Retail giant Walmart, traditionally viewed as the curtain call to earnings season, reported results that beat on the top and bottom line and also raised its annual profit forecast for the second straight quarter after scoring new sales gains with bargain-hunting US shoppers. A quick look at the company's Q2 results:

- Revenue $161.63 billion, +5.7% y/y, beating estimate of $159.72 billion

- Adjusted EPS $1.84, beating estimates of $1.70

- Total US comparable sales ex-gas +6.3%, beating estimates of +4.04%

- Walmart-only US stores comparable sales ex-gas +6.4%, beating estimates of +4.29%

- Sam's Club US comparable sales ex-gas +5.5%, in line with estimate +5.58%

- Change in US E-Commerce sales +24%

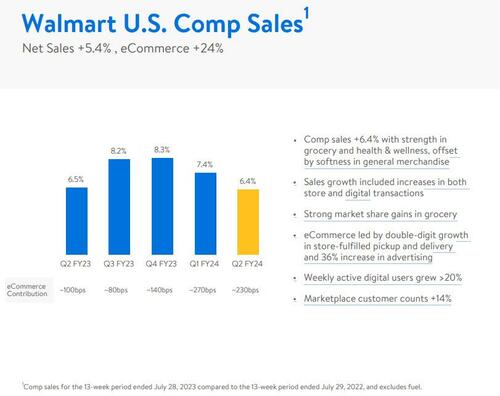

Comp sales of 6.4%, while below last year's 6.5% and down from 7.4% in Q1, beat estimates of a 4% increase with "strength in grocery and health & wellness, offset by softness in general merchandise." The company reported that sales growth included increases in both store and digital transactions, and was boosted by "strong market share gains in grocery."

Some other highlights from Q1:

WMT's Gross profit rate rose +40 bps

The company said that "the lapping of last year's elevated markdowns and supply chain costs benefited margins." Prices were "managed" to reflect elevated levels of cost inflation (this is what socialist economists call "greedflation") and was partly offset by unfavorable product mix shifts as grocery and health & wellness increased nearly 240 bps as a portion of sales mix, while general merchandise sales declined.

Operating expenses as a percentage of net sales +28 bps

- Reflects higher variable pay relative to last year as well as technology investments

- Store remodel costs increased as we continue rollout of an elevated store experience

Operating income $6.1 billion, +7.6%

Reflects increased gross margins and Walmart+membership income, partially offset by expense deleverage

Inventory -7.6%

- In-stock levels and the composition of inventory mix has improved

- Maintaining discipline in buying general merchandise due to macro uncertainty

According to CFO John David Rainey, food revenue continued to rise strongly and Walmart’s general merchandise business was stronger than the company expected at the beginning of the second quarter. As discussed previously, the retailer is also still benefiting from "stepped-up demand among higher-income customers." Translation: Bidenomics is doing so well, more and more higher-income customers have to shot at Walmart.

“We’re gaining share and our value proposition continues to resonate, both for value and convenience,” Rainey said in an interviewy. “The consumer is still spending, but they’re being discerning in their spending.”

It was the strong consumer outlook that helped boost Walmart's guidance:

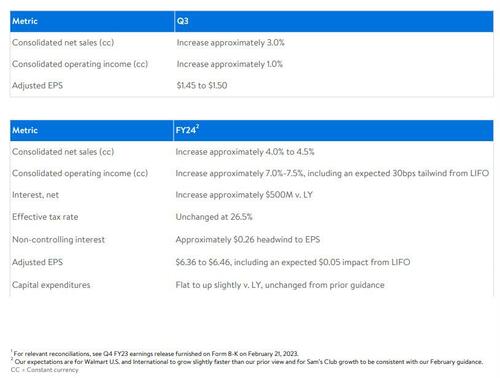

- For Q2, WMT sees:

- net sales +3.0%

- operating income 1.0%

- adjusted EPS of $1.45 to $1.50, just above the estimate $1.49;

- For the the full year, WMT sees:

- Net sales up 4.0% to 4.5%

- Operating income 7.0%-7.5%, including an expected 30bps tailwind from LIFO

- Adjusted EPS $6.36 to $6.46, up from the previous range of $6.10 to $6.20, and above the estimate of $6.28.

The improved forecast underscored the resilience of Walmart’s massive grocery business, which is enabling the company to grab more sales even as consumers think twice before buying discretionary goods. Earlier this week, Target and Home Depot reported sharp comparable-sales declines as consumers continued to pull back from nonessential items.

While the stock initially jumped in premarket trading, some downbeat commentary from the CFO during the conference call, in which he warned of "uncertainty in the economy during the rest of the year", hit the stock and it was subsequently unchanged.

The company's Q2 presentation is below (pdf link)

Retail giant Walmart, traditionally viewed as the curtain call to earnings season, reported results that beat on the top and bottom line and also raised its annual profit forecast for the second straight quarter after scoring new sales gains with bargain-hunting US shoppers. A quick look at the company’s Q2 results:

- Revenue $161.63 billion, +5.7% y/y, beating estimate of $159.72 billion

- Adjusted EPS $1.84, beating estimates of $1.70

- Total US comparable sales ex-gas +6.3%, beating estimates of +4.04%

- Walmart-only US stores comparable sales ex-gas +6.4%, beating estimates of +4.29%

- Sam’s Club US comparable sales ex-gas +5.5%, in line with estimate +5.58%

- Change in US E-Commerce sales +24%

Comp sales of 6.4%, while below last year’s 6.5% and down from 7.4% in Q1, beat estimates of a 4% increase with “strength in grocery and health & wellness, offset by softness in general merchandise.” The company reported that sales growth included increases in both store and digital transactions, and was boosted by “strong market share gains in grocery.”

Some other highlights from Q1:

WMT’s Gross profit rate rose +40 bps

The company said that “the lapping of last year’s elevated markdowns and supply chain costs benefited margins.” Prices were “managed” to reflect elevated levels of cost inflation (this is what socialist economists call “greedflation”) and was partly offset by unfavorable product mix shifts as grocery and health & wellness increased nearly 240 bps as a portion of sales mix, while general merchandise sales declined.

Operating expenses as a percentage of net sales +28 bps

- Reflects higher variable pay relative to last year as well as technology investments

- Store remodel costs increased as we continue rollout of an elevated store experience

Operating income $6.1 billion, +7.6%

Reflects increased gross margins and Walmart+membership income, partially offset by expense deleverage

Inventory -7.6%

- In-stock levels and the composition of inventory mix has improved

- Maintaining discipline in buying general merchandise due to macro uncertainty

According to CFO John David Rainey, food revenue continued to rise strongly and Walmart’s general merchandise business was stronger than the company expected at the beginning of the second quarter. As discussed previously, the retailer is also still benefiting from “stepped-up demand among higher-income customers.” Translation: Bidenomics is doing so well, more and more higher-income customers have to shot at Walmart.

“We’re gaining share and our value proposition continues to resonate, both for value and convenience,” Rainey said in an interviewy. “The consumer is still spending, but they’re being discerning in their spending.”

It was the strong consumer outlook that helped boost Walmart’s guidance:

- For Q2, WMT sees:

- net sales +3.0%

- operating income 1.0%

- adjusted EPS of $1.45 to $1.50, just above the estimate $1.49;

- For the the full year, WMT sees:

- Net sales up 4.0% to 4.5%

- Operating income 7.0%-7.5%, including an expected 30bps tailwind from LIFO

- Adjusted EPS $6.36 to $6.46, up from the previous range of $6.10 to $6.20, and above the estimate of $6.28.

The improved forecast underscored the resilience of Walmart’s massive grocery business, which is enabling the company to grab more sales even as consumers think twice before buying discretionary goods. Earlier this week, Target and Home Depot reported sharp comparable-sales declines as consumers continued to pull back from nonessential items.

While the stock initially jumped in premarket trading, some downbeat commentary from the CFO during the conference call, in which he warned of “uncertainty in the economy during the rest of the year”, hit the stock and it was subsequently unchanged.

The company’s Q2 presentation is below (pdf link)

Loading…