Authored by Charles Hugh Smith via OfTwoMinds blog,

Can an economy in which 10% of the households qualify as middle class claim to offer widespread opportunities for secure prosperity? No, it cannot.

Defining the middle class is a perpetually popular parlor game because it's well-known that the foundation of widespread prosperity is a broad-based middle class and a sturdy ladder of social mobility that enables those below the middle class to work their way up to middle class security.

Here's an example of a typical trope on the subject: What Does It Take To Be Middle Class?

The topic is also a perennial favorite because the middle class is losing ground. By basic measures of income, it's slipped from 60% of the populace to 50%.

A strong case can be made that assessed by characteristics of middle class security and prosperity rather than income, the middle class has effectively shrunk to 10% of households as only the top 30% of households earn enough to afford what was within reach of the top 60% in decades past.

By definition, the top 20% cannot be "middle class." The top 20% is comprised of the upper-middle class, the wealthy and the super-wealthy (the 80% to 95% bracket, top 5% and the top 1%).

Attempting to define the middle class by income alone is futile due to regional differences in costs and purchasing power. $100,000 annual household income that will barely pay rent and necessities in a major metro city can stretch considerably further in smaller cities far from high-cost zones.

Regardless of income, households that are living paycheck to paycheck don't qualify as middle class if we qualify "middle class" by these characteristics:

In Why the Middle Class Is Doomed (April 2012) I listed five "threshold" characteristics of membership in the middle class:

1. Meaningful healthcare insurance (i.e. not phantom coverage that only kicks in after thousands of dollars are paid in cash).

2. Significant equity (25%-50%) in a home or other real estate.

3. Income/expenses that enable the household to save at least 6% of its net income.

4. Significant retirement funds: 401Ks, IRAs, etc.

5. The ability to service all debt and expenses over the medium-term if one of the primary household wage-earners lose their job.

I then added a taken-for-granted sixth:

6. Reliable vehicles for each wage-earner that are fully covered by insurance.

Author Chris Sullins suggested adding these additional thresholds:

7. If a household requires government assistance (SNAP, Medicaid, rent subsidies, etc.) to maintain the family lifestyle, their middle class status is in doubt.

8. A percentage of non-financial hard assets such as family heirlooms, precious metals, business equity, rental income property, land, etc. that can be transferred to the next generation, i.e. generational wealth.

9. Ability to invest in offspring (education, extracurricular clubs/training, etc.).

10. Leisure time devoted to the maintenance of physical/spiritual/mental fitness.

Correspondent Mark G. suggested two more:

11. Continual accumulation of human and social capital (adding new skills, expanding social networks and markets for one's services, etc.)

And the money shot:

12. Family ownership of income-producing assets such as rental properties, bonds, etc.

The key point of these thresholds is that propping up a precarious illusion of consumption and status signifiers does not qualify as middle class. To qualify as middle class (that is, what was considered middle class a generation or two ago), the household must actually own/control wealth that won't vanish if the investment bubble du jour pops, and won't be wiped out by a medical emergency.

In Chris's phrase, "They should be focusing resources on the next generation and passing on Generational Wealth" as opposed to "keeping up appearances" via aspirational consumption financed with debt.

So how much does it cost to meet these qualifying standards? Two generations ago, public school teachers, healthcare workers, skilled craft workers and others with median-level incomes could meet all of these qualifications, for the purchasing power of their earnings was extremely high compared to now. A median wage bought a lot of shelter, vehicle, healthcare, college education, etc.

According to the US Census Bureau, Real median household income was $74,580 in 2022. (Source: Income in the United States: 2022) This is the "middle income" that presumably qualifies as "middle class," but it would take extreme frugality and sacrifices to stretch $75,000 to cover the qualifications listed above, even in low-cost regions.

As a general guideline, $75,000 would only stretch to meet these qualifications if 1) the family home was owned free and clear, i.e. no mortgage, either via inheritance or extreme efforts such as building your own home with cash savings, 2) no student loan debt, either by gaining desirable skills outside college or completing college on scholarships, with family financial aid, etc., and no vehicle loan, i.e. a reliable used car/truck that is owned free and clear.

These may strike younger readers as impossible fantasies, but as I've often noted here, forty years ago I worked my way through a four-year university program with part-time jobs and built a house from scratch with only savings, income from temp construction jobs and a $5,000 bank loan ($17,000 in today's dollars) which we paid off in two years.

Even with extreme frugality, this debt-free lifestyle is no longer within reach of the non-wealthy, as costs for college, land, permits and building materials have skyrocketed, along with the costs of healthcare, insurance, vehicles, childcare, etc.

I submit that for most households in higher-cost regions, these qualifications can only be met with an annual household income of $150,000 or more, which according to the Census Bureau, is the cutoff level for the top 20% (top quintile) of American households.

According to the Census Bureau, the top 20% earn 52% of all income, and the top 5% earn 23.5% of all income. The top 10% of households have an income of $216,000 or higher, and the top 5% have incomes of $295,000 or higher. The top 1% bracket is $867,000 and up. (TableA-4a, Income in the United States: 2022).

In lower-cost regions, it may be possible for frugal households in the 70% to 80% income bracket to qualify. According to the Census Bureau, this bracket earns between $118,700 and $153,000. This 10% might qualify as middle class. Households earning less would likely qualify only if they inherited significant wealth from their families or received substantial financial aid from their families, such as college paid for in full, a down payment for a home purchase, etc.

In summary: if we set minimum standards for qualifying as middle class by what was within reach of typical American households two generations ago, relatively few households qualify as middle class. Middle class means more than being able to charge a lavish cruise or foreign vacation on a credit card or buying a new truck with a huge loan. It once meant owning assets, not owing debt on assets.

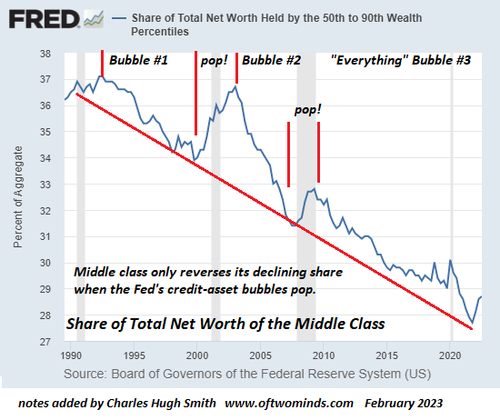

Consider a few charts. Here we see the percentage of wealth owned by the 50% to 90% bracket--what we might consider middle class--has declined sharply as wealth has concentrated in the top 10%.

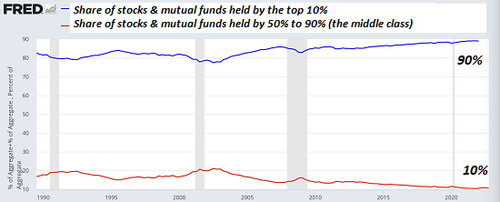

By way of example, the top 10% own 90% of stocks.

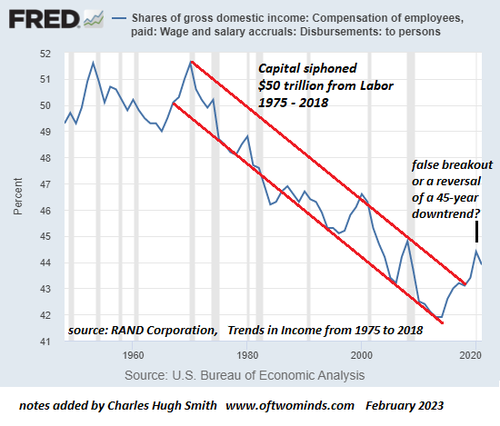

Wages are the bedrock of middle class income and wealth accumulation, and here we see wages share of the national income has been in a freefall for 45 years. It has recently ticked up, but it is not yet clear if this is just another temporary blip or an overdue clawback of income that has predominantly flowed to capital.

Can an economy in which 10% of the households qualify as middle class claim to offer widespread opportunities for secure prosperity? No, it cannot. "Middle class" isn't just income or consumption; it demands a toehold of ownership of real assets that offer security, not a lifetime of debt servitude.

As security becomes increasingly precarious and unaffordable, Self-Reliance offers an alternative to a lifetime of debt servitude.

* * *

My new book is now available at a 10% discount ($8.95 ebook, $18 print): Self-Reliance in the 21st Century. Read the first chapter for free (PDF)

Authored by Charles Hugh Smith via OfTwoMinds blog,

Can an economy in which 10% of the households qualify as middle class claim to offer widespread opportunities for secure prosperity? No, it cannot.

Defining the middle class is a perpetually popular parlor game because it’s well-known that the foundation of widespread prosperity is a broad-based middle class and a sturdy ladder of social mobility that enables those below the middle class to work their way up to middle class security.

Here’s an example of a typical trope on the subject: What Does It Take To Be Middle Class?

The topic is also a perennial favorite because the middle class is losing ground. By basic measures of income, it’s slipped from 60% of the populace to 50%.

A strong case can be made that assessed by characteristics of middle class security and prosperity rather than income, the middle class has effectively shrunk to 10% of households as only the top 30% of households earn enough to afford what was within reach of the top 60% in decades past.

By definition, the top 20% cannot be “middle class.” The top 20% is comprised of the upper-middle class, the wealthy and the super-wealthy (the 80% to 95% bracket, top 5% and the top 1%).

Attempting to define the middle class by income alone is futile due to regional differences in costs and purchasing power. $100,000 annual household income that will barely pay rent and necessities in a major metro city can stretch considerably further in smaller cities far from high-cost zones.

Regardless of income, households that are living paycheck to paycheck don’t qualify as middle class if we qualify “middle class” by these characteristics:

In Why the Middle Class Is Doomed (April 2012) I listed five “threshold” characteristics of membership in the middle class:

1. Meaningful healthcare insurance (i.e. not phantom coverage that only kicks in after thousands of dollars are paid in cash).

2. Significant equity (25%-50%) in a home or other real estate.

3. Income/expenses that enable the household to save at least 6% of its net income.

4. Significant retirement funds: 401Ks, IRAs, etc.

5. The ability to service all debt and expenses over the medium-term if one of the primary household wage-earners lose their job.

I then added a taken-for-granted sixth:

6. Reliable vehicles for each wage-earner that are fully covered by insurance.

Author Chris Sullins suggested adding these additional thresholds:

7. If a household requires government assistance (SNAP, Medicaid, rent subsidies, etc.) to maintain the family lifestyle, their middle class status is in doubt.

8. A percentage of non-financial hard assets such as family heirlooms, precious metals, business equity, rental income property, land, etc. that can be transferred to the next generation, i.e. generational wealth.

9. Ability to invest in offspring (education, extracurricular clubs/training, etc.).

10. Leisure time devoted to the maintenance of physical/spiritual/mental fitness.

Correspondent Mark G. suggested two more:

11. Continual accumulation of human and social capital (adding new skills, expanding social networks and markets for one’s services, etc.)

And the money shot:

12. Family ownership of income-producing assets such as rental properties, bonds, etc.

The key point of these thresholds is that propping up a precarious illusion of consumption and status signifiers does not qualify as middle class. To qualify as middle class (that is, what was considered middle class a generation or two ago), the household must actually own/control wealth that won’t vanish if the investment bubble du jour pops, and won’t be wiped out by a medical emergency.

In Chris’s phrase, “They should be focusing resources on the next generation and passing on Generational Wealth” as opposed to “keeping up appearances” via aspirational consumption financed with debt.

So how much does it cost to meet these qualifying standards? Two generations ago, public school teachers, healthcare workers, skilled craft workers and others with median-level incomes could meet all of these qualifications, for the purchasing power of their earnings was extremely high compared to now. A median wage bought a lot of shelter, vehicle, healthcare, college education, etc.

According to the US Census Bureau, Real median household income was $74,580 in 2022. (Source: Income in the United States: 2022) This is the “middle income” that presumably qualifies as “middle class,” but it would take extreme frugality and sacrifices to stretch $75,000 to cover the qualifications listed above, even in low-cost regions.

As a general guideline, $75,000 would only stretch to meet these qualifications if 1) the family home was owned free and clear, i.e. no mortgage, either via inheritance or extreme efforts such as building your own home with cash savings, 2) no student loan debt, either by gaining desirable skills outside college or completing college on scholarships, with family financial aid, etc., and no vehicle loan, i.e. a reliable used car/truck that is owned free and clear.

These may strike younger readers as impossible fantasies, but as I’ve often noted here, forty years ago I worked my way through a four-year university program with part-time jobs and built a house from scratch with only savings, income from temp construction jobs and a $5,000 bank loan ($17,000 in today’s dollars) which we paid off in two years.

Even with extreme frugality, this debt-free lifestyle is no longer within reach of the non-wealthy, as costs for college, land, permits and building materials have skyrocketed, along with the costs of healthcare, insurance, vehicles, childcare, etc.

I submit that for most households in higher-cost regions, these qualifications can only be met with an annual household income of $150,000 or more, which according to the Census Bureau, is the cutoff level for the top 20% (top quintile) of American households.

According to the Census Bureau, the top 20% earn 52% of all income, and the top 5% earn 23.5% of all income. The top 10% of households have an income of $216,000 or higher, and the top 5% have incomes of $295,000 or higher. The top 1% bracket is $867,000 and up. (TableA-4a, Income in the United States: 2022).

In lower-cost regions, it may be possible for frugal households in the 70% to 80% income bracket to qualify. According to the Census Bureau, this bracket earns between $118,700 and $153,000. This 10% might qualify as middle class. Households earning less would likely qualify only if they inherited significant wealth from their families or received substantial financial aid from their families, such as college paid for in full, a down payment for a home purchase, etc.

In summary: if we set minimum standards for qualifying as middle class by what was within reach of typical American households two generations ago, relatively few households qualify as middle class. Middle class means more than being able to charge a lavish cruise or foreign vacation on a credit card or buying a new truck with a huge loan. It once meant owning assets, not owing debt on assets.

Consider a few charts. Here we see the percentage of wealth owned by the 50% to 90% bracket–what we might consider middle class–has declined sharply as wealth has concentrated in the top 10%.

By way of example, the top 10% own 90% of stocks.

Wages are the bedrock of middle class income and wealth accumulation, and here we see wages share of the national income has been in a freefall for 45 years. It has recently ticked up, but it is not yet clear if this is just another temporary blip or an overdue clawback of income that has predominantly flowed to capital.

Can an economy in which 10% of the households qualify as middle class claim to offer widespread opportunities for secure prosperity? No, it cannot. “Middle class” isn’t just income or consumption; it demands a toehold of ownership of real assets that offer security, not a lifetime of debt servitude.

As security becomes increasingly precarious and unaffordable, Self-Reliance offers an alternative to a lifetime of debt servitude.

* * *

My new book is now available at a 10% discount ($8.95 ebook, $18 print): Self-Reliance in the 21st Century. Read the first chapter for free (PDF)

Loading…