Matt Drudge's slide into mainstream media obscurity has been one of the more remarkable events of the post-Trump era, yet - like an insane uncle locked up in the attic - few would bring it up in polite conversation (especially since so little is known about what caused Drudge's striking U-turn in his one-time embrace of Trump). However, his tweet (or post) from last week that according to Wall Street, Kamala had a 72 chance to win (since deleted)...

... prompted us to respond.

That's completely incorrect: according to Goldman Sachs, the Trump Victory index just hit an all time high while the Kamala index is back to Joe Biden Levels. Meanwhile, JPMorgan said that hedge funds are piling into Republican winner trades while dumping Democrat winners. https://t.co/wZBPOHbMBG pic.twitter.com/mq3uCxWjEI

— zerohedge (@zerohedge) October 18, 2024

We were the first, but hardly last, and shortly after our response to Drudge, both Goldman and JPMorgan chimed in, with reports that validated our criticism of Drudge's naive - and dead wrong - claim.

Later that day, JPMorgan's closely followed Positioning Intelligence team published a must read report (available to pro subs), in which John Schlegel summarized the recent hedge fund positioning rather simply: "all-in on Trump themes."

This is how the JPM trader summarizes the findings of his report:

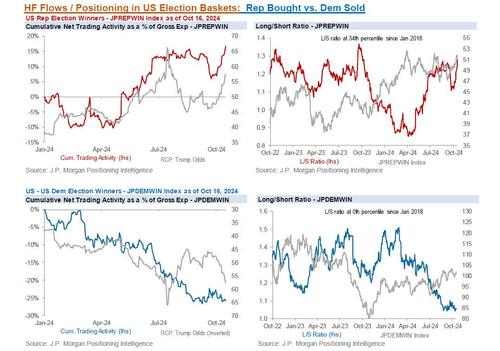

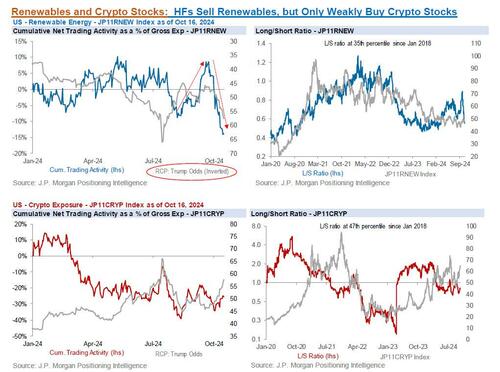

As odds of a Trump presidency and Red Wave have increased over the past few weeks, we’ve seen themes that are perceived to be Republican Winners (JPREPWIN) outperform Democratic Winners (JPDEMWIN) by ~7% over the past month. Crypto stocks and small caps have performed better, while Renewables have underperformed. In addition, the wider US equity market continues to make new ATHs and positioning appears to be elevated. Based on the thematic shifts, historical returns around elections, and elevated positioning, there’s room for a bit of disappointment and reversal in coming weeks if odds start to shift the other way.

In other words, the "smart market" is increasingly going all-in on a Trump victory.

Below we excerpt the main highlights from the report (much more in the full report available to professional subs):

- 1. All in on Trump Themes? Hedge Fund flows have shown a strong preference for Republican themes with Rep Winners (JPREPWIN) bought over the past few weeks, putting positioning near ~2yr highs, while Dem Winners (JPDEMWIN) were sold throughout the year and positioning at multi-year low. The relative Rep vs. Dem flows have shifted from -2z a few weeks ago to +2z over the past 10 days. Renewables (JP11RNEW, a clear proxy for a Dem win) have been sold a lot in the past couple weeks and positioning is turning more bearish again.

- Crypto stocks have seen volatile flows, though buying lately has not been as strong as it was in mid-July.

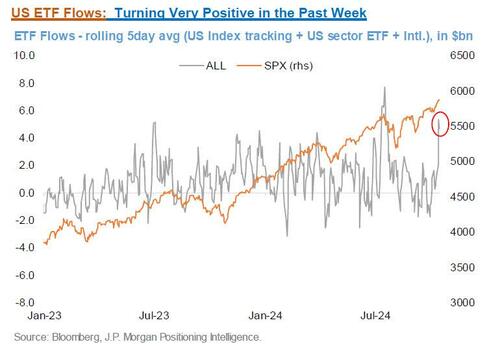

- 2. Flows Turning Positive & Positioning Relatively High Ahead of Election (vs. Prior Cycles). HF and ETF flows have been turning more positive lately and 4 week HF net flows have shifted materially from -2z in early Sep to +1z most recently.

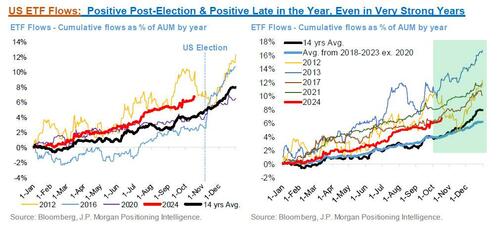

- ETF flows tend to stay positive post elections and even in years when they’re very strong, but S&P returns are often very muted in Oct during election years since 1950 (avg +10bps with range of +2.6% to -2.7% (ex. 2008)).

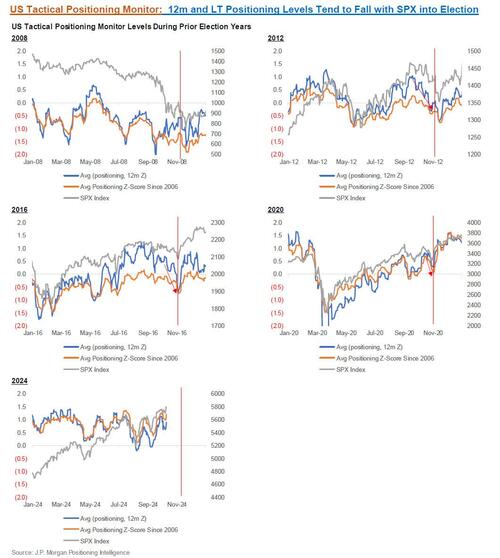

- Overall positioning level for US equities remains somewhat elevated (+1.0z, >90th %-tile) and in prior election years since 2012, both positioning and SPX returns have tended to trend lower in the weeks heading into the election.

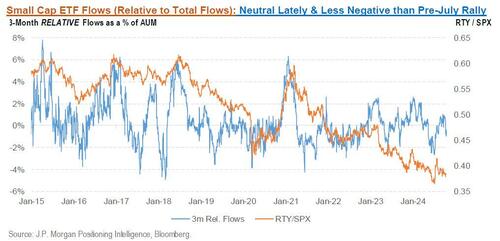

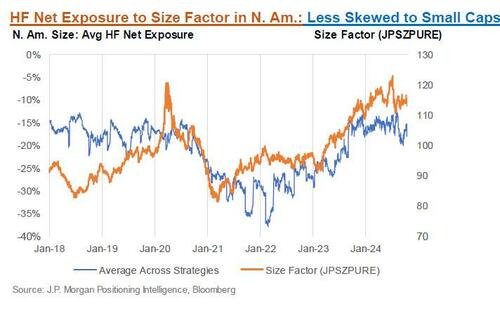

- 3. Small Caps and Momentum…What’s the Setup? Small Caps / Russell 2000 is perceived to rally if we get a Red Wave, but Russell 2000 futures positioning seems pretty elevated already (vs. more neutral prior to the July bump).

- Looking at a 3yr z-score of net positioning, it’s at +2z already, in line with prior highs. ETF flows into small cap ETFs vs. the broader universe are neutral, though not as bearish as they were heading into the July rally, while HF net exp to Size factor is biased more towards Large on a multi-year basis, but not particularly so on a 12m basis.

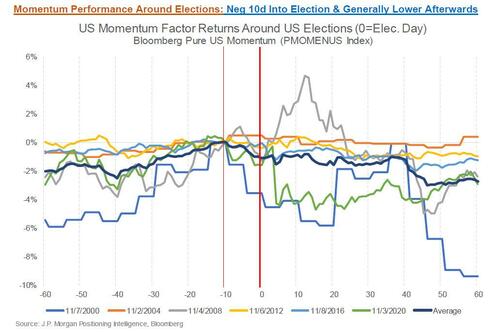

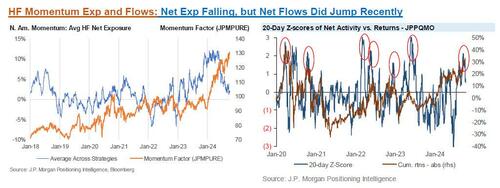

- Momentum tends to underperform in the 10d leading up to the election (and continues to decline on average in 3m post-election), but its performance has been quite correlated to the wider market.

- HFs don’t appear to be running material net exposure to Momentum, but flows have shown a bias towards selling laggards lately

* * *

Turning to Goldman Sachs, we find a similar bias. As we noted last week, a Republican Sweep Scenario, has emerged as one of the bank's preferred trades ahead of the elections. This is how Goldman put it:

Long our Republican Policy Pair (GSP24REP), consisting of long Republican Policy Outperformers (GS24REPL, ex-commods version is GS24RLXC) vs short Republican Policy Underperformers (GS24REPS)

- Buy GS24REPL 20Dec24 107% / 117% OTC call spread for 1.30%. 7.69x net leverage. 15% delta. 23 iv. Max loss premium paid.

- Buy GS24RLXC 20Dec24 108% / 118% OTC call spread for 1.30%. 7.69x net leverage. 16% delta. 25 iv. Max loss premium paid.

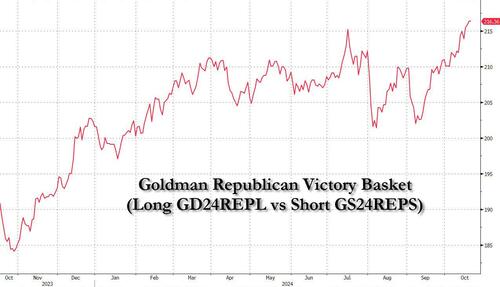

As shown below, the Goldman Republican victory pair trade discussed above just hit an all time high.

Decomposed into its constituents indexes, we find that the Republican Victory basket just hit an all time high, while the Democrat Victory basket is back to Biden levels.

In a new report from Goldman FICC vice president Vincent Mistretta (available here to pro subscribers), the trader confirms what we have said, namely that "positioning in markets leans toward Trump-win expressions. That has been the case since even before the recent run up in betting market odds for Trump." To help its clients, the bank has come up with a dashboard enumerating these aforementioned preconceived notions, and some trades that should perform well in scenarios that feel under-positioned, underappreciated or are anti-consensus.

GS Trading Views:

- Anshul Sehgal (Co-Head of Global Interest Rate Products Trading & Head of US Interest Rate Products) – Don’t have strong views or a robust framework for the election. It’s a binary event, and unclear what the policies/implications will be either way. Rates have been and will continue to be volatile. The market is pricing a 20bp breakeven move over the election, which seems a bit high, but not so high that you want to be short that convexity over the event. If you have a Republican sweep scenario, the night of the market probably doesn’t move a lot – it’s rates higher, risk assets higher initially, largely because what you would likely expect is that the Trump tax cuts get extended and there may well be more fiscal coming. We think the right area of the curve to be short is 2y2y. On Harris victory with divided Congress, we expect the curve to initially bull steepen, and for risk assets to trade weaker – which we would view as an opportunity to set up belly shorts.

- Mark Salib/Fernando Alvarado Aguilar (FX Trading): Many clients are long USDCNH via risk reversals to position for a possible Trump presidency, as there isn’t a strong case for USDCNH to depreciate significantly from here. We also like AUDJPY or USDJPY topside on a Trump win. On a potential Harris win we think USDMXN downside is one of the best trades, with favorable entry levels after the recent squeeze higher amid buying from all client types this week, including hedge funds to position for a possible Trump win (especially given Trump’s comments throughout the campaign on implementing tariffs) as well as CTA and real money buying. In a Harris scenario we think EURUSD may rally around 1.5%, but think the moves would be larger in USDMXN and would prefer to express the trade there.

- Shawn Tuteja/Joseph Clyne (Equities Derivatives Trading/Index Trading) – Among a host of macro factors, we think that the run up in stocks, the collapse in implied vols, and the outperformance of RUT over NDX are partially due to the recent uptick in Trump odds, and a reversion of that move could reverse all three trends. Generally, we like owning year-end upside in SPX on a 12 vol handle which we think can carry flat/positive through the election while having spot up vol up beta on any sustained rally. On the sector side, we’ve seen the “Trump trades” from 2016 start to work, as this last leg higher in SPX has been driven by regional banks (KRE), large-cap banks (XLF), and energy. We’ve seen this buying come at the expense of AI in the past week or so. Interestingly, we’ve gotten a lot of questions from clients in the past 24 hours on best ways to “fade a Republican sweep,” thinking the odds and market pricing have run too far on this.

- Nick Bartal (Oil Products Trading) – There is currently little positioning in oil directly related to the election. The conflict in the Middle East has shaken a short/low positioned oil market into having length. However, the consensus still remains that the oil balance will be heavy in 2025, which led to the short positioning coming into the Israel/Iran conflict rally in early October. While little direct positioning surrounding the election exists, a Trump victory would likely be day 1 bullish for oil, as he may strengthen sanctions on Iran.

Much more in the Goldman note available to pro subscribers.

* * *

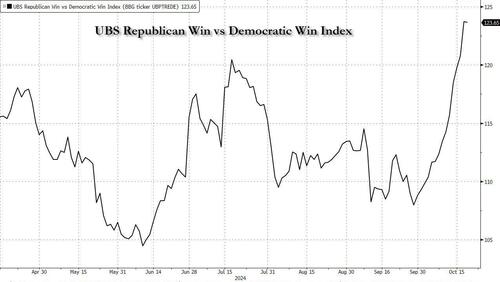

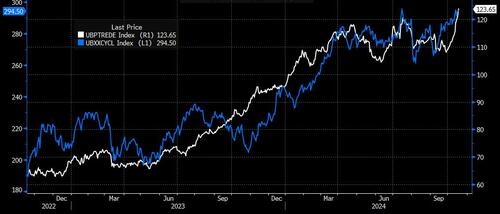

Taking a quick look at UBS, the bank has its own thematic pair trade, and writes that the recent surge in the "Republican Sweep" basket supported the S&P 500 rallying to an all-time high. Indeed, as shown below, the UBS Republican Win basket has trounced the Democrat Win having closed higher for 14 consecutive days! Also, UBS notes that the dramatic ascent in dollar has largely been driven by Chinese Yuan weakness thanks to the surge the Republican Sweep theme.

Elsewhere, in a note from UBS trader Michael Romano, he writes that "the UBS Republican vs. Democrat election pair trade is up 15% month to date to fresh highs in virtually a straight line, suggesting the market has largely priced former President Donald Trump's victory." Romano adds that "the election repricing, driven primarily by banks and solar, coincided with a growth re-pricing following a strong payrolls and strong earnings, making it less clear whether the recent moves are election or growth driven."

His conclusion: "While the end result is the same, i.e. banks higher, cyclicals/consumer/growth oriented stocks higher, the more the repricing was driven by an actual growth re-pricing, the more upside there still is on a Trump win. As most of the moves followed bank earnings, with strong follow-through on consumer, my money is on a lot more upside to come on a Trump win."

* * *

By now the big picture should be clear: whether due to his surge in online betting markets, or simply because Kamala's honeymoon is dead and buried, there has been a rush of sentiment - by people who put money where their mouths - into the Trump Victory/Republican sweep camps, which also largely explains why stocks continue to make new all time highs day after day. However, if one takes a step back and asks a more neutral question without assuming the outcome, such as How will markets react to different US election outcomes?

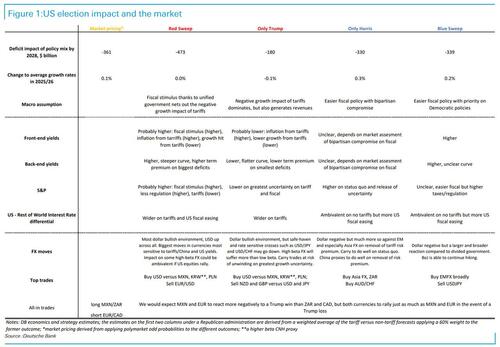

To help with the answer, we go to a recent note from Deutsche Bank's George Saravelos (available to pro subscribers), who took recently published Deutsche Bank Research economics estimates of the likely impact of different election outcomes and translated them in to a market reaction across asset classes with a specific focus on FX. The table is intended to capture the immediate market reaction to year-end rather than the long-term impact. Below are DB's four main conclusions:

- There is large variance of opinion on the likely market and growth outcomes within the DB team. This largely stems from uncertainty on three fronts: the fiscal outcomes in the event of divided government, the extent to which tariff policy is applied, the medium-term effects of supply side policies relating to regulation, immigration and energy. Even with full certainty on tariff policy for example, the countervailing growth-inflation impact of a negative supply shock creates great ambivalence.

- The largest variation in fiscal policy and growth outcomes is likely under a Trump administration: a red sweep would likely lead to the largest deficits while divided government could lead to the smallest deficits via the revenue impact of tariffs. By extension, a Trump victory has the most potential to generate the largest market moves in both directions in bond markets.

- The largest variation in relative growth differentials between the US and the rest of the world is likely under a Trump versus Harris administration, irrespective of the Congressional outcome, due to tariff policy. By extension, the FX market outcome is more clear cut than the bond market in the event of a Trump victory.

- We see the most bullish dollar outcome as a red sweep and the most bearish dollar outcome on a blue sweep, but the magnitude of the moves is likely larger in the former. There is also likely to be a large degree of variation in market response across different currency pairs: we see the dollar rising across all currency pairs in a red sweep. We see the dollar strong but FX carry trades as most likely to suffer in a Trump victory without Congress. Asia FX is likely to rally the most in the event of a Harris victory without Congress, while the broadest dollar losses would likely be in a Blue Sweep, albeit more limited than the dollar gains in a Red Sweep. We see short EUR/CAD and long MXN/ZAR as the two most asymmetric trades in FX heading in to the election.

Much more int he full notes from JPMorgan, Goldman, UBS and Deutsche Bank

Matt Drudge’s slide into mainstream media obscurity has been one of the more remarkable events of the post-Trump era, yet – like an insane uncle locked up in the attic – few would bring it up in polite conversation (especially since so little is known about what caused Drudge’s striking U-turn in his one-time embrace of Trump). However, his tweet (or post) from last week that according to Wall Street, Kamala had a 72 chance to win (since deleted)…

… prompted us to respond.

That’s completely incorrect: according to Goldman Sachs, the Trump Victory index just hit an all time high while the Kamala index is back to Joe Biden Levels. Meanwhile, JPMorgan said that hedge funds are piling into Republican winner trades while dumping Democrat winners. https://t.co/wZBPOHbMBG pic.twitter.com/mq3uCxWjEI

— zerohedge (@zerohedge) October 18, 2024

We were the first, but hardly last, and shortly after our response to Drudge, both Goldman and JPMorgan chimed in, with reports that validated our criticism of Drudge’s naive – and dead wrong – claim.

Later that day, JPMorgan’s closely followed Positioning Intelligence team published a must read report (available to pro subs), in which John Schlegel summarized the recent hedge fund positioning rather simply: “all-in on Trump themes.“

This is how the JPM trader summarizes the findings of his report:

As odds of a Trump presidency and Red Wave have increased over the past few weeks, we’ve seen themes that are perceived to be Republican Winners (JPREPWIN) outperform Democratic Winners (JPDEMWIN) by ~7% over the past month. Crypto stocks and small caps have performed better, while Renewables have underperformed. In addition, the wider US equity market continues to make new ATHs and positioning appears to be elevated. Based on the thematic shifts, historical returns around elections, and elevated positioning, there’s room for a bit of disappointment and reversal in coming weeks if odds start to shift the other way.

In other words, the “smart market” is increasingly going all-in on a Trump victory.

Below we excerpt the main highlights from the report (much more in the full report available to professional subs):

- 1. All in on Trump Themes? Hedge Fund flows have shown a strong preference for Republican themes with Rep Winners (JPREPWIN) bought over the past few weeks, putting positioning near ~2yr highs, while Dem Winners (JPDEMWIN) were sold throughout the year and positioning at multi-year low. The relative Rep vs. Dem flows have shifted from -2z a few weeks ago to +2z over the past 10 days. Renewables (JP11RNEW, a clear proxy for a Dem win) have been sold a lot in the past couple weeks and positioning is turning more bearish again.

- Crypto stocks have seen volatile flows, though buying lately has not been as strong as it was in mid-July.

- 2. Flows Turning Positive & Positioning Relatively High Ahead of Election (vs. Prior Cycles). HF and ETF flows have been turning more positive lately and 4 week HF net flows have shifted materially from -2z in early Sep to +1z most recently.

- ETF flows tend to stay positive post elections and even in years when they’re very strong, but S&P returns are often very muted in Oct during election years since 1950 (avg +10bps with range of +2.6% to -2.7% (ex. 2008)).

- Overall positioning level for US equities remains somewhat elevated (+1.0z, >90th %-tile) and in prior election years since 2012, both positioning and SPX returns have tended to trend lower in the weeks heading into the election.

- 3. Small Caps and Momentum…What’s the Setup? Small Caps / Russell 2000 is perceived to rally if we get a Red Wave, but Russell 2000 futures positioning seems pretty elevated already (vs. more neutral prior to the July bump).

- Looking at a 3yr z-score of net positioning, it’s at +2z already, in line with prior highs. ETF flows into small cap ETFs vs. the broader universe are neutral, though not as bearish as they were heading into the July rally, while HF net exp to Size factor is biased more towards Large on a multi-year basis, but not particularly so on a 12m basis.

- Momentum tends to underperform in the 10d leading up to the election (and continues to decline on average in 3m post-election), but its performance has been quite correlated to the wider market.

- HFs don’t appear to be running material net exposure to Momentum, but flows have shown a bias towards selling laggards lately

* * *

Turning to Goldman Sachs, we find a similar bias. As we noted last week, a Republican Sweep Scenario, has emerged as one of the bank’s preferred trades ahead of the elections. This is how Goldman put it:

Long our Republican Policy Pair (GSP24REP), consisting of long Republican Policy Outperformers (GS24REPL, ex-commods version is GS24RLXC) vs short Republican Policy Underperformers (GS24REPS)

- Buy GS24REPL 20Dec24 107% / 117% OTC call spread for 1.30%. 7.69x net leverage. 15% delta. 23 iv. Max loss premium paid.

- Buy GS24RLXC 20Dec24 108% / 118% OTC call spread for 1.30%. 7.69x net leverage. 16% delta. 25 iv. Max loss premium paid.

As shown below, the Goldman Republican victory pair trade discussed above just hit an all time high.

Decomposed into its constituents indexes, we find that the Republican Victory basket just hit an all time high, while the Democrat Victory basket is back to Biden levels.

In a new report from Goldman FICC vice president Vincent Mistretta (available here to pro subscribers), the trader confirms what we have said, namely that “positioning in markets leans toward Trump-win expressions. That has been the case since even before the recent run up in betting market odds for Trump.” To help its clients, the bank has come up with a dashboard enumerating these aforementioned preconceived notions, and some trades that should perform well in scenarios that feel under-positioned, underappreciated or are anti-consensus.

GS Trading Views:

- Anshul Sehgal (Co-Head of Global Interest Rate Products Trading & Head of US Interest Rate Products) – Don’t have strong views or a robust framework for the election. It’s a binary event, and unclear what the policies/implications will be either way. Rates have been and will continue to be volatile. The market is pricing a 20bp breakeven move over the election, which seems a bit high, but not so high that you want to be short that convexity over the event. If you have a Republican sweep scenario, the night of the market probably doesn’t move a lot – it’s rates higher, risk assets higher initially, largely because what you would likely expect is that the Trump tax cuts get extended and there may well be more fiscal coming. We think the right area of the curve to be short is 2y2y. On Harris victory with divided Congress, we expect the curve to initially bull steepen, and for risk assets to trade weaker – which we would view as an opportunity to set up belly shorts.

- Mark Salib/Fernando Alvarado Aguilar (FX Trading): Many clients are long USDCNH via risk reversals to position for a possible Trump presidency, as there isn’t a strong case for USDCNH to depreciate significantly from here. We also like AUDJPY or USDJPY topside on a Trump win. On a potential Harris win we think USDMXN downside is one of the best trades, with favorable entry levels after the recent squeeze higher amid buying from all client types this week, including hedge funds to position for a possible Trump win (especially given Trump’s comments throughout the campaign on implementing tariffs) as well as CTA and real money buying. In a Harris scenario we think EURUSD may rally around 1.5%, but think the moves would be larger in USDMXN and would prefer to express the trade there.

- Shawn Tuteja/Joseph Clyne (Equities Derivatives Trading/Index Trading) – Among a host of macro factors, we think that the run up in stocks, the collapse in implied vols, and the outperformance of RUT over NDX are partially due to the recent uptick in Trump odds, and a reversion of that move could reverse all three trends. Generally, we like owning year-end upside in SPX on a 12 vol handle which we think can carry flat/positive through the election while having spot up vol up beta on any sustained rally. On the sector side, we’ve seen the “Trump trades” from 2016 start to work, as this last leg higher in SPX has been driven by regional banks (KRE), large-cap banks (XLF), and energy. We’ve seen this buying come at the expense of AI in the past week or so. Interestingly, we’ve gotten a lot of questions from clients in the past 24 hours on best ways to “fade a Republican sweep,” thinking the odds and market pricing have run too far on this.

- Nick Bartal (Oil Products Trading) – There is currently little positioning in oil directly related to the election. The conflict in the Middle East has shaken a short/low positioned oil market into having length. However, the consensus still remains that the oil balance will be heavy in 2025, which led to the short positioning coming into the Israel/Iran conflict rally in early October. While little direct positioning surrounding the election exists, a Trump victory would likely be day 1 bullish for oil, as he may strengthen sanctions on Iran.

Much more in the Goldman note available to pro subscribers.

* * *

Taking a quick look at UBS, the bank has its own thematic pair trade, and writes that the recent surge in the “Republican Sweep” basket supported the S&P 500 rallying to an all-time high. Indeed, as shown below, the UBS Republican Win basket has trounced the Democrat Win having closed higher for 14 consecutive days! Also, UBS notes that the dramatic ascent in dollar has largely been driven by Chinese Yuan weakness thanks to the surge the Republican Sweep theme.

Elsewhere, in a note from UBS trader Michael Romano, he writes that “the UBS Republican vs. Democrat election pair trade is up 15% month to date to fresh highs in virtually a straight line, suggesting the market has largely priced former President Donald Trump’s victory.” Romano adds that “the election repricing, driven primarily by banks and solar, coincided with a growth re-pricing following a strong payrolls and strong earnings, making it less clear whether the recent moves are election or growth driven.”

His conclusion: “While the end result is the same, i.e. banks higher, cyclicals/consumer/growth oriented stocks higher, the more the repricing was driven by an actual growth re-pricing, the more upside there still is on a Trump win. As most of the moves followed bank earnings, with strong follow-through on consumer, my money is on a lot more upside to come on a Trump win.“

* * *

By now the big picture should be clear: whether due to his surge in online betting markets, or simply because Kamala’s honeymoon is dead and buried, there has been a rush of sentiment – by people who put money where their mouths – into the Trump Victory/Republican sweep camps, which also largely explains why stocks continue to make new all time highs day after day. However, if one takes a step back and asks a more neutral question without assuming the outcome, such as How will markets react to different US election outcomes?

To help with the answer, we go to a recent note from Deutsche Bank’s George Saravelos (available to pro subscribers), who took recently published Deutsche Bank Research economics estimates of the likely impact of different election outcomes and translated them in to a market reaction across asset classes with a specific focus on FX. The table is intended to capture the immediate market reaction to year-end rather than the long-term impact. Below are DB’s four main conclusions:

- There is large variance of opinion on the likely market and growth outcomes within the DB team. This largely stems from uncertainty on three fronts: the fiscal outcomes in the event of divided government, the extent to which tariff policy is applied, the medium-term effects of supply side policies relating to regulation, immigration and energy. Even with full certainty on tariff policy for example, the countervailing growth-inflation impact of a negative supply shock creates great ambivalence.

- The largest variation in fiscal policy and growth outcomes is likely under a Trump administration: a red sweep would likely lead to the largest deficits while divided government could lead to the smallest deficits via the revenue impact of tariffs. By extension, a Trump victory has the most potential to generate the largest market moves in both directions in bond markets.

- The largest variation in relative growth differentials between the US and the rest of the world is likely under a Trump versus Harris administration, irrespective of the Congressional outcome, due to tariff policy. By extension, the FX market outcome is more clear cut than the bond market in the event of a Trump victory.

- We see the most bullish dollar outcome as a red sweep and the most bearish dollar outcome on a blue sweep, but the magnitude of the moves is likely larger in the former. There is also likely to be a large degree of variation in market response across different currency pairs: we see the dollar rising across all currency pairs in a red sweep. We see the dollar strong but FX carry trades as most likely to suffer in a Trump victory without Congress. Asia FX is likely to rally the most in the event of a Harris victory without Congress, while the broadest dollar losses would likely be in a Blue Sweep, albeit more limited than the dollar gains in a Red Sweep. We see short EUR/CAD and long MXN/ZAR as the two most asymmetric trades in FX heading in to the election.

Much more int he full notes from JPMorgan, Goldman, UBS and Deutsche Bank

Loading…