In retrospect, what is happening was obvious to anyone with half a brain. Back in April, when CPI prints were still coming in hot, we said that it is only a matter of time before CPI starts missing month after month driven by the badly lagging Owner's Equivalent Rent, which would proceed to tumble for the "next 18 months, and since shelter is 36% of the CPI basket, inflation will soon appear low (even though real rents are rising again... so Fed is two cycles behind now)"

this is what the Fed is betting on: OER will keep dropping for the next 18 months due to the huge lag to current rents, and since shelter is 36% of the CPI basket, inflation will soon appear low (even though real rents are rising again... so Fed is two cycles behind now) pic.twitter.com/x9zBi1dvCd

— zerohedge (@zerohedge) April 5, 2024

And just for the cheap seats, we repeated this prediction again...

Fed’s Goolsbee Says Housing Is Key to Getting Inflation Down

— zerohedge (@zerohedge) April 12, 2024

Translation: OER cpi will tumble next month just in time for the Fed to cut as actual rents are surging again

... and again...

This is how much of a downside buffer core CPI has: real time rents are flat/negative while BLS reports OER at +5.6%. This will provide an inflation cushion for the next 18 months pic.twitter.com/PtFt8MsCxD

— zerohedge (@zerohedge) June 12, 2024

... and again...

It was a miss but not for the reason expected: OER catch down STILL to kick in; next few CPI print will be a dovish meltdown https://t.co/w1px0HrJN0

— zerohedge (@zerohedge) May 15, 2024

Finally, just to make sure everyone got the message, also in April we explained what will happen next, and how the BLS will "collapse" inflation to give the Fed the green light to cut in September and just in time for the election (back then nobody knew that Biden would suffer such a spectacular collapse).

How will inflation be "tamed"? Simple: The next 9-12 months rent/OER inflation (43% of CPI basket) will surprise to the downside as it catches down to stale lagged real-time data, even as rents are actually rising right now... but the BLS won't observe this until early 2025.

— zerohedge (@zerohedge) April 16, 2024

So yes: it was all about the OER wild card, and which we correctly said would "surprise to the downside as it catches down to stale lagged real-time data, even as rents are actually rising right now... but the BLS won't observe this until early 2025."

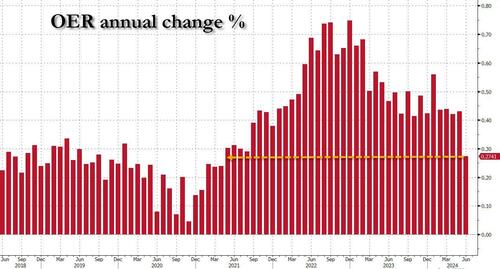

Fast forward to today when the CPI print came in far cooler than pretty much anyone expected, on the back of - drumroll- OER, or Owners Equivalent Rent, just as we said it would (although granted we were a monthly early) and which rose just 0.27% in June, a sudden plunge from the recent prints above 0.4% and the lowest annual increase since April 2021.

According to UBS, this is a notable help for the FOMC in their quest to move inflation sustainably back to 2 percent. The Swiss bank agrees with what we have been saying for months, namely that "OER rose 43 and 42 bps in the preceding two months and had seen a notable stalling out of progress in slowing since last year. It is also a component where Chair Powell noted he expected slowing as far back as his 2022 Brookings speech where he outlined the buckets of inflation." The bank also noted that "if OER was going to remain as sticky as it had appeared, given the weight even in PCE prices, the FOMC would have little chance of getting inflation back to 2 percent." The rub, of course, is that real-time trackers of rental inflation are already rising, and as we warned in April, by the time the Fed is cutting rates to reverse the slide in OER (and its 12-18 month lag) rents will be already on their way up, assuring an perfect storm of easier conditions just as housing costs soar to all time highs.

Then again, by the time this dynamic is obvious to everyone it will be early 2025 and this will be Trump's problem to deal with, so nobody in the deep state will lose too much sleep about about this particular fallout.

With that in mind, we go straight to the Wall Street penguin parade, none of whom had the right take on what to expect (like the one above for example), but everyone is certainly willing to share their bombastic "splanations" for what just happened and what to expect next.

Nick Timiraos, Fed's WSJ mouthpiece:

The market is easing for the Fed on the heels of a mild June CPI, where the big story is shelter disinflation. A September cut is mostly priced in, as is a second cut by December. Market-implied probabilities of a third rate cut this year are rising

Bloomberg economist Molly Smith:

"The figures add to evidence that inflation has resumed its downward trend after a flare up at the start of the year, while broader economic activity appears to be slowing. In the wake of a report last week that showed a third straight month of rising unemployment, the data should keep the Fed on a path toward cutting interest rates later this year."

David Russell, global head of market strategy at trade station

“Investors have waited for a long time for shelter to soften and they got it in June. Given rising inventories in housing, this sizeable component of the price index is finally starting to give the Fed what it needs to see for rate cuts. Goldilocks is here and a September cut looks more likely than ever.”

Seema Shah, global strategist at Principal Asset Management

"The inflation numbers put the Fed fimrly on the path for a September rate cut. Having said that, a July policy cut is still off the table. Not only would it spark questions of ‘what do they know about the economy that we don’t know?’ but the Fed still needs to gather additional evidence of waning price pressures to be absolutely certain of the inflation path. For now, the combination of resolute jobs data and slowing inflation is an all-out positive for equities.”

Lindsay Rosner, strategist at Goldman Sachs Asset Management:

“One word: pivotal. With three inflation prints between this morning and September’s Fed meeting, today’s print was crucial in helping the Fed gain confidence inflation is still moving in the right direction. The economic data heat wave seems to have subsided as we are getting cooler inflation data on the heels of cooler labor market prints last week. Cooler temperatures forecast a Fed cut in September.”

Ira Jersey, rates strategist at Bloomberg Intel

“What this data does is give more confidence to the market that not only might the Fed cut in September, but that once they do the Fed will go more regularly.”

Ali Jaffery, an economist at CIBC:

"Core CPI ran at a 2.1% pace annualized over the past three months, well down from 3.3% as of May. That is a material resumption of progress and makes the Q1 flare-up in price pressures feel like a distant memory.”

Rubeela Farooqi, chief US economist at High Frequency Economics:

"A change of tone from the Fed will come at the July meeting. A further deceleration in prices combined with a softening in labor market conditions support a change in message from the Fed, at the July FOMC meeting, opening to the door to rate cuts as soon as the September meeting.”

Skyler Weinand, chief investment officer at Regan Capital:

"Both September and December are now in play for the Fed, but he is also urging investors to hold their horses for what comes after. While Thursday’s CPI raises the odds of a 2024 rate cut or two, the market is expecting a total of five rate cuts over the next 12 months, which is too optimistic. The inflation picture is not likely to improve enough in the next year to warrant five rate cuts.”

Steven Ricchiuto, chief economist at Mizuho Securities:

"The Fed can’t really do a “hawkish cut,” warning of the risks of cutting too quickly. All they could do is do a cut that could fulfill he dots, and the markets are likely to go beyond that.”

Anna Wong, chief economist at Bloomberg Economics:

“June’s very soft core CPI reading — lower even than May’s ‘really good’ report, to borrow Fed Chair Jerome Powell’s words – highlighted two powerful disinflationary forces: housing rents and car prices. Those two sectors should bring inflation down over time, albeit gradually due to some offsetting impulses in the insurance sector. Together with evidence of a rapidly cooling labor market, the June inflation data should boost the Fed’s confidence that it’s almost time to cut rates. Two more inflation and jobs reports are due before the Sept. 17-18 FOMC meeting, and we expect them to invoke a similar narrative. Our baseline is for the Fed to begin to cut rates at the Sept. 17-18 FOMC meeting.”

Richard Flynn, managing director at Charles Schwab:

“This report is the cherry on top of the cake for both the Fed and investors who are eager to see rates slashed at long last.This is the latest in a string of data releases that continues to set the stage for the Fed to cut interest rates this year, potentially as soon as September. We expect that this economic optimism will benefit markets.”

Michael Brown, senior research strategist at Pepperstone Group:

“This should continue to see the ‘path of least resistance’ lead higher for equities over the medium-term, albeit with Q2 earnings season a key risk to navigate in the ‘here and now.’ Nevertheless, even if cuts were further delayed, contrary to what recent rhetoric would suggest, the flexible and forceful ‘Fed put’ remains in place, with policymakers still seeking to ease policy sooner rather than later. Hence, dips are likely to remain relatively shallow, and be seen as buying opportunities.”

Gregory Faranello, head of US rates trading and strategy for AmeriVet:

“The economy in the United States has weakened. And with lower inflation in tow. This is a good scenario for the Fed and our expectations are for more friendly data in the months ahead for both employment and inflation which should lead the Fed to begin lowering rates albeit slowly and cautiously.”

And last but not least, here is Neil Dutta of Renaissance Macro Research:

“The doves have what they need. It is time to cut.”

Source: Bloomberg

In retrospect, what is happening was obvious to anyone with half a brain. Back in April, when CPI prints were still coming in hot, we said that it is only a matter of time before CPI starts missing month after month driven by the badly lagging Owner’s Equivalent Rent, which would proceed to tumble for the “next 18 months, and since shelter is 36% of the CPI basket, inflation will soon appear low (even though real rents are rising again… so Fed is two cycles behind now)”

this is what the Fed is betting on: OER will keep dropping for the next 18 months due to the huge lag to current rents, and since shelter is 36% of the CPI basket, inflation will soon appear low (even though real rents are rising again… so Fed is two cycles behind now) pic.twitter.com/x9zBi1dvCd

— zerohedge (@zerohedge) April 5, 2024

And just for the cheap seats, we repeated this prediction again…

Fed’s Goolsbee Says Housing Is Key to Getting Inflation Down

Translation: OER cpi will tumble next month just in time for the Fed to cut as actual rents are surging again

— zerohedge (@zerohedge) April 12, 2024

… and again…

This is how much of a downside buffer core CPI has: real time rents are flat/negative while BLS reports OER at +5.6%. This will provide an inflation cushion for the next 18 months pic.twitter.com/PtFt8MsCxD

— zerohedge (@zerohedge) June 12, 2024

… and again…

It was a miss but not for the reason expected: OER catch down STILL to kick in; next few CPI print will be a dovish meltdown https://t.co/w1px0HrJN0

— zerohedge (@zerohedge) May 15, 2024

Finally, just to make sure everyone got the message, also in April we explained what will happen next, and how the BLS will “collapse” inflation to give the Fed the green light to cut in September and just in time for the election (back then nobody knew that Biden would suffer such a spectacular collapse).

How will inflation be “tamed”? Simple: The next 9-12 months rent/OER inflation (43% of CPI basket) will surprise to the downside as it catches down to stale lagged real-time data, even as rents are actually rising right now… but the BLS won’t observe this until early 2025.

— zerohedge (@zerohedge) April 16, 2024

So yes: it was all about the OER wild card, and which we correctly said would “surprise to the downside as it catches down to stale lagged real-time data, even as rents are actually rising right now… but the BLS won’t observe this until early 2025.”

Fast forward to today when the CPI print came in far cooler than pretty much anyone expected, on the back of – drumroll- OER, or Owners Equivalent Rent, just as we said it would (although granted we were a monthly early) and which rose just 0.27% in June, a sudden plunge from the recent prints above 0.4% and the lowest annual increase since April 2021.

According to UBS, this is a notable help for the FOMC in their quest to move inflation sustainably back to 2 percent. The Swiss bank agrees with what we have been saying for months, namely that “OER rose 43 and 42 bps in the preceding two months and had seen a notable stalling out of progress in slowing since last year. It is also a component where Chair Powell noted he expected slowing as far back as his 2022 Brookings speech where he outlined the buckets of inflation.” The bank also noted that “if OER was going to remain as sticky as it had appeared, given the weight even in PCE prices, the FOMC would have little chance of getting inflation back to 2 percent.” The rub, of course, is that real-time trackers of rental inflation are already rising, and as we warned in April, by the time the Fed is cutting rates to reverse the slide in OER (and its 12-18 month lag) rents will be already on their way up, assuring an perfect storm of easier conditions just as housing costs soar to all time highs.

Then again, by the time this dynamic is obvious to everyone it will be early 2025 and this will be Trump’s problem to deal with, so nobody in the deep state will lose too much sleep about about this particular fallout.

With that in mind, we go straight to the Wall Street penguin parade, none of whom had the right take on what to expect (like the one above for example), but everyone is certainly willing to share their bombastic “splanations” for what just happened and what to expect next.

Nick Timiraos, Fed’s WSJ mouthpiece:

The market is easing for the Fed on the heels of a mild June CPI, where the big story is shelter disinflation. A September cut is mostly priced in, as is a second cut by December. Market-implied probabilities of a third rate cut this year are rising

Bloomberg economist Molly Smith:

“The figures add to evidence that inflation has resumed its downward trend after a flare up at the start of the year, while broader economic activity appears to be slowing. In the wake of a report last week that showed a third straight month of rising unemployment, the data should keep the Fed on a path toward cutting interest rates later this year.”

David Russell, global head of market strategy at trade station

“Investors have waited for a long time for shelter to soften and they got it in June. Given rising inventories in housing, this sizeable component of the price index is finally starting to give the Fed what it needs to see for rate cuts. Goldilocks is here and a September cut looks more likely than ever.”

Seema Shah, global strategist at Principal Asset Management

“The inflation numbers put the Fed fimrly on the path for a September rate cut. Having said that, a July policy cut is still off the table. Not only would it spark questions of ‘what do they know about the economy that we don’t know?’ but the Fed still needs to gather additional evidence of waning price pressures to be absolutely certain of the inflation path. For now, the combination of resolute jobs data and slowing inflation is an all-out positive for equities.”

Lindsay Rosner, strategist at Goldman Sachs Asset Management:

“One word: pivotal. With three inflation prints between this morning and September’s Fed meeting, today’s print was crucial in helping the Fed gain confidence inflation is still moving in the right direction. The economic data heat wave seems to have subsided as we are getting cooler inflation data on the heels of cooler labor market prints last week. Cooler temperatures forecast a Fed cut in September.”

Ira Jersey, rates strategist at Bloomberg Intel

“What this data does is give more confidence to the market that not only might the Fed cut in September, but that once they do the Fed will go more regularly.”

Ali Jaffery, an economist at CIBC:

“Core CPI ran at a 2.1% pace annualized over the past three months, well down from 3.3% as of May. That is a material resumption of progress and makes the Q1 flare-up in price pressures feel like a distant memory.”

Rubeela Farooqi, chief US economist at High Frequency Economics:

“A change of tone from the Fed will come at the July meeting. A further deceleration in prices combined with a softening in labor market conditions support a change in message from the Fed, at the July FOMC meeting, opening to the door to rate cuts as soon as the September meeting.”

Skyler Weinand, chief investment officer at Regan Capital:

“Both September and December are now in play for the Fed, but he is also urging investors to hold their horses for what comes after. While Thursday’s CPI raises the odds of a 2024 rate cut or two, the market is expecting a total of five rate cuts over the next 12 months, which is too optimistic. The inflation picture is not likely to improve enough in the next year to warrant five rate cuts.”

Steven Ricchiuto, chief economist at Mizuho Securities:

“The Fed can’t really do a “hawkish cut,” warning of the risks of cutting too quickly. All they could do is do a cut that could fulfill he dots, and the markets are likely to go beyond that.”

Anna Wong, chief economist at Bloomberg Economics:

“June’s very soft core CPI reading — lower even than May’s ‘really good’ report, to borrow Fed Chair Jerome Powell’s words – highlighted two powerful disinflationary forces: housing rents and car prices. Those two sectors should bring inflation down over time, albeit gradually due to some offsetting impulses in the insurance sector. Together with evidence of a rapidly cooling labor market, the June inflation data should boost the Fed’s confidence that it’s almost time to cut rates. Two more inflation and jobs reports are due before the Sept. 17-18 FOMC meeting, and we expect them to invoke a similar narrative. Our baseline is for the Fed to begin to cut rates at the Sept. 17-18 FOMC meeting.”

Richard Flynn, managing director at Charles Schwab:

“This report is the cherry on top of the cake for both the Fed and investors who are eager to see rates slashed at long last.This is the latest in a string of data releases that continues to set the stage for the Fed to cut interest rates this year, potentially as soon as September. We expect that this economic optimism will benefit markets.”

Michael Brown, senior research strategist at Pepperstone Group:

“This should continue to see the ‘path of least resistance’ lead higher for equities over the medium-term, albeit with Q2 earnings season a key risk to navigate in the ‘here and now.’ Nevertheless, even if cuts were further delayed, contrary to what recent rhetoric would suggest, the flexible and forceful ‘Fed put’ remains in place, with policymakers still seeking to ease policy sooner rather than later. Hence, dips are likely to remain relatively shallow, and be seen as buying opportunities.”

Gregory Faranello, head of US rates trading and strategy for AmeriVet:

“The economy in the United States has weakened. And with lower inflation in tow. This is a good scenario for the Fed and our expectations are for more friendly data in the months ahead for both employment and inflation which should lead the Fed to begin lowering rates albeit slowly and cautiously.”

And last but not least, here is Neil Dutta of Renaissance Macro Research:

“The doves have what they need. It is time to cut.”

Source: Bloomberg

Loading…