Authored by Mike Shedlock via MishTalk.com,

President Biden, Elizabeth Warren, Bernie Sanders all want to tax the rich for their goals. What’s the key problem?

The answer is the rich do not have enough money.

Not even a 91 percent marginal rate would do it.

That means the problem is spending, not taxes.

The Limits of Taxing the Rich

Please consider The Limits of Taxing the Rich by Brian Riedl at the Manhattan Institute. I recommend reading the entire article.

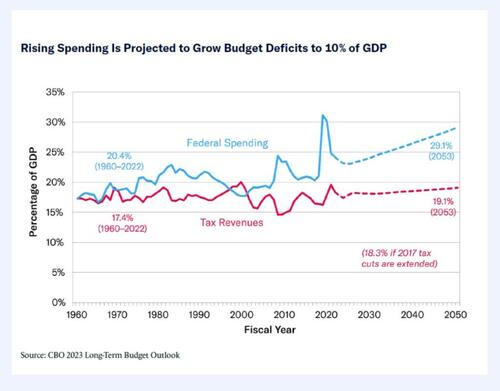

When pressed on how to finance budget deficits likely heading past 8% of GDP within a decade, as well as trillions of dollars in proposed spending expansions, progressive leaders and activists usually respond, “Easy! Just tax the rich!” Indeed, President Biden and many progressive lawmakers have committed to never raising taxes on the 98% of families earning below $400,000, and opposing all spending cuts involving Social Security, Medicare, Medicaid, the safety net, veterans, and most social programs.

Yet the persistence of these claims raises the important question of just how much tax revenue can be raised by taxing “the rich.” Specifying the limits of taxing the rich can help us move past the false “easy answers” and begin to explore other, less popular, options to stabilize budget deficits, such as restraining the Social Security and health-care spending that are driving deficits upward, and raising middle-class taxes.

Washington’s income taxes are extraordinarily top-heavy. Treasury data show that, in 2023, the bottom 40% of earners collectively pay no income tax and will instead receive a collective tax rebate of $123 billion.

Meanwhile, the top-earning quintile—while earning 58% of all income—pays 69% of all federal taxes and 90% of all income taxes. And the top 1% of earners—while earning 18% of all income—pay 25% of all federal taxes and 40% of all income taxes. By contrast, the bottom-earning 60% earns 23% of all income, yet pays just 13% of the total federal taxes, including a combined negative income tax

How Much Tax Revenue Can Be Raised from the Wealthy?

Point-by-point, the article examines the proposals of Biden, Sanders, and Warren to address the question “How Much Tax Revenue Can Be Raised from the Wealthy?“

This report shows that: 1) Senator Bernie Sanders’s tax agenda has not identified additional plausible tax-the-rich policies; 2) America’s upper-income-tax rates align with international norms, and Europe’s higher tax revenues overwhelmingly result from broad-based consumption and payroll taxes; and 3) the 1950s and 1960s income tax rates exceeding 90% raised little additional tax revenue.

Key Ideas

-

America’s federal tax code is already the most progressive in the Organisation for Economic Co-operation and Development (OECD) and has become sharply more progressive over the past 40 years.

-

Much of this tax progressivity is the result of drastic cuts to low- and middle-income taxes while leaving upper-income-tax rates closer to international norms.

-

The income-tax rates exceeding 90% in the 1950s and early 1960s produced minuscule levels of additional tax revenue.

Partisan Politics?

In order to avoid the partisan misrepresentations that typify tax policy debates, it is important to clarify, at the outset, that this report is not a conservative antitax manifesto. It does not argue that upper-income taxes should not be raised at all. Nor does it claim that all tax cuts pay for themselves. Indeed, soaring deficits will require some tax increases to accompany the necessary spending reforms.

Instead, this report employs consensus economic modeling and research to build a more realistic framework for taxing the rich—and to rein in the unrealistic perception that taxing the rich can sufficiently eliminate budget deficits and finance the progressive agenda. The limits of upper-income taxes should induce lawmakers, analysts, and voters to broaden their savings proposals to include substantial spending reforms and even to consider middle-class tax increases.

What About Europe?

American progressives often hold up Europe—and especially the Scandinavian social democracies of Denmark, Finland, Norway, and Sweden—as successful tax-the-rich utopias that the U.S. should replicate. In reality, European tax systems do not fit the American progressive stereotype, as their higher revenues are overwhelmingly raised through steep income, payroll, and consumption taxes on the middle class.

Yes, Finland, Norway, and Sweden collect an average of 42.6% of GDP in taxes, versus 26.6% from America’s federal, state, and local governments. However, 14.5 percentage points of this 16-percentage-point overage comes from higher payroll taxes and VAT, which broadly hit the middle class. These nations’ individual income-tax revenues exceed those of the U.S. by just 0.8% of GDP, while their 3.5% of GDP advantage in corporate-tax revenues is overwhelmingly driven by Norway’s steep corporate-tax revenues from its massive oil and gas industry (by contrast, Finland and Sweden exceed the U.S. by 1% of GDP). These nations’ remaining taxes combine to collect nearly 3% of GDP less than those of America

Taxing the rich won’t do. The progressive goals will require huge tax hikes on everyone, especially the middle clash.

Biden’s promise of only taxing the rich, cannot work. Brian Riedl explains every Leftist proposal, and why their ideas cannot work.

Please read the report.

How Much Will That GOP Deal on Child Tax Credits Really Cost?

Meanwhile , Republicans are in la-la land with the Democrats. It’s a truly pitiful performance that is adding trillions of dollars to the deficit over 10 years.

For discussion, please see How Much Will That GOP Deal on Child Tax Credits Really Cost?

Also consider, Is Inflation Down? That’s What President Biden Says

For the 36 percent of the nation that rents, Bidenomics on top of Fed asset bubbles boosting home prices and rent has been a complete disaster.

It should be no wonder that people say they were better off economically under Trump.

Authored by Mike Shedlock via MishTalk.com,

President Biden, Elizabeth Warren, Bernie Sanders all want to tax the rich for their goals. What’s the key problem?

The answer is the rich do not have enough money.

Not even a 91 percent marginal rate would do it.

That means the problem is spending, not taxes.

The Limits of Taxing the Rich

Please consider The Limits of Taxing the Rich by Brian Riedl at the Manhattan Institute. I recommend reading the entire article.

When pressed on how to finance budget deficits likely heading past 8% of GDP within a decade, as well as trillions of dollars in proposed spending expansions, progressive leaders and activists usually respond, “Easy! Just tax the rich!” Indeed, President Biden and many progressive lawmakers have committed to never raising taxes on the 98% of families earning below $400,000, and opposing all spending cuts involving Social Security, Medicare, Medicaid, the safety net, veterans, and most social programs.

Yet the persistence of these claims raises the important question of just how much tax revenue can be raised by taxing “the rich.” Specifying the limits of taxing the rich can help us move past the false “easy answers” and begin to explore other, less popular, options to stabilize budget deficits, such as restraining the Social Security and health-care spending that are driving deficits upward, and raising middle-class taxes.

Washington’s income taxes are extraordinarily top-heavy. Treasury data show that, in 2023, the bottom 40% of earners collectively pay no income tax and will instead receive a collective tax rebate of $123 billion.

Meanwhile, the top-earning quintile—while earning 58% of all income—pays 69% of all federal taxes and 90% of all income taxes. And the top 1% of earners—while earning 18% of all income—pay 25% of all federal taxes and 40% of all income taxes. By contrast, the bottom-earning 60% earns 23% of all income, yet pays just 13% of the total federal taxes, including a combined negative income tax

How Much Tax Revenue Can Be Raised from the Wealthy?

Point-by-point, the article examines the proposals of Biden, Sanders, and Warren to address the question “How Much Tax Revenue Can Be Raised from the Wealthy?“

This report shows that: 1) Senator Bernie Sanders’s tax agenda has not identified additional plausible tax-the-rich policies; 2) America’s upper-income-tax rates align with international norms, and Europe’s higher tax revenues overwhelmingly result from broad-based consumption and payroll taxes; and 3) the 1950s and 1960s income tax rates exceeding 90% raised little additional tax revenue.

Key Ideas

-

America’s federal tax code is already the most progressive in the Organisation for Economic Co-operation and Development (OECD) and has become sharply more progressive over the past 40 years.

-

Much of this tax progressivity is the result of drastic cuts to low- and middle-income taxes while leaving upper-income-tax rates closer to international norms.

-

The income-tax rates exceeding 90% in the 1950s and early 1960s produced minuscule levels of additional tax revenue.

Partisan Politics?

In order to avoid the partisan misrepresentations that typify tax policy debates, it is important to clarify, at the outset, that this report is not a conservative antitax manifesto. It does not argue that upper-income taxes should not be raised at all. Nor does it claim that all tax cuts pay for themselves. Indeed, soaring deficits will require some tax increases to accompany the necessary spending reforms.

Instead, this report employs consensus economic modeling and research to build a more realistic framework for taxing the rich—and to rein in the unrealistic perception that taxing the rich can sufficiently eliminate budget deficits and finance the progressive agenda. The limits of upper-income taxes should induce lawmakers, analysts, and voters to broaden their savings proposals to include substantial spending reforms and even to consider middle-class tax increases.

What About Europe?

American progressives often hold up Europe—and especially the Scandinavian social democracies of Denmark, Finland, Norway, and Sweden—as successful tax-the-rich utopias that the U.S. should replicate. In reality, European tax systems do not fit the American progressive stereotype, as their higher revenues are overwhelmingly raised through steep income, payroll, and consumption taxes on the middle class.

Yes, Finland, Norway, and Sweden collect an average of 42.6% of GDP in taxes, versus 26.6% from America’s federal, state, and local governments. However, 14.5 percentage points of this 16-percentage-point overage comes from higher payroll taxes and VAT, which broadly hit the middle class. These nations’ individual income-tax revenues exceed those of the U.S. by just 0.8% of GDP, while their 3.5% of GDP advantage in corporate-tax revenues is overwhelmingly driven by Norway’s steep corporate-tax revenues from its massive oil and gas industry (by contrast, Finland and Sweden exceed the U.S. by 1% of GDP). These nations’ remaining taxes combine to collect nearly 3% of GDP less than those of America

Taxing the rich won’t do. The progressive goals will require huge tax hikes on everyone, especially the middle clash.

Biden’s promise of only taxing the rich, cannot work. Brian Riedl explains every Leftist proposal, and why their ideas cannot work.

Please read the report.

How Much Will That GOP Deal on Child Tax Credits Really Cost?

Meanwhile , Republicans are in la-la land with the Democrats. It’s a truly pitiful performance that is adding trillions of dollars to the deficit over 10 years.

For discussion, please see How Much Will That GOP Deal on Child Tax Credits Really Cost?

Also consider, Is Inflation Down? That’s What President Biden Says

For the 36 percent of the nation that rents, Bidenomics on top of Fed asset bubbles boosting home prices and rent has been a complete disaster.

It should be no wonder that people say they were better off economically under Trump.

Loading…