| Apr 2020 | $6,778 | 105.9M |

| Mar 2020 | $8,758 | 111.5M |

| Feb 2020 | $9,614 | 109.1M |

| Jan 2020 | $7,334 | 96.3M |

| Dec 2019 | $7,394 | 91.7M |

| Nov 2019 | $9,322 | 95.1M |

| Oct 2019 | $8,240 | 89.5M |

| Sep 2019 | $10,628 | 74.8M |

| Aug 2019 | $10,978 | 67.0M |

| Jul 2019 | $11,005 | 57.4M |

| Jun 2019 | $7,789 | 50.4M |

| May 2019 | $5,657 | 45.8M |

| Apr 2019 | $4,976 | 45.0M |

| Mar 2019 | $3,701 | 44.0M |

| Feb 2019 | $3,428 | 41.9M |

| Jan 2019 | $3,788 | 38.3M |

| Dec 2018 | $3,694 | 42.9M |

| Nov 2018 | $6,404 | 51.3M |

| Oct 2018 | $6,466 | 51.3M |

| Sep 2018 | $7,257 | 49.0M |

| Aug 2018 | $7,005 | 40.0M |

| Jul 2018 | $6,533 | 37.4M |

| Jun 2018 | $7,613 | 31.7M |

| May 2018 | $9,726 | 28.5M |

| Apr 2018 | $7,425 | 25.2M |

| Mar 2018 | $11,470 | 22.3M |

| Feb 2018 | $6,905 | 18.2M |

| Jan 2018 | $15,098 | 13.6M |

| Dec 2017 | $11,718 | 9.9M |

| Nov 2017 | $7,392 | 9.4M |

| Oct 2017 | $4,308 | 7.9M |

| Sep 2017 | $4,626 | 6.4M |

| Aug 2017 | $2,857 | 6.1M |

| Jul 2017 | $2,617 | 5.1M |

| Jun 2017 | $2,698 | 4.5M |

| May 2017 | $1,533 | 3.8M |

| Apr 2017 | $1,152 | 3.5M |

| Mar 2017 | $1,274 | 3.2M |

| Feb 2017 | $1,016 | 2.8M |

| Jan 2017 | $1,021 | 2.3M |

| Dec 2016 | $768 | 2.0M |

| Nov 2016 | $706 | 1.8M |

| Oct 2016 | $613 | 1.7M |

| Sep 2016 | $606 | 1.6M |

| Aug 2016 | $573 | 1.5M |

| Jul 2016 | $682 | 1.5M |

| Jun 2016 | $576 | 1.4M |

| May 2016 | $450 | 1.3M |

| Apr 2016 | $422 | 1.2M |

Since bitcoin’s fourth halving in April 2024, the hashrate has hit all-time highs, while bitcoin’s price has increased by roughly 4% as of November 4, 2024.

During each halving event, which occurs every four years, the reward for mining bitcoin is cut in half. In April, it dropped from 6.25 to 3.125 bitcoins, making it harder for miners to turn a profit with unchanged operating costs.

Despite this, rising hashrates indicate a rising number of active miners, signaling a bullish outlook. As bitcoin’s price rises, it incentivizes miners to join the network since it becomes more profitable, pushing up the hashrate.

Today, notable miners include publicly traded companies like Core Scientific, Riot Platforms, and Marathon Digital, which operate machines capable of trillions of hashes per second using specialized hardware. For instance, Core Scientific runs 169,000 miners, while Riot Platforms aims to fully deploy at least 100,000 miners by 2025.

Still, performance varies across major bitcoin mining companies this year. While Core Scientific stands as one of the top-performing miners year-to-date, with 267% returns as of November 4, both Riot Platforms and Marathon Digital have declined over 20%. By comparison, bitcoin has risen 53%, approaching record highs seen in March.

To learn more about this topic from a crypto ownership perspective, check out this graphic on the largest corporate holders of bitcoin.

Loading…