Update (1000ET): Fed Chair Powell's prepared remarks have dropped and are dovish at the nuanced margin:

“We continue to make decisions meeting by meeting. We know that reducing policy restraint too soon or too much could stall or even reverse the progress we have seen on inflation. At the same time, in light of the progress made both in lowering inflation and in cooling the labor market over the past two years, elevated inflation is not the only risk we face. Reducing policy restraint too late or too little could unduly weaken economic activity and employment.”

Additionally, Powell called the labor market “strong, but not overheated” -- a pretty clear indication that the Fed is not trying to moderate the job market further.

Overall, Powell seems pretty balanced in his monetary policy take. Recent inflation data have shown modest further progress and more good data would strengthen the Fed’s confidence in inflation returning to 2%, a condition for cutting rates.

And the chair stresses that there are two-sided risks for policy: moving too soon or moving too late.

* * *

Fed Chair Powell will give his dual testimonies to Congress on Tuesday (to the Senate Banking Committee) and Wednesday (to the House Financial Services Committee), both due to start at 10 am Eastern Time. Powell will be testifying in his capacity as Fed Chair, and therefore, what he says is likely to reflect the overall feelings of the Committee (his remarks to the House will likely be a copy-and-paste of his remarks to the Senate).

Market participants expect very little with Powell sticking to the script that modest further progress on inflation has been seen this year, but officials still needed 'greater confidence' before moving on to rate cuts, and it expects that housing-related inflation pressures will gradually decline.

On the labor market, supply and demand now resembles the period right before the pandemic, when the labor market was relatively tight but not overheated but despite the improvements, the report said that significant disparities in the job market still exist.

On financial conditions, the Fed said they appeared somewhat restrictive on balance, and the pace of bank lending was somewhat tepid.

The financial system remains 'sound and resilient' though parts of banks' ORE portfolios are facing stress. Though liquidity at most domestic banks was ample. It added that valuations were high relative to fundamentals in major asset classes.

As Newsquawk summarizes, analysts are generally of the view that Powell will stick to the script on the comments that he gave after the FOMC meeting, as well as his remarks from the ECB's monetary policy conference in Sintra last week.

Powell said that the disinflation trend is showing signs of resuming and that they are getting back on the disinflationary path. And while he noted progress on inflation, he reiterated that officials want more confidence before being comfortable with reducing policy rates. He added his recently usual line that if the labor market unexpectedly weakens, the Fed would react. He acknowledged the Fed has the ability to take their time and get it right.

Meanwhile, minutes of the FOMC's June meeting, which Powell is likely to underscore in his testimonies, noted that most policymakers saw the current policy stance as restrictive; several said if inflation were to persist at elevated levels or rise further, the Fed funds rate might need to be raised. Participants saw 'modest further progress' toward the inflation objective, with May's CPI data seen by participants as providing additional evidence of progress toward the inflation goal. Participants affirmed that additional favourable data was required to give them greater confidence that inflation was moving sustainably towards target.

Participants highlighted a variety of factors that were likely to help contribute to continued disinflation in the period ahead, including the continued easing of demand-supply pressures in product and labor markets, lagged effects on wages and prices of past monetary policy tightening, the delayed response of measured shelter prices to rental market developments, and the prospect of additional supply-side improvements.

With inflation data now showing some signs that the economy is back onto the path of disinflation, many analysts are becoming more attentive to policymakers' remarks on the jobs market, where the recent data showed the unemployment rate ticking above the Fed's end-2024 projection (4.1% vs the Fed's forecast for 4.0%), and was received dovishly by markets. On the labor market specifically, a number of participants said policy should stand ready to respond to unexpected economic weakness, with the vast majority seeing US economic growth as having cooled gradually. Several specifically emphasized further demand weakening could generate a larger unemployment response than in the recent past, and observed that many labor market indicators pointed to a reduced degree of tightness in labor market conditions.

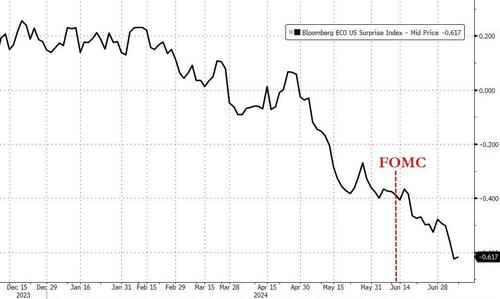

And since the last FOMC meeting, macro data has serially disappointed...

Source: Bloomberg

As Powell prepares to speak, STIRs have fully discounted two rate cuts this year, with around 51bps of rate cuts priced in by the end of the year; this pricing has moved dovishly in the wake of the June jobs data. This is in contrast to the Fed's median projection, which has penciled in just one reduction this year. The first cut is fully priced by November, though there is around an 80% chance of it being seen in September.

Source: Bloomberg

We would also expect some partisan pressure from the Right over The Fed's independence and the need to cut rates with inflation still high (though falling) and unemployment still so low (though rising).

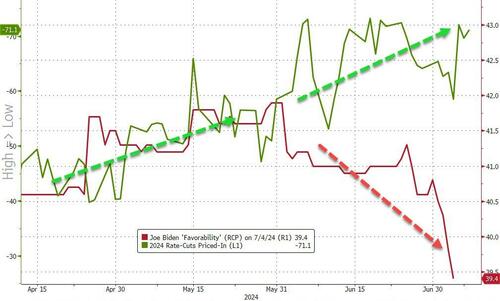

Why so desperate to cut? Is the banking system really as solid as The Fed claims? Or will rate-cuts be just the juice to avoid a recession call right before the election?

Source: Bloomberg

Biden's gonna need more rate-cuts...

Source: Bloomberg

Watch Live (due to start at 1000ET):

Update (1000ET): Fed Chair Powell’s prepared remarks have dropped and are dovish at the nuanced margin:

“We continue to make decisions meeting by meeting. We know that reducing policy restraint too soon or too much could stall or even reverse the progress we have seen on inflation. At the same time, in light of the progress made both in lowering inflation and in cooling the labor market over the past two years, elevated inflation is not the only risk we face. Reducing policy restraint too late or too little could unduly weaken economic activity and employment.”

Additionally, Powell called the labor market “strong, but not overheated” — a pretty clear indication that the Fed is not trying to moderate the job market further.

Overall, Powell seems pretty balanced in his monetary policy take. Recent inflation data have shown modest further progress and more good data would strengthen the Fed’s confidence in inflation returning to 2%, a condition for cutting rates.

And the chair stresses that there are two-sided risks for policy: moving too soon or moving too late.

* * *

Fed Chair Powell will give his dual testimonies to Congress on Tuesday (to the Senate Banking Committee) and Wednesday (to the House Financial Services Committee), both due to start at 10 am Eastern Time. Powell will be testifying in his capacity as Fed Chair, and therefore, what he says is likely to reflect the overall feelings of the Committee (his remarks to the House will likely be a copy-and-paste of his remarks to the Senate).

Market participants expect very little with Powell sticking to the script that modest further progress on inflation has been seen this year, but officials still needed ‘greater confidence’ before moving on to rate cuts, and it expects that housing-related inflation pressures will gradually decline.

On the labor market, supply and demand now resembles the period right before the pandemic, when the labor market was relatively tight but not overheated but despite the improvements, the report said that significant disparities in the job market still exist.

On financial conditions, the Fed said they appeared somewhat restrictive on balance, and the pace of bank lending was somewhat tepid.

The financial system remains ‘sound and resilient’ though parts of banks’ ORE portfolios are facing stress. Though liquidity at most domestic banks was ample. It added that valuations were high relative to fundamentals in major asset classes.

As Newsquawk summarizes, analysts are generally of the view that Powell will stick to the script on the comments that he gave after the FOMC meeting, as well as his remarks from the ECB’s monetary policy conference in Sintra last week.

Powell said that the disinflation trend is showing signs of resuming and that they are getting back on the disinflationary path. And while he noted progress on inflation, he reiterated that officials want more confidence before being comfortable with reducing policy rates. He added his recently usual line that if the labor market unexpectedly weakens, the Fed would react. He acknowledged the Fed has the ability to take their time and get it right.

Meanwhile, minutes of the FOMC’s June meeting, which Powell is likely to underscore in his testimonies, noted that most policymakers saw the current policy stance as restrictive; several said if inflation were to persist at elevated levels or rise further, the Fed funds rate might need to be raised. Participants saw ‘modest further progress’ toward the inflation objective, with May’s CPI data seen by participants as providing additional evidence of progress toward the inflation goal. Participants affirmed that additional favourable data was required to give them greater confidence that inflation was moving sustainably towards target.

Participants highlighted a variety of factors that were likely to help contribute to continued disinflation in the period ahead, including the continued easing of demand-supply pressures in product and labor markets, lagged effects on wages and prices of past monetary policy tightening, the delayed response of measured shelter prices to rental market developments, and the prospect of additional supply-side improvements.

With inflation data now showing some signs that the economy is back onto the path of disinflation, many analysts are becoming more attentive to policymakers’ remarks on the jobs market, where the recent data showed the unemployment rate ticking above the Fed’s end-2024 projection (4.1% vs the Fed’s forecast for 4.0%), and was received dovishly by markets. On the labor market specifically, a number of participants said policy should stand ready to respond to unexpected economic weakness, with the vast majority seeing US economic growth as having cooled gradually. Several specifically emphasized further demand weakening could generate a larger unemployment response than in the recent past, and observed that many labor market indicators pointed to a reduced degree of tightness in labor market conditions.

And since the last FOMC meeting, macro data has serially disappointed…

Source: Bloomberg

As Powell prepares to speak, STIRs have fully discounted two rate cuts this year, with around 51bps of rate cuts priced in by the end of the year; this pricing has moved dovishly in the wake of the June jobs data. This is in contrast to the Fed’s median projection, which has penciled in just one reduction this year. The first cut is fully priced by November, though there is around an 80% chance of it being seen in September.

Source: Bloomberg

We would also expect some partisan pressure from the Right over The Fed’s independence and the need to cut rates with inflation still high (though falling) and unemployment still so low (though rising).

Why so desperate to cut? Is the banking system really as solid as The Fed claims? Or will rate-cuts be just the juice to avoid a recession call right before the election?

Source: Bloomberg

Biden’s gonna need more rate-cuts…

Source: Bloomberg

Watch Live (due to start at 1000ET):

[embedded content]

Loading…