Fed Chair Jerome Powell is scheduled to speak this afternoon and the big question is how many times will he said the word "patience", "confidence", and/or "we must get Biden re-elected."

Powell has been less hawkish than many of his peers on the FOMC - leaving all doors open for cuts 'at some point' this year, merely needing a little more confidence that they are really winning the inflation war.

The problem is - they are not anymore. As the following chart shows, inflation data has been surprising significantly to the upside for four months... and US macroeconomic data has also been surprising to the upside...

Source: Bloomberg

Neither of which provide any rate-cutting-leg to stand on for Powell and his pals.

Powell's comments today come after Fed Vice Chair Philip Jefferson suggested this morning that the central bank's key rate may have to remain at its peak for a while to bring down persistently elevated inflation.

Specifically, Jefferson's remarks to a Fed research conference excluded key phrases about gaining "confidence" in lower inflation and then cutting rates, but noted the central bank was facing a strong economy and little recent progress on the pace of price increases.

"if incoming data suggest that inflation is more persistent than I currently expect it to be, it will be appropriate to hold in place the current restrictive stance of policy for longer. I am fully committed to getting inflation back to 2%."

As Reuters reports, whether or not Powell follows in a similar vein, outside analysts and investors have been steadily marking down the likelihood and timing of Fed rate cuts as policymakers struggle to reconcile a gravity-defying economy with their assessment that monetary policy is "restrictive" and inflation likely on its way down.

The market has made its mind up - slashing expectations for 2024 to just 1.5 rate-cuts (half what The Fed's Dot-Plot is expecting)...

Source: Bloomberg

Of course, Biden has also expressed his opinion that there will be rate-cuts this year (by the election?)...

“Well, I do stand by my prediction that, before the year is out, there’ll be a rate cut,” Biden said last Wednesday at a White House press conference alongside Japanese Prime Minister Fumio Kishida, adding that today's CPI report could delay a rate cut by at least a month...

Will Powell feel the need to reiterate the importance for 'Fed independence' that he was spouting on about in his speech two weeks ago at Stanford Business School...

The Fed has been assigned two goals for monetary policy - maximum employment and stable prices.

Our success in delivering on these goals matters a great deal to all Americans. To support our pursuit of those goals, Congress granted the Fed a substantial degree of independence in our conduct of monetary policy. Fed policymakers serve long terms that are not synchronized with election cycles.

Our decisions are not subject to reversal by other parts of the government, other than through legislation.

This independence both enables and requires us to make our monetary policy decisions without consideration of short-term political matters.

Such independence for a federal agency is and should be rare. In the case of the Fed, independence is essential to our ability to serve the public.

And finally...

“One of Chair Powell’s responsibilities is to protect the public standing of the Fed,” said Vincent Reinhart, chief economist at Dreyfus and Mellon.

“The closer the FOMC acts to the election, the more likely it is that the public will question the Fed’s intent.”

Watch Fed Chair Powell speak live here (due to start at 1315ET):

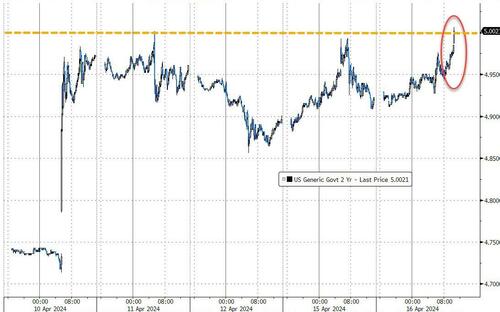

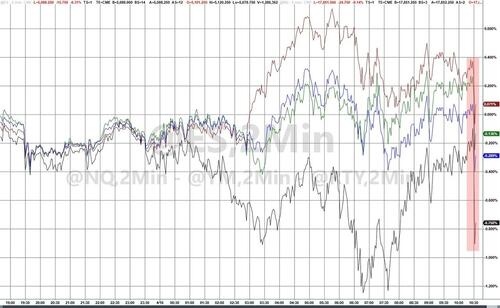

Update (1330ET): In his most direct comments about The Fed’s expected path for rates, Chair Powell just admitted that “recent data show lack of further progress on inflation” and the market did not like it much…

And 2Y yield tops 5% for first time since November…

Powell added that it “will likely take longer for confidence on inflation” and in the meantime it “is appropriate to let policy take further time to work.”

* * *

Fed Chair Jerome Powell is scheduled to speak this afternoon and the big question is how many times will he said the word “patience“, “confidence“, and/or “we must get Biden re-elected.”

Powell has been less hawkish than many of his peers on the FOMC – leaving all doors open for cuts ‘at some point’ this year, merely needing a little more confidence that they are really winning the inflation war.

The problem is – they are not anymore. As the following chart shows, inflation data has been surprising significantly to the upside for four months… and US macroeconomic data has also been surprising to the upside…

Source: Bloomberg

Neither of which provide any rate-cutting-leg to stand on for Powell and his pals.

Powell’s comments today come after Fed Vice Chair Philip Jefferson suggested this morning that the central bank’s key rate may have to remain at its peak for a while to bring down persistently elevated inflation.

Specifically, Jefferson’s remarks to a Fed research conference excluded key phrases about gaining “confidence” in lower inflation and then cutting rates, but noted the central bank was facing a strong economy and little recent progress on the pace of price increases.

“if incoming data suggest that inflation is more persistent than I currently expect it to be, it will be appropriate to hold in place the current restrictive stance of policy for longer. I am fully committed to getting inflation back to 2%.”

As Reuters reports, whether or not Powell follows in a similar vein, outside analysts and investors have been steadily marking down the likelihood and timing of Fed rate cuts as policymakers struggle to reconcile a gravity-defying economy with their assessment that monetary policy is “restrictive” and inflation likely on its way down.

The market has made its mind up – slashing expectations for 2024 to just 1.5 rate-cuts (half what The Fed’s Dot-Plot is expecting)…

Source: Bloomberg

Of course, Biden has also expressed his opinion that there will be rate-cuts this year (by the election?)…

“Well, I do stand by my prediction that, before the year is out, there’ll be a rate cut,” Biden said last Wednesday at a White House press conference alongside Japanese Prime Minister Fumio Kishida, adding that today’s CPI report could delay a rate cut by at least a month…

Will Powell feel the need to reiterate the importance for ‘Fed independence’ that he was spouting on about in his speech two weeks ago at Stanford Business School…

The Fed has been assigned two goals for monetary policy – maximum employment and stable prices.

Our success in delivering on these goals matters a great deal to all Americans. To support our pursuit of those goals, Congress granted the Fed a substantial degree of independence in our conduct of monetary policy. Fed policymakers serve long terms that are not synchronized with election cycles.

Our decisions are not subject to reversal by other parts of the government, other than through legislation.

This independence both enables and requires us to make our monetary policy decisions without consideration of short-term political matters.

Such independence for a federal agency is and should be rare. In the case of the Fed, independence is essential to our ability to serve the public.

And finally…

“One of Chair Powell’s responsibilities is to protect the public standing of the Fed,” said Vincent Reinhart, chief economist at Dreyfus and Mellon.

“The closer the FOMC acts to the election, the more likely it is that the public will question the Fed’s intent.”

Watch Fed Chair Powell speak live here (due to start at 1315ET):

[embedded content]

Loading…