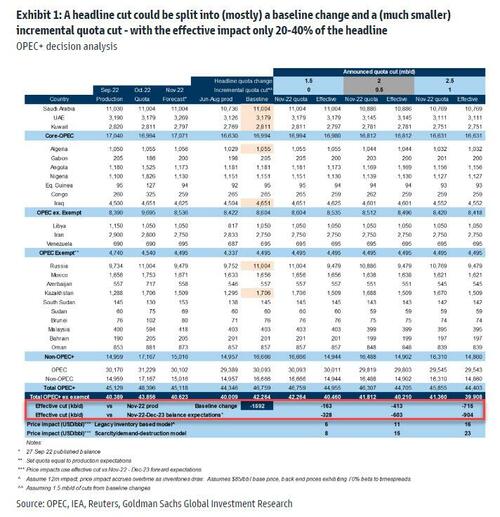

On the surface, the OPEC+ headline cut of 2mb/d sounds very large, but the cut is from baselines and there were no revisions to the baselines... which means that to figure out the real impact of the "gross" cut one needs to net out countries which are already producing well below their quotas.

As Goldman's Damien Courvalin writes, given Russia is under-producing by c.1.3 mb/d versus its current quotas, it would need to be exempted for a 2mb/d cut to add up. Additionally, Russia is unlikely to allow for a quota much below its capacity. Meanwhile, the other countries in the aforementioned list have not displayed the level of capacity erosion observed in much of the rest of OPEC+.

From this alternative perspective, Goldman believes that such a baseline adjustment is worth approximately 1.5 mb/d alone (even excluding a Russia rebasement). As such, the bank believes that the 2mb/d headline OPEC+ cut would only be implemented as an incremental 0.5 mb/d quota cut on top of such a baseline change.

Net, this only amounts to an effective cut of 400-600 mb/d versus Goldman's expected November/Nov-22 - Dec-23 expectations from the bank's 27-Sep-22 balances respectively. This is very similar to the 1mb/d announced quota cut scenario from the bank's previous report, which we discussed here.

More in the full Goldman note available to pro subs.

Energy Intel's Amena Bakr confirm's Goldman's math:

- Here is the answer: Adjust downward the overall production by 2 mb/d, from the August 2022 required production levels, starting November 2022 for OPEC and Non-OPEC Participating Countries

- This means an actual cut of a little under 1 million bpd

This means an actual cut of a little under 1 million bpd #OOTT

— Amena Bakr (@Amena__Bakr) October 5, 2022

As a bonus, here is Bloomberg commodity guru Julian Lee with his initial calculation of what the new targets would look like for key OPEC+ members (in thousand barrels a day):

- Saudi Arabia and Russia: 10,481 from 11,004

- UAE: 3,028 from 3,179

- Kuwait: 2,544 from 2,811

- Iraq: 4,430 from 4,651

- OPEC-10: 25,421 from 26,689

- OPEC+: 41,856 from 43,856

On the surface, the OPEC+ headline cut of 2mb/d sounds very large, but the cut is from baselines and there were no revisions to the baselines… which means that to figure out the real impact of the “gross” cut one needs to net out countries which are already producing well below their quotas.

As Goldman’s Damien Courvalin writes, given Russia is under-producing by c.1.3 mb/d versus its current quotas, it would need to be exempted for a 2mb/d cut to add up. Additionally, Russia is unlikely to allow for a quota much below its capacity. Meanwhile, the other countries in the aforementioned list have not displayed the level of capacity erosion observed in much of the rest of OPEC+.

From this alternative perspective, Goldman believes that such a baseline adjustment is worth approximately 1.5 mb/d alone (even excluding a Russia rebasement). As such, the bank believes that the 2mb/d headline OPEC+ cut would only be implemented as an incremental 0.5 mb/d quota cut on top of such a baseline change.

Net, this only amounts to an effective cut of 400-600 mb/d versus Goldman’s expected November/Nov-22 – Dec-23 expectations from the bank’s 27-Sep-22 balances respectively. This is very similar to the 1mb/d announced quota cut scenario from the bank’s previous report, which we discussed here.

More in the full Goldman note available to pro subs.

Energy Intel’s Amena Bakr confirm’s Goldman’s math:

- Here is the answer: Adjust downward the overall production by 2 mb/d, from the August 2022 required production levels, starting November 2022 for OPEC and Non-OPEC Participating Countries

- This means an actual cut of a little under 1 million bpd

This means an actual cut of a little under 1 million bpd #OOTT

— Amena Bakr (@Amena__Bakr) October 5, 2022

Finally, the clearest answer comes from Saudi Energy Minister Abdulaziz bin Salman, who confirmed that “the actual drop will be between 1 and 1.1 million barrels a day.“