The environment for uranium and nuclear power has never been better as the atomic energy sector's revival is being shifted into high gear for this very reason:

A ChatGPT search requires 10x as much power as a traditional Google search pic.twitter.com/khdSbvxsOH

— zerohedge (@zerohedge) May 19, 2024

Yes, artificial intelligence data centers and the urgent need for a next-generation power grid to handle surging power demands are key themes through 2030.

Let's revisit our December 2020 note titled "Buy Uranium: Is This The Beginning Of The Next ESG Craze" and, more recently, "The Next AI Trade." In these notes, we argue that nuclear power is the cleanest and most reliable energy source for electrifying America.

In recent weeks, we pointed out that "Everyone Is Piling Into The "Next AI Trade."" Even Blackrock's Larry Fink and Blackstone CEO Steve Schwarzman have acknowledged the dire need for America's power grid to receive a major upgrade.

In March, the federal government achieved a critical inflection point. Officials announced a $1.5 billion loan to restart a nuclear power plant in southwestern Michigan by 2025. This historical reversal indicates that more retired nuclear power plants would be revived as Wall Street finally realizes that wind and solar are not the most reliable and cleanest forms of energy for powering data centers.

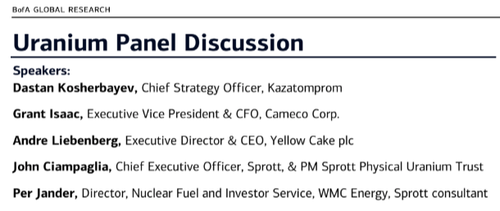

Last week, uranium insiders gathered at the Bank of America Securities 2024 Global Metals, Mining & Steel Conference in Miami to discuss the ultra-bullish environment.

BofA's Lawson Winder provided clients with a transcript of a panel discussion with some of the world's top uranium executives:

Here's the panel discussion of the executives talking about the energy transition, supply-driven catalysts, and supply shocks, such as the US ban on Russian uranium imports, and how Wall Street is still only learning about uranium's role in the energy transition.

This comment from Sprott execs stands out the most: "Many institutions are still learning the role of uranium in the energy transition , suggesting upside to money in the space."

The environment for uranium and nuclear power has never been better as the atomic energy sector’s revival is being shifted into high gear for this very reason:

A ChatGPT search requires 10x as much power as a traditional Google search pic.twitter.com/khdSbvxsOH

— zerohedge (@zerohedge) May 19, 2024

Yes, artificial intelligence data centers and the urgent need for a next-generation power grid to handle surging power demands are key themes through 2030.

Let’s revisit our December 2020 note titled “Buy Uranium: Is This The Beginning Of The Next ESG Craze” and, more recently, “The Next AI Trade.” In these notes, we argue that nuclear power is the cleanest and most reliable energy source for electrifying America.

In recent weeks, we pointed out that “Everyone Is Piling Into The “Next AI Trade.”” Even Blackrock’s Larry Fink and Blackstone CEO Steve Schwarzman have acknowledged the dire need for America’s power grid to receive a major upgrade.

In March, the federal government achieved a critical inflection point. Officials announced a $1.5 billion loan to restart a nuclear power plant in southwestern Michigan by 2025. This historical reversal indicates that more retired nuclear power plants would be revived as Wall Street finally realizes that wind and solar are not the most reliable and cleanest forms of energy for powering data centers.

Last week, uranium insiders gathered at the Bank of America Securities 2024 Global Metals, Mining & Steel Conference in Miami to discuss the ultra-bullish environment.

BofA’s Lawson Winder provided clients with a transcript of a panel discussion with some of the world’s top uranium executives:

Here’s the panel discussion of the executives talking about the energy transition, supply-driven catalysts, and supply shocks, such as the US ban on Russian uranium imports, and how Wall Street is still only learning about uranium’s role in the energy transition.

This comment from Sprott execs stands out the most: “Many institutions are still learning the role of uranium in the energy transition , suggesting upside to money in the space.”

Loading…