Authored by Mike Shedlock via MishTalk.com,

An article in the Wall Street Journal wants to add discipline to deposit insurance. Discipline is sure needed, but not what the authors propose...

Headscratcher or Something Else

Please consider The Private Market Can Add Discipline to Deposit Insurance by Thomas D. Lehrman and Randal K. Quarles.

Following the collapse of Silicon Valley Bank, Signature Bank and First Republic Bank this spring, U.S. lawmakers have faced a policy head-scratcher. When bank runs happen on the internet, not at the teller’s window, how can the government ensure that smaller and regional banks can meet increased demands for liquidity during moments of panic? Excessive capital requirements would harm smaller banks more than larger ones, while reducing the demand for liquidity by increasing the amount of deposit insurance would create serious moral hazard.

Congress should revisit the idea of a public-private deposit-insurance program and add a new twist that draws on historical experience. To encourage the growth of the nuclear-energy industry, Congress passed the Price-Anderson Act in 1957, which established a federal insurance backstop for nuclear accidents. Following 9/11, Congress passed the Terrorism Risk Insurance Act to ensure customers could obtain terrorism coverage from property and casualty insurers.

Congress should learn from these laws and propose new public-private deposit-insurance legislation. The bill could require banks to provide private-sector deposit insurance up to a certain threshold per depositor—say $5 million—and mandate that at least 90% of total deposits of each bank be covered by a combination of FDIC and private insurance policies. There is already a model that legislators, regulators and banks could follow: Credit unions have offered excess deposit insurance through private-sector insurance companies for over two decades.

An added wrinkle: If a bank isn’t able to obtain private market insurance for 90% of its deposits during a given year, legislation could require the bank to pay a substantial premium over the private-market insurance rate of peer institutions for additional FDIC coverage. This pricing discipline would give the FDIC confidence that it’s reducing the risk of bank runs without encouraging bankers to act imprudently.

No Headscratcher

There should be no FDIC at all. Instead, what we need is a safekeeping bank.

Fed policies and actions precipitate excessive risk taking. Because of FDIC people have no skin in the game. This encourages people to shop for the best deal not the safest deal because there is no risk up to the FDIC limit.

And banks, following ludicrous Fed forward guidance, excessively speculate on outcomes.

There is no apparent risk now because risk happens all at once. Then, and as recently happened, the Fed had to take extraordinary actions to stop not just runs on a few banks, but runs on the entire system.

This is why the WSJ proposal will not work.

Need for a Genuine Safekeeping Bank

A genuine safekeeping bank is one that takes deposits and parks the entire amount in short-term treasuries. It make no loans and there is never any risk.

Deposits would earn a fluctuating interest rate that is the Fed’s overnight rate minus a safekeeping fee that allows the safe bank to pay its bills.

There is no need for FDIC because there is no risk. Under this proposal, banks cannot borrow short and lend long. Nor can they speculate on future interest rates.

Customers Free to Take Risk

Under my proposal, customers would be free to take risks and seek higher returns but that needs to be their risk.

Importantly, safe banks should not be punished for the risks other banks take.

If some private company, not the FDIC, wants to insure that risk, OK, fine. But ultimately, customers need to understand there is a risk to buying CDs offering interest higher than one can get in short term bonds.

Interest rate speculation blew up Silicon Valley Bank. The way to impose discipline is not another dubious Fed program by people proven to be oblivious to the problem.

The Fed and the FDIC were asleep at the wheel on SVB. The Fed has never called a recession in real time, and is totally clueless about what inflation is.

To fix the problem we need to start over.

How about creating a safekeeping bank that needs no insurance of any kind other than perhaps a token amount for fraud protection to ensure safe keeping banks are doing what’s required.

FDIC did not stop a run on SVB. Had it been a safekeeping bank, there never would have been a run in the first place.

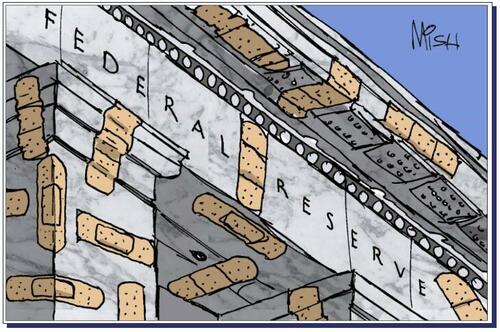

No Band-Aids Needed

Creation of a 100 percent safekeeping bank would in and of itself cause a stampede to safety if the proposal was implemented immediately.

Thus, we need to phase in my proposal until 100% of deposits in demand accounts are parked in short-term T-Bills and all CDs are backed by duration-matched US Treasuries, at every financial institution.

I have discussed this before. I bring it up again due to the proposal by Thomas D. Lehrman and Randal K. Quarles that does not solve the need for having a truly safe bank.

Once that is done, we can kill FDIC and let market rates and private insurance take over.

Discussion and 10 Details

For discussion and 10 specific details on what I propose, please see Dear FDIC and Fed, We Need a Genuine Safekeeping Bank, Not Band-Aids

Of the above, one key rule would have solved the mess at SVB: Banks should not speculate on interest rates.

To counter the claim that lending would cease, deposits don’t fund lending. Rather, lending creates deposits.

Q: Why Don’t We Have a Safekeeping Bank?

A: That’s easy. The Fed doesn’t want one.

Peter Schiff created one and the Fed forced Schiff out. Caitlin Long, CEO and founder of Custodia Bank, wants to create one and the Fed said no.

See the Fed press release: Federal Reserve Board announces denial of application by Custodia Bank, Inc. to become a member of the Federal Reserve System

The Fed does not want competition because it wants to eventually force you at some later date into using its own allegedly safe Central Bank Digital currency.

Meanwhile, expect more Band-Aids.

Irony of the Day Addendum – Legalized Fraud

Silicon Valley Bank, Signature Bank, and First Republic Bank failed due to classic runs on the bank. The banks took customer deposits and speculated on long-term interest rates. When the Fed hiked rates more than expected, bank losses mounted, the banks became insolvent, and customers pulled deposits.

This is a classic example of a duration mismatch scheme that I consider legalized fraud. Money that was supposed to be available on demand was not available on demand.

One cannot legally lease an apartment to two different parties at the same time. Anyone who tried would be quickly arrested. This is in essence what these banks did by investing for years money supposedly available on demand.

Because Custodia Bank does not make loans and because it holds deposits in short term treasuries, a run on Custodia Bank would not cause the bank to fail.

The big irony is the Fed refused to grant FDIC to a bank operating on the safest possible policies but fails to monitor massive speculation (arguably outright fraud) on banks right under its nose.

FDIC did not save foreign depositors at SVB who lost all their money.

Dollar Weaponization Expands – FDIC Message to Foreign Depositors Is Don’t Trust the US

For discussion of how FDIC outright failed foreign depositors, please see Dollar Weaponization Expands – FDIC Message to Foreign Depositors Is Don’t Trust the US

Authored by Mike Shedlock via MishTalk.com,

An article in the Wall Street Journal wants to add discipline to deposit insurance. Discipline is sure needed, but not what the authors propose…

Headscratcher or Something Else

Please consider The Private Market Can Add Discipline to Deposit Insurance by Thomas D. Lehrman and Randal K. Quarles.

Following the collapse of Silicon Valley Bank, Signature Bank and First Republic Bank this spring, U.S. lawmakers have faced a policy head-scratcher. When bank runs happen on the internet, not at the teller’s window, how can the government ensure that smaller and regional banks can meet increased demands for liquidity during moments of panic? Excessive capital requirements would harm smaller banks more than larger ones, while reducing the demand for liquidity by increasing the amount of deposit insurance would create serious moral hazard.

Congress should revisit the idea of a public-private deposit-insurance program and add a new twist that draws on historical experience. To encourage the growth of the nuclear-energy industry, Congress passed the Price-Anderson Act in 1957, which established a federal insurance backstop for nuclear accidents. Following 9/11, Congress passed the Terrorism Risk Insurance Act to ensure customers could obtain terrorism coverage from property and casualty insurers.

Congress should learn from these laws and propose new public-private deposit-insurance legislation. The bill could require banks to provide private-sector deposit insurance up to a certain threshold per depositor—say $5 million—and mandate that at least 90% of total deposits of each bank be covered by a combination of FDIC and private insurance policies. There is already a model that legislators, regulators and banks could follow: Credit unions have offered excess deposit insurance through private-sector insurance companies for over two decades.

An added wrinkle: If a bank isn’t able to obtain private market insurance for 90% of its deposits during a given year, legislation could require the bank to pay a substantial premium over the private-market insurance rate of peer institutions for additional FDIC coverage. This pricing discipline would give the FDIC confidence that it’s reducing the risk of bank runs without encouraging bankers to act imprudently.

No Headscratcher

There should be no FDIC at all. Instead, what we need is a safekeeping bank.

Fed policies and actions precipitate excessive risk taking. Because of FDIC people have no skin in the game. This encourages people to shop for the best deal not the safest deal because there is no risk up to the FDIC limit.

And banks, following ludicrous Fed forward guidance, excessively speculate on outcomes.

There is no apparent risk now because risk happens all at once. Then, and as recently happened, the Fed had to take extraordinary actions to stop not just runs on a few banks, but runs on the entire system.

This is why the WSJ proposal will not work.

Need for a Genuine Safekeeping Bank

A genuine safekeeping bank is one that takes deposits and parks the entire amount in short-term treasuries. It make no loans and there is never any risk.

Deposits would earn a fluctuating interest rate that is the Fed’s overnight rate minus a safekeeping fee that allows the safe bank to pay its bills.

There is no need for FDIC because there is no risk. Under this proposal, banks cannot borrow short and lend long. Nor can they speculate on future interest rates.

Customers Free to Take Risk

Under my proposal, customers would be free to take risks and seek higher returns but that needs to be their risk.

Importantly, safe banks should not be punished for the risks other banks take.

If some private company, not the FDIC, wants to insure that risk, OK, fine. But ultimately, customers need to understand there is a risk to buying CDs offering interest higher than one can get in short term bonds.

Interest rate speculation blew up Silicon Valley Bank. The way to impose discipline is not another dubious Fed program by people proven to be oblivious to the problem.

The Fed and the FDIC were asleep at the wheel on SVB. The Fed has never called a recession in real time, and is totally clueless about what inflation is.

To fix the problem we need to start over.

How about creating a safekeeping bank that needs no insurance of any kind other than perhaps a token amount for fraud protection to ensure safe keeping banks are doing what’s required.

FDIC did not stop a run on SVB. Had it been a safekeeping bank, there never would have been a run in the first place.

No Band-Aids Needed

Creation of a 100 percent safekeeping bank would in and of itself cause a stampede to safety if the proposal was implemented immediately.

Thus, we need to phase in my proposal until 100% of deposits in demand accounts are parked in short-term T-Bills and all CDs are backed by duration-matched US Treasuries, at every financial institution.

I have discussed this before. I bring it up again due to the proposal by Thomas D. Lehrman and Randal K. Quarles that does not solve the need for having a truly safe bank.

Once that is done, we can kill FDIC and let market rates and private insurance take over.

Discussion and 10 Details

For discussion and 10 specific details on what I propose, please see Dear FDIC and Fed, We Need a Genuine Safekeeping Bank, Not Band-Aids

Of the above, one key rule would have solved the mess at SVB: Banks should not speculate on interest rates.

To counter the claim that lending would cease, deposits don’t fund lending. Rather, lending creates deposits.

Q: Why Don’t We Have a Safekeeping Bank?

A: That’s easy. The Fed doesn’t want one.

Peter Schiff created one and the Fed forced Schiff out. Caitlin Long, CEO and founder of Custodia Bank, wants to create one and the Fed said no.

See the Fed press release: Federal Reserve Board announces denial of application by Custodia Bank, Inc. to become a member of the Federal Reserve System

The Fed does not want competition because it wants to eventually force you at some later date into using its own allegedly safe Central Bank Digital currency.

Meanwhile, expect more Band-Aids.

Irony of the Day Addendum – Legalized Fraud

Silicon Valley Bank, Signature Bank, and First Republic Bank failed due to classic runs on the bank. The banks took customer deposits and speculated on long-term interest rates. When the Fed hiked rates more than expected, bank losses mounted, the banks became insolvent, and customers pulled deposits.

This is a classic example of a duration mismatch scheme that I consider legalized fraud. Money that was supposed to be available on demand was not available on demand.

One cannot legally lease an apartment to two different parties at the same time. Anyone who tried would be quickly arrested. This is in essence what these banks did by investing for years money supposedly available on demand.

Because Custodia Bank does not make loans and because it holds deposits in short term treasuries, a run on Custodia Bank would not cause the bank to fail.

The big irony is the Fed refused to grant FDIC to a bank operating on the safest possible policies but fails to monitor massive speculation (arguably outright fraud) on banks right under its nose.

FDIC did not save foreign depositors at SVB who lost all their money.

Dollar Weaponization Expands – FDIC Message to Foreign Depositors Is Don’t Trust the US

For discussion of how FDIC outright failed foreign depositors, please see Dollar Weaponization Expands – FDIC Message to Foreign Depositors Is Don’t Trust the US

Loading…