By Ye Xie Bloomberg Markets Live commentator and reporter

China’s Politburo meeting for July, which usually takes place at the end of the month, sets the agenda for the rest of the year.

While the meeting of the top 25 policy makers rarely delves into specifics, it could provide some guidance on a more-realistic growth target, a continuation of Covid policies and limited support for the struggling housing market. The bottom line is that no major policy overhaul is expected.

Here are some key areas to look for.

-

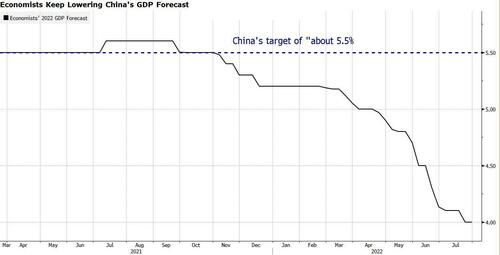

GDP target. The 5.5% GDP target, which was set in March before the latest Covid outbreaks, has long been viewed as unreachable. After the economy grew only 2.5% in the first half, China needs to deliver a growth rate of more than 8% for the second half to hit the target. Earlier this month, Premier Li Keqiang hinted that a lower growth rate is “acceptable” as long as employment and prices are stable. A number of economists, including Bloomberg Economics, have penciled in a growth rate of about 3%. An official nod from the Politburo of a more realistic target won’t be a total surprise.

-

Stimulus plans. A lower GDP target means any large-scale stimulus is not in the cards. Standard Chartered’s economists, including Ding Shuang, expect Beijing to bring forward 1.5 trillion yuan of next year’s local special-bond quota to support investment. Citigroup’s economist Xiangrong Xu and Xiaowen Jin said the Politburo could give hints about other options, including special bonds from the central government, more profit transfer from the PBOC to the Ministry of Finance, or a general budget revision.

-

Covid policies. Few expect Beijing to shift away from the Zero Covid policy before President Xi seeks a third term later this year. Still, Beijing may be laying some groundwork for the eventual exit. Over the weekend, China made a rare revelation that all of its leaders received locally-made Covid-19 shots. The move aims to demonstrate the safety and effectiveness of domestic vaccines. The disclosure and renewed campaigns to vaccinate the elderly in multiple cities suggest that “the government may have decided to put in place the conditions required for an eventual exit from COVID-zero,” wrote Standard Chartered’s Ding.

-

Housing market. Property investment fell by 5.4% in the first half of the year, on track for the first annual decline. While the Politburo meeting will most likely reiterate the mantra of “housing is for living, not for speculation,” it could soften that stance by mentioning plans to stabilize property prices and support reasonable home demand, according to Larry Hu from Macquarie.

By Ye Xie Bloomberg Markets Live commentator and reporter

China’s Politburo meeting for July, which usually takes place at the end of the month, sets the agenda for the rest of the year.

While the meeting of the top 25 policy makers rarely delves into specifics, it could provide some guidance on a more-realistic growth target, a continuation of Covid policies and limited support for the struggling housing market. The bottom line is that no major policy overhaul is expected.

Here are some key areas to look for.

-

GDP target. The 5.5% GDP target, which was set in March before the latest Covid outbreaks, has long been viewed as unreachable. After the economy grew only 2.5% in the first half, China needs to deliver a growth rate of more than 8% for the second half to hit the target. Earlier this month, Premier Li Keqiang hinted that a lower growth rate is “acceptable” as long as employment and prices are stable. A number of economists, including Bloomberg Economics, have penciled in a growth rate of about 3%. An official nod from the Politburo of a more realistic target won’t be a total surprise.

-

Stimulus plans. A lower GDP target means any large-scale stimulus is not in the cards. Standard Chartered’s economists, including Ding Shuang, expect Beijing to bring forward 1.5 trillion yuan of next year’s local special-bond quota to support investment. Citigroup’s economist Xiangrong Xu and Xiaowen Jin said the Politburo could give hints about other options, including special bonds from the central government, more profit transfer from the PBOC to the Ministry of Finance, or a general budget revision.

-

Covid policies. Few expect Beijing to shift away from the Zero Covid policy before President Xi seeks a third term later this year. Still, Beijing may be laying some groundwork for the eventual exit. Over the weekend, China made a rare revelation that all of its leaders received locally-made Covid-19 shots. The move aims to demonstrate the safety and effectiveness of domestic vaccines. The disclosure and renewed campaigns to vaccinate the elderly in multiple cities suggest that “the government may have decided to put in place the conditions required for an eventual exit from COVID-zero,” wrote Standard Chartered’s Ding.

-

Housing market. Property investment fell by 5.4% in the first half of the year, on track for the first annual decline. While the Politburo meeting will most likely reiterate the mantra of “housing is for living, not for speculation,” it could soften that stance by mentioning plans to stabilize property prices and support reasonable home demand, according to Larry Hu from Macquarie.