Now that the CPI shocker is in the history book, the market has the start of earnings season to look forward to and specifically the big banks starting tomorrow with JPM, Morgan Stanley and Friday when Wells, Citi, PNC and Blackrock all report.

What to expect? According to JPM financial sector specialist James Goulbourne, the key cross-currents to keep an eye on are: strong loan growth and rates higher with consumer spending good; offset by markets, regulatory environment and rising loss reserves. Deposit betas have been low so far and loan growth has benefited from a more challenging market. That said, the last updates from large banks about consumer deposit balances were still positive with balances still well above pre-pandemic levels.

The JPM analyst also points to near-term raised estimates given NIM and loan growth with volatility helping trading revenues; however, he concedes that the key concern is forward looking issues of recession and/or stagflation and fears Fed moves might lead to hard landing. Prior periods of high inflation haven’t been met with extremely rapid tightening. Which may explain why there is very limited interest in new money going into sector despite appealing valuations given uncertainty of earnings.

Some more details on what the JPM strategist expects from Q2 bank earnings (full note available to pro subs).

-

Regionals positioned better into Q2 with less of the market related hits vs money centers. Both groups trading below long term averages but more about less mkt related exposure and higher revenue from NII at regionals.

-

Loan growth – strong due to market turmoil, with corporates borrowing from banks; spreads still well below pandemic so still scope for widening. Multi-family CRE and other consumer loans both growing strongly adding to unsecured consumer indebtedness.

-

Deposits – declined in Q2 despite no impact from QT yet. Part of decline was seasonal but QT will impact into H2 of year. LTD ratios have risen in second quarter but still very low at 54%.

-

NIM – should be up sharply across board; and, we see 20bps expansion q/q from rates moving up and deposit betas low. Expect most banks to raise guides for NII for rest of the year.

-

Fees – overall weak with key headwind from fees coming from weak markets and wealth mgmt. revenues. IB outlook important on deals being cancelled vs just postponed.

-

Equity trading benefitting from EDG volumes; wealth mgmt. fee revenue negative but will see lagged impact so Q2 weakness shows up in Q3. PE gains will remain under pressure. Mortgage banking fee revenue will be negative, -30% q/q driven by refinancing. Card fees remain robust due to strong trends in consumer spending.

-

Hung loans will be concern area, BAC disclosed $100-150mn impact, and we also see Citi as having risk on this side. RBC, GS, MS also involved in a lot of hung deals.

-

Expenses – is some higher creep from inflation which is only partly offset by reduction on incentive comp side.

-

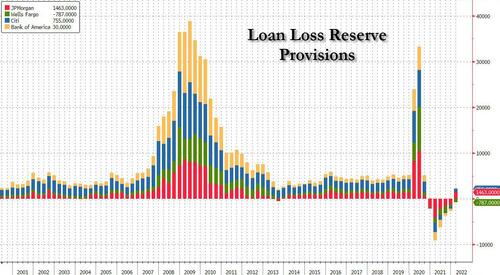

Credit quality – remains strong, provisions will rise at least partly for loan growth but also from recessionary playbook, banks may increase weighting of pessimistic scenario. We do have normalization built into our numbers with 2023 provision back to pre- pandemic levels (not recession levels).

-

May see impairments on equity investments and hung loan impacts and will be H2 impact.

-

Capital/CCAR – big surprise with CCAR was increase in SCB impacts for large names and what that means for RoTCE and growing trading businesses. We don’t expect any buybacks for any of the money centers for the H2 period. GSIB buffers also going up in Q123 and Q124.

-

M&A – deals keep getting pushed back – we wouldn’t be surprised if USB doesn’t close until 2023. STT acquisition delay more to do with legal structure.

-

Trust banks – a little more interest given valuations and low credit risk. Strong NII growth driven by NIM with balance sheets down given deposits are shrinking. Servicing also weak given weaker markets and will be seen on a lag. FX trading revenue will be strong for all names but clearly unsustainable. Capital impacts from AOCI impacts and don’t expect to see buybacks in H2 and will see betas move higher rapidly.

-

BAC – remains a popular name on the rates sensitivity, big surprise has been the 100bps CCAR capital increase; hung loan exposure disappointing given risk management which might suggest market share push.

Stepping back to look at the bigger picture, Bloomberg's Matt Turner writes that bank earnings will address a key question that’s been burning a hole through markets for months: whether cracks are forming in the economy.

Banks face an array of countervailing forces as the Federal Reserve hikes interest rates to combat soaring inflation. On the one hand, demand for interest-bearing products is benefiting, but as borrowing costs rise and growth slows, appetite for loans is at risk. That’s why investors will be so focused on any clues from bank officials on whether the economy has reached a tipping point.

Industry heavyweights including JPMorgan, Morgan Stanley and Citigroup are all set to report results this week, giving equity investors an opportunity to hear what some of Wall Street’s most powerful executives have to say about the economic outlook.

“The big banks will tell us if the US consumer and the economy are weakening faster than most earnings estimates are implying,” said Ed Moya, senior market analyst at Oanda. “Inflation is ‘public enemy number one’ and that will continue to drive fears that the Fed will aggressively tighten policy and send the US economy quickly into a recession.”

Analyst estimates reflect the push and pull of the various economic forces that banks are dealing with. Net interest income for the six largest US lenders is expected to rise by roughly 15%, while at the same time mortgage and investment-banking revenue is projected to decline, according to data compiled by Bloomberg.

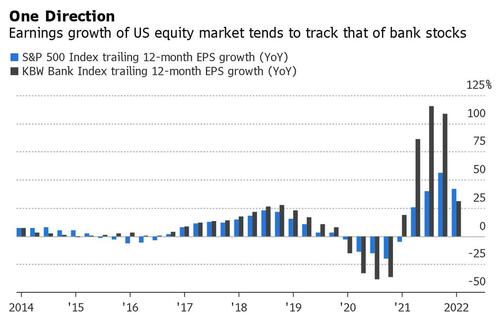

How it all nets out is pivotal for investors: Over the last five years, outside of one quarter, trailing 12-month earnings growth for bank stocks and the overall equity market have moved the same direction!

Turner also notes that investors will also be on the lookout for any comments from banks on the US yield curve, which has been inverted in recent days. That phenomenon is often seen as a harbinger of recession, and it could also erode the benefits banks typically derive from rising interest rates by shrinking their net interest margins.

Last month, JPMorgan Chief Executive Officer Jamie Dimon spooked markets with a warning that an economic “hurricane” was on the horizon. Granted, the market turbulence resulting from angst over the economy can also help banks by fueling trading opportunities.

Acording to Alison Williams from Bloomberg Intelligence,“the largest US banks’ economic signals, especially assumptions baked into loan-loss provisions, will be in focus with results, even as we expect generally positive 2Q trends. Higher interest rates, loan growth, solid credit and cost controls, and strong trading will support profitability, as fees slide and buybacks remain mostly stalled near term.”

Banks have been among some of the hardest-hit stocks this year after being one of the best-performing sectors in 2021. The S&P 500 Banks Index has fallen 25% this year, and is on pace for its worst annual performance since 2008, while the S&P 500 Index has shed about 20%. Today was no different, and financial stocks dropped again after data showed consumer prices rising by a much hotter-than-expected 9.1% in June.

Market watchers will pay particular attention to any signs of a weakening consumer, especially with inflation at its highest level since the early 1980s. Loan growth, credit-card spending and delinquencies are all among the areas that will be closely watched.

“It’s difficult to have high conviction either way just because there’s so many cross-currents,” said Matt Orton, chief market strategist at Carillon Tower Advisers. “But I think the tone that is set this week and early next week is going to be very important to the recession discussion moving forward.”

In the latest financial news, banks are sitting on roughly $80 billion in leveraged buyout financing; VanEck is warning that bank fees are “significantly eroding” what little of the fund’s value remains; RBC hired Mark Dickenson from HSBC; and JPMorgan and Morgan Stanely will kick off the second quarter earnings season Thursday morning.

Now that the CPI shocker is in the history book, the market has the start of earnings season to look forward to and specifically the big banks starting tomorrow with JPM, Morgan Stanley and Friday when Wells, Citi, PNC and Blackrock all report.

What to expect? According to JPM financial sector specialist James Goulbourne, the key cross-currents to keep an eye on are: strong loan growth and rates higher with consumer spending good; offset by markets, regulatory environment and rising loss reserves. Deposit betas have been low so far and loan growth has benefited from a more challenging market. That said, the last updates from large banks about consumer deposit balances were still positive with balances still well above pre-pandemic levels.

The JPM analyst also points to near-term raised estimates given NIM and loan growth with volatility helping trading revenues; however, he concedes that the key concern is forward looking issues of recession and/or stagflation and fears Fed moves might lead to hard landing. Prior periods of high inflation haven’t been met with extremely rapid tightening. Which may explain why there is very limited interest in new money going into sector despite appealing valuations given uncertainty of earnings.

Some more details on what the JPM strategist expects from Q2 bank earnings (full note available to pro subs).

-

Regionals positioned better into Q2 with less of the market related hits vs money centers. Both groups trading below long term averages but more about less mkt related exposure and higher revenue from NII at regionals.

-

Loan growth – strong due to market turmoil, with corporates borrowing from banks; spreads still well below pandemic so still scope for widening. Multi-family CRE and other consumer loans both growing strongly adding to unsecured consumer indebtedness.

-

Deposits – declined in Q2 despite no impact from QT yet. Part of decline was seasonal but QT will impact into H2 of year. LTD ratios have risen in second quarter but still very low at 54%.

-

NIM – should be up sharply across board; and, we see 20bps expansion q/q from rates moving up and deposit betas low. Expect most banks to raise guides for NII for rest of the year.

-

Fees – overall weak with key headwind from fees coming from weak markets and wealth mgmt. revenues. IB outlook important on deals being cancelled vs just postponed.

-

Equity trading benefitting from EDG volumes; wealth mgmt. fee revenue negative but will see lagged impact so Q2 weakness shows up in Q3. PE gains will remain under pressure. Mortgage banking fee revenue will be negative, -30% q/q driven by refinancing. Card fees remain robust due to strong trends in consumer spending.

-

Hung loans will be concern area, BAC disclosed $100-150mn impact, and we also see Citi as having risk on this side. RBC, GS, MS also involved in a lot of hung deals.

-

Expenses – is some higher creep from inflation which is only partly offset by reduction on incentive comp side.

-

Credit quality – remains strong, provisions will rise at least partly for loan growth but also from recessionary playbook, banks may increase weighting of pessimistic scenario. We do have normalization built into our numbers with 2023 provision back to pre- pandemic levels (not recession levels).

-

May see impairments on equity investments and hung loan impacts and will be H2 impact.

-

Capital/CCAR – big surprise with CCAR was increase in SCB impacts for large names and what that means for RoTCE and growing trading businesses. We don’t expect any buybacks for any of the money centers for the H2 period. GSIB buffers also going up in Q123 and Q124.

-

M&A – deals keep getting pushed back – we wouldn’t be surprised if USB doesn’t close until 2023. STT acquisition delay more to do with legal structure.

-

Trust banks – a little more interest given valuations and low credit risk. Strong NII growth driven by NIM with balance sheets down given deposits are shrinking. Servicing also weak given weaker markets and will be seen on a lag. FX trading revenue will be strong for all names but clearly unsustainable. Capital impacts from AOCI impacts and don’t expect to see buybacks in H2 and will see betas move higher rapidly.

-

BAC – remains a popular name on the rates sensitivity, big surprise has been the 100bps CCAR capital increase; hung loan exposure disappointing given risk management which might suggest market share push.

Stepping back to look at the bigger picture, Bloomberg’s Matt Turner writes that bank earnings will address a key question that’s been burning a hole through markets for months: whether cracks are forming in the economy.

Banks face an array of countervailing forces as the Federal Reserve hikes interest rates to combat soaring inflation. On the one hand, demand for interest-bearing products is benefiting, but as borrowing costs rise and growth slows, appetite for loans is at risk. That’s why investors will be so focused on any clues from bank officials on whether the economy has reached a tipping point.

Industry heavyweights including JPMorgan, Morgan Stanley and Citigroup are all set to report results this week, giving equity investors an opportunity to hear what some of Wall Street’s most powerful executives have to say about the economic outlook.

“The big banks will tell us if the US consumer and the economy are weakening faster than most earnings estimates are implying,” said Ed Moya, senior market analyst at Oanda. “Inflation is ‘public enemy number one’ and that will continue to drive fears that the Fed will aggressively tighten policy and send the US economy quickly into a recession.”

Analyst estimates reflect the push and pull of the various economic forces that banks are dealing with. Net interest income for the six largest US lenders is expected to rise by roughly 15%, while at the same time mortgage and investment-banking revenue is projected to decline, according to data compiled by Bloomberg.

How it all nets out is pivotal for investors: Over the last five years, outside of one quarter, trailing 12-month earnings growth for bank stocks and the overall equity market have moved the same direction!

Turner also notes that investors will also be on the lookout for any comments from banks on the US yield curve, which has been inverted in recent days. That phenomenon is often seen as a harbinger of recession, and it could also erode the benefits banks typically derive from rising interest rates by shrinking their net interest margins.

Last month, JPMorgan Chief Executive Officer Jamie Dimon spooked markets with a warning that an economic “hurricane” was on the horizon. Granted, the market turbulence resulting from angst over the economy can also help banks by fueling trading opportunities.

Acording to Alison Williams from Bloomberg Intelligence,“the largest US banks’ economic signals, especially assumptions baked into loan-loss provisions, will be in focus with results, even as we expect generally positive 2Q trends. Higher interest rates, loan growth, solid credit and cost controls, and strong trading will support profitability, as fees slide and buybacks remain mostly stalled near term.”

Banks have been among some of the hardest-hit stocks this year after being one of the best-performing sectors in 2021. The S&P 500 Banks Index has fallen 25% this year, and is on pace for its worst annual performance since 2008, while the S&P 500 Index has shed about 20%. Today was no different, and financial stocks dropped again after data showed consumer prices rising by a much hotter-than-expected 9.1% in June.

Market watchers will pay particular attention to any signs of a weakening consumer, especially with inflation at its highest level since the early 1980s. Loan growth, credit-card spending and delinquencies are all among the areas that will be closely watched.

“It’s difficult to have high conviction either way just because there’s so many cross-currents,” said Matt Orton, chief market strategist at Carillon Tower Advisers. “But I think the tone that is set this week and early next week is going to be very important to the recession discussion moving forward.”

In the latest financial news, banks are sitting on roughly $80 billion in leveraged buyout financing; VanEck is warning that bank fees are “significantly eroding” what little of the fund’s value remains; RBC hired Mark Dickenson from HSBC; and JPMorgan and Morgan Stanely will kick off the second quarter earnings season Thursday morning.