Authored by Charles Hugh Smith via OfTwoMinds blog,

The unencumbered realist concludes that there are no solutions within a status quo structure that is itself the problem.

Realists who question received wisdom and conclude the status quo is untenable are quickly labeled pessimists because the zeitgeist expects a solution is always at hand--preferably a technocratic one that requires zero sacrifice and doesn't upset the status quo apple cart.

Realists ask "what if" without selecting the "solution" first. The conventional approach is to select the "answer/solution" first and then design the question and cherry-pick the evidence to support the pre-selected "solution."

What if all the status quo "solutions" don't actually address the real problems? This line of inquiry is strictly verboten, for there must be a solution that solves everything in one fell swoop.

Examples of this approach abound: a one-size fits all solution that resolves all the systemic problems by itself. All we have to do is implement it.

Replacing fiat currencies is one example that I have explored:

You Want Truly "Sound Money"? A Thought Experiment

Contrarian Thoughts on the Petro-Yuan and Gold-Backed Currencies

I've also explored how real change works: it takes many years (or even decades) of sacrifices and high costs with none of the immediate payoff we now expect as a birthright. Real change pits those benefiting from the status quo against those finally grasp that the status quo is the problem, not the solution, and these political/social battles are endless and brutal because any gains come at somebody else's expense.

The Forgotten History of the 1970s

The 1970s: From Rotting Carcasses Floating in the River to Kayak Races

Fiat currencies contain the seeds of their own self-destruction, but establishing a gold or bitcoin standard creates its own problems. As I explained in the essays listed above, trade imbalances are inherent in a world of scarcity and so exporters of essentials will end up with all the gold / bitcoin and the importers of essentials will end up with no gold or bitcoin, and no means to buy exports. Since the exporting economies are mercantilist by nature, they cannot import enough from their customers to balance trade asymmetries.

The other problem with the gold / bitcoin standard is there is nothing inherently decentralized, equitable or democratic about these standards. In other words, any standard based on wealth distributed by scarcity is inherently neofeudal, as the wealthy / powerful acquire asymmetric ownership of all forms of wealth and use this to buy political influence to maintain this asymmetry to their advantage.

Wealth and political power are two sides of the same coin, and so the majority of gold / bitcoin / quatloos / land always end up in the hands or control of the few.

This asymmetry then enable the few to influence political processes to defend their ownership / control and lower the costs of their dominance while increasing the costs / taxes paid by the peasantry.

The ownership/control of gold and bitcoin is already extremely asymmetric, and making either the sole form of "money" will greatly benefit the few who already own/control these assets. The few peasants who acquire a gold coin or slice of bitcoin will remain as powerless as the majority who own none.

This doesn't mean I don't see the value of precious metals or cryptocurrencies, it simply means I recognize that all forms of "money" distributed by scarcity or power are inherently asymmetric, which means the few always gain a consequential share of these assets, just as they acquire a consequential share of all other assets. Neither gold nor 'bitcoin are immune from this dynamic, which is inherent to all assets distributed by scarcity or power, be it existing wealth or political/financial power.

The Pareto Distribution is rather ruthless. The top 20% eventually end up with 80% of the assets even when everyone starts with the same stake (an historical rarity, to be sure).

The real problem is what happens within the top 20%. If centralized power holds sway (and defends its perquisites), then the bottom 19.9% in the top 20% are slowly stripmined of wealth and power, leaving the vast majority of consequential wealth and political power in a tiny elite at the top.

There is nothing inherent in a gold or bitcoin standard that precludes this concentration / centralization of ownership. There are numerous historical examples of how this dynamic concentrates wealth and political power at the expense of social / economic stability. (Late-era Western Rome, to name but one of many.)

To be a real solution, "money" has to be inherently decentralized in distribution and ownership, inherently equitable (i.e. not distributed by power/scarcity) and inherently democratic, i.e. the way it is created precludes the concentration of wealth and power. I have proposed one such solution, a labor-backed currency, i.e. a currency that is originated and distributed solely in exchange for human labor. (I explain how this might work in my book A Radically Beneficial World.)

Yes, it's pie-in-the-sky, blah-blah-blah, but let's not confuse "solutions" that maintain the status quo with real solutions. Real solutions upend the status quo, not just little pieces of the status quo but the entirety of the power structure of concentrated wealth and power.

Meet the new boss, same as the old boss is not a solution, it's simply substituting another team at the top. Asymmetries guarantee that some will always be more equal than others.

True decentralization is hard because as I explain in Global Crisis, National Renewal, it requires a social revolution that renders the existing structure no longer acceptable. Financial or political tweaks aren't enough. Real change requires a complete transformation of values at the most profound level.

The same problem applies to all the techno-"solutions" of endless energy. All this endless energy will be owned / controlled by the few at the top of the highly centralized status quo, and this asymmetry guarantees that the few will benefit from the endless energy at the expense of the many politically powerless peasants.

The unencumbered realist concludes that there are no solutions within a status quo structure that is itself the problem. The "solutions" being offered substitute another neofeudal asymmetry for the existing neofeudal asymmetry.

We all want solutions, but let's not fool ourselves into believing that changing pieces of finance or politics will actually solve the big problems of centralization (i.e. inequality and corruption) and the fantasy of endless expansion on a finite planet via our "waste is growth" Landfill Economy. If a "solution" doesn't directly resolve those problems, it isn't a real solution.

The only real solutions require changing our own lives rather than engaging in fantasies that new asymmetries in centralized systems will transform a status quo doomed by asymmetries.

Realists are neither optimists or pessimists, they focus on increasing what they directly control by advancing their Self-Reliance.

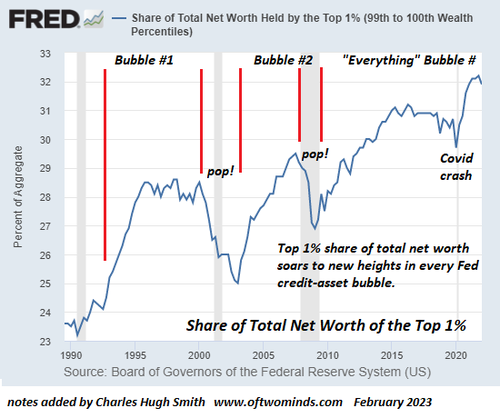

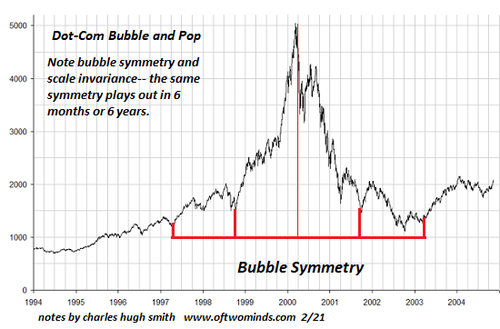

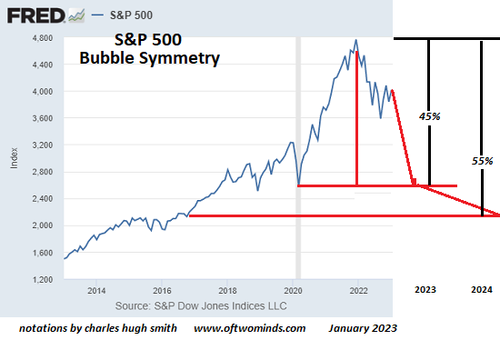

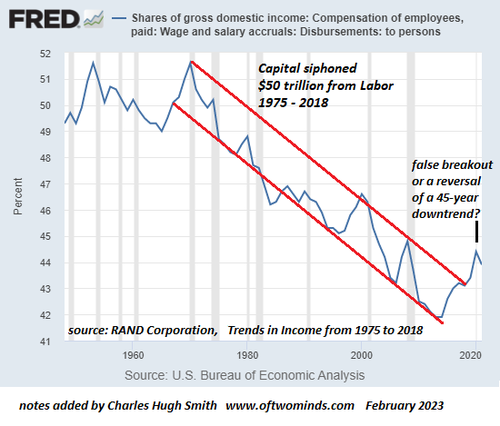

These charts tell the story...

* * *

New Podcast: Turmoil Ahead As We Enter The New Era Of 'Scarcity' (53 min)

* * *

My new book is now available at a 10% discount ($8.95 ebook, $18 print): Self-Reliance in the 21st Century. Read the first chapter for free (PDF)

Authored by Charles Hugh Smith via OfTwoMinds blog,

The unencumbered realist concludes that there are no solutions within a status quo structure that is itself the problem.

Realists who question received wisdom and conclude the status quo is untenable are quickly labeled pessimists because the zeitgeist expects a solution is always at hand–preferably a technocratic one that requires zero sacrifice and doesn’t upset the status quo apple cart.

Realists ask “what if” without selecting the “solution” first. The conventional approach is to select the “answer/solution” first and then design the question and cherry-pick the evidence to support the pre-selected “solution.”

What if all the status quo “solutions” don’t actually address the real problems? This line of inquiry is strictly verboten, for there must be a solution that solves everything in one fell swoop.

Examples of this approach abound: a one-size fits all solution that resolves all the systemic problems by itself. All we have to do is implement it.

Replacing fiat currencies is one example that I have explored:

You Want Truly “Sound Money”? A Thought Experiment

Contrarian Thoughts on the Petro-Yuan and Gold-Backed Currencies

I’ve also explored how real change works: it takes many years (or even decades) of sacrifices and high costs with none of the immediate payoff we now expect as a birthright. Real change pits those benefiting from the status quo against those finally grasp that the status quo is the problem, not the solution, and these political/social battles are endless and brutal because any gains come at somebody else’s expense.

The Forgotten History of the 1970s

The 1970s: From Rotting Carcasses Floating in the River to Kayak Races

Fiat currencies contain the seeds of their own self-destruction, but establishing a gold or bitcoin standard creates its own problems. As I explained in the essays listed above, trade imbalances are inherent in a world of scarcity and so exporters of essentials will end up with all the gold / bitcoin and the importers of essentials will end up with no gold or bitcoin, and no means to buy exports. Since the exporting economies are mercantilist by nature, they cannot import enough from their customers to balance trade asymmetries.

The other problem with the gold / bitcoin standard is there is nothing inherently decentralized, equitable or democratic about these standards. In other words, any standard based on wealth distributed by scarcity is inherently neofeudal, as the wealthy / powerful acquire asymmetric ownership of all forms of wealth and use this to buy political influence to maintain this asymmetry to their advantage.

Wealth and political power are two sides of the same coin, and so the majority of gold / bitcoin / quatloos / land always end up in the hands or control of the few.

This asymmetry then enable the few to influence political processes to defend their ownership / control and lower the costs of their dominance while increasing the costs / taxes paid by the peasantry.

The ownership/control of gold and bitcoin is already extremely asymmetric, and making either the sole form of “money” will greatly benefit the few who already own/control these assets. The few peasants who acquire a gold coin or slice of bitcoin will remain as powerless as the majority who own none.

This doesn’t mean I don’t see the value of precious metals or cryptocurrencies, it simply means I recognize that all forms of “money” distributed by scarcity or power are inherently asymmetric, which means the few always gain a consequential share of these assets, just as they acquire a consequential share of all other assets. Neither gold nor ‘bitcoin are immune from this dynamic, which is inherent to all assets distributed by scarcity or power, be it existing wealth or political/financial power.

The Pareto Distribution is rather ruthless. The top 20% eventually end up with 80% of the assets even when everyone starts with the same stake (an historical rarity, to be sure).

The real problem is what happens within the top 20%. If centralized power holds sway (and defends its perquisites), then the bottom 19.9% in the top 20% are slowly stripmined of wealth and power, leaving the vast majority of consequential wealth and political power in a tiny elite at the top.

There is nothing inherent in a gold or bitcoin standard that precludes this concentration / centralization of ownership. There are numerous historical examples of how this dynamic concentrates wealth and political power at the expense of social / economic stability. (Late-era Western Rome, to name but one of many.)

To be a real solution, “money” has to be inherently decentralized in distribution and ownership, inherently equitable (i.e. not distributed by power/scarcity) and inherently democratic, i.e. the way it is created precludes the concentration of wealth and power. I have proposed one such solution, a labor-backed currency, i.e. a currency that is originated and distributed solely in exchange for human labor. (I explain how this might work in my book A Radically Beneficial World.)

Yes, it’s pie-in-the-sky, blah-blah-blah, but let’s not confuse “solutions” that maintain the status quo with real solutions. Real solutions upend the status quo, not just little pieces of the status quo but the entirety of the power structure of concentrated wealth and power.

Meet the new boss, same as the old boss is not a solution, it’s simply substituting another team at the top. Asymmetries guarantee that some will always be more equal than others.

True decentralization is hard because as I explain in Global Crisis, National Renewal, it requires a social revolution that renders the existing structure no longer acceptable. Financial or political tweaks aren’t enough. Real change requires a complete transformation of values at the most profound level.

The same problem applies to all the techno-“solutions” of endless energy. All this endless energy will be owned / controlled by the few at the top of the highly centralized status quo, and this asymmetry guarantees that the few will benefit from the endless energy at the expense of the many politically powerless peasants.

The unencumbered realist concludes that there are no solutions within a status quo structure that is itself the problem. The “solutions” being offered substitute another neofeudal asymmetry for the existing neofeudal asymmetry.

We all want solutions, but let’s not fool ourselves into believing that changing pieces of finance or politics will actually solve the big problems of centralization (i.e. inequality and corruption) and the fantasy of endless expansion on a finite planet via our “waste is growth” Landfill Economy. If a “solution” doesn’t directly resolve those problems, it isn’t a real solution.

The only real solutions require changing our own lives rather than engaging in fantasies that new asymmetries in centralized systems will transform a status quo doomed by asymmetries.

Realists are neither optimists or pessimists, they focus on increasing what they directly control by advancing their Self-Reliance.

These charts tell the story…

* * *

New Podcast: Turmoil Ahead As We Enter The New Era Of ‘Scarcity’ (53 min)

[embedded content]

* * *

My new book is now available at a 10% discount ($8.95 ebook, $18 print): Self-Reliance in the 21st Century. Read the first chapter for free (PDF)

Loading…