"Clearly you don’t want to own bonds and stocks."

Those were the ominous words uttered by billionaire hedge fund manager Paul Tudor Jones (PTJ) this morning during an extensive interview on CNBC's 'Squawk Box'.

With The Fed expected to hike by 50bps tomorrow (and the short-term interest-rate market starting to price in 75bps for June) and 10 more hikes for the full-year... as financial conditions tighten and the economy contracts, CNBC reports that the founder and chief investment officer of Tudor Investment Corp. believes that we are now in “uncharted territory” as the central bank had only eased monetary policy during past economic slowdowns and financial crises.

Specifically, PTJ warned investors to prioritize capital preservation in such a challenging environment for “virtually anything.”

“I think we’re in one of those very difficult periods where simply capital preservation is I think the most important thing we can strive for,” Jones said.

“I don’t know if it’s going to be one of those periods where you’re actually trying to make money.”

It's not just investors that are in 'uncharted territory' as The Fed faces global stagflation...

Jones fears The Fed's actions will tip the US economy into recession...

“They’ve got inflation on the one hand, slowing growth on the other, and they’re going to be clashing all the time,” Jones said.

Finally, PTJ's world-view can be summed up with this simple statement that he shocked the CNBC anchors with...

“You can’t think of a worse environment than where we are right now for financial assets.”

"You can't think of a worse macro environment than now," says @ptj_official. "Even with the tightening of financial conditions, the Fed still probably has to raise rates to get inflation under control." pic.twitter.com/grC0LgEnr2

— Squawk Box (@SquawkCNBC) May 3, 2022

However, Jones does believe in buying one asset in this environment: "it's hard to not want to be long crypto"...

Billionaire Paul Tudor Jones: it’s hard to not want to be long on crypto pic.twitter.com/gs8dQ3IwEr

— frxresearch 🔶 (@frxresearch) May 3, 2022

And yet the world of commission-rakers and asset-gatherers continue to press the silver-lining just over the horizon and the term "priced in" morphs to a whole new meaning.

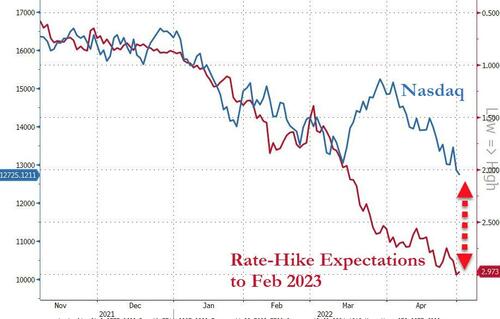

Some markets are "pricing-in" The Fed, others aren't... yet.

“Clearly you don’t want to own bonds and stocks.”

Those were the ominous words uttered by billionaire hedge fund manager Paul Tudor Jones (PTJ) this morning during an extensive interview on CNBC’s ‘Squawk Box’.

With The Fed expected to hike by 50bps tomorrow (and the short-term interest-rate market starting to price in 75bps for June) and 10 more hikes for the full-year… as financial conditions tighten and the economy contracts, CNBC reports that the founder and chief investment officer of Tudor Investment Corp. believes that we are now in “uncharted territory” as the central bank had only eased monetary policy during past economic slowdowns and financial crises.

Specifically, PTJ warned investors to prioritize capital preservation in such a challenging environment for “virtually anything.”

“I think we’re in one of those very difficult periods where simply capital preservation is I think the most important thing we can strive for,” Jones said.

“I don’t know if it’s going to be one of those periods where you’re actually trying to make money.”

It’s not just investors that are in ‘uncharted territory’ as The Fed faces global stagflation…

Jones fears The Fed’s actions will tip the US economy into recession…

“They’ve got inflation on the one hand, slowing growth on the other, and they’re going to be clashing all the time,” Jones said.

Finally, PTJ’s world-view can be summed up with this simple statement that he shocked the CNBC anchors with…

“You can’t think of a worse environment than where we are right now for financial assets.”

“You can’t think of a worse macro environment than now,” says @ptj_official. “Even with the tightening of financial conditions, the Fed still probably has to raise rates to get inflation under control.” pic.twitter.com/grC0LgEnr2

— Squawk Box (@SquawkCNBC) May 3, 2022

However, Jones does believe in buying one asset in this environment: “it’s hard to not want to be long crypto”…

Billionaire Paul Tudor Jones: it’s hard to not want to be long on crypto pic.twitter.com/gs8dQ3IwEr

— frxresearch 🔶 (@frxresearch) May 3, 2022

And yet the world of commission-rakers and asset-gatherers continue to press the silver-lining just over the horizon and the term “priced in” morphs to a whole new meaning.

Some markets are “pricing-in” The Fed, others aren’t… yet.