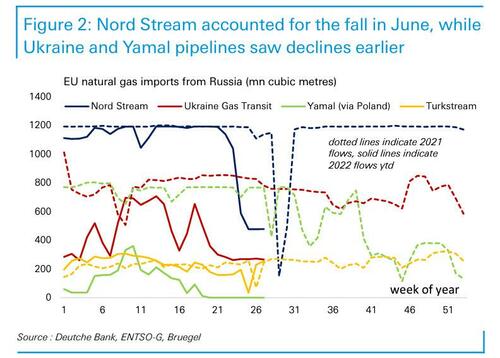

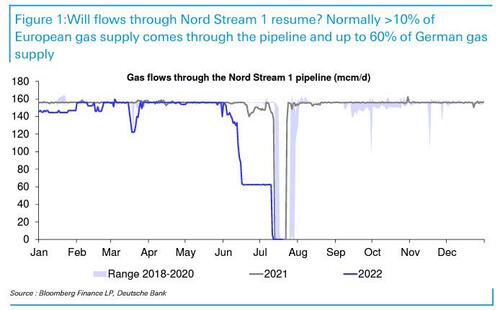

Over the last 24 hours it has become, Deutsche Bank's Jim Reid writes, clearer that Russia will recommence gas flows when the Nord Stream pipeline reopens tomorrow. Indeed, Putin’s comments last night and again this morning, suggest we should have initial flows at the pre-maintenance volumes of 40% capacity.

To be sure, in light of "Doomsday" expectations as recently as one week ago, it is safe to say this is notably better and quicker than the worst case assumed by economists and pundits over the last couple of weeks. However, as Reid notes, there are near-term hurdles: even with the return of the turbine under maintenance in Canada that is expected back next week, Putin has warned that another turbine will require works around July 26th and, if the turbine that was in Canada does not return, then capacity may drop to 20%.

There are also doubts that Putin’s claims should be taken at face value, with German officials saying earlier this week that the turbine being returned from Canada was not due to be used until September, although with Putin calling all the shots, it's not like Germany can do anything about this.

Incidentally, overnight Goldman energy analyst Samantha Dart looked at the question of what changes with the return of the NS1 turbine from Canada. Her response? "Not much." She adds that "despite the recent focus around the timing of the repaired turbine’s return to Russia, now expected around Jul 24th, after NS1 maintenance is scheduled to end, we don’t believe this will be the sole driver of NS1 flows. In addition to the opaqueness behind the scale of the volume curtailments via NS1 last month, the absence of any Gazprom-driven re-routing of the reduced flows via an alternative pipeline to mitigate the impact to supply suggest Russia’s gas exports are as much a political/economic decision as a technical one."

They sure are, but in any case, according to Deutsche Bank if we do manage constant 40% flows, the bank believes that Germany can just about get through the winter with a mild demand curtailment and quite high gas imports from other countries (including indirect LNG imports).

In summary, Reid warns to "expect the uncertainty to continue for many months and potential gas flows be linked to various geopolitical themes such as a cease-fire with Ukraine, Russian oil caps etc." Furthermore, it’s unlikely that even if supply does hit 40% that you will have any certainty that it will remain there.

As such, Europe will be planning for reduced energy consumption this winter which will hit growth and push the continent into recession. Uncertainty will remain for the next few quarters but the news flow has been more positive for Europe over the last 24 hours.

For more on this topic Deutsche Bank has published a lengthy note "Thoughts ahead of scheduled NS1 re-opening" available to pro subscribers.

Over the last 24 hours it has become, Deutsche Bank’s Jim Reid writes, clearer that Russia will recommence gas flows when the Nord Stream pipeline reopens tomorrow. Indeed, Putin’s comments last night and again this morning, suggest we should have initial flows at the pre-maintenance volumes of 40% capacity.

To be sure, in light of “Doomsday” expectations as recently as one week ago, it is safe to say this is notably better and quicker than the worst case assumed by economists and pundits over the last couple of weeks. However, as Reid notes, there are near-term hurdles: even with the return of the turbine under maintenance in Canada that is expected back next week, Putin has warned that another turbine will require works around July 26th and, if the turbine that was in Canada does not return, then capacity may drop to 20%.

There are also doubts that Putin’s claims should be taken at face value, with German officials saying earlier this week that the turbine being returned from Canada was not due to be used until September, although with Putin calling all the shots, it’s not like Germany can do anything about this.

Incidentally, overnight Goldman energy analyst Samantha Dart looked at the question of what changes with the return of the NS1 turbine from Canada. Her response? “Not much.” She adds that “despite the recent focus around the timing of the repaired turbine’s return to Russia, now expected around Jul 24th, after NS1 maintenance is scheduled to end, we don’t believe this will be the sole driver of NS1 flows. In addition to the opaqueness behind the scale of the volume curtailments via NS1 last month, the absence of any Gazprom-driven re-routing of the reduced flows via an alternative pipeline to mitigate the impact to supply suggest Russia’s gas exports are as much a political/economic decision as a technical one.”

They sure are, but in any case, according to Deutsche Bank if we do manage constant 40% flows, the bank believes that Germany can just about get through the winter with a mild demand curtailment and quite high gas imports from other countries (including indirect LNG imports).

In summary, Reid warns to “expect the uncertainty to continue for many months and potential gas flows be linked to various geopolitical themes such as a cease-fire with Ukraine, Russian oil caps etc.” Furthermore, it’s unlikely that even if supply does hit 40% that you will have any certainty that it will remain there.

As such, Europe will be planning for reduced energy consumption this winter which will hit growth and push the continent into recession. Uncertainty will remain for the next few quarters but the news flow has been more positive for Europe over the last 24 hours.

For more on this topic Deutsche Bank has published a lengthy note “Thoughts ahead of scheduled NS1 re-opening” available to pro subscribers.