Authored by Egon von Greyerz via GoldSwitzerland.com,

The time has now come for the 99.5% of financial assets which are not invested in gold, silver or precious metals mining stocks to grab both the investment and wealth preservation opportunity of a life time.

Making that decision before it is too late is likely to determine your financial and also general wellbeing for the rest of your life!

If you have already joined that exclusive group of 0.5% of global financial assets which are invested in precious metals, you understand what is coming.

But if you belong to the group that neither understands precious metals nor holds any, it might be worthwhile to continue reading.

More about this opportunity later in the article.

FROM A DEBT BASED WEST TO A COMMODITY BASED EAST AND SOUTH

As the Western Empire is breaking up currently, the Eastern & Southern Empire is gaining ever more significance. More than 30 countries want to join the BRICS and many also the SCO (Shanghai Cooperation Organisation). There is also the Eurasian Economic Union (EEU) which exists since 2014 and consists of several ex Soviet Union States.

The enlarged group will consist of more than 40 countries and represent around 2/3 of global population and 1/3 of global GDP. As I have written about in the article “A disorderly reset with gold revalued by multiples”, this is the area which will experience the fastest growth in coming decades as the West gradually declines/collapses under its own deficits and debt burden together with political and moral decay.

The Russian Foreign Minister Lavrov has just announced that Iran will join the SCO on July 4 and that Belarus will also become a full member. There is a virtual SCO meeting on July 4 chaired by India. It seems like more than a coincidence that the meeting takes place on the US Independence Day!

The BRICS meeting in Johannesburg takes place on Aug 22-24 with Macron trying to gatecrash. But he was rejected. Macron is devious and has always tried to ride several horses simultaneously.

But BRICS is not interested in opportunists happy to turn with the wind of success.

At some point, these three groupings might be merged into one, with gold playing a central role. I don’t expect that there will be one gold backed currency at a fixed parity but rather that gold will float at a much higher value than currently with a link to BRICS currencies.

So as the West and especially the US licks its mortal wounds the East is looking forward to the coming feast.

THE DOLLAR IS NO LONGER AS GOOD AS GOLD

There was a time when the US dollar was “As Good as Gold” and until 15 August 1971, sovereign nations could exchange dollars for gold at $35 per ounce.

But sadly most leaders whether of countries or corporations eventually resort to GREED when real money runs out. So this is what Nixon did in 1971 when he closed the gold window.

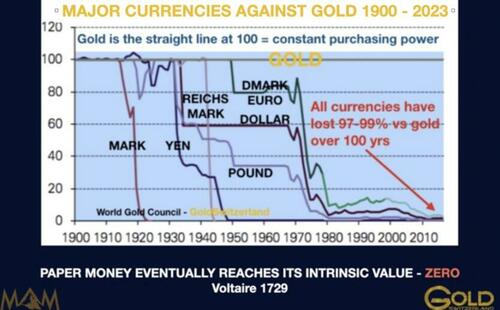

In spite of falling 98% in real terms since 1971, the dollar has remained both the preferred reserve currency and also the currency of choice for global trade.

The two principal reasons why the dollar hasn’t yet died is that virtually all other currencies have declined by similar percentages. Also the astute introduction of the Petrodollar in 1973-4, the brainchild of Nixon’s secretary of state Henry Kissinger, played an important role in convincing Saudi Arabia ( the dominant oil producer at the time) to sell oil in dollars against a package of US weapons and protection.

As the West now sinks in a quagmire of debt, corruption and decadence, the world will experience a tectonic shift away from fiat/fake money with zero intrinsic value to currencies backed by commodities with gold playing a central role.

WHERE HAVE ALL THE STATESMEN GONE

The West has not got one single statesman who can pull it out of the swamp. Many countries are now turning to the right like Italy with Meloni and Spain also probably swinging right in July with the Partido Popular and the far right Vox party. Macron is extremely unpopular and Le Pen now leads the opinion polls with 55%. Scholz in Germany has also failed badly and the Nationalist AfD is now ahead of the ruling social democrats in the polls.

The UK is currently the only major country that is likely to turn to the left at the next election in 2025. No one believes in the weak Sunak and Labour leader Kier Starmer is the clear favourite to win. But sadly he is not a statesman either.

So with a motley crew of weak leaders in Europe, things don’t look any better if we look west to the US. Sadly, the US hasn’t got a leader at all. It seems that Biden has got his strings pulled by an unelected and unaccountable team around him. This is an extremely vulnerable situation for what has been the mightiest country in the world. A major military power without a leader is very dangerous.

As President Eisenhower said in the 1950s:

“In the councils of government, we must guard against the acquisition of unwarranted influence, whether sought or unsought, by the military industrial complex. The potential for the disastrous rise of misplaced power exists and will persist. We must never let the weight of this combination endanger our liberties or democratic processes.”

As empires die, weak leaders are the norm and seem a necessary condition to exacerbate the inevitable collapse.

So we can all speculate about the outcome of the current crisis in the West and how it will all end. These situations seldom consist of individual events but are normally processes that take a number of years or even decades.

We must remember that we have already seen half a century of decline since 1971 so we are now likely to experience an acceleration of the process. As I have pointed out above, it is not just the decline of the West which is happening in front of our eyes, but also the emergence of an extremely powerful cooperation of 40 plus countries which will drive a global commodity based expansion on a scale never seen before in history.

Just take Russia. With $85 trillion of natural resource reserves, they will play a major role in this real physical asset expansion as long as the country holds together politically, which I would expect.

Remember that the massive global shift which is about to start is not based on personalities. Leaders are instruments of their time and the right leaders will emerge in most countries to bring about this tectonic shift.

DON’T TOUCH SOVEREIGN DEBT, EVEN WITH A BARGEPOLE

So how will ordinary investors in the West protect and enhance their assets in a world which is on the cusp of major shifts financially, economically and politically?

Well let’s first look at what not to do.

As I have stressed for many years, it is not a matter of maximising returns but minimising risk. After the biggest global asset bubble in history, the everything collapse will be vicious and take down many investments that have been regarded as safe as sovereign debt. See my article “First gradually and then suddenly – the Everything Collapse”.

Take US government bonds or treasuries. For years I have never understood how someone can invest in a “security” which is created by just snapping your fingers. This is how a senior Swedish Riksbank (central bank) official described to a journalist where money comes from. So whether we call it mouse-click money like my good colleague Matt Piepenburg or finger-snapping money, both expressions clearly tell us that we live in a hocus-pocus world where money is unlimited and can be created by snapping your fingers.

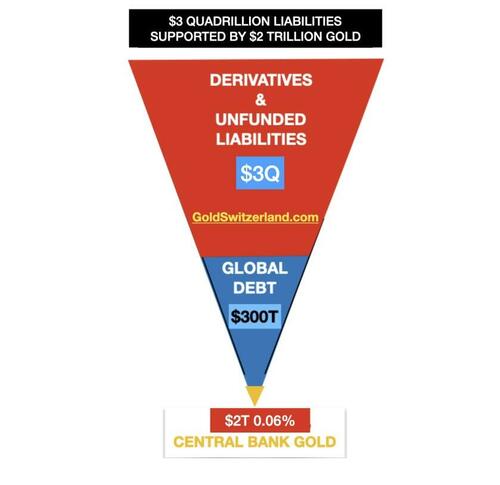

Oh yes, we mustn’t forget the additional $2+ quadrillion of quasi debt or liabilities in the form of derivatives. I have argued many times that a big part of these derivatives are likely to become debt as central banks create liquidity to save the financial system from a an implosion of these financial instruments of mass destruction as Warren Buffett calls them.

I have long argued that holding Western sovereign debt is financial suicide. Lately some big names agree with me whether it is Jamie Dimon of JP Morgan- “Don’t touch US bonds”- or Ray Dalio the very successful hedge fund investor – “It would take 500 years to get the money back”. Yes, but what money I wonder??

Firstly, whether it is the Fed or the ECB, their balance sheets are insolvent and no one can ever get real money back. At best it would be another worthless debt/money instrument like CBDC (Central Bank Digital Currency) that would lose 99-100% over 1 to 50 years. Not the best of odds to say the least.

The US 10 year treasury bond peaked in 1981 at just below 16% after a 39 year downtrend it bottomed in 2020 at 0.55%. That was the bottom of the interest and inflation cycle. We will now see higher inflation and rates for decades. But it obviously won’t be a move without major corrections and volatility.

As major central banks are pressing for higher rates, one wonders if they are aware of the consequences. Because in a debt infested world, higher rates mean a high risk of default, both private and sovereign.

But in their normal style, central banks will be behind the curve and realise their misdemeanours once the system has collapsed.

NB: The only buyer of US treasuries will be the Fed as the rest of the world runs away from the US poisonous debt chalice. It’s like passing the parcel when you can only pass it to yourself.

OPPORTUNITIES OF A LIFETIME COMING

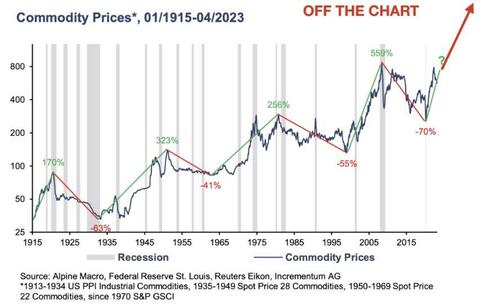

So buying anything commodity based will be a clear growth area for decades. In this group is not just commodity businesses but companies that supply the commodity companies with software or hardware.

In addition to the precious metals market whether physical or stocks, we see the potentially most interesting areas being oil and uranium.

We have been in the physical precious metals market for almost 25 years for wealth preservation purposes. During that time gold has gone up 6-12 times in most Western currencies and silver slightly less.

As the premier company for bigger wealth preservation investors in physical gold and silver, outside the financial system, we have had a very exciting journey so far.

But looking at the last 23 years I am very clear that in spite of greater returns in physical gold than most investment classes and much lower risk, the real moves haven’t even started yet.

I have never seen a more obvious situation during my soon 60 years in investment markets.

Although some of the precious metals mining stocks will vastly outperform physical gold and silver, we will stick to what we know best in order to serve our esteemed clients as well as future wealth preservation investors.

In coming years, most investors will lose a major part of their investments and net worth as they hold on to their conventional investments.

For a quarter of a century I have been standing on a soap box, imploring investors to protect their wealth. During that time we have seen The Nasdaq lose 80% in the early 2000s and the financial system being a few minutes from implosion in 2008.

But with the help of finger-snapping $10s of trillions into existence, most markets have remained strong. Still, the (almost) Everything Collapse is hanging over us and this time finger-snapping money into existence is unlikely to help.

WHEN SHOULD YOU NOT HOLD GOLD?

You should not hold gold when:

-

There are no deficits and there is a balanced budget

-

There is negligible or no inflation

-

There is no debasement of currencies

-

There is strong statesmanship based on real longterm values

When that day comes, we will also see flying elephants as well as flying central bankers with wings!

But just like Icarus, the son of Daedalus in the Greek mythology, these bankers will crash!

Anyone who has held a major part of his wealth in physical gold, in any country, in this century has achieved an excellent return and still has his gold asset intact. He has also been able to sleep well at night.

Although picking the right precious metals stocks can lead to an opportunity of a lifetime, we will still recommend that investors keep the majority of their funds in physical gold and silver, stored in the right jurisdiction and in the safest vaults with direct access to your metals.

That way investors avoid many risks like:

-

Custodial risk, your shares held in a fragile financial system

-

Political risk, mines are often in risky countries),

-

Fraud, corruption, Doug Casey can tell you about this. Read his book Speculator

-

Financial risk, many companies will run out of cash

Still I would advise even the cautious investor to hold some gold and silver stocks or a fund or an index, since the upside is substantial.

NO MAJOR GOLD DISCOVERY FOR YEARS

There has not been a major gold discovery for 4 years.

Major gold discoveries over 1 million ounces:

-

1990s – 180

-

2000s – 120

-

2010 to 2018 – 40

-

2019 to date – 0

Not only do we have peak oil but also peak gold. So the world is facing a vicious a cycle of increasing energy costs leading to higher costs of extracting precious metals and other commodities.

This confirms that high inflation is here to stay, leading to higher interest rates and very high risk of debt defaults within the private and sovereign sectors.

To hold US dollars is to hand your wealth to the state which is likely to either debase it, lose it, spend it, confiscate it or misappropriate it in any other way.

Why would anyone trust a government like the US which currently is doing all of the above things.

And don’t believe that the Euro will fare better.

The only way to be in control of your own money is to hold it in physical gold outside your country of residence in private vaults.

The trust in the US and the dollar is now coming to an end after the confiscation of all Russian assets. Who would want to hold their assets under the control of a government what can just steal it at will.

So we are not facing a dollar crisis. Instead, the dollar and its issuer is the crisis. No one who is worried about preserving his wealth would ever consider holding it in a crisis currency, controlled by a crisis government.

I find it fascinating that the JP Morgan who has become a joint custodian of the GLD gold ETF is planning to move the gold to Switzerland. This confirms my strong view that Switzerland will further strengthen its position as a major gold hub. Currently 70% of all the gold bars in the world are refined in Switzerland which also have more major private gold vaults than any other country.

Also, as I discussed in a recent article, no central bank will want to hold its reserves in US dollars with to a capricious US government that can steal it at will. The only money that could mantle the role as a reserve asset as the dollar fades away is obviously gold.

TOO LATE TO JUMP ON THE GOLD WAGON?

Nobody should believe that it is too late to jump on the Gold Wagon. It has hardly started yet.

Even if the percentage invested in physical precious metals and precious metals stocks, goes from 0.5% to only 1.5%, there will not be enough metals or stocks available to satisfy a fraction of that increase at current prices for the metals.

So the only way that the increased money flows into metals can be satisfied is through vastly higher prices.

AND AS I HAVE OUTLINED IN THIS ARTICLE, THE SCENE IS NOW SET FOR SUCH A MAJOR REVALUATION OF GOLD AND SILVER AND THE WHOLE PRECIOUS METALS SECTOR

Authored by Egon von Greyerz via GoldSwitzerland.com,

The time has now come for the 99.5% of financial assets which are not invested in gold, silver or precious metals mining stocks to grab both the investment and wealth preservation opportunity of a life time.

Making that decision before it is too late is likely to determine your financial and also general wellbeing for the rest of your life!

If you have already joined that exclusive group of 0.5% of global financial assets which are invested in precious metals, you understand what is coming.

But if you belong to the group that neither understands precious metals nor holds any, it might be worthwhile to continue reading.

More about this opportunity later in the article.

FROM A DEBT BASED WEST TO A COMMODITY BASED EAST AND SOUTH

As the Western Empire is breaking up currently, the Eastern & Southern Empire is gaining ever more significance. More than 30 countries want to join the BRICS and many also the SCO (Shanghai Cooperation Organisation). There is also the Eurasian Economic Union (EEU) which exists since 2014 and consists of several ex Soviet Union States.

The enlarged group will consist of more than 40 countries and represent around 2/3 of global population and 1/3 of global GDP. As I have written about in the article “A disorderly reset with gold revalued by multiples”, this is the area which will experience the fastest growth in coming decades as the West gradually declines/collapses under its own deficits and debt burden together with political and moral decay.

The Russian Foreign Minister Lavrov has just announced that Iran will join the SCO on July 4 and that Belarus will also become a full member. There is a virtual SCO meeting on July 4 chaired by India. It seems like more than a coincidence that the meeting takes place on the US Independence Day!

The BRICS meeting in Johannesburg takes place on Aug 22-24 with Macron trying to gatecrash. But he was rejected. Macron is devious and has always tried to ride several horses simultaneously.

But BRICS is not interested in opportunists happy to turn with the wind of success.

At some point, these three groupings might be merged into one, with gold playing a central role. I don’t expect that there will be one gold backed currency at a fixed parity but rather that gold will float at a much higher value than currently with a link to BRICS currencies.

So as the West and especially the US licks its mortal wounds the East is looking forward to the coming feast.

THE DOLLAR IS NO LONGER AS GOOD AS GOLD

There was a time when the US dollar was “As Good as Gold” and until 15 August 1971, sovereign nations could exchange dollars for gold at $35 per ounce.

But sadly most leaders whether of countries or corporations eventually resort to GREED when real money runs out. So this is what Nixon did in 1971 when he closed the gold window.

In spite of falling 98% in real terms since 1971, the dollar has remained both the preferred reserve currency and also the currency of choice for global trade.

The two principal reasons why the dollar hasn’t yet died is that virtually all other currencies have declined by similar percentages. Also the astute introduction of the Petrodollar in 1973-4, the brainchild of Nixon’s secretary of state Henry Kissinger, played an important role in convincing Saudi Arabia ( the dominant oil producer at the time) to sell oil in dollars against a package of US weapons and protection.

As the West now sinks in a quagmire of debt, corruption and decadence, the world will experience a tectonic shift away from fiat/fake money with zero intrinsic value to currencies backed by commodities with gold playing a central role.

WHERE HAVE ALL THE STATESMEN GONE

The West has not got one single statesman who can pull it out of the swamp. Many countries are now turning to the right like Italy with Meloni and Spain also probably swinging right in July with the Partido Popular and the far right Vox party. Macron is extremely unpopular and Le Pen now leads the opinion polls with 55%. Scholz in Germany has also failed badly and the Nationalist AfD is now ahead of the ruling social democrats in the polls.

The UK is currently the only major country that is likely to turn to the left at the next election in 2025. No one believes in the weak Sunak and Labour leader Kier Starmer is the clear favourite to win. But sadly he is not a statesman either.

So with a motley crew of weak leaders in Europe, things don’t look any better if we look west to the US. Sadly, the US hasn’t got a leader at all. It seems that Biden has got his strings pulled by an unelected and unaccountable team around him. This is an extremely vulnerable situation for what has been the mightiest country in the world. A major military power without a leader is very dangerous.

As President Eisenhower said in the 1950s:

“In the councils of government, we must guard against the acquisition of unwarranted influence, whether sought or unsought, by the military industrial complex. The potential for the disastrous rise of misplaced power exists and will persist. We must never let the weight of this combination endanger our liberties or democratic processes.”

As empires die, weak leaders are the norm and seem a necessary condition to exacerbate the inevitable collapse.

So we can all speculate about the outcome of the current crisis in the West and how it will all end. These situations seldom consist of individual events but are normally processes that take a number of years or even decades.

We must remember that we have already seen half a century of decline since 1971 so we are now likely to experience an acceleration of the process. As I have pointed out above, it is not just the decline of the West which is happening in front of our eyes, but also the emergence of an extremely powerful cooperation of 40 plus countries which will drive a global commodity based expansion on a scale never seen before in history.

Just take Russia. With $85 trillion of natural resource reserves, they will play a major role in this real physical asset expansion as long as the country holds together politically, which I would expect.

Remember that the massive global shift which is about to start is not based on personalities. Leaders are instruments of their time and the right leaders will emerge in most countries to bring about this tectonic shift.

DON’T TOUCH SOVEREIGN DEBT, EVEN WITH A BARGEPOLE

So how will ordinary investors in the West protect and enhance their assets in a world which is on the cusp of major shifts financially, economically and politically?

Well let’s first look at what not to do.

As I have stressed for many years, it is not a matter of maximising returns but minimising risk. After the biggest global asset bubble in history, the everything collapse will be vicious and take down many investments that have been regarded as safe as sovereign debt. See my article “First gradually and then suddenly – the Everything Collapse”.

Take US government bonds or treasuries. For years I have never understood how someone can invest in a “security” which is created by just snapping your fingers. This is how a senior Swedish Riksbank (central bank) official described to a journalist where money comes from. So whether we call it mouse-click money like my good colleague Matt Piepenburg or finger-snapping money, both expressions clearly tell us that we live in a hocus-pocus world where money is unlimited and can be created by snapping your fingers.

Oh yes, we mustn’t forget the additional $2+ quadrillion of quasi debt or liabilities in the form of derivatives. I have argued many times that a big part of these derivatives are likely to become debt as central banks create liquidity to save the financial system from a an implosion of these financial instruments of mass destruction as Warren Buffett calls them.

I have long argued that holding Western sovereign debt is financial suicide. Lately some big names agree with me whether it is Jamie Dimon of JP Morgan- “Don’t touch US bonds”- or Ray Dalio the very successful hedge fund investor – “It would take 500 years to get the money back”. Yes, but what money I wonder??

Firstly, whether it is the Fed or the ECB, their balance sheets are insolvent and no one can ever get real money back. At best it would be another worthless debt/money instrument like CBDC (Central Bank Digital Currency) that would lose 99-100% over 1 to 50 years. Not the best of odds to say the least.

The US 10 year treasury bond peaked in 1981 at just below 16% after a 39 year downtrend it bottomed in 2020 at 0.55%. That was the bottom of the interest and inflation cycle. We will now see higher inflation and rates for decades. But it obviously won’t be a move without major corrections and volatility.

As major central banks are pressing for higher rates, one wonders if they are aware of the consequences. Because in a debt infested world, higher rates mean a high risk of default, both private and sovereign.

But in their normal style, central banks will be behind the curve and realise their misdemeanours once the system has collapsed.

NB: The only buyer of US treasuries will be the Fed as the rest of the world runs away from the US poisonous debt chalice. It’s like passing the parcel when you can only pass it to yourself.

OPPORTUNITIES OF A LIFETIME COMING

So buying anything commodity based will be a clear growth area for decades. In this group is not just commodity businesses but companies that supply the commodity companies with software or hardware.

In addition to the precious metals market whether physical or stocks, we see the potentially most interesting areas being oil and uranium.

We have been in the physical precious metals market for almost 25 years for wealth preservation purposes. During that time gold has gone up 6-12 times in most Western currencies and silver slightly less.

As the premier company for bigger wealth preservation investors in physical gold and silver, outside the financial system, we have had a very exciting journey so far.

But looking at the last 23 years I am very clear that in spite of greater returns in physical gold than most investment classes and much lower risk, the real moves haven’t even started yet.

I have never seen a more obvious situation during my soon 60 years in investment markets.

Although some of the precious metals mining stocks will vastly outperform physical gold and silver, we will stick to what we know best in order to serve our esteemed clients as well as future wealth preservation investors.

In coming years, most investors will lose a major part of their investments and net worth as they hold on to their conventional investments.

For a quarter of a century I have been standing on a soap box, imploring investors to protect their wealth. During that time we have seen The Nasdaq lose 80% in the early 2000s and the financial system being a few minutes from implosion in 2008.

But with the help of finger-snapping $10s of trillions into existence, most markets have remained strong. Still, the (almost) Everything Collapse is hanging over us and this time finger-snapping money into existence is unlikely to help.

WHEN SHOULD YOU NOT HOLD GOLD?

You should not hold gold when:

-

There are no deficits and there is a balanced budget

-

There is negligible or no inflation

-

There is no debasement of currencies

-

There is strong statesmanship based on real longterm values

When that day comes, we will also see flying elephants as well as flying central bankers with wings!

But just like Icarus, the son of Daedalus in the Greek mythology, these bankers will crash!

Anyone who has held a major part of his wealth in physical gold, in any country, in this century has achieved an excellent return and still has his gold asset intact. He has also been able to sleep well at night.

Although picking the right precious metals stocks can lead to an opportunity of a lifetime, we will still recommend that investors keep the majority of their funds in physical gold and silver, stored in the right jurisdiction and in the safest vaults with direct access to your metals.

That way investors avoid many risks like:

-

Custodial risk, your shares held in a fragile financial system

-

Political risk, mines are often in risky countries),

-

Fraud, corruption, Doug Casey can tell you about this. Read his book Speculator

-

Financial risk, many companies will run out of cash

Still I would advise even the cautious investor to hold some gold and silver stocks or a fund or an index, since the upside is substantial.

NO MAJOR GOLD DISCOVERY FOR YEARS

There has not been a major gold discovery for 4 years.

Major gold discoveries over 1 million ounces:

-

1990s – 180

-

2000s – 120

-

2010 to 2018 – 40

-

2019 to date – 0

Not only do we have peak oil but also peak gold. So the world is facing a vicious a cycle of increasing energy costs leading to higher costs of extracting precious metals and other commodities.

This confirms that high inflation is here to stay, leading to higher interest rates and very high risk of debt defaults within the private and sovereign sectors.

To hold US dollars is to hand your wealth to the state which is likely to either debase it, lose it, spend it, confiscate it or misappropriate it in any other way.

Why would anyone trust a government like the US which currently is doing all of the above things.

And don’t believe that the Euro will fare better.

The only way to be in control of your own money is to hold it in physical gold outside your country of residence in private vaults.

The trust in the US and the dollar is now coming to an end after the confiscation of all Russian assets. Who would want to hold their assets under the control of a government what can just steal it at will.

So we are not facing a dollar crisis. Instead, the dollar and its issuer is the crisis. No one who is worried about preserving his wealth would ever consider holding it in a crisis currency, controlled by a crisis government.

I find it fascinating that the JP Morgan who has become a joint custodian of the GLD gold ETF is planning to move the gold to Switzerland. This confirms my strong view that Switzerland will further strengthen its position as a major gold hub. Currently 70% of all the gold bars in the world are refined in Switzerland which also have more major private gold vaults than any other country.

Also, as I discussed in a recent article, no central bank will want to hold its reserves in US dollars with to a capricious US government that can steal it at will. The only money that could mantle the role as a reserve asset as the dollar fades away is obviously gold.

TOO LATE TO JUMP ON THE GOLD WAGON?

Nobody should believe that it is too late to jump on the Gold Wagon. It has hardly started yet.

Even if the percentage invested in physical precious metals and precious metals stocks, goes from 0.5% to only 1.5%, there will not be enough metals or stocks available to satisfy a fraction of that increase at current prices for the metals.

So the only way that the increased money flows into metals can be satisfied is through vastly higher prices.

AND AS I HAVE OUTLINED IN THIS ARTICLE, THE SCENE IS NOW SET FOR SUCH A MAJOR REVALUATION OF GOLD AND SILVER AND THE WHOLE PRECIOUS METALS SECTOR

Loading…