Walmart has secured its position as America's "price discount juggernaut" retailer as the Biden-Harris inflation storm sparked a scramble by big box retailers, supermarket retail chains, and discount chains into a value war to retain consumer market share.

As previously noted, Walmart has emerged as the clear winner in the "trade-down phenomenon" that continues today as more affluent shoppers gravitate to the retail giant, and a new Goldman report shows this trend is only gaining pace.

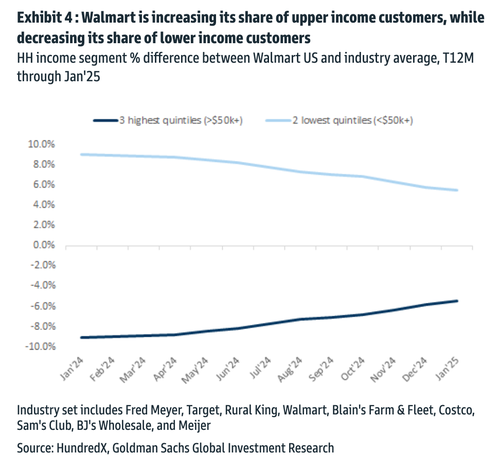

Goldman's Kate McShane, Mark Jordan, and others used retail data from HundredX, including a household income breakdown and Net Purchase Intent trends, to show that Walmart has continued to gain market share of upper-income households, while other retailers, including Costco and Target, have marginally increased their share of lower-income households relative to the industry over the last year.

"In our view, the share shift among income cohorts is likely due in part to upper-income consumers seeking out convenience, everyday value, and a comprehensive assortment through Walmart, which over-indexes to lower-income consumers relative to COST and TGT," McShane told clients.

The analysts add more color on the shifting consumer trends:

However, over the course of the last year, certain companies have increased their customer share of lower-income households relative to the industry average. In Jan '24, TGT's share was -5.4% lower than the industry, but it is now -3.0% lower in Jan '25. Similarly, COST's share in Jan '24 was -7.7% lower than the industry, but it is now only -4.9% lower. In comparison, Walmart's share of lower-income consumers relative to the industry has been decreasing: in Jan '24, the company's share was +9.0% higher than the industry but is now only +5.5% higher. More of Walmart's customer base has been shifting towards upper-income households, where share was -9.0% lower than the industry in Jan '24, but it is now only -5.5% lower. In general, trends point towards companies such as COST and TGT increasing their lower-income audience share, while Walmart is shifting towards increasing its upper-income audience share.

The analysts noted that price discounts and free delivery of goods likely led to a growing share of upper-income shoppers trading down to Walmart:

In 3Q, WMT saw higher engagement across income cohorts, with upper-income households continuing to account for the majority of share gains. In our view, this is likely due in part to WMT's expanded convenience offerings (e.g., free delivery through Walmart+ on $35+ orders, curbside pick up), store remodels, more comprehensive assortment through Marketplace, and a continued focus on every day value, with our pricing studies showing that Walmart US grocery prices remain ~11% below peers, on average.

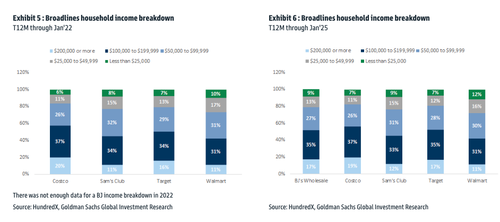

Here's the income breakdown of shoppers at each of the retail giants:

The takeaway is that the multi-year inflation storm has transformed the nation's consumers into Walmart shoppers—yet another sign that living standards continue to erode due to horrible decision-making by elected and unelected elites in the DC swamp. This has even impacted wealthy consumers who must trade down to Walmart. The financial misery DC folks have inflicted on all consumers has unified the nation, and many are thrilled with DOGE disrupting the swamp. It's called payback.

Walmart has secured its position as America’s “price discount juggernaut” retailer as the Biden-Harris inflation storm sparked a scramble by big box retailers, supermarket retail chains, and discount chains into a value war to retain consumer market share.

As previously noted, Walmart has emerged as the clear winner in the “trade-down phenomenon” that continues today as more affluent shoppers gravitate to the retail giant, and a new Goldman report shows this trend is only gaining pace.

Goldman’s Kate McShane, Mark Jordan, and others used retail data from HundredX, including a household income breakdown and Net Purchase Intent trends, to show that Walmart has continued to gain market share of upper-income households, while other retailers, including Costco and Target, have marginally increased their share of lower-income households relative to the industry over the last year.

“In our view, the share shift among income cohorts is likely due in part to upper-income consumers seeking out convenience, everyday value, and a comprehensive assortment through Walmart, which over-indexes to lower-income consumers relative to COST and TGT,” McShane told clients.

The analysts add more color on the shifting consumer trends:

However, over the course of the last year, certain companies have increased their customer share of lower-income households relative to the industry average. In Jan ’24, TGT’s share was -5.4% lower than the industry, but it is now -3.0% lower in Jan ’25. Similarly, COST’s share in Jan ’24 was -7.7% lower than the industry, but it is now only -4.9% lower. In comparison, Walmart’s share of lower-income consumers relative to the industry has been decreasing: in Jan ’24, the company’s share was +9.0% higher than the industry but is now only +5.5% higher. More of Walmart’s customer base has been shifting towards upper-income households, where share was -9.0% lower than the industry in Jan ’24, but it is now only -5.5% lower. In general, trends point towards companies such as COST and TGT increasing their lower-income audience share, while Walmart is shifting towards increasing its upper-income audience share.

The analysts noted that price discounts and free delivery of goods likely led to a growing share of upper-income shoppers trading down to Walmart:

In 3Q, WMT saw higher engagement across income cohorts, with upper-income households continuing to account for the majority of share gains. In our view, this is likely due in part to WMT’s expanded convenience offerings (e.g., free delivery through Walmart+ on $35+ orders, curbside pick up), store remodels, more comprehensive assortment through Marketplace, and a continued focus on every day value, with our pricing studies showing that Walmart US grocery prices remain ~11% below peers, on average.

Here’s the income breakdown of shoppers at each of the retail giants:

The takeaway is that the multi-year inflation storm has transformed the nation’s consumers into Walmart shoppers—yet another sign that living standards continue to erode due to horrible decision-making by elected and unelected elites in the DC swamp. This has even impacted wealthy consumers who must trade down to Walmart. The financial misery DC folks have inflicted on all consumers has unified the nation, and many are thrilled with DOGE disrupting the swamp. It’s called payback.

Loading…