With the eventual introduction of central bank digital currency (CBDCs) now seemingly inevitable, there are a lot of directions central banks could take with their digital currency projects that would have dramatic implications for the price of gold.

Touted for their “convenience” and “efficiency,” the endgame of digital currencies is not only achieving greater power over the currency but also a means of surveilling and micromanaging the personal finances of each individual. Owe taxes or a parking ticket? It could be automatically deducted. Does the Fed think it needs to cool inflation? Deduct money straight from people’s accounts, or impose a daily spending limit. The possibilities for control and profit are endless, and too tempting for control freak bureaucracies and amoral tech companies to ignore.

As countries like China implement their own CBDCs, buy more precious metals, and generally buck dependence on the US dollar for trade, Western central banks also feel like they have to compete in order to retain their power. That’s the essence of the other motivation for CBDCs — a currency race between East and West wherein the winner solidifies not only unprecedented control over its own citizenry but a place atop the global power structure for the next century or longer.

Since CBDCs and the idea of a “cashless society” are mostly about increasing centralization and control on the societal and individual level, it’s easy to see how they might be accompanied by new legislation banning precious metals investing and other non-state-approved financial activities. All they need is a severe enough financial crisis to provide the justification. After all, during the Great Depression, the federal government swiftly used an Executive Order to demand that citizens submit their gold to the Federal Reserve en masse.

And with new developments in crypto-tokenization technology and a brewing global financial crisis, the Tech-Banking-Political complex is preparing for what they collectively know will be a crucial window of opportunity to force their CBDCs down the throats of the people and make opting out from their new system after the fact nearly impossible.

Once their CBDC is rolled out, central bankers will have more ability than ever to manipulate the money supply and your personal finances according to their whims. This summary from a 2023 BIS report on the promise of CBDCs to increase the scope of central bank activities describes in (cheery banker-speak) the increase in power and control that central planners will grant themselves under a unified digital currency system:

“As well as improving existing processes through the seamless integration of transactions, a unified ledger could harness programmability to enable arrangements that are currently not practicable, thereby expanding the universe of possible economic outcomes.”

Zimbabwe’s new CBDC experiment uses an interesting ”gold-backed” approach, appearing on paper to be a combination of the traditional gold standard with digital currency tech. This is a promising approach, but to avoid being corrupted by authorities, it needs a protocol that makes it nearly impossible to fake a higher gold supply with tokens for gold that doesn’t really exist. Otherwise, its claims of returning to a “gold standard” are meaningless.

I wouldn’t expect a Western CBDC to contain gold backing or the protection of any kind of restrictive protocol, but I predict that in a centralized national or international digital currency system of any kind, central banks will still hold large amounts of gold in reserve. Just as Bitcoin isn’t truly “digital gold” but only numbers on a screen, bankers know they will still have to hold real money as an insurance policy.

The difference is, that banks could be the only ones who are allowed to hold gold, while broader society will no longer have access to cash. With all other potential options to opt out of this system fully digitized and prevented from competing with CBDCs, gold, and silver will become the only way to exist and transact outside the Central Bank’s digital control grid with any semblance of true freedom or agency. Black markets will have to turn to various forms of analog money, and gold and silver will rise as the top options.

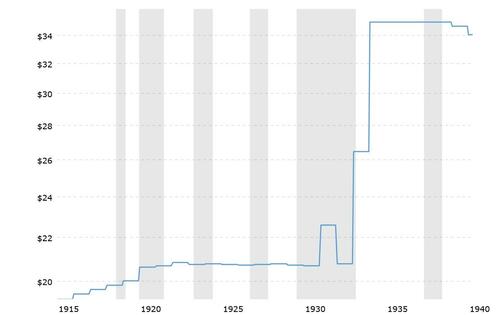

Just look at the gold chart for 1933: When Executive Order 6102 demanded that citizens give up their gold, the price skyrocketed, never again returning to pre-1933 levels. A similar effect would occur from the announcement of CBDCs, phasing out of paper cash, and restrictions on private gold ownership:

Gold vs USD Pre and Post-Executive Order 6102

Some legislators are recognizing the CBDC threat and fighting against it, declaring CBDCs a threat and empowering precious metals holders. However, I’m not sure it will be enough to fight the CBDC tide being engineered by central planners. The system may begin as optional, but with the phasing-out of cash and other incremental measures, will eventually become permanent either through direct legislation or by making it totally impractical to resist.

If the architects of CBDCs can market their new system as the solution to an epic financial crash (of their own making), it will likely appear as a sign of stability that calms global markets, possibly causing gold and silver to drop. But as precious metals emerge as the best form of physical money in a tightly controlled, micromanaged financial dystopia, they’ll become the only way to make private or off-grid transactions, making them more valuable than ever — not only as investments, but a means of survival outside the fully-digitized fiat nightmare.

With the eventual introduction of central bank digital currency (CBDCs) now seemingly inevitable, there are a lot of directions central banks could take with their digital currency projects that would have dramatic implications for the price of gold.

Touted for their “convenience” and “efficiency,” the endgame of digital currencies is not only achieving greater power over the currency but also a means of surveilling and micromanaging the personal finances of each individual. Owe taxes or a parking ticket? It could be automatically deducted. Does the Fed think it needs to cool inflation? Deduct money straight from people’s accounts, or impose a daily spending limit. The possibilities for control and profit are endless, and too tempting for control freak bureaucracies and amoral tech companies to ignore.

As countries like China implement their own CBDCs, buy more precious metals, and generally buck dependence on the US dollar for trade, Western central banks also feel like they have to compete in order to retain their power. That’s the essence of the other motivation for CBDCs — a currency race between East and West wherein the winner solidifies not only unprecedented control over its own citizenry but a place atop the global power structure for the next century or longer.

Since CBDCs and the idea of a “cashless society” are mostly about increasing centralization and control on the societal and individual level, it’s easy to see how they might be accompanied by new legislation banning precious metals investing and other non-state-approved financial activities. All they need is a severe enough financial crisis to provide the justification. After all, during the Great Depression, the federal government swiftly used an Executive Order to demand that citizens submit their gold to the Federal Reserve en masse.

And with new developments in crypto-tokenization technology and a brewing global financial crisis, the Tech-Banking-Political complex is preparing for what they collectively know will be a crucial window of opportunity to force their CBDCs down the throats of the people and make opting out from their new system after the fact nearly impossible.

Once their CBDC is rolled out, central bankers will have more ability than ever to manipulate the money supply and your personal finances according to their whims. This summary from a 2023 BIS report on the promise of CBDCs to increase the scope of central bank activities describes in (cheery banker-speak) the increase in power and control that central planners will grant themselves under a unified digital currency system:

“As well as improving existing processes through the seamless integration of transactions, a unified ledger could harness programmability to enable arrangements that are currently not practicable, thereby expanding the universe of possible economic outcomes.”

Zimbabwe’s new CBDC experiment uses an interesting ”gold-backed” approach, appearing on paper to be a combination of the traditional gold standard with digital currency tech. This is a promising approach, but to avoid being corrupted by authorities, it needs a protocol that makes it nearly impossible to fake a higher gold supply with tokens for gold that doesn’t really exist. Otherwise, its claims of returning to a “gold standard” are meaningless.

I wouldn’t expect a Western CBDC to contain gold backing or the protection of any kind of restrictive protocol, but I predict that in a centralized national or international digital currency system of any kind, central banks will still hold large amounts of gold in reserve. Just as Bitcoin isn’t truly “digital gold” but only numbers on a screen, bankers know they will still have to hold real money as an insurance policy.

The difference is, that banks could be the only ones who are allowed to hold gold, while broader society will no longer have access to cash. With all other potential options to opt out of this system fully digitized and prevented from competing with CBDCs, gold, and silver will become the only way to exist and transact outside the Central Bank’s digital control grid with any semblance of true freedom or agency. Black markets will have to turn to various forms of analog money, and gold and silver will rise as the top options.

Just look at the gold chart for 1933: When Executive Order 6102 demanded that citizens give up their gold, the price skyrocketed, never again returning to pre-1933 levels. A similar effect would occur from the announcement of CBDCs, phasing out of paper cash, and restrictions on private gold ownership:

Gold vs USD Pre and Post-Executive Order 6102

Some legislators are recognizing the CBDC threat and fighting against it, declaring CBDCs a threat and empowering precious metals holders. However, I’m not sure it will be enough to fight the CBDC tide being engineered by central planners. The system may begin as optional, but with the phasing-out of cash and other incremental measures, will eventually become permanent either through direct legislation or by making it totally impractical to resist.

If the architects of CBDCs can market their new system as the solution to an epic financial crash (of their own making), it will likely appear as a sign of stability that calms global markets, possibly causing gold and silver to drop. But as precious metals emerge as the best form of physical money in a tightly controlled, micromanaged financial dystopia, they’ll become the only way to make private or off-grid transactions, making them more valuable than ever — not only as investments, but a means of survival outside the fully-digitized fiat nightmare.

Loading…