By Peter Tchir of Academy Securities

We Didn’t Learn a Whole Lot Last Week

Data was mixed. Unemployment claims were lower (a sign of strength), durable goods were weak, and Global PMIs were just above 50 (Goldilocks economy). While I don’t pay much attention to CONsumer CONfidence, it is interesting that one-year inflation expectations jumped from 3.2% to 4.5% in two months. That occurred while oil (often a proxy for CONsumer CONfidence inflation expectations) dropped, some major retailers warned about deflating prices, and as far as I can tell, everyone is having some sort of a sale, which doesn’t seem inflationary to me.

The 10-year Treasury inched higher, finishing at 4.47% (up from 4.44%, and it was as low as 4.39%). Since it was illiquid/holiday-oriented trading, we can probably ignore most of those moves as noise.

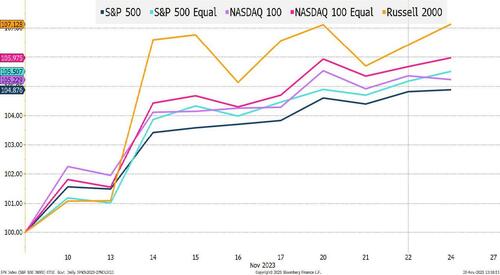

We also had NVDA earnings, which tend to serve as a “proxy” for AI. NVDA itself is down a touch since those earnings, but the markets as a whole have not suffered. That, along with the ongoing outperformance of the equal weighted indices and Russell 2000, is worth noting.

Since November 9th, the Russell 2000 has led the way, followed by the equal-weighted indices. That trend continued, and could be one of the more useful lessons of the week.

Ultimately, if AI is truly capable of generating efficiencies (today’s costs, versus today’s benefits) we should see more benefits accruing to companies that adopt and incorporate AI, thereby increasing earnings per share and multiples. So far, almost all of the AI benefits have accrued to the companies providing AI, which cannot last forever.

- Either AI works, and the broad economy and a wide swath of companies should benefit, or the current cost/benefit doesn’t work, in which case spending on AI will decrease as we move away from “hype” spending into critical analysis.

Personally, I’m in the “tide will lift all boats” camp but cannot deny that the current up-front costs versus value (especially at today’s higher cost of capital) may slow adoption. We will learn more as we get through year-end earnings and have more time to digest the true “success” stories, rather than just looking at certain investments which seem to be more about “keeping up with the Joneses’” rather than being fully incorporated into corporate strategy (which is a necessary condition for AI to be truly effective).

China

To get more of a sustained rally into year-end, we likely need some positive developments on the Chinese economy via some new deals with the U.S., more domestic stimulus, or some combination of the two. That is a bet that I’m still making for all the reasons listed in prior reports (Rally on Garth, Dictator, and More than a Photo Op).

Credit

CDS index spreads are hovering around their tightest levels of the year (CDX IG closed at 63). Corporate bond index spreads are at the lowest levels of the year (109 bps for the Bloomberg Corporate OAS). That is a little misleading, as the average maturity has been dropping all year (far fewer long-dated bonds have been issued this year relative to short-dated bonds because rates rose and the curve became less inverted).

High yield prices, while not back to levels seen at the start of the year, have rallied nicely and are trading well.

As a “contrarian” it would be easy to be bearish, but I think that we will see spreads tighten further (largely because of the “pain trade” element, but also due to the “safety” element).

- Enormous sums of money that have been allocated to private credit and distressed debt in anticipation of problems may need to be put to work. The “obvious” problems were the weak B credits and CCC credits in the leveraged loan universe. I can agree that this is where the “problems” arose. But if CLOs and private credit funds act like banks used to (“extend and pretend”), then the risk of default may be put off for some time. “Extend and pretend” occasionally is enough for a credit to recover, but it also tends to just delay default and result in lower recoveries. However, that won’t help those sitting on money meant for distressed investments. If the CLO market can open nicely for actual arbitrage deals (deals where non-sponsor/non-manager owned equity looks compelling), we could see a lot of buying interest in these loans that are supposed to be the problem. This could push the squeeze higher.

- Rethinking the “safety” of Treasuries. I remain convinced that we have only seen the start of investors being significantly underweight Treasuries in favor of other asset classes. High-quality investment grade credit is one of the obvious beneficiaries, but anything floating rate, things that don’t trade on a spread to Treasuries, and products that require more work (like ABS) will do very well. Heck, you could even argue that equities and crypto may deserve some “portion” of the allocation being channeled out of Treasuries. There are several reasons why assets trade at a spread to Treasuries

- Credit risk. Sure, but when was the last time a multinational/highly rated corporate credit haphazardly discussed not paying something on time? The U.S. government has, as recently as this summer. That is a somewhat frivolous argument, but when was the last IG default? The last time (on a quick glance) that CDX IG had a Credit Event was Series 25, launched in 2015! So, in the last 8 years we haven’t had a Credit Event in a CDX index (and my view is that the index committee is always in favor of more volatile names). So why are we getting such a big premium?

- Liquidity risk. Sure, Treasuries are more liquid, but most insurance companies, pension funds, and index funds rarely sell, so why “pay up” (give up yield) for liquidity that they will never use? Even large IG funds that are not indexed don’t tend to manage portfolios in an “actively” traded way, so why “pay up” and “give up” yield for liquidity? Treasury liquidity seems worse than it was years ago, so what are you really getting for that lower yield? Finally, if I had to bet on which bond market was susceptible to a “flash crash” scenario (in which bonds went up for sale, triggering stop loss after stop loss), I’d bet that this would occur in Treasuries before other markets based on market structure.

- Governance. ESG investing has had some fits and starts, but I strongly believe that one thing that has largely changed for the better is corporate governance. I generally like what I see in corporate governance and think that is beneficial to creditors. I do NOT like what I see out of D.C. in terms of debt management or fiscal responsibility.

- The Debt Diet. While corporations are governed for the benefit of shareholders, the boards are all well aware that if you mess up the debt too badly, the creditors are first in line and can destroy shareholder wealth quickly. So even if we get a mild recession, I expect that corporate governance will demonstrate that not just the top-rated credits deserve to trade at tighter spreads to Treasuries. The case for credit across the board to trade tighter than it does remains in place.

I’m not as bullish as I sound. We are near recent “tights”, I’m bearish on the economy, and this re-allocation will be a slow/long process, but I do like credit spreads here.

Bottom Line

I’m still in the “everything rally” camp.

- 10-year Treasury to 4.3%.

- S&P 500 to 4,600 but expect significant outperformance by the Russell 2000 and equal weighted indices.

- Credit spreads to grind tighter (with CDX outperforming cash and a target of 55 bps).

- At some point if the “Wayne’s World” rally continues, I’m going to have to behave even more immaturely to support it, but we haven’t yet reached “Beavis and Butt-Head” mode (at least I hope not).

I hope that you had a great Thanksgiving and are ready for the next few weeks as we power into year-end!

By Peter Tchir of Academy Securities

We Didn’t Learn a Whole Lot Last Week

Data was mixed. Unemployment claims were lower (a sign of strength), durable goods were weak, and Global PMIs were just above 50 (Goldilocks economy). While I don’t pay much attention to CONsumer CONfidence, it is interesting that one-year inflation expectations jumped from 3.2% to 4.5% in two months. That occurred while oil (often a proxy for CONsumer CONfidence inflation expectations) dropped, some major retailers warned about deflating prices, and as far as I can tell, everyone is having some sort of a sale, which doesn’t seem inflationary to me.

The 10-year Treasury inched higher, finishing at 4.47% (up from 4.44%, and it was as low as 4.39%). Since it was illiquid/holiday-oriented trading, we can probably ignore most of those moves as noise.

We also had NVDA earnings, which tend to serve as a “proxy” for AI. NVDA itself is down a touch since those earnings, but the markets as a whole have not suffered. That, along with the ongoing outperformance of the equal weighted indices and Russell 2000, is worth noting.

Since November 9th, the Russell 2000 has led the way, followed by the equal-weighted indices. That trend continued, and could be one of the more useful lessons of the week.

Ultimately, if AI is truly capable of generating efficiencies (today’s costs, versus today’s benefits) we should see more benefits accruing to companies that adopt and incorporate AI, thereby increasing earnings per share and multiples. So far, almost all of the AI benefits have accrued to the companies providing AI, which cannot last forever.

- Either AI works, and the broad economy and a wide swath of companies should benefit, or the current cost/benefit doesn’t work, in which case spending on AI will decrease as we move away from “hype” spending into critical analysis.

Personally, I’m in the “tide will lift all boats” camp but cannot deny that the current up-front costs versus value (especially at today’s higher cost of capital) may slow adoption. We will learn more as we get through year-end earnings and have more time to digest the true “success” stories, rather than just looking at certain investments which seem to be more about “keeping up with the Joneses’” rather than being fully incorporated into corporate strategy (which is a necessary condition for AI to be truly effective).

China

To get more of a sustained rally into year-end, we likely need some positive developments on the Chinese economy via some new deals with the U.S., more domestic stimulus, or some combination of the two. That is a bet that I’m still making for all the reasons listed in prior reports (Rally on Garth, Dictator, and More than a Photo Op).

Credit

CDS index spreads are hovering around their tightest levels of the year (CDX IG closed at 63). Corporate bond index spreads are at the lowest levels of the year (109 bps for the Bloomberg Corporate OAS). That is a little misleading, as the average maturity has been dropping all year (far fewer long-dated bonds have been issued this year relative to short-dated bonds because rates rose and the curve became less inverted).

High yield prices, while not back to levels seen at the start of the year, have rallied nicely and are trading well.

As a “contrarian” it would be easy to be bearish, but I think that we will see spreads tighten further (largely because of the “pain trade” element, but also due to the “safety” element).

- Enormous sums of money that have been allocated to private credit and distressed debt in anticipation of problems may need to be put to work. The “obvious” problems were the weak B credits and CCC credits in the leveraged loan universe. I can agree that this is where the “problems” arose. But if CLOs and private credit funds act like banks used to (“extend and pretend”), then the risk of default may be put off for some time. “Extend and pretend” occasionally is enough for a credit to recover, but it also tends to just delay default and result in lower recoveries. However, that won’t help those sitting on money meant for distressed investments. If the CLO market can open nicely for actual arbitrage deals (deals where non-sponsor/non-manager owned equity looks compelling), we could see a lot of buying interest in these loans that are supposed to be the problem. This could push the squeeze higher.

- Rethinking the “safety” of Treasuries. I remain convinced that we have only seen the start of investors being significantly underweight Treasuries in favor of other asset classes. High-quality investment grade credit is one of the obvious beneficiaries, but anything floating rate, things that don’t trade on a spread to Treasuries, and products that require more work (like ABS) will do very well. Heck, you could even argue that equities and crypto may deserve some “portion” of the allocation being channeled out of Treasuries. There are several reasons why assets trade at a spread to Treasuries

- Credit risk. Sure, but when was the last time a multinational/highly rated corporate credit haphazardly discussed not paying something on time? The U.S. government has, as recently as this summer. That is a somewhat frivolous argument, but when was the last IG default? The last time (on a quick glance) that CDX IG had a Credit Event was Series 25, launched in 2015! So, in the last 8 years we haven’t had a Credit Event in a CDX index (and my view is that the index committee is always in favor of more volatile names). So why are we getting such a big premium?

- Liquidity risk. Sure, Treasuries are more liquid, but most insurance companies, pension funds, and index funds rarely sell, so why “pay up” (give up yield) for liquidity that they will never use? Even large IG funds that are not indexed don’t tend to manage portfolios in an “actively” traded way, so why “pay up” and “give up” yield for liquidity? Treasury liquidity seems worse than it was years ago, so what are you really getting for that lower yield? Finally, if I had to bet on which bond market was susceptible to a “flash crash” scenario (in which bonds went up for sale, triggering stop loss after stop loss), I’d bet that this would occur in Treasuries before other markets based on market structure.

- Governance. ESG investing has had some fits and starts, but I strongly believe that one thing that has largely changed for the better is corporate governance. I generally like what I see in corporate governance and think that is beneficial to creditors. I do NOT like what I see out of D.C. in terms of debt management or fiscal responsibility.

- The Debt Diet. While corporations are governed for the benefit of shareholders, the boards are all well aware that if you mess up the debt too badly, the creditors are first in line and can destroy shareholder wealth quickly. So even if we get a mild recession, I expect that corporate governance will demonstrate that not just the top-rated credits deserve to trade at tighter spreads to Treasuries. The case for credit across the board to trade tighter than it does remains in place.

I’m not as bullish as I sound. We are near recent “tights”, I’m bearish on the economy, and this re-allocation will be a slow/long process, but I do like credit spreads here.

Bottom Line

I’m still in the “everything rally” camp.

- 10-year Treasury to 4.3%.

- S&P 500 to 4,600 but expect significant outperformance by the Russell 2000 and equal weighted indices.

- Credit spreads to grind tighter (with CDX outperforming cash and a target of 55 bps).

- At some point if the “Wayne’s World” rally continues, I’m going to have to behave even more immaturely to support it, but we haven’t yet reached “Beavis and Butt-Head” mode (at least I hope not).

I hope that you had a great Thanksgiving and are ready for the next few weeks as we power into year-end!

Loading…