As we expected in our preview calling for "optimism for a low print", today's CPI delivered the kind of downside surprise that bond bulls and the Fed have been waiting for, as both headline and core came in a tenth lower than expected, largely driven by a 3.6% drop in gasoline prices - the biggest reason why the headline CPI was flat on the month - and as Bloomberg adds, "the miss looks legit, given the shortfall in the actual indices relative to forecast." Indeed, at 0.16% the rise in core nearly rose just 0.1% when rounded. Meanwhile, in what may have been the biggest surprise, supercore services ex housing fell by 0.04%, the first negative reading since September 2021!

Supercore NEGATIVE! pic.twitter.com/zxlBDGtyyX

— zerohedge (@zerohedge) June 12, 2024

The soft CPI print obvious puts two rate cuts in 2024 as the obvious center of policy distribution - with an outside chance for the Fed to keep its 3 cut baseline in today's dots - and opens the door for the market to price more in 2025.

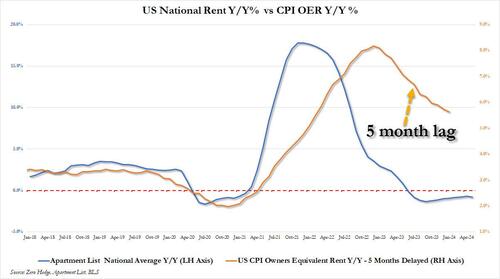

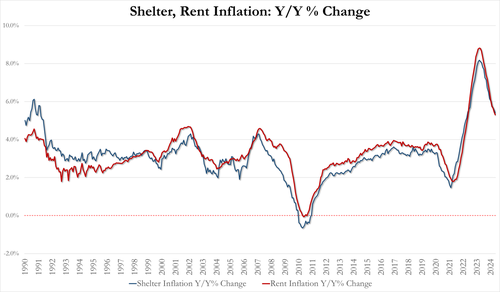

Meanwhile, the big delta remains housing: as the BLS noted, the shelter index increased 5.4% over the last year, accounting for over two thirds of the total 12-month increase in the all items less food and energy index. Yet with lagged OER/shelter/rent still hot relative to real-time prices, the core monthly CPI gain undershot the median forecast for the first time since October.

And here is the punchline: with real-time rent flat to down for the past year, the BLS-tracked OER 5-months lagged, is up 5.6%, and will decline gradually for the next 18 months as it catches down to real-time rents, even as the latter are actively rising, something which Omair Sharif at Inflation Insights agrees with in his morning note titled "Down and Out" : “A 0.2% monthly core CPI reading should be the base case for the balance of the year, especially as it looks more and more like the long-awaited slowdown in shelter costs will hit as soon as the next report.”

In any case, however one looks at today's report, the bottom line is clear: the doves have it, and now the ball is in the Fed's court to decide whether to keep the dots at 3 cuts for 2024 or move to 2, even as the hawkish "1 cut" case has been officially eliminated. Indeed, here is Bloomberg's Fed Watcher Chris Antsey on this issue: "for any Fed governor or district bank president who had been on the fence about one rate cut or two for 2024, this might have tipped them over. All eyes at 2 p.m. in Washington will be on that median estimate for the year-end policy rate."

And to underscore that, here are some of the more notable Wall Street reactions.

Gregory Faranello, head of rates strategy at AmeriVet Securities:

"The CPI is a really nice inflation reading. The Fed meeting today should see officials move toward two rate cuts for 2024 and softer CPI readings from here will keep a September cut in play."

Omair Sharif at Inflation Insights:

“A 0.2% monthly core CPI reading should be the base case for the balance of the year, especially as it looks more and more like the long-awaited slowdown in shelter costs will hit as soon as the next report.”

Ira Jersey, Bloomberg Intel chief rates strategist:

“The knee-jerk reaction in the Treasury market isn’t surprising given the Fed-friendly CPI print, particularly the “low” 0.2% on core CPI. Jay Powell can now say ‘we’re making slow but additional progress on inflation’ at this afternoon’s press conference. Investors have been asking if members of the FOMC might change their summary of economic projection forecasts after the CPI print, since they are submitted prior to the start of the meeting. Today’s report probably doesn’t really shift expectations much. We’ve been thinking November and December cuts as our base base, and this data solidifies that view.”

Lindsay Rosner of Goldman Sachs Asset Management

“This was good news but it is one piece of news. June is a no-go. We have felt July the same. Again today is a good print for restrictive rates working to quell inflation, so September is a possibility.”

Bryce Doty, Sit Investment Associates senior PM:

“A calm CPI report. This CPI report gives the Fed the flexibility to still cut rates. We still expect the Fed to hold off until after the election though.”

Ashwin Alankar, head of asset allocation at Janus Henderson Investors:

"Until greater dis-inflation evidence is seen both in breadth and depth, today’s softness is supportive of a preemptive cut rather than a pivot in Fed policy towards accommodation.”

Ana Galvao, Bloomberg Economics:

“The downside surprise in CPI could have an impact on asset prices over the medium term, not just today. Bloomberg Economics’ Macro-Finance model suggests forecasts for two-year Treasury yields will fall by 15 bps through 1Q25.”

Olu Sonola, head of US econ at Fitch

"This was unequivocally a good report, a delightful appetizer while we await the main course later on today. The core services print of 0.2% was the lowest since September 2021 and that will definitely boost confidence if that trend continues over the next couple of months. While the door to an interest rate cut in July is effectively shut, the window still looks open for later on this year."

Finally, here is a good wrapper from Bloomberg's econ team:

“May’s soft core CPI reading should reassure the Fed that inflation is slowing. Disinflation was broad across both goods and services categories.

“We expect core CPI prints over the summer to proceed at a mostly similar pace. With three more moderate prints in hand by the time of the September FOMC meeting, we think Fed officials will be convinced to start cutting rates then.”

Source: Bloomberg

As we expected in our preview calling for “optimism for a low print“, today’s CPI delivered the kind of downside surprise that bond bulls and the Fed have been waiting for, as both headline and core came in a tenth lower than expected, largely driven by a 3.6% drop in gasoline prices – the biggest reason why the headline CPI was flat on the month – and as Bloomberg adds, “the miss looks legit, given the shortfall in the actual indices relative to forecast.” Indeed, at 0.16% the rise in core nearly rose just 0.1% when rounded. Meanwhile, in what may have been the biggest surprise, supercore services ex housing fell by 0.04%, the first negative reading since September 2021!

Supercore NEGATIVE! pic.twitter.com/zxlBDGtyyX

— zerohedge (@zerohedge) June 12, 2024

The soft CPI print obvious puts two rate cuts in 2024 as the obvious center of policy distribution – with an outside chance for the Fed to keep its 3 cut baseline in today’s dots – and opens the door for the market to price more in 2025.

Meanwhile, the big delta remains housing: as the BLS noted, the shelter index increased 5.4% over the last year, accounting for over two thirds of the total 12-month increase in the all items less food and energy index. Yet with lagged OER/shelter/rent still hot relative to real-time prices, the core monthly CPI gain undershot the median forecast for the first time since October.

And here is the punchline: with real-time rent flat to down for the past year, the BLS-tracked OER 5-months lagged, is up 5.6%, and will decline gradually for the next 18 months as it catches down to real-time rents, even as the latter are actively rising, something which Omair Sharif at Inflation Insights agrees with in his morning note titled “Down and Out” : “A 0.2% monthly core CPI reading should be the base case for the balance of the year, especially as it looks more and more like the long-awaited slowdown in shelter costs will hit as soon as the next report.”

In any case, however one looks at today’s report, the bottom line is clear: the doves have it, and now the ball is in the Fed’s court to decide whether to keep the dots at 3 cuts for 2024 or move to 2, even as the hawkish “1 cut” case has been officially eliminated. Indeed, here is Bloomberg’s Fed Watcher Chris Antsey on this issue: “for any Fed governor or district bank president who had been on the fence about one rate cut or two for 2024, this might have tipped them over. All eyes at 2 p.m. in Washington will be on that median estimate for the year-end policy rate.”

And to underscore that, here are some of the more notable Wall Street reactions.

Gregory Faranello, head of rates strategy at AmeriVet Securities:

“The CPI is a really nice inflation reading. The Fed meeting today should see officials move toward two rate cuts for 2024 and softer CPI readings from here will keep a September cut in play.”

Omair Sharif at Inflation Insights:

“A 0.2% monthly core CPI reading should be the base case for the balance of the year, especially as it looks more and more like the long-awaited slowdown in shelter costs will hit as soon as the next report.”

Ira Jersey, Bloomberg Intel chief rates strategist:

“The knee-jerk reaction in the Treasury market isn’t surprising given the Fed-friendly CPI print, particularly the “low” 0.2% on core CPI. Jay Powell can now say ‘we’re making slow but additional progress on inflation’ at this afternoon’s press conference. Investors have been asking if members of the FOMC might change their summary of economic projection forecasts after the CPI print, since they are submitted prior to the start of the meeting. Today’s report probably doesn’t really shift expectations much. We’ve been thinking November and December cuts as our base base, and this data solidifies that view.”

Lindsay Rosner of Goldman Sachs Asset Management

“This was good news but it is one piece of news. June is a no-go. We have felt July the same. Again today is a good print for restrictive rates working to quell inflation, so September is a possibility.”

Bryce Doty, Sit Investment Associates senior PM:

“A calm CPI report. This CPI report gives the Fed the flexibility to still cut rates. We still expect the Fed to hold off until after the election though.”

Ashwin Alankar, head of asset allocation at Janus Henderson Investors:

“Until greater dis-inflation evidence is seen both in breadth and depth, today’s softness is supportive of a preemptive cut rather than a pivot in Fed policy towards accommodation.”

Ana Galvao, Bloomberg Economics:

“The downside surprise in CPI could have an impact on asset prices over the medium term, not just today. Bloomberg Economics’ Macro-Finance model suggests forecasts for two-year Treasury yields will fall by 15 bps through 1Q25.”

Olu Sonola, head of US econ at Fitch

“This was unequivocally a good report, a delightful appetizer while we await the main course later on today. The core services print of 0.2% was the lowest since September 2021 and that will definitely boost confidence if that trend continues over the next couple of months. While the door to an interest rate cut in July is effectively shut, the window still looks open for later on this year.”

Finally, here is a good wrapper from Bloomberg’s econ team:

“May’s soft core CPI reading should reassure the Fed that inflation is slowing. Disinflation was broad across both goods and services categories.

“We expect core CPI prints over the summer to proceed at a mostly similar pace. With three more moderate prints in hand by the time of the September FOMC meeting, we think Fed officials will be convinced to start cutting rates then.”

Source: Bloomberg

Loading…