Well, technically, any outcome tomorrow will be beneficial for stocks, but a red wave should be especially bullish.

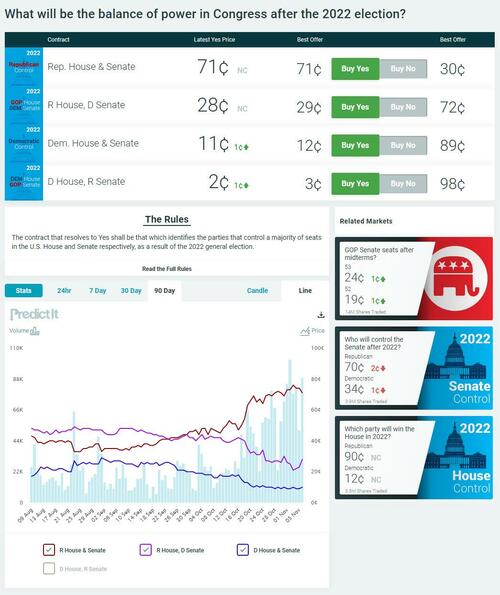

According to Deutsche Bank economists, their base case is that Republicans will take the House but Democrats will maintain their slim majority in the Senate, although they admit that the latter is a close call. And indeed, according to PredictIt, the odds of a Red tide (full sweep) have now risen to 71%, more than double from their early September lows.

That said, it is highly unlikely that either party will achieve a two-thirds majority in Congress, thus effectively maintaining President Biden's veto power and continuation of the mostly lame duck Congress courtesy of Joe Manchin (with a few notable exceptions).

While DB tries its best to remain impartial, Morgan Stanley has no such qualms, and in his latest Weekly Warmup note (available to professional subs in the usual place), chief US equity strategist Michael Wilson - who is becoming less bearish by the day - writes that investors should remain bullish on equities ahead of this week’s US midterm elections, because polls pointing to Republicans winning at least one chamber of Congress provide a potential catalyst for lower bond yields and higher equity prices, which would be enough to keep the bear-market rally going.

According to Wilson, a "clean sweep" by the Republicans could greatly increase the chance of fiscal spending being frozen and historically high budget deficits being reduced, fueling a rally in 10-year Treasuries that can keep the equity market rising. And, echoing what we said all the way back in January, the only possible stimulus for the next two years - and with a bone-crushing recession on deck the US will definitely need it - will be monetary, which as everyone knows by now benefits mostly, if not only, asset holders while leading to general disinflation elsewhere in the economy.

How long until the market realizes that after the midterms, the only stimulus until (at least) Nov 2024 will be monetary pic.twitter.com/c89mILMHEj

— zerohedge (@zerohedge) January 23, 2022

While not entirely predicated on the midterms, Wilson retains his "tactical" upside targets of 4,000 to 4,150 (while keeping 3,625 to 3,650 as their stop-loss level for the S&P 500).

However, as MS Public Policy Strategist Michael Zezas said over the weekend, there is a caveat as the results may not be clear on Tuesday night given the delay in counting mail in ballots which means we can expect price volatility in equity markets will remain high and provide ammo for bears and bulls alike.

For those who missed it, here again is Zezas listing the 3 key takeawas for investor from tomorrow's midterms:

-

Concerned about near-term market volatility? Higher volatility more likely results from a better-than-expected night for Democrats than for Republicans. Outcomes that meet expectations typically do not move markets a lot. And judging from recent levels and trends in both polls and prediction markets, Republicans are expected to win a majority in at least one chamber of Congress. Against that backdrop, it is important to note that we do not see a Republican win as leading to policies that on their own would be important market catalysts in any direction. Conversely, Democrats' expanding their majorities in Congress would buck the expectations set by polls and prediction markets. That outcome would also undercut the notion that inflation is an electoral liability for the Democrats. Investors could see this result as freeing the party from the political and legislative constraints that kept Congress from enacting some of the fiscally expansionary policies that were part of President Biden’s original ‘Build Back Better’ agenda. Hence, markets could assign a higher probability to further fiscal expansion, with Congress and the Fed effectively pulling in opposite directions on inflation. The short-term implications for markets could be higher Treasury yields and a stronger dollar, reflecting the potential for a higher peak federal funds rate.

-

A Republican ‘win’ may not create near-term market volatility, but does introduce situational risks for 2023. Benign neglect is often the outcome for a split government in the US, but not always. Following the 2010 midterm elections, gridlock led to protracted debt limit standoffs and government shutdowns. The resolution to one such standoff was the Budget Control Act of 2011, which implemented contractionary fiscal policy while the economy was still weak. Indeed, when the legislation was passed in August of that year, the unemployment rate stood at 9%. The result was weaker growth and a slower economic recovery, which partially explains why the liftoff of the fed funds rate was delayed until 2015 and unfolded gradually thereafter. At present, Republican leadership is signaling its intent to deploy the same tactics if the party wins majorities. While markets could easily dismiss these negotiations as political theater, as they have in recent years amid solid economic conditions, if the economic outlook sours in 2023 in unexpected ways, the specter of the Budget Control Act could weigh on markets.

-

Beware premature conclusions on election night. As in 2020, the increased use of vote by mail means the early reported vote tallies may not be a good indicator of who is winning, especially in races expected to be close. What we saw in 2020 and in other elections is that mail-in ballots were cast more often by Democrats than Republicans, and in many jurisdictions were counted after in-person voting. That means early reported results should look favorable to Republicans, but as in 2020, leads can vanish over time. Consider the Pennsylvania Senate race. Assuming mail-in ballots are cast in the same proportions and with the same party skew as they were in 2020, we estimate that the Republican candidate could win the in-person vote by 29% and still lose after all ballots are counted. Hence, we will need to reserve judgement, perhaps for days, on which party seems poised to control Congress.

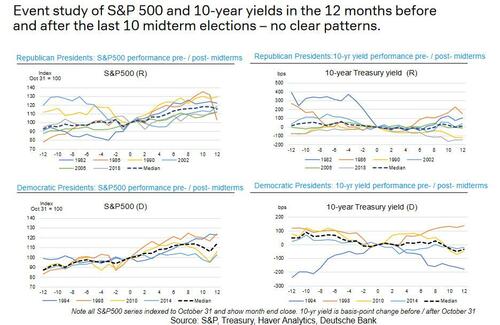

Turning to market statistics, DB proposes that there is no clear pattern for either the S&P500 or 10Y yields in the 12 months before or after the last 10 midterm elections...

... although that is not strictly speaking true: as DB's Jim Ried points out, "in every 12-month period post mid-terms over the last century, the equity market has always gone up with the inflection point being immediately after mid-terms."

Others disagree: according to Evercore ISI strategist Julian Emanuel, viewed from a multiple-week perspective, history is on bulls’ side: in 19 midterm election years since 1946, stocks have advanced from late October through year-end every single time except 2018.

Still, a bearish take by markets can not be dismissed: with memories of politics-focused market jitters in the UK still fresh in investors’ minds, any lack of clarity about the US election outcome may trigger renewed equity declines: “The recent asset-market instability from politics in the UK and China” highlights “the near-term risk” of this week’s midterms, the Evercore strategists said in a note to clients. “Divided government, which appears to be investors’ preference” should “underpin equities into 2023, but any lack of clarity with regard to Senate control or loud questions about election integrity increases the likelihood that the S&P 500 joins the Nasdaq 100 Index in the retest of the lows.”

Below is a detailed presentation looking at the odds and market probabilities around tomorrow's midterms courtesy of DB.

Well, technically, any outcome tomorrow will be beneficial for stocks, but a red wave should be especially bullish.

According to Deutsche Bank economists, their base case is that Republicans will take the House but Democrats will maintain their slim majority in the Senate, although they admit that the latter is a close call. And indeed, according to PredictIt, the odds of a Red tide (full sweep) have now risen to 71%, more than double from their early September lows.

That said, it is highly unlikely that either party will achieve a two-thirds majority in Congress, thus effectively maintaining President Biden’s veto power and continuation of the mostly lame duck Congress courtesy of Joe Manchin (with a few notable exceptions).

While DB tries its best to remain impartial, Morgan Stanley has no such qualms, and in his latest Weekly Warmup note (available to professional subs in the usual place), chief US equity strategist Michael Wilson – who is becoming less bearish by the day – writes that investors should remain bullish on equities ahead of this week’s US midterm elections, because polls pointing to Republicans winning at least one chamber of Congress provide a potential catalyst for lower bond yields and higher equity prices, which would be enough to keep the bear-market rally going.

According to Wilson, a “clean sweep” by the Republicans could greatly increase the chance of fiscal spending being frozen and historically high budget deficits being reduced, fueling a rally in 10-year Treasuries that can keep the equity market rising. And, echoing what we said all the way back in January, the only possible stimulus for the next two years – and with a bone-crushing recession on deck the US will definitely need it – will be monetary, which as everyone knows by now benefits mostly, if not only, asset holders while leading to general disinflation elsewhere in the economy.

How long until the market realizes that after the midterms, the only stimulus until (at least) Nov 2024 will be monetary pic.twitter.com/c89mILMHEj

— zerohedge (@zerohedge) January 23, 2022

While not entirely predicated on the midterms, Wilson retains his “tactical” upside targets of 4,000 to 4,150 (while keeping 3,625 to 3,650 as their stop-loss level for the S&P 500).

However, as MS Public Policy Strategist Michael Zezas said over the weekend, there is a caveat as the results may not be clear on Tuesday night given the delay in counting mail in ballots which means we can expect price volatility in equity markets will remain high and provide ammo for bears and bulls alike.

For those who missed it, here again is Zezas listing the 3 key takeawas for investor from tomorrow’s midterms:

-

Concerned about near-term market volatility? Higher volatility more likely results from a better-than-expected night for Democrats than for Republicans. Outcomes that meet expectations typically do not move markets a lot. And judging from recent levels and trends in both polls and prediction markets, Republicans are expected to win a majority in at least one chamber of Congress. Against that backdrop, it is important to note that we do not see a Republican win as leading to policies that on their own would be important market catalysts in any direction. Conversely, Democrats’ expanding their majorities in Congress would buck the expectations set by polls and prediction markets. That outcome would also undercut the notion that inflation is an electoral liability for the Democrats. Investors could see this result as freeing the party from the political and legislative constraints that kept Congress from enacting some of the fiscally expansionary policies that were part of President Biden’s original ‘Build Back Better’ agenda. Hence, markets could assign a higher probability to further fiscal expansion, with Congress and the Fed effectively pulling in opposite directions on inflation. The short-term implications for markets could be higher Treasury yields and a stronger dollar, reflecting the potential for a higher peak federal funds rate.

-

A Republican ‘win’ may not create near-term market volatility, but does introduce situational risks for 2023. Benign neglect is often the outcome for a split government in the US, but not always. Following the 2010 midterm elections, gridlock led to protracted debt limit standoffs and government shutdowns. The resolution to one such standoff was the Budget Control Act of 2011, which implemented contractionary fiscal policy while the economy was still weak. Indeed, when the legislation was passed in August of that year, the unemployment rate stood at 9%. The result was weaker growth and a slower economic recovery, which partially explains why the liftoff of the fed funds rate was delayed until 2015 and unfolded gradually thereafter. At present, Republican leadership is signaling its intent to deploy the same tactics if the party wins majorities. While markets could easily dismiss these negotiations as political theater, as they have in recent years amid solid economic conditions, if the economic outlook sours in 2023 in unexpected ways, the specter of the Budget Control Act could weigh on markets.

-

Beware premature conclusions on election night. As in 2020, the increased use of vote by mail means the early reported vote tallies may not be a good indicator of who is winning, especially in races expected to be close. What we saw in 2020 and in other elections is that mail-in ballots were cast more often by Democrats than Republicans, and in many jurisdictions were counted after in-person voting. That means early reported results should look favorable to Republicans, but as in 2020, leads can vanish over time. Consider the Pennsylvania Senate race. Assuming mail-in ballots are cast in the same proportions and with the same party skew as they were in 2020, we estimate that the Republican candidate could win the in-person vote by 29% and still lose after all ballots are counted. Hence, we will need to reserve judgement, perhaps for days, on which party seems poised to control Congress.

Turning to market statistics, DB proposes that there is no clear pattern for either the S&P500 or 10Y yields in the 12 months before or after the last 10 midterm elections…

… although that is not strictly speaking true: as DB’s Jim Ried points out, “in every 12-month period post mid-terms over the last century, the equity market has always gone up with the inflection point being immediately after mid-terms.”

Others disagree: according to Evercore ISI strategist Julian Emanuel, viewed from a multiple-week perspective, history is on bulls’ side: in 19 midterm election years since 1946, stocks have advanced from late October through year-end every single time except 2018.

Still, a bearish take by markets can not be dismissed: with memories of politics-focused market jitters in the UK still fresh in investors’ minds, any lack of clarity about the US election outcome may trigger renewed equity declines: “The recent asset-market instability from politics in the UK and China” highlights “the near-term risk” of this week’s midterms, the Evercore strategists said in a note to clients. “Divided government, which appears to be investors’ preference” should “underpin equities into 2023, but any lack of clarity with regard to Senate control or loud questions about election integrity increases the likelihood that the S&P 500 joins the Nasdaq 100 Index in the retest of the lows.”

Below is a detailed presentation looking at the odds and market probabilities around tomorrow’s midterms courtesy of DB.